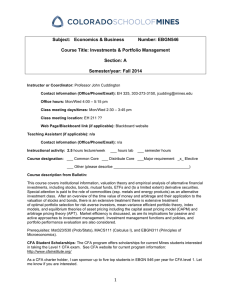

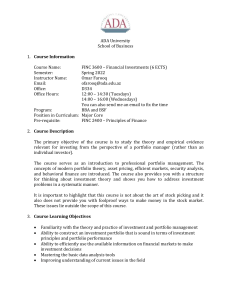

Syllabus

advertisement

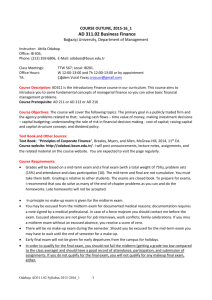

COURSE OUTLINE, 2015-16_1 AD 470 Investment Analysis and Portfolio Management Boğaziçi University, Department of Management Instructor: Attila Odabaşı TA: Çiğdem Vural Yavaş Email: odabasi@boun.edu.tr TA Email: crocusv@gmail.com Office: IB 403; Phone. 359-6806; TA office hours: Office Hours: W 12:00-13:00 and Th 12:00-13:00 or by appointment Course Schedule: WWW 678, Local: M1171______________________________________________ Course Objectives: We study the theory of investments, and particularly portfolio management in this course. We discuss the following topics: the estimation of reward and risk in investments, optimal portfolio choice, factor models of returns, security trading mechanisms, statistical analysis of investment opportunities, and measurement of the performance of investment managers (mutual funds vs hedge funds). We will devote time to applied portfolio management and portfolio insurance using derivatives. Course Prerequisites: You must complete AD 311 Business Finance prior to enrolling in this course. Basic statistics. Textbook and other sources: Text book: Essentials of Investments, 9th Ed., by Bodie, Kane, and Marcus (BKM), 2013, McGraw-Hill. Note: The same authors do have another (advanced) text book entitled “Investments”. If you want you can use it but it is not the course’s text book. The web address for our course page: http://odabasi.boun.edu.tr I will post announcements, lecture notes, exercises, solutions, spreadsheets, readings, and other course information on the course web page. You are responsible for downloading, printing, and reading the relevant materials. Visit the page regularly. Course Requirements: Grades will be based on: Activity Midterm exam Final Exam Investment Project Exercises Attendance and Class Participation Proportion of Course Grade 30% 35% 10% 15% 10% The mid-term and final are not cumulative. You must take them both. The exams are closed book. To prepare for exams, I recommend that you do solve as many of the end-of-chapter problems as you can. In principle no make-up exam is given for the midterm exam. 1 You may be excused from the midterm exam for documented medical reasons; documentation requires a note signed by a medical professional. In case of a force majeure you should contact me before the exam. If you miss the midterm exam without an excused absence, you receive a score of zero. Should you be excused for the mid-term exam you may have to wait until the end of semester for a make-up. Early final exam will not be given for early departures from the campus for holidays. In order to qualify for the final exam, you should not fail the midterm and should have a good record of attendance, participation, and submitting assignments. If you do not qualify for the final exam, you will not qualify for any makeup final exam, either. Assignments: There is one term assignment, which I will call “Investment Project” and 3-4 assignments that cover the topics reviewed in the course. These exercises aim to help you understand the major concepts and develop spread sheet modelling skills. The assignments are due at the beginning of class. Late homeworks will be penalized. If you work in a group, you only need to hand in one set of answers for each assignment. Groups can not include more than two students and you are expected to keep the same group throughout the semester. Classroom Responsibilities: Class Participation: Regular class attendance is mandatory. Active class participation is an important aspect of effective learning. Sharing your ideas and experience, asking questions, contributing to class discussions, and participating in in-class exercises will benefit you and your classmates. Excessive absences will be penalized. Attendance on-time is proper business etiquette and a minimal requirement for classroom participation. Being regularly late is unprofessional and is not to your advantage. Interfering with learning of others is not acceptable. The use of handheld communication devices is forbidden in class. You acknowledge that the use of laptops and tablets is allowed for specific purpose of notetaking only. Academic Honesty and Misconduct: You should abide by the University’s rule concerning academic misconduct and appreciate the serious consequences of a violation of these rules. Academic honesty requires that the course work, including exams and reports that a student presents to an instructor honestly and accurately indicates the student’s own academic efforts. The University code defines academic misconduct. Examples include but are not limited to: using another person’s written answers, ideas, words, or research and presenting it as one’s own by not properly crediting the originator; signing another person’s name to an attendance sheet; using notes or a programmable calculator in an exam when such use is not allowed. 2 AD470 Fall 2015-16 Course Schedule The following course schedule is tentative. The readings in BKM are required (the chapters’ numbers are as they appear in the 9th edition of BKM). Topic Topics Sep 30 Introduction Asset Classes, Securities Markets, Investment Companies Risk and Return Efficient Diversification CAPM and APT The Efficient Market Hypothesis Midterm Random Walk, Efficient Markets Behavioral Finance and Technical Analysis Fixed-Income: Bond Prices and Yields Managing Bond Portfolios Equity Valuation Futures Markets and Risk Management Performance Evaluation and Active Portfolio Management FINAL Oct 7 Oct 14 Oct 21 Nov 4 Nov 11 Nov 18 Nov 25 Dec 2 Dec 9 Dec 16 Dec 23 Readings in BKM Chapter No: 1-4 5 6 7 8 8 9 10 11 12-13 17 18 Suggestions for submitting written assignments: 1. Pay attention to formatting asked by the instructor, 2. Save a backup copy when you submit. It may contain something that you will wish to review for the upcoming exam. 3