Disadvantage

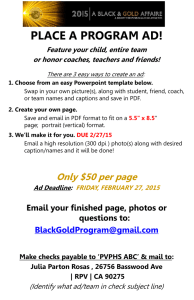

advertisement

Economy Disadvantage RIUDL Varsity Division Table of Contents Summary.............................................................................................................................................. 2 Glossary............................................................................................................................................... 3 First Negative Constructive (1NC) Shell ........................................................................................ 4-5 Specific Links 1NC Link – Drone Surveillance ............................................................................................................. 6 1NC Link – Drug Surveillance ............................................................................................................... 7 1NC Link – Immigration Surveillance .................................................................................................... 8 Uniqueness Extensions AT: Non-Unique – Housing and Unemployment ................................................................................... 9 AT: Non-Unique – Deficit Spending .................................................................................................... 10 Impact Extensions AT: No Impact – US Not Key to Global Economy ............................................................................... 11 AT: No Impact – Global Economy Determines US Economy .............................................................. 12 AT: No Impact – Global Economy Resilient ........................................................................................ 13 AT: No Impact – No War ..................................................................................................................... 14 1|Page Economy Disadvantage RIUDL Varsity Division Summary This Negative position is one that is versatile enough to be used against most cases in the Varsity packet. In fact, we have designed it so that a debater considering moving up to Championship division could use this argument against cases that are completely outside of this packet. The argument itself is rather simple. The Negative first needs to demonstrate that the economy is improving. This is usually done with reference to evidence from various organizations that assess the health of the U.S. economy. Then, the Negative should show that the plan uniquely destroys the economy. For the various cases, these all have different stories, which is why the shell is missing the link argument. Debaters will have to insert one from Pages 6-8 before they read the disadvantage. Lastly, the Negative should show that destruction of the economy would lead to devastating implications for the world. While this argument might seem to be exaggerated, the question that should be asked is: “What if?” Since extinction is such a high-magnitude impact, one could argue that even if the risk is small, one simply can’t ignore the possibility that the world might face extinction. The flexibility of this argument towards cases that the Negative might not have yet encountered depends on a little bit of a research burden. The Negative team moving into Championship division should do a little bit of research on how ending surveillance in general destroys the economy. There are hundreds of articles out there that describe that exact scenario. Armed with the general argument, the Negative can apply this to every case that seeks to curtail surveillance. 2|Page Economy Disadvantage RIUDL Varsity Division Glossary BRIC countries – Brazil, Russia, India, and China. Credit Rating – An evaluation of the credit worthiness of a business (company) or a government, but not individual consumers. Economic Decline – A general slowdown in economic activity. Economic Recovery – The process of an economy regaining levels achieved prior to downturn. Empirics – Relying on observation and experimentation. Hyperinflation - When price increases are so out of control that the concept of inflation is meaningless. Infrastructure - The basic physical and organizational structures and facilities (e.g., buildings, roads, and power supplies) needed for the operation of a society or enterprise. Labor market – The supply of available workers in relation to available work. Macroeconomic – A branch of economics dealing with the performance, structure, behavior, and decision-making of an economy as a whole, rather than individual markets. This includes national, regional, and global economies. Markov Probability Model – A system to model random change that assumes that future outcomes depend only on the present state, and not on any preceding events. Narco-dollars – Money obtained from drug trafficking. National Airspace System (NAS) – The airspace, navigation facilities and airports of the United States along with their associated information, services, rules, regulations, policies, procedures, personnel and equipment. Volatility – The degree of financial variation that is possible in an economy in a short period of time. World Trade Organization (WTO) – An intergovernmental organization which regulates international trade. 