Conducting a Retreat - Family Office Services

advertisement

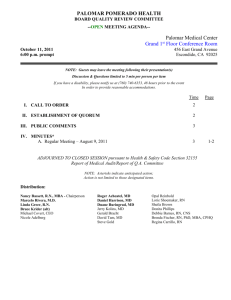

Conducting Discovery Sessions and Client Retreats Best Practices Session D Updated 2/7/2005 © Tim Voorhees, JD, MBA 1996-2005 1 1. 2. 3. 4. 5. 6. Engaging clients Asking practice management questions Discussing goals and tools Upgrading a Discovery Session into a Retreat Conducting a Retreat Differentiating Personal, Corporate, and Family Wealth Planning 7. Addressing challenging situations 8. Drafting a Family Wealth Statement 9. Accessing the best resources 2 © Tim Voorhees, JD, MBA 1996-2005 Access Seven Levels of Service 3 © Tim Voorhees, JD, MBA 1996-2005 Begin with the Free Discovery Session Provide Clear Value Before Upgrading the Level of Service Offer an optional Family Retreat and Family Wealth Statement (for $3,500+) before agreeing to do the VPL. 4 © Tim Voorhees, JD, MBA 1996-2005 During the Discovery Session decide which deliverables are most needed and who will prepare the deliverable •Family Wealth Statement (Counselor) •Financial Checkup (Analyst) •Value Proposition Letter (Planners) •Tactical Plan (Planners, Adviser Coordinator, and Binder Publisher) •Comprehensive Plan (Planners, Adviser Coordinator, and Binder Publisher) •Legal, Insurance, & Investment Implementation (Licensed Implementers) •Annual Updates (Evaluator/Educator) Tim Voorhees, JD, MBA, 1996-2005 Typically offer needed deliverables during four phases Family Wealth Statement Financial Checkup Value Proposition Letter Tactical Plan Comprehensive Plan Legal, Insurance, & Investment Implementation Annual Updates Phase 1 Phase 2 Tim Voorhees, JD, MBA, 1996-2005 Phase 3 Phase 4 1. 2. 3. 4. 5. 6. Engaging clients for retreats Asking practice management questions Discussing goals and tools Upgrading a Discovery Session into a Retreat Conducting a Retreat Differentiating Personal, Corporate, and Family Wealth Planning 7. Addressing challenging situations 8. Drafting a Family Wealth Statement 9. Accessing the best resources 7 © Tim Voorhees, JD, MBA 1996-2005 Questions Who has the retail engagement to…. 1. Conduct the Phase 1 Discovery Session and Prepare the Value Proposition Letter? 2. Conduct the Phase 1 Retreat and prepare the Family Wealth Statement? 3. Present the Phase 2 plan? Tim Voorhees, JD, MBA, 1996-2005 The Biggest Producers Leave Phase 1 and Phase 2 to Channel Members • It is most profitable when you focus entirely on Phase 3 implementation of investment and insurance tools. • If a VFOS Channel Member works with your client to complete Phase 1 and 2 deliverables, we maximize the likelihood that Phase 3 investment and insurance tools will be implemented through you. 9 © Tim Voorhees, JD, MBA 1996-2005 Requirements before you can deliver our deliverables with VFOS only acting as a back office for you: • You must believe that it is a good use of your time to go through the training. • You must complete Best Practices and Best Tools training and sign our Allied Adviser Agreement to access Phase 1 deliverables at wholesale costs. 10 © Tim Voorhees, JD, MBA 1996-2005 1. 2. 3. 4. 5. 6. Engaging clients for retreats Asking practice management questions Discussing goals and tools Upgrading a Discovery Session into a Retreat Conducting a Retreat Differentiating Personal, Corporate, and Family Wealth Planning 7. Addressing challenging situations 8. Drafting a Family Wealth Statement 9. Accessing the best resources 11 © Tim Voorhees, JD, MBA 1996-2005 Goals of the Discovery Sessions • • • • • • Attract prospects -- create referrals Convert prospects to clients Deliver indispensable value Turn clients into lifelong partners Establish a foundation for Wealth Blueprinting Help clients review 300 tools x 200 services to achieve 100 goals: 6 Million options! 