Answers

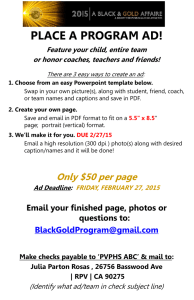

advertisement

Economy Disadvantage Affirmative RIUDL Varsity Division Table of Contents Summary.............................................................................................................................................. 2 Glossary............................................................................................................................................... 3 Link Answers No Link – Drones .................................................................................................................................. 4 No Link – Drug Trade ............................................................................................................................ 5 No Link – Immigration ........................................................................................................................... 6 No Link – NSA Surveillance Slows the Economy.................................................................................. 7 Uniqueness Answers Non-Unique – Housing and Unemployment .......................................................................................... 8 Non-Unique – Deficit Spending ............................................................................................................. 9 Impact Answers No Impact – US Not Key to Global Economy ...................................................................................... 10 No Impact – Global Economy Determines US Economy .................................................................... 11 No Impact – Global Economy is Resilient ........................................................................................... 12 No Impact – No War ........................................................................................................................... 13 1|Page Economy Disadvantage Affirmative RIUDL Varsity Division Summary The central defense against this disadvantage should focus on three areas: 1. Does the plan cause a decline in the economy? This is the easiest area to challenge, as the economy is rather large and full of many different sectors. It is hard to argue that one change in one sector would have such devastating impacts on the larger economy. 2. Is the economy currently doing well? If the Affirmative can prove that the economy is already on a downward trend, then there would be substantive difference between the status quo and the world in which the plan passes. If there’s no substantive difference, then the disadvantage would not be a reason to reject the plan. 3. Is the impact overstated? Many of these generic arguments overstate their impacts to appear stronger to the judge. A smart impact defense will always challenge the likelihood of a terrifying impact happening due to a dip in the economy. It is best to draw upon the evidence provided, as well as historical examples. 2|Page Economy Disadvantage Affirmative RIUDL Varsity Division Glossary BRIC countries – Brazil, Russia, India, and China. Credit Rating – An evaluation of the credit worthiness of a business (company) or a government, but not individual consumers. Economic Decline – A general slowdown in economic activity. Economic Recovery – The process of an economy regaining levels achieved prior to downturn. Empirics – Relying on observation and experimentation. Hyperinflation - When price increases are so out of control that the concept of inflation is meaningless. Infrastructure - The basic physical and organizational structures and facilities (e.g., buildings, roads, and power supplies) needed for the operation of a society or enterprise. Labor market – The supply of available workers in relation to available work. Macroeconomic – A branch of economics dealing with the performance, structure, behavior, and decision-making of an economy as a whole, rather than individual markets. This includes national, regional, and global economies. Markov Probability Model – A system to model random change that assumes that future outcomes depend only on the present state, and not on any preceding events. Narco-dollars – Money obtained from drug trafficking. National Airspace System (NAS) – The airspace, navigation facilities and airports of the United States along with their associated information, services, rules, regulations, policies, procedures, personnel and equipment. Volatility – The degree of financial variation that is possible in an economy in a short period of time. World Trade Organization (WTO) – An intergovernmental organization which regulates international trade. 