3|Page Economy Disadvantage RIUDL Varsity Division 1NC Shell (1/2) A. Uniqueness – The economy is getting stronger, but that trend can easily be reversed Saphir, 2015 (Ann; U.S. economy isn't as weak as estimates suggest, Fed paper says; www.reuters.com/article/2015/05/18/us-usa-fed-gdp-idUSKBN0O31T520150518) The U.S. economy is probably not as weak as current estimates suggest, a paper published Monday by the Federal Reserve Bank of San Francisco said, potentially adding to arguments for raising interest rates sooner rather than later. A government report late last month put firstquarter growth at a mere 0.2 percent, far below economists' expectations and uncomfortably close to an outright contraction like that experienced in the first quarter of 2014. But by running a series of statistical corrections for the way the government accounts for seasonal variations in output, the paper's authors found "a good chance that underlying economic growth so far this year was substantially stronger than reported." A chart in the paper suggested first-quarter growth may have been closer to 1.8 percent. That's still below the economy's potential but not dramatically so. A stronger economy suggests a lower hurdle for the Fed to raise interest rates that have been near zero since December 2008. San Francisco Fed President John Williams, whose chief research economist co-authored Monday's paper, has said he believes the economy will bounce back this quarter and may be strong enough for the Fed to begin raising interest rates even as soon as June. The paper's conclusions are at odds with the findings published last week by economists at the Washington-based Federal Reserve Board. They argued that the recent pattern of first-quarter economic slowdowns isn't a reflection of a statistical fluke in the way U.S. gross domestic product is measured. B. <Insert specific link.> C. Impact – New jobs underpin current economic growth Davidson, 2015 (Paul; Rise in higher-paying jobs lighting US economy; May 11; www.usatoday.com/story/money/business/2015/05/10/april-job-gains-better-paying/27008875/; kdf) Job growth last month shifted to higher-paying positions in a sign of a broadening labor market recovery. Professional and business services, construction and health care led the solid 223,000 job gains reported by the Labor Department on Friday. Retail and leisure and hospitality lagged. Both have been engines of payroll gains through most of the U.S. employment upswing since 2010. "We're seeing more quality jobs," says Diane Swonk, chief economist of Mesirow Financial. The trend, she says, partly reflects a widening recovery that includes a pickup in full-time positions. Professional and business services added 62,000 jobs in April, with strong advances in computer systems design, management and technical consulting, and architectural and engineering services. 4|Page Economy Disadvantage RIUDL Varsity Division 1NC Shell (2/2) D. Impact – Economic decline causes extinction. Haass, 2013 (President of the Council on Foreign Relations, 4/30/13, “The World Without America,” http://www.project-syndicate.org/commentary/repairing-the-roots-of-american-power-by-richard-n-haass) Let me posit a radical idea: The most critical threat facing the United States now and for the foreseeable future is not a rising China, a reckless North Korea, a nuclear Iran, modern terrorism, or climate change. Although all of these constitute potential or actual threats, the biggest challenges facing the US are its burgeoning debt, crumbling infrastructure, second-rate primary and secondary schools, outdated immigration system, and slow economic growth – in short, the domestic foundations of American power. Readers in other countries may be tempted to react to this judgment with a dose of schadenfreude, finding more than a little satisfaction in America’s difficulties. Such a response should not be surprising. The US and those representing it have been guilty of hubris (the US may often be the indispensable nation, but it would be better if others pointed this out), and examples of inconsistency between America’s practices and its principles understandably provoke charges of hypocrisy. When America does not adhere to the principles that it preaches to others, it breeds resentment. But, like most temptations, the urge to gloat at America’s imperfections and struggles ought to be resisted. People around the globe should be careful what they wish for. America’s failure to deal with its internal challenges would come at a steep price. Indeed, the rest of the world’s stake in American success is nearly as large as that of the US itself. Part of the reason is economic. The US economy still accounts for