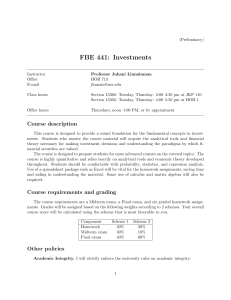

Instructor Professor Anthony Lynch, 9-13 Tisch, phone: (212) 998 0350. Course Content

advertisement

Foundations of Finance (B09.2316) Spring Semester, 1998. Instructor Professor Anthony Lynch, 9-13 Tisch, phone: (212) 998 0350. Course Content This course is about financial markets and how financial assets (securities) are valued and traded. Most of this course is taught from the viewpoint of the user of a financial market: an investor, investment advisor or someone using the market to hedge risk. Although much of what we cover is relevant to corporate finance (that is, financial decisions within the firm), this area is not the primary focus of the course. Only rarely will we take the viewpoint of a corporate chief financial officer dealing with internal decisions. This perspective is covered in great detail in Corporate Finance, a separate subsequent course. Prerequisites The prerequisites for this course are all core courses in accounting, statistics, operations research and economics. Finance is very mathematical and you will need to utilize material developed in the prerequisite courses. If you have not taken these courses, it is highly likely that you will have difficulty in this one. Grading Your grade will be based on a midterm exam and a final exam. The midterm exam will be worth 45% and cover the first half of the course. The final will be worth 55% and cover the entire course. However, if your grade on the final is better than your midterm grade, the final will count for the entire 100%. The date for the midterm exam will be set in the first two weeks of class. Please keep this date free. No makeup exam for the midterm will be given; makeup exams for the final may be given only during the first week in June. Both exams will be closed book except as follows: one 8.5" x 11" sheet with anything written on it can be taken into the midterm and two 8.5" x 11" sheets can be taken into the final. The curve for this course is the one established by the Finance Department for the introductory course: A (10%-15%); B (40%-65%); C (15%-25%); D, F (remainder). Problem Sets Problem sets will be assigned throughout the semester, and solutions will be distributed. You are strongly encouraged to attempt the problem set questions. These questions are designed to reinforce concepts learnt in class. Finance involves applying theory to solve problems and the only way to learn how to do this is by solving problems. 1 Textbooks Required Bodie, Kane and Marcus, Investments, Third Edition, Irwin (BKM). Solutions Manual, BKM (SM). Ross, Westerfield and Jordon, Fundamentals of Corporate Finance, Second Edition, custom version containing Chapter 5, Irwin (RWJ). Optional Elton and Gruber, Modern Portfolio Theory and Investment Analysis, Fifth Edition, John Wiley and Sons. Course Orientation By its very nature, finance is mathematical and theory based. However, most of the theory covered in this course has immediate practical applications and implications. These will be emphasized as much as possible especially before introducing the theory so as to motivate why its being taught. Concepts will wherever possible be illustrated using real data that has been obtained from the Wall Street Journal or some other data service. Every effort will be made to highlight how the theory and concepts taught in this course would be used by an investor to make real decisions. Miscellanea Supplementary Material: Other readings and notes will be distributed in class and are an integral part of the course. Reading of the Wall Street Journal or the financial sections of the New York Times is also encouraged. Class Attendance: You are responsible for knowing what occurs in class which may include material not covered in the readings, modifications to the syllabus and announcements concerning exams. Calculator: To solve financial problems, you will need a financial calculator. In addition to the standard operations (+,-,×,÷), it should be able to compute ex and ln(x) (the exponential and natural log functions) and should be able to compute present and future values of simple sums and annuities. An ability to compute internal rates of return is sometimes useful but is not required. Suitable calculators include the Hewlett-Packard 10B, 14B and 12C, the Texas Instruments BA II Plus and the Sharp EL 733A. Cheating: If evidence of cheating comes to my attention by any means, I will prosecute to the extent permitted under faculty guidelines. Use of E-mail: From time to time, I will use E-mail to communicate with you, so you should try and check your E-mail regularly. Where to go for help The availability of the TAs for this course will be announced in class. My office hours also will be announced in class. 2 Organization of the Course Number of Sessions 1 3 1 1 4 2 1 1 1.5 1.5 3 1 2 1.5 1.5 1 Topic Reading Overview BKM Ch 1, skim Ch 2 Time Value of Money RWJ Ch 5 Equities: Characteristics and Markets BKM Ch 3.2-3.7 Stock Positions and Portfolio Return BKM Ch 3.6-3.7 and 4.2 Portfolio Management BKM Characterizing the return distribution Ch 4.2; A2-A8, A19-A34 Asset allocation between one risky Ch 5, 6 (partic. 6.3) and one riskless asset Diversification with two risky assets Ch 7.1-7.3 Diversification with many risky assets Ch 7.4-7.5 Capital Asset Pricing Model (CAPM) BKM Ch 8.1, 9 (not 9.3) More General Asset Pricing Models BKM Ch 8.2, 25.2 and 29.2 Midterm Exam Asset Pricing Models and Market Efficiency BKM Ch 11 and 12.1-12.2 Fixed Income Markets BKM Ch 2.1-2.2 and 13.1-13.4 Bond Pricing and No-arbitrage BKM Ch 14 Bond Portfolio Management BKM Ch 15.1-15.2 Derivatives: Definitions and Payoffs BKM Ch 19.1-19.4, 21.1-21.3 Options: Valuation BKM Ch 20 (not 20.3) Futures and Forward Contracts: Valuation BKM Ch 21.4, 22 (not 22.5) Valuation Models BKM Ch 17 (not 17.6) 3