3|Page Economy Disadvantage Affirmative RIUDL Varsity Division No Link – Drones [___] [___] Restricting drone surveillance won’t hurt the economy, private drones will still create jobs no matter the restriction on law enforcement drones. Bernd, 2013 (Candice [assistant editor/reporter with Truthout]; The Coming Domestic Drone Wars; Sep 19; www.truth-out.org/news/item/18951-the-coming-domestic-drone-wars#; kdf) States Push to Regulate Domestic Drones as Industry Pushes Back The Texas law is just one of many pieces of legislation placing restrictions on the use of domestic drones to be introduced in 43 states this year, passing in eight. Many of these state-level bills seek to require search warrants for surveillance drones used by local police departments, and at least six states have required warrants. In 2013, Virginia put in place a two-year moratorium on the use of drones by law enforcement to develop more stringent guidelines. Legislation restricting civilian drone use has passed in states such as Florida, Tennessee, Idaho, Montana and Oregon, but other states such as North Dakota have tried to pass laws that would ban weapons from domestic drones and have failed. But the industry is pushing back against privacy restrictions and regulations on civilian drones, saying the restrictions will hinder job creation. In Maine, Gov. Paul LePage backed up the claim by vetoing a bill that would have required police to obtain a warrant before deploying a drone, citing concerns it would kill new aerospace jobs. "We don't support rewriting existing search warrant requirements under the guise of privacy," Mario Mairena told the AP. Mairena is a government relations manager for the Virginia-based Association for Unmanned Vehicle Systems International (AUVSI), an industry group. The group's website boasts hundreds of corporate members, many of which are defense contractors. The group also has ties to the Unmanned Systems Caucus in Congress. Whether or not requiring a warrant in law enforcement drone operations would kill jobs remains to be seen, but the integration of civilian drones into the NAS would create a considerable economic impact, to be sure. An AUVSI report estimates that the integration of unmanned systems in the U.S. will generate more than $13.6 billion and create 74,000 jobs within the first three years. But strong regulations of domestic drones in the states may prove especially important depending on what guidelines the FAA puts in place to integrate the technology into the national airspace by 2015, as some experts fear the susceptibility to co-option of unmanned systems by third-party operators could pose serious risks to domestic security. 4|Page Economy Disadvantage Affirmative RIUDL Varsity Division No Link – Drug Trade [___] [___] The drug trade destroys the U.S. economy, ending the War on Drugs would help the economy. Chalk, 2011 (Peter, Senior Political Scientist at RAND Corporation, Ph.D. in political science, University of British Columbia, M.A. in political studies and international relations, University of Aberdeen, “The Latin American Drug Trade Scope, Dimensions, Impact, and Response,” RAND Project Air Force, http://www.rand.org/content/dam/rand/pubs/monographs/2011/RAND_MG1076.pdf) The narcotics trade has also significantly impeded fiscal growth and stability by diverting scarce resources away from more-productive uses. Between 1981 and 2008, federal, state, and local governments are estimated to have spent at least $600 billion (adjusted for inflation) on drug interdiction and related law enforcement efforts; factoring in costs associated with treatment and rehabilitation, the overall total rises to around $800 billion.34 If one were to also add in “invisible” losses brought about by curtailed job opportunities and reduced workplace productivity, the true cost would be far higher. As ONDCP has observed, this financial burden is one that is shared by all of society, either directly or indirectly through higher tax dollars.35 5|Page Economy Disadvantage Affirmative RIUDL Varsity Division No Link – Immigration [___] [___] Undocumented immigrants are good for the economy because they are essential to the labor force, agriculture, and bring in millions in tax revenue. Goodman, 2014 (H. A. Goodman is an author and journalist who studied International Relations at USC and worked for a brief stint at the U.S. Department of State's Foreign Service Institute, Illegal immigrants benefit the U.S. economy, http://thehill.com/blogs/congress-blog/foreign-policy/203984-illegal-immigrantsbenefit-the-us-economy) According to the Pew Research Hispanic Trends Project, there were 8.4 million unauthorized immigrants employed in the U.S.; representing 5.2 percent of the U.S. labor force (an increase from 3.8 percent in 2000). Their importance was highlighted in a report by Texas Comptroller Susan Combs that stated, “Without the undocumented population, Texas’ work force would decrease by 6.3 percent” and Texas’ gross state product would decrease by 2.1 percent. Furthermore, certain segments of the U.S. economy, like agriculture, are entirely dependent upon illegal immigrants. The U.S. Department