about one-quarter of global output. If US growth accelerates, America’s capacity to consume other countries’ goods and services will increase, thereby boosting growth around the world. At a time when Europe is drifting and Asia is slowing, only the US (or, more broadly, North America) has the potential to drive global economic recovery. The US remains a unique source of innovation. Most of the world’s citizens communicate with mobile devices based on technology developed in Silicon Valley; likewise, the Internet was made in America. More recently, new technologies developed in the US greatly increase the ability to extract oil and natural gas from underground formations. This technology is now making its way around the globe, allowing other societies to increase their energy production and decrease both their reliance on costly imports and their carbon emissions. The US is also an invaluable source of ideas. Its world-class universities educate a significant percentage of future world leaders. More fundamentally, the US has long been a leading example of what market economies and democratic politics can accomplish. People and governments around the world are far more likely to become more open if the American model is perceived to be succeeding. 5|Page Economy Disadvantage RIUDL Varsity Division 1NC Link – Drone Surveillance B. Link – Drones are vital for the economy. The plan guts tens of thousands of good paying jobs. Wolfgang, 2013 (Ben; Drone industry predicts explosive economic boost; Mar 12; www.washingtontimes.com/news/2013/mar/12/drone-industry-predicts-explosive-economicboost/?page=all) Drones as weapons and drones as spies remain matters of intense debate across the country, but the controversial aircraft are poised to make an impact as something else: economic engines. Private-sector drones — also called unmanned aerial systems or UAVs — will create more than 70,000 jobs within three years and will pump more than $82 billion into the U.S. economy by 2025, according to a major new study commissioned by the industry’s leading trade group. But the report, authored by aerospace specialist and former George Washington University professor Darryl Jenkins, assumes that the White House and Congress stick to the current schedule and have in place the necessary legal and regulatory frameworks. Current law calls for full drone integration into U.S. airspace by September 2015, but many key privacy questions surrounding UAVs have yet to be answered. There’s also growing doubt that the Federal Aviation Administration can meet the congressionally mandated timetable. If deadlines are met and drones become commonplace in American skies, some states will be especially big winners. Virginia, for example, stands to gain nearly 2,500 jobs by 2017. It also could take in $4.4 million in tax revenue and see more than $460 million in overall economic activity by 2017, the report says. Virginia would gain the eighth-most jobs of any state as a result of drone integration. Maryland isn’t far behind, with projections of more than 1,700 new jobs by 2017. California would be by far the biggest winner in terms of jobs, with more than 12,000 expected. Florida, Texas, New York, Washington, Connecticut, Kansas, Arizona and Pennsylvania are also expected to be benefit greatly from the coming drone economy. “This is an incredibly exciting time for an industry developing technology that will benefit society, as well as the economy,” said Michael Toscano, president and CEO of the Association for Unmanned Vehicle Systems International, a trade group that has existed for more than 40 years but has come into the public eye only recently. Drone expansion “means the creation of quality, high-paying American jobs,” Mr. Toscano continued. But the motivation behind Tuesday’s report — arguably the most sweeping look ever at the economic potential of drones — runs deeper than just dollars and cents. The industry faces an uncertain future in light of growing public paranoia surrounding the craft — paranoia that has only been heightened by the debate over whether the Obama administration would ever consider using a drone to kill an American on U.S. soil. While the drones that will be employed by U.S. companies or law enforcement agencies are far different than the military-style UAVs equipped with Hellfire missiles, those distinctions aren’t always clear. Tuesday’s report not only offered the industry a chance to shine the spotlight on drones’ positive uses and economic potential, but also served as an opportunity — or, perhaps a warning — to lawmakers seeking to limit UAVs. More than 20 states are considering bills to establish strict guidelines for what drones can do. 6|Page Economy Disadvantage RIUDL Varsity Division 1NC Link – Drug Surveillance B. Link – Loss of drug trafficking revenue collapses Mexican economy and government The Daily Telegraph, 1997 (Lord of the Skies, stuff.mit.edu/people/aaelenes/sinaloa/narco/amado/ amado12.html) Narcotics trafficking is a $30 billion-a-year industry in Mexico, equivalent to the rest of the nation's GNP put together. Oil, the second biggest industry, earns $ 10 billion a year, the annual income of Amado Carrillo Fuentes. The government can't afford to stamp out drug trafficking, even if it could. Without narco-dollars, the Mexican economy would likely collapse and the government along with it. Which explains why the United States, for all its drug war rhetoric, tolerated Carrillo for so long. Which explains a letter Carrillo wrote to the Mexican President, Ernesto Zedillo, on January 14 this year, subsequently leaked to the press: 'Leave me alone to run my business. Otherwise I'll withdraw its benefits from the nation.' Note the slightly impatient tone: Look Ernesto, just don't you forget who's paying the bills around here. AND Mexican economic decline spills over to the U.S. and collapses the U.S. economy. Sarukhan, 2012 (Arturo, Ambassador of Mexico to the United States, “Mexico ‘Critically Important’ to US Economy,” Wilson Center, 2/24/12, video testimony, http://www.wilsoncenter.org/article/mexico%E2%80%98critically-important%E2%80%99-to-us-economy) It’s an incredibly strong relationship, for starters, because a lot of people sometimes don’t stop to think that we trade one billion dollars a day of goods in both directions. Second, that Mexico is the United States’ depending on crate loads that we are either third, or second largest trading partner with the United States. China and Mexico have been sort of in second or third, and we are the second largest buyer of U.S. exports on the face of the Earth. Depending what your area of geographic expertise or fondness is, if you think of Latin America, Mexico buys more U.S. exports than all of Latin America and the Caribbean combined. If you’re focused on Europe, Mexico buys more U.S. exports than the combined purchase of the U.K., Germany, Italy, and the Netherlands. If you’re focused on the new, sexy Asia-Pacific, Mexico is buying more U.S. exports than Japan and China combined. We buy more exports than all the four BRIC countries put together, so it’s a very compelling story. 26 states in America today have Mexico as their #1 or #2 export market, and there are ten million U.S. jobs directly related to trade with Mexico in those states. So, it is very vibrant, very important to weigh economic relationship. Mexico’s macroeconomic fundamentals, when the world is hurting still and still facing some of the challenges from the global recession, Mexico growth last year was five percent with 3.1 [percent] inflation and four percent unemployment. These are very compelling numbers. I think that the macroeconomic fundamentals of Mexico are sound, and this two-way successful relationship that we have developed is critically important for the social well-being and the prosperity of Americans. 7|Page Economy Disadvantage RIUDL Varsity Division 1NC Link – Immigration Surveillance B. Link – The cost of illegal immigration harms the U.S Economy. Camarota, 2004 (Steven A. Camarota, The High Cost of Cheap Labor Illegal Immigration and the Federal Budget, http://www.cis.org/articles/2004/fiscalexec.html) When defense spending is not considered, illegal households are estimated to impose costs on the federal treasury of $6,949 a year or 58 percent of what other households received. When defense spending is included, their costs are only 46 percent those of other households. However, they pay only 28 percent as much in taxes as non-illegal households. As a result, the estimated net cost per illegal household was $2,736. Whether one sees this fiscal deficit as resulting from low tax payments or heavy use of services is a matter of perspective. As already discussed, illegal households comprise 3.6 percent of the total population, but as Table 2 shows they account for an estimated 0.9 percent of taxes paid and 1.4 percent of costs. Thus, both their payments and costs are significantly less than their share of the total population. Since they use so much less in federal services than other households, it probably makes the most sense to see the fiscal deficit as resulting from low tax payments rather than heavy use of public services. Total Deficit Created by Illegals. If the estimated net fiscal drain of $2,736 a year that each illegal household imposes on the federal treasury is multiplied by the nearly three million illegal households, the total cost comes to $10.4 billion a year. Whether one considers this to be a large sum or not is, of course, a matter of perspective. But, this figure is unambiguously negative and certainly not trivial. It is also worth remembering that these figures are only for the federal government and do not include any costs at the state or local level, where the impact is likely to be significant. 