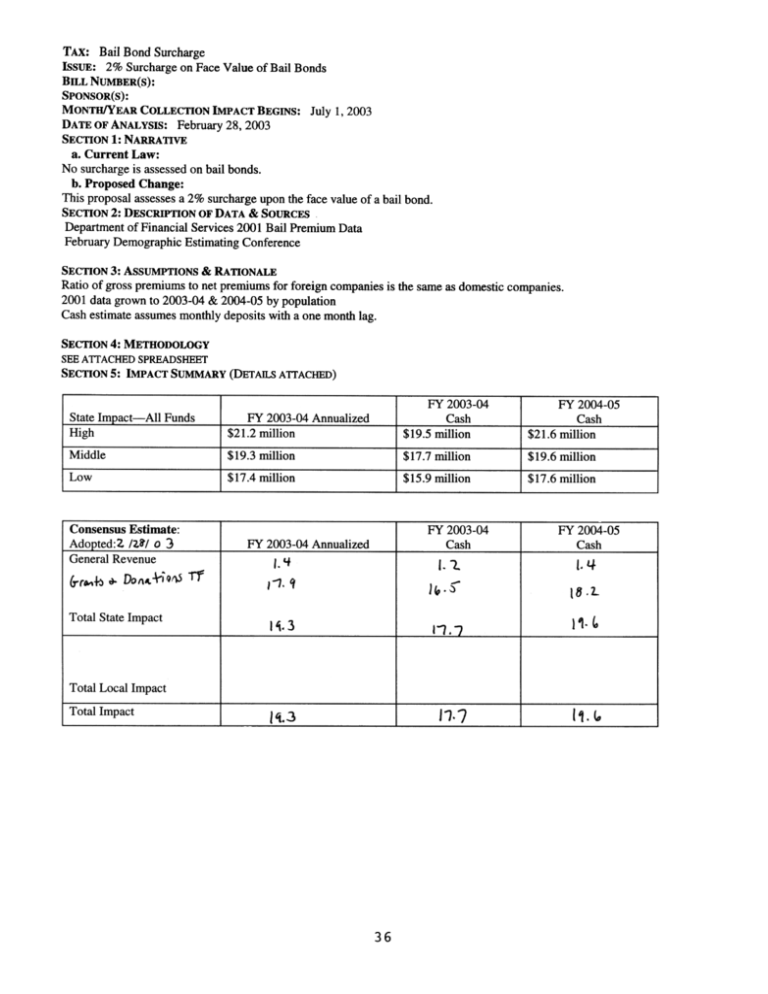

TAX: Bail Bond Surcharge IsSUE: 2% Surcharge on Face Value of

advertisement

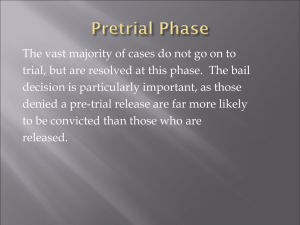

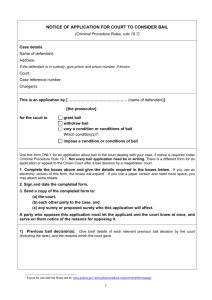

TAX: Bail Bond Surcharge IsSUE: 2% Surcharge on Face Value of Bail Bonds BILL NUMBER(S): SPONSOR(S): MONTH/YEAR COLLECTIONIMPACT BEGINS: July 1,2003 DATE OF ANALYSIS: February 28,2003 SECTIONI: NARRATIVE a. Current Law: No surcharge is assessedon bail bonds. b. Proposed Change: This proposal assessesa 2% surcharge upon the face value of a bail bond. SECTION2: DESCRIPTIONOF DATA & SOURCES Department of Financial Services 2001 Bail Premium Data February Demographic Estimating Conference SECTION3: ASSUMPTIONS& RATIONALE Ratio of gross premiums to net premiums for foreign companies is the same as domestic companies. 2001 data grown to 2003-04 & 2004-05 by population Cash estimate assumesmonthly deposits with a one month lag. SECTION 4: METHODOLOGY SEEATTACHED SPREADSHEET SECTION 5: IMPACT SUMMARY (DETAIlS ATTACHED) FY 2003-04 State Imoact-All Funds FY 2003-04 Cash Annualized FY 2004-05 Cash High $21.2 million $19.5 million $21.6 million Middle $19.3 million $17.7 million $19.6 million Low $17.4 million $15.9 million $17.6 million 36 Company Calendar Year 2001 Gross Premiums Received by Net Premiums Bondsmen Written Name Accredited Surety and Casualty Roche Surety & Casualty Bankers Insurance Co Capital Preferred Insurance Co Total Domestic 16.6 12.9 8.9 2.0 40.4 I I ? 0.4 ? ? 0.5 I 51.9 I Domestic Companies 404.0 Foreign Companies 519.4 Total Bail 2.8 I 0.7 0.9 0.1 1.0 Allegheny Insurance American Bankers Insurance Co of FI American Contractors Indemnity Co Continental Heritage Evergreen American Surety International Fidelity Ranger Insurance Safety National Seneca Total Foreign 1.2 0.9 0.7 I 923.4 37 I 3.6 I 6.4 I