of Agriculture states that, “about half of the hired workers employed in U.S. crop agriculture were unauthorized, with the overwhelming majority of these workers coming from Mexico.” The USDA has also warned that, “any potential immigration reform could have significant impacts on the U.S. fruit and vegetable industry.” From the perspective of National Milk Producers Federation in 2009, retail milk prices would increase by 61 percent if its immigrant labor force were to be eliminated. Echoing the Department of Labor, the USDA, and the National Milk Producers Federation, agricultural labor economist James S. Holt made the following statement to Congress in 2007: “The reality, however, is that if we deported a substantial number of undocumented farm workers, there would be a tremendous labor shortage.” In terms of overall numbers, The Department of Labor reports that of the 2.5 million farm workers in the U.S., over half (53 percent) are illegal immigrants. Growers and labor unions put this figure at 70 percent. But what about the immense strain on social services and money spent on welfare for these law breakers? The Congressional Budget Office in 2007 answered this question in the following manner: “Over the past two decades, most efforts to estimate the fiscal impact of immigration in the United States have concluded that, in aggregate and over the long term, tax revenues of all types generated by immigrants—both legal and unauthorized—exceed the cost of the services they use.” According to the New York Times, the chief actuary of the Social Security Administration claims that undocumented workers have contributed close to 10% ($300 billion) of the Social Security Trust Fund. Finally, the aggregate economic impact of illegal immigration is debatable, but any claim that they’ve ruined the country doesn’t correlate to the views of any notable economist. An open letter to President George W. Bush in 2006, signed by around five hundred economists (including five Nobel laureates) stated the following: “While a small percentage of native-born Americans may be harmed by immigration, vastly more Americans benefit from the contributions that immigrants make to our economy, including lower consumer prices.” 6|Page Economy Disadvantage Affirmative RIUDL Varsity Division No Link – NSA Surveillance Slows the Economy [___] [___] Too much surveillance impedes economic competition. Stiennon, 2013 (Richard; NSA Surveillance Threatens US Competitiveness; Jun 7; www.forbes.com/sites/richardstiennon/2013/06/07/nsa-surveillance-threatens-us-competitiveness/) The vast foreign and domestic spying by the NSA revealed this week threatens the global competitiveness of US tech companies. We are told we live in a digital world and the future is bright for tech startups as costs of launching new products and services plummet and global markets open up to the smallest vendor. Yet, there is a worldwide perception that any data that is stored or even routed through the United States is sucked into cavernous NSA data centers for analysis and cataloging. That perception was solidified in 2006 when former AT&T technician Mark Klein blew the whistle on the fiber tap that ATT had provided to the NSA in some of its data centers. Those perceptions have had real consequences for US tech firms seeking to offer global services. Email archiving services such as ProofPoint could not sell to even Canadian customers without building local infrastructure. Even establishing separate data centers in Canada and Europe is not enough to assure customers that their data would forever stay out of the grasp of US intelligence services. One of the fastest growing segments of the tech industry is cloud services, with Salesforce.com one of the leading examples. Box.net, and other cloud storage solutions, are burgeoning. Cloud infrastructure providers like Amazon, Microsoft, and Rackspace are investing billions to serve markets that should be global but will be barred from most countries thanks to the complete abandonment of trust caused by NSA/FBI spying. Since 2006, every time I present outside the US the same question has been asked: “Is the US reading our email?” Answers that allude to ‘protections from abuse’ and ‘oversight’ now seem specious. From this week forward a universal suspicion has transformed into acknowledged fact. Yes, US government agencies are reading email, tracking phone calls, and monitoring all communications. 