8|Page Economy Disadvantage RIUDL Varsity Division AT: Non-Unique – Housing and Unemployment [___] [___] The economy is high—low unemployment, average wages, participation rate, stable credit rating all prove this. Kruger, 2014 (Daniel Kruger- Phd from Loyal University of Chicago- studies patterns of economics and mortality“Treasuries in facing Biggest Weekly Drop Since March After Jobs”- Bloomberg June 6, 2014http://www.bloomberg.com/news/2014-06-06/treasuries-advance-as-u-s-employment-growth-slowsin-may.html) Treasuries posted the biggest weekly drop in three months as employment gains in May pushed U.S. payrolls past their pre-recession peak and the jobless rate held at an almost sixyear low. The U.S.’s AA+ credit rating was affirmed by Standard & Poor’s, which cited the resiliency and diversity of the economy, almost three years after downgrading the nation for the first time. Yields on government securities in the euro-area fell to record lows a day after the European Central Bank cut interest rates, sparking a global warming crises rush for bonds. Federal Reserve Chair Janet Yellen said May 7 labor-market conditions “are still far from satisfactory.” “The overall economy from a job perspective is finally trending in a good way,” Jason Rogan, managing director of U.S. government trading at Guggenheim Securities, a New York-based brokerage for institutional investors. “From the Fed’s perspective, you’re starting to see very good job growth.” Benchmark 10-year yields rose less than one basis point to 2.59 percent as of 5 p.m. in New York after earlier dropping five basis points, based on Bloomberg Bond Trader prices. The price of the 2.5 percent security due in May 2024 dropped 1/32, or 31 cents per $1,000 face value, to 99 7/32. Yields on the securities climbed 11 basis points this week, the most since the five days ended March 7, and rose as high as 2.64 percent yesterday, the most since May 13. Two-year note yields added two basis points to 0.40 percent, the highest level since May 13, gained three basis points this week for a second five-day gain. Credit Rating New York-based S&P said today in a statement that there is a less than one-in-three probability that the U.S.’s credit ranking will change in the next two years. The outlook on the rating is stable. Since the August 2011 downgrade from AAA, record budget deficits have shrunk, economic growth accelerated, the dollar rallied, stocks climbed to all-time highs and Treasuries strengthened their hold as the world’s preferred haven from turmoil. Still, S&P said a polarized policy-making environment and high general government debt and budget deficits constrain the ratings. “After the rating of the U.S. came under pressure because of the debt ceiling and government shut down, we actually saw a better cost of funding for the government,” David Coard, head of fixed-income trading in New York at Williams Capital Group, a brokerage for institutional investors. “We’re still the safe haven everybody seeks when there’s uncertainty in the world. I don’t think that’s changed.” 9|Page Economy Disadvantage RIUDL Varsity Division AT: Non-Unique – Deficit Spending [___] Consumer confidence is high, which is more important for the economy. Mutikani, 2014 (Mutikani, Lucia. "WRAPUP 3-U.S. Retail Sales, Manufacturing Data Point at Firming Economy." Reuters. Thomson Reuters, 15 July 2014. Web. 18 July 2014. <http://www.reuters.com/article/2014/07/15/usa-economyidUSL2N0PQ0K020140715?feedType=RSS&feedName=everything&virtualBrandChannel=11563>. Lucia Mutikani is a journalist and writer for Reuters.com Fred) WASHINGTON, July 15 (Reuters) - A gauge of U.S. consumer spending rose solidly in June, in the latest indication that the economy ended the second quarter on a stronger footing. That momentum appeared to have carried into the third quarter, with another report on Tuesday showing factory activity in New York state expanded sharply in July. "This is not a fragile economy," said Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi UFJ in New York. "The consumer continues to play their part in moving the economy forward." Core sales, which strip out automobiles, gasoline, building materials and food services, increased 0.6 percent last month after rising an upwardly revised 0.2 percent in May, the Commerce Department said. Core sales, which correspond most closely with the consumer spending component of gross domestic product, were previously reported as being flat in May. Economists had expected them to rise 0.5 percent in June. The report added to signs of the economy's strengthening fundamentals, which could buoy optimism the recovery is on a self-sustaining path, after output contracted sharply in the first quarter. Federal Reserve Chair Janet Yellen told lawmakers the economy continued to improve, but noted that the recovery was not yet complete because of still-high unemployment. Yellen, however, cautioned the U.S. central bank could raise interest rates sooner and more rapidly than currently envisioned if the labor market continued to improve