12 © Tim Voorhees, JD, MBA 1996-2005 Tools/Benefits Grid l Le pita Mo re S oc i al C a Ma xim iz N Y Y Y Y Y N Y N Y Y Y 10 million + Y Y Y Y Y Y Y Y Y Y Y Y Y Contingent Swap Income Tax Planning 10 million + Y Y N Y Y Y N N N N N N N Costless Collar Income Tax Planning 5 million + N N N Y N Y N N N N N N N Employee Stock Ownership Plan Wealth Transfer 10 million + Y Y Y Y Y Y N Y Y Y Y N N Exchange Fund Wealth Transfer 5 million + Y Y N Y N N N N N N N N N Family Split Dollar Wealth Transfer 5 million + N N N N N Y N Y Y Y N N N Flip CRT Income Tax Planning 3 million + Y Y Y Y Y Y Y N Y N Y Y Y Hedge Fund Investment Planning 5 million + Y Y N Y N N N N N N N N N Investor Play Basket Investment Planning 5 million + Y Y Y Y Y Y Y Y Y Y Y N N Leveraged Retirement Distribution Technique Wealth Transfer 5 million + Y N Y N Y Y N Y Y Y Y N N Non-Qualified Stock Option Strategies Income Tax Planning 5 million + Y Y Y Y Y N Y N N N Y N N Offshore Insurance Investment Planning 5 million + Y Y Y Y Y Y N Y Y Y Y N N Private Equity Investment Planning 5 million + N Y N Y Y Y Y N N N Y Y Y Receivable Asset Monetization Investment Planning 5 million + Y Y N Y Y Y Y N N N Y N N Re-Engineered Corporate Balance Sheet Corporate Finance 100 million + Y N N N N N N N N N N N N SERP SWAP Wealth Transfer 3 million + Y N Y N Y Y N Y Y Y Y N N Pension Distribution Strategy Wealth Transfer 3 million + Y N Y N Y Y N Y Y Y Y N N Stretch IRA Wealth Transfer 3 million + Y Y Y N N N N Y N N Y N N Super CLAT Income Tax Planning 3 million + Y N Y N Y N Y Y Y N Y Y Y Synthetic Equity Income Tax Planning 10 million + Y Y Y Y Y Y N Y Y Y Y N N Tax-Free CRT Distributions Charitable Planning 5 million + Y N Y Y N Y Y Y N N N Y Y Tax-Free S Corporation Sale Strategy Income Tax Planning 5 million + Y Y Y Y N Y N Y Y N Y N N Unitrust Limited Partnership Income Tax Planning 5 million + Y Y Y N Y Y Y Y N N Y Y Y 13 ver a S oc ers o Ma inta in eC ont rol Ov er er P l Ov ntro Co Ma na Y Wealth Transfer ge F Pro tec tA 10 million + Charitable LLC © Tim Voorhees, JD, MBA 1996-2005 ge ial C api tal Aff airs nal ess ion ucc Exp ne s sS usi dm in. ily B am ns t Coo rdin gai Es t ate D istr i le G ivin Inc rea se C a te ash Ma na Target Net worth Business planning ge C Ma inta in ha r itab w Flo l ntro Ma na Common Application Aircraft Acquisition Strategy ge R Pro tec tA Co is k Est ate A but ion s ote ntia l gP rs dito Cre om sse t s fr eal th te W Acc um ul a WORKSHOP TOOLS LISTED BELOW ize Min im Ta x es ./De lay s A partial list of tools and goals Key 3 indicates a primary benefit. A major reason that someone would implement this strategy. 2 indicates a secondary benefit--not the only reason but a plus in the decisionmaking process 1 indicates an ancillary benefit--not a significant positive or negative factor. 0 indicates the benefit is irrelevant to the strategy or the strategy may actually be a detriment. 1031 Exchange 1035 Exchange 402(e) Rollover 412(i) with sale to Family Entity 412(i) with rollout to Participant Aircraft Acquisition Strategy Accounts Receivable Financing Asset Allocation Charitable Gift Annuity, Deferred Charitable Gift Annuity, Immediate Charitable Gift Subject to Life Estate Charitable Limited Liability Company Charitable Remainder Unitrust, Standard (SCRUT) Charitable Remainder Unitrust, Standard with Wealth Replacement Charitable Remainder Unitrust, Net Income with Makeup (NIMCRUT) Charitable Remainder Unitrust, with Flip