7|Page Economy Disadvantage Affirmative RIUDL Varsity Division Non-Unique – Housing and Unemployment [___] [___] US economy still struggling—housing and long term unemployment Kohl, 2014 (David Kohl is a professor in finance, business management and banking at Virginia Tech- “Economic indicators and confusing signals” Corn and Soybean Digest Road Warrior- May 27, 2014 http://cornandsoybeandigest.com/blog/economic-indicators-and-confusing-signals) The U.S. economy is showing mixed signals. The lead economic index (LEI) which foretells the future of the economy has been increasing in recent months, most recently up 0.4%, which is bullish for the economy. Sixty percent of the factors that make up the LEI are exhibiting positive signs. The purchasing manager index (PMI) also illustrates a positive growth oriented economy for the next few months. The readings have consistently been above 50, a metric that suggests an expanding economy. Another positive sign is 78.6% factory capacity utilization. For comparison, at the height of the great economic recession of 2009, this figure dropped to 68%, the lowest ever recorded. Confusing Signals Despite the forward-looking good news, housing, which is a pivotal part of the economy, is still struggling. With one in seven jobs in America tied to housing, this engine of the economy is improving at a modest pace. Ideally, housing starts range between 1.1 million and 1.5 million annually. In recent months, this metric has been in the 900,000 range, and it increased to 1.072 million in April. Reasons for the struggle include higher mortgage rates, students with over $1 trillion of student loan debt collectively, increased regulation of mortgage lenders, the desire to rent rather than own a home, and affordability of housing with flattening or reduced wage scales. Another area of the economy that is struggling is unemployment. While the rate has declined to 6.3%, the U-6 unemployment rate which includes the long-term unemployed, discouraged workers and people mismatched in the workforce is at 12.3%. While many jobs are available, the particular skill sets needed may not be available, creating a gap. This is particularly true in the agriculture industry with more use of technology and innovation, which requires a highly skilled agricultural workforce. Oil prices remain stubbornly high impacting consumer purchases. Copper prices, a bellwether of world economic growth and inflation, have declined by approximately 25% year-over-year. Yes, first quarter gross domestic product (GDP) growth was a paltry 0.1%. Everyone he is blaming the winter weather, but there may be other factors involved. 8|Page Economy Disadvantage Affirmative RIUDL Varsity Division Non-Unique – Deficit Spending [___] [___] Budget deficit is currently high—This is the key for international perception of the global markets. Hunter, 2014 (Hunter, Greg. "Budget Deficit Exploding Out of Control -John Williams."Greg Hunters USAWatchdog. N.p., 13 July 2014. Web. 18 July 2014. <http://usawatchdog.com/budget-deficit-exploding-out-ofcontrol-john-williams/>. Greg Hunter is a writer for usawatchdogs.com Fred). Economist John Williams says don’t be fooled by the new highs on the Dow. Williams contends, “The economy is still in serious trouble. The banking system is still in serious trouble. The budget deficit is exploding out of control.” Williams thinks the ongoing banking crisis in Cyprus has global implications. Williams says, “You have a precedence set in Cyprus that they can seize the funds. They will not guarantee all deposits. If that’s the case, you may have a much worse crisis than you had back in 2008.” Williams adds, “The big problem is the government is insolvent in the long term.” Williams says the U.S. dollar could start selling off in May because of a deadlock in Congress on the budget. Williams predicts, “The global markets are looking for the U.S. to address its long term sovereign solvency issues. That’s not going to happen. . . . In response, it’s going to be off to the races with a dollar sell-off. That could be the trigger for the early stages of hyperinflation.” Join Greg Hunter as he goes One-on-One with John Williams of Shadowstats.com. 9|Page Economy Disadvantage Affirmative RIUDL Varsity Division No Impact – US Not Key to Global Economy [___] The US isn’t key to the global economy. Kenny, 2015 (Charles; Why the Developing World Won't Catch the U.S. Economy's Cold; May 4; www.bloomberg.com/news/articles/2015-05-04/why-the-developing-world-won-t-catch-the-u-seconomy-s-cold) Last week the U.S. Commerce Department announced that first-quarter GDP growth for 2015 was an anemic 0.2 percent. This immediately sparked fears that a U.S. slowdown could lead to a global recession. But the cliché about America sneezing and the rest of the world catching the cold doesn’t hold like it used to. The U.S. isn’t as contagious as it was, and developing countries in particular are far more robust to economic shocks. That’s good news for everyone. It means less volatility in Asia, Africa, and Latin America, which contributes to happier people, greater political stability, and stronger long-term growth—all of which should help lift the U.S. out of its own doldrums. A team of IMF researchers has looked at the long-term record of the world’s economies when it