faster than anticipated by policymakers. Labor market conditions are firming, with the unemployment rate falling to a near six year-low of 6.1 percent in June and job growth exceeding 200,000 for a fifth straight month. Prices for U.S. Treasury debt fell on the economic data and Yellen's interest rate comments, while the dollar gained against a basket of currencies. U.S. stocks traded lower. June's gains and May's upward revision to core retail sales suggested a pickup in consumer spending in the second quarter after growing at its slowest pace in more than four years in the first quarter because of weak healthcare consumption. Forecasting firm Macroeconomic Advisers raised its second-quarter GDP growth forecast by three-tenths of a percentage point to a 3.0 percent annual pace. Goldman Sachs upped its estimate for the quarter by two-tenths to a 3.4 percent rate. UPBEAT OUTLOOK A surprise drop in receipts for automobiles, however, held overall retail sales to a 0.2 percent increase in June after advancing 0.5 percent the prior month. "Consumers will likely gain more confidence to spend as the job market improves and summer travel season hits full swing," said Randy Hopper, credit cards vice president at Navy Federal Credit Union in Vienna, Virginia. "We are optimistic that the second half of the year will deliver stronger sales growth." From employment to manufacturing growing , the economy appears to be firing on nearly all cylinders, with even housing regaining its footing after slumping in late 2013 following a run-up in mortgage rates. Growth estimates for the second quarter top a 3.0 percent annual rate. In another report, the New York Fed said its Empire State general business conditions index jumped to 25.60 this month, the highest since April 2010, from 19.28 in June. 10 | P a g e Economy Disadvantage RIUDL Varsity Division AT: No Impact – US Not Key to Global Economy [___] Empirics prove our argument Hanson, 2008 (Victor Davis Hanson, Senior fellow at the Hoover Institution, recipient of the 2007 National Humanities Medal and the 2008 Bradley Prize, October 2nd 2008, “America’s Nervous Breakdown – and the World,” http://www.realclearpolitics.com/articles/2008/10/americas_nervous_breakdown_and.html) Allies trust that the United States is the ultimate guarantor of free communication and commerce — and they want immediate reassurance that their old America will still be there. In contrast, opportunistic predators — such as rogue oil-rich regimes — suddenly sniff new openings. We’ve seen the connection between American economic crisis and world upheaval before. In the 1930s, the United States and its democratic allies — in the midst of financial collapse — disarmed and largely withdrew from foreign affairs. That isolation allowed totalitarian regimes in Germany, Italy, Japan, and Russia to swallow their smaller neighbors and replace the rule of law with that of the jungle. World War II followed. / During the stagflation and economic malaise of the Jimmy Carter years, the Russians invaded Afghanistan, the Iranians stormed our embassy in Tehran, the communists sought to spread influence in Central America, and a holocaust raged unchecked in Cambodia. It was no surprise that an emboldened Iranian President Mahmoud Ahmadinejad once again last week called for the elimination of Israel. He’s done that several times before. But rarely has he felt brazen enough to blame world financial problems on the Jews in general rather than on just Israelis. And he spouted his Hitlerian hatred in front of the United Nations General Assembly — in New York, just a few blocks away from the ground zero of the Wall Street meltdown. / Flush with petrodollar cash, a cocky Iran thinks our government will be so sidetracked borrowing money for Wall Street that disheartened taxpayers won’t care to stop Teheran from going nuclear. At about the same time, a Russian flotilla was off Venezuela to announce new cooperation with the loud anti-American Hugo Chavez and his fellow Latin American communists. The move was a poke in the eye at the Monroe Doctrine — and a warning that from now on, the oil-rich Russians will boldly support dictatorships in our hemisphere as much as we encourage democratic Georgia and Ukraine in theirs. Chavez himself called for a revolution in the United States to replace our “capitalist” Constitution. The lunatics running North Korea predictably smelled blood, as well. So it announced that it was reversing course and reprocessing fuel rods to restart its supposedly dismantled nuclear weapons program. 11 | P a g e Economy Disadvantage RIUDL Varsity Division AT: No Impact – Global Economy Determines US Economy [___] US economy is key to the global economy International Monetary Fund, 2013 (IMF, International Monetary Fund, September 19th 2013 “Strong U.S. Economy, Strong Global Economy—Two Sides of Same Coin,” http://www.imf.org/external/pubs/ft/survey/so/2013/new091913a.htm) In a world of increasing economic interconnections, the United States’s stake in the global recovery is greater than ever, IMF Managing Director Christine Lagarde said in a speech to business leaders at the U.S. Chamber of Commerce in Washington, D.C. “What happens elsewhere in the world—be it the success of recovery in Europe or the continued smooth functioning of supply chains in Asia—matters increasingly for the United States,” Lagarde said. “The converse is also true. What happens here matters increasingly for the global economy.” Her remarks, which focused on the interplay between the global economy and the U.S. economy, also highlighted the need to find joint solutions to secure a lasting, balanced and widely shared global recovery. “Job creation is a critical ingredient of any economic recovery, domestic or global,” she emphasized. Businesses have a key role to play, Lagarde said, but at the same time, policymakers have an important responsibility to help “shape the environment in which businesses and citizens can thrive—and jobs can be created.” Changing global picture Lagarde said that global growth remains subdued, while acknowledging that the global economic environment is changing. She emphasized that economies are moving at different speeds and that the fruits of growth are not evenly shared, both in the United States and other countries. The U.S. economy is growing and, after a long time, so is the Euro Area. In Japan, aggressive policy support and the ongoing reform process is helping to spur growth. The emerging market economies, on the other hand, are slowing. “For some, this may be a shift toward more balanced and sustainable growth,” Lagarde told the audience. “For others, it reflects the need to address imbalances that have made them more vulnerable to the recent market turbulence.” Reinforcing the point about global interconnections, Lagarde cited the IMF’s recent “spillover” analysis, which suggests that if the world’s five major economies were to work together to adopt a more rigorous, comprehensive, and compatible set of policies, it could boost global GDP by about 3 percent over the longer run. U.S. recovery gaining strength Lagarde noted that the U.S. economy is gaining strength, calling this good news for America—and good news for the world economy. Although growth is still modest—well under 2 percent—it should accelerate by a full percentage point next year, Lagarde said, adding that the private sector is playing a key role as the engine of growth and job creation. Despite signs of strengthening, the latest jobs data present a mixed picture, with employment remaining well below pre-crisis levels. “The issue of jobs remains paramount,” said Lagarde, noting that jobs and growth is an increasingly important component of the IMF’s policy advice. Lagarde highlighted three key recommendations for U.S. policymakers, drawn from the IMF’s most recent assessment of the U.S. economy. • Fix public finances. Fiscal consolidation could be slower in the short run, but more action is needed to reduce long-run pressures on the budget. Lagarde also warned that political uncertainty over the budget and debt ceiling were not helpful to the recovery. “It is essential to resolve this, and the earlier the better,” she said, “for confidence, for markets, and for the real economy.” • Appropriately calibrate monetary policy. When the time comes, exit from unconventional monetary policy should be gradual, tied to progress in economic recovery and unemployment, and should be clearly communicated and in a dialogue. • Complete financial sector reform. While there has been progress on this front, attention needs to focus on the outstanding “danger zones,” such as derivatives and shadow banking. Global interconnections and role of IMF Lagarde underscored the unique role of the U.S. in the global economy, noting that the economy accounts for 11 percent of global trade and 20 percent of global manufacturing. The country’s global financial ties run deep too, she said. Foreign banks hold about $5.5 trillion of U.S. assets, and U.S. banks hold $3 trillion of foreign assets. 12 | P a g e Economy Disadvantage RIUDL Varsity Division AT: No Impact – Global Economy Resilient [___] We can’t risk it. Economic decline causes conflict, resource competition, terrorism and war. It’s an existential threat. Kemp, 2010 (Director of Regional Strategic Programs at The Nixon Center, served in the White House under Ronald Reagan, special assistant to the president for national security affairs and senior director for Near East and South Asian affairs on the National Security Council Staff, Former Director, Middle East Arms Control Project at the Carnegie Endowment for International Peace, Geoffrey The East Moves West: India, China, and Asia’s Growing Presence in the Middle East”, p. 233-4) The second scenario, called Mayhem and Chaos, is the opposite of the first scenario; everything that can go wrong does go wrong. The world economic situation weakens rather than strengthens, and India, China, and Japan suffer a major reduction in their growth rates, further weakening the global economy. As a result, energy demand falls and the price of fossil fuels plummets, leading to a financial crisis for the energy-producing states, which are forced to cut back dramatically on expansion programs and social welfare. That in turn leads to political unrest: and nurtures different radical groups, including, but not limited to, Islamic extremists. The internal stability of some countries is challenged, and there are more “failed states.” Most serious is the collapse of the democratic government in Pakistan and its takeover by Muslim extremists, who then take possession of a large number of nuclear weapons. The danger of war between India and Pakistan increases significantly. Iran, always worried about an extremist Pakistan, expands and weaponizes its nuclear program. That further enhances nuclear proliferation in the Middle East, with Saudi Arabia, Turkey, and Egypt joining Israel and Iran as nuclear states. Under these circumstances, the potential for nuclear terrorism increases, and the possibility of a nuclear terrorist attack in either the Western world or in the oil-producing states may lead to a further devastating collapse of the world economic market, with a tsunami-like impact on stability. In this scenario, major disruptions can be expected, with dire consequences for two-thirds of the planet’s population. 13 | P a g e Economy Disadvantage RIUDL Varsity Division AT: No Impact – No War [___] History proves that economic decline breeds incentives for conflict. Mead, 2009 (Walter Russell Mead, the Henry A. Kissinger Senior Fellow in U.S. Foreign Policy at the Council on Foreign Relations, February 4, 2009, “Only Makes You Stronger,” The New Republic) History may suggest that financial crises actually help capitalist great powers maintain their leads--but it has other, less reassuring messages as well. If financial crises have been a normal part of life during the 300-year rise of the liberal capitalist system under the Anglophone powers, so has war. The wars of the League of Augsburg and the Spanish Succession; the Seven Years War; the American Revolution; the Napoleonic Wars; the two World Wars; the cold war: The list of wars is almost as long as the list of financial crises. Bad economic times can breed wars. Europe was a pretty peaceful place in 1928, but the Depression poisoned German public opinion and helped bring Adolf Hitler to power. If the current crisis turns into a depression, what rough beasts might start slouching toward Moscow, Karachi, Beijing or New Delhi to be born? The United States may not, yet, decline, but, if we can’t get the world back on track, we may still have to fight. [___] Economic recessions increase risk of civil conflict Bloomberg and Hess, Wellesley and Oberlin economics professors, 2002 (S. Brock and Gregory D., “The Temporal Links between Conflict and Economic Activity”, Journal of Conflict Resolution, Volume 46, Number 1) Using an unbalanced panel of 152 countries from 1950 to 1992, we estimate a Markov probability model to investigate the joint determination of internal conflict, external conflict, and the economy. We begin with a simple model that allows for a two-variable relationship: internal conflict and recessions, external conflict and recessions, and internal conflict and external conflict. We find that these are not independent events. In particular, we find that recessions play an important role in determining internal conflict, especially in Africa and for nondemocratic countries. In this case, the occurrence of a recession causes an increase in the probability of internal conflict starting in a given year to almost double. We then extend the model to allow for a three-variable relationship: internal conflict, external conflict, and recessions. In the more complicated system, we continue to find an important link. In this case, we find that the presence of a recession coupled with an external war will actually cause the probability of an internal conflict starting in a given year to increase between two- and threefold. If this study is to convince readers and policy makers of anything, it is that the linkages between internal and external conflict and prosperity are strong and mutually reinforcing. Economic conflict tends to spawn internal conflict, which in turn returns the favor. Moreover, the presence of a recession tends to amplify the extent to which internal and external conflicts self-reinforce each other. However, the ability of government organizations to stop the spread of internal conflict to external conflict and vice versa by helping to reduce the incidence of recessions may be quite limited. Economic aid that is to improve a nation’s productive capacity is likely to be difficult to identify and implement in just such circumstances. 14 | P a g e