The Dutch Business Model in Social Renting

advertisement

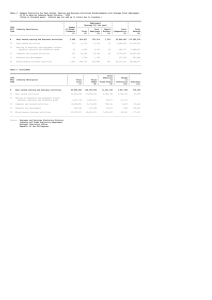

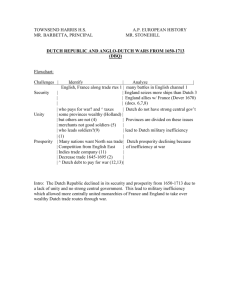

The Dutch business model in social renting: A historic perspective Marietta Haffner OTB – Research for the Built Environment / TU Delft 25 September 2014 – Brazil/EU Dialogue seminar, LSE, London Delft University of Technology Challenge the future Dutch social rental sector – biggest 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Social renting Other Owner-occupation Private renting Haffner et al. 2012 (diverse sources, most recent year) Social housing in the Netherlands 2| Structure 1. 2. 3. 4. History -1990s in a nutshell Revolving fund business model Institutional landscape Ingredients to remember Dutch business model in social renting 3 From private initiative… … to “extension of government” • Roots in 19th century civil society • Providing housing for workers, not the most vulnerable • State involvement: Housing Act of 1901 • Government influence increased in the 20th century • Social landlords transformed into semi-public institutions with strong financial and hierarchical ties with central government up until the 1980s … towards independence • Decentralisation in the 1980s and 1990s • 1995, cancellation of outstanding government loans to social landlords in exchange for future owed supply subsidies Financial independence and social entrepreneurship Dutch business model in social renting 4 Towards financial independence Government loans: social renting Supply subsidies: Rent control: renting rental sector Government Guarantee: social renting Housing allowance: rental sector 19451960 ++ +++ +++ 60s + +++ +++ + 70s + ++ ++ + + 80s + + ++ + ++ 90s + ++ ++ 00s + ++ ++ Dutch business model in social renting 5 Towards social entrepreneurship Housing associations (HAs) • are private registered organizations with a public task (legal status) that • operate within central government framework • operate in the interest of housing • should re-invest in social housing any profits made (non-profit) Dutch business model in social renting 6 Structure 1. 2. 3. 4. History Revolving fund business model Institutional landscape Ingredients to remember Dutch business model in social renting 7 Revolving Fund Principle New affordable housing Rent income Housing refurbishment Housing sale revenues Community investments Dutch business model in social renting 8 Asset management Sales • About 15 000 sales per year in the period 2007-2010 Intermediate tenure • Sector initiative • Instrument to create mixed neighbourhoods • Risk of deterioration is risk for housing association (HA) • Sold dwellings remain tied to housing association • HA guarantees to buy back the dwelling • HA shares value gain/loss • HA can then invest in deteriorated neighbourhood Dutch business model in social renting 9 Structure 1. 2. 3. 4. History Revolving fund business model Institutional landscape Ingredients to remember Dutch business model in social renting 10 Government Regulation Performance agreements Local authorities Subsidy Housing allowance Housing associations Central Fund WSW Guarantee Tenants Rents Loans Banks Dutch business model in social renting 11 Social housing governance • Tasks • Supervision by ministry • Performance agreements between housing associations and local authorities • Self-regulation • Governance code • External performance assessments • Tenant Participation Act Dutch business model in social renting 12 Social housing finance Housing association Loan Contribution Central Housing Fund (CFV) Bank Triple A or AA+ credit rating Social Housing Guarantee Fund (WSW) Guarantee by national and local governments Dutch business model in social renting 13 Bank loans Mainly provided by two government-related banks: 1. Bank Nederlandse Gemeente (BNG) 2. Nederlandse Waterschapsbank Not a closed financial circuit Dutch business model in social renting 14 Central Housing Fund (CFV) Government agency which • supervises the financial viability of housing associations • can order remedial actions from housing associations if they run into financial difficulties • provides additional financial support to housing associations while they implement remedial actions Dutch business model in social renting 15 WSW and its guaranty structure Primary security: Housing associations Secondary security: WSW Tertiary security: State and municipalities Dutch business model in social renting 16 Structure 1. 2. 3. 4. History Revolving fund business model Institutional landscape Social renting ingredients to remember Dutch business model in social renting 17 Social entrepreneurship – what went wrong? Loss societal support because of • Sideline activities • better financial position allowed for taking on more tasks • Fraud and mismanagement (often in sidelines) • Supervision not strong enough • Self-regulation did not work • Towards market rents • Loss of social basis for the societal democratic ideal for a broad ‘social’ rental sector Dutch business model in social renting 18 Social entrepreneurship – what may be worth remembering? • Cooperation for achieving public task between state and non-profit organizations to realize • Benefits created by revolving fund principle involving dwelling sale, dwelling management, new affordable housing, maintenance and refurbishment of affordable housing, community investments, including the neighborhood • Realization of investment programs for energy efficiency • Financial safety net created by guarantee structure • Development of skills in social management and allocation Dutch business model in social renting 19 Thank you! Dutch business model in social renting 20