comes to growth and recession. They measured how long economies expanded without interruption, as well as the depth and length of downturns. Over the past two decades, low and middle-income economies have spent more time in expansions, while downturns and recoveries have become shallower and shorter. This suggests countries have become more resilient to shocks. In the 1970s and '80s, the median developing economy took more than 10 years after a downturn to recover to the GDP per capita it had prior to that slump. By the early 2000s, that recovery time had dropped to two years. In the 1970s and '80s, countries of the developing world spent more than a third of their time in downturns, but by the 2000s they spent 80 percent of their time in expansions. The first decade of the 21st century was the first time that developing economies saw more expansion and shorter downturns than did advanced economies: Median growth in the developing world was at its highest since 1950 and volatility at its lowest. Developing countries still face a larger risk of deeper recession when terms of trade turn against them, capital flows dry up, or advanced economies enter recessions themselves. But the scale of that risk has diminished. That’s because low and middle-income economies have introduced policy reforms that increase resilience: flexible exchange rates, inflation targeting, and lower debt. Economies with inflation-targeting regimes see recovery periods less than a third as long as economies without targeting, for example. Larger reserves are associated with longer expansions. And median reserves in developing countries more than doubled as a percentage of GDP between the 1990s and 2010. 10 | P a g e Economy Disadvantage Affirmative RIUDL Varsity Division No Impact – Global Economy Determines US Economy [___] [___] The global economy determines the US economy, not vice versa. Rasmus, 2015 (Jack; US Economy Collapses Again; May 14; www.counterpunch.org/2015/05/14/us-economycollapses-again/) The problem of weak, stop-go, recovery in the U.S. today is further exacerbated by a global economy that continues to slow even more rapidly and, in case after case, slip increasingly into recessions or stagnate at best. Signs of weakness and stress in the global economy are everywhere and growing. Despite massive money injections by its central bank in 2013, and again in 2014, Japan’s economy has fallen in 2015, a fourth time, into recession. After having experienced two recessions since 2009, Europe’s economy is also trending toward stagnation once more after it too, like Japan, just introduced a US$60 billion a month central bank money injection this past winter. Despite daily hype in the business press, unemployment in the Eurozone is still officially at 11.4 percent, and in countries like Spain and Greece, still at 24 percent. Yet we hear Spain is now the ‘poster-boy’ of the Eurozone, having returned to robust growth. Growth for whom? Certainly not the 24 percent still jobless, a rate that hasn’t changed in years. Euro businesses in Spain are doing better, having imposed severe ‘labor market reforms’ on workers there, in order to drive down wages to help reduce costs and boost Spanish exports. Meanwhile, Italy remains the economic black sheep of the Eurozone, still in recession for years now, while France officially records no growth, but is likely in recession as well. Elites in both Italy and France hope to copy Spain’s ‘labor market reforms’ (read: cut wages, pensions, and make it easier to layoff full time workers). In order to boost its growth, Italy is considering, or may have already decided, to redefine its way to growth by including the services of prostitutes and drug dealers as part of its GDP. Were the USA to do the same redefinition, it would no doubt mean a record boost to GDP. Across the Eurozone, the greater economy of its 18 countries still hasn’t reached levels it had in 2007, before the onset of the last recession. Unlike the U.S.’s ‘stop-go’, Europe has been ‘stop-go-stop’. 11 | P a g e Economy Disadvantage Affirmative RIUDL Varsity Division No Impact – Global Economy is Resilient [___] The global economy is resilient. Behravesh, 2006 (Nariman, most accurate economist tracked by USA Today and chief global economist and executive vice president for Global Insight, Newsweek, “The Great Shock Absorber; Good macroeconomic policies and improved microeconomic flexibility have strengthened the global economy's 'immune system.'” 10-15-2006, www.newsweek.com/id/47483) The U.S. and global economies were able to withstand three body blows in 2005--one of the worst tsunamis on record (which struck at the very end of 2004), one of the worst hurricanes on record and the highest energy prices after Hurricane Katrina--without missing a beat. This resilience was especially remarkable in the case of the United States, which since 2000 has been able to shrug off the biggest stock-market drop since the 1930s, a major terrorist attack, corporate scandals and war. Does this mean that recessions are a relic of the past? No, but recent events do suggest that the global economy's "immune system" is now strong enough to absorb shocks that 25 years ago would probably have triggered a downturn. In fact, over the past two decades, recessions have not disappeared, but have become considerably milder in many parts of the world. What explains this enhanced recession resistance? The answer: a combination of good macroeconomic policies and improved microeconomic flexibility. Since the mid-1980s, central banks worldwide have had great success in taming inflation. This has meant that long-term interest rates are at levels not seen in more than 40 years. A low-inflation and lowinterest-rate environment is especially conducive to sustained, robust growth. Moreover, central bankers have avoided some of the policy mistakes of the earlier oil shocks (in the mid-1970s and early 1980s), during which they typically did too much too late, and exacerbated the ensuing recessions. Even more important, in recent years the Fed has been particularly adept at crisis management, aggressively cutting interest rates in response to stock-market crashes, terrorist attacks and weakness in the economy. The benign inflationary picture has also benefited from increasing competitive pressures, both worldwide (thanks to globalization and the rise of Asia as a manufacturing juggernaut) and domestically (thanks to technology and deregulation). Since the late 1970s, the United States, the United Kingdom and a handful of other countries have been especially aggressive in deregulating their financial and industrial sectors. This has greatly increased the flexibility of their economies and reduced their vulnerability to inflationary shocks. Looking ahead, what all this means is that a global or U.S. recession will likely be avoided in 2006, and probably in 2007 as well. Whether the current expansion will be able to break the record set in the 1990s for longevity will depend on the ability of central banks to keep the inflation dragon at bay and to avoid policy mistakes. 12 | P a g e Economy Disadvantage Affirmative RIUDL Varsity Division No Impact – No War [___] [___] Economic decline does not cause war. Barnett, 2009 (Thomas P.M. Barnett, senior managing director of Enterra Solutions LLC, “The New Rules: Security Remains Stable Amid Financial Crisis,” 8/25/2009) Sure, we've finally seen global defense spending surpass the previous world record set in the late 1980s, but even that's likely to wane given the stress on public budgets created by all this unprecedented "stimulus" spending. If anything, the friendly cooperation on such stimulus packaging was the most notable great-power dynamic caused by the crisis. Can we say that the world has suffered a distinct shift to political radicalism as a result of the economic crisis? Indeed, no. The world's major economies remain governed by center-left or center-right political factions that remain decidedly friendly to both markets and trade. In the short run, there were attempts across the board to insulate economies from immediate damage (in effect, as much protectionism as allowed under current trade rules), but there was no great slide into "trade wars." Instead, the World Trade Organization is functioning as it was designed to function, and regional efforts toward free-trade agreements have not slowed. Can we say Islamic radicalism was inflamed by the economic crisis? If it was, that shift was clearly overwhelmed by the Islamic world's growing disenchantment with the brutality displayed by violent extremist groups such as alQaida. And looking forward, austere economic times are just as likely to breed connecting evangelicalism as disconnecting fundamentalism. At the end of the day, the economic crisis did not prove to be sufficiently frightening to provoke major economies into establishing global regulatory schemes, even as it has sparked a spirited -- and much needed, as I argued last week -- discussion of the continuing viability of the U.S. dollar as the world's primary reserve currency. Naturally, plenty of experts and pundits have attached great significance to this debate, seeing in it the beginning of "economic warfare" and the like between "fading" America and "rising" China. And yet, in a world of globally integrated production chains and interconnected financial markets, such "diverging interests" hardly constitute signposts for wars up ahead. Frankly, I don't welcome a world in which America's fiscal profligacy goes undisciplined, so bring it on -- please! Add it all up and it's fair to say that this global financial crisis has proven the great resilience of America's post-World War II international liberal trade order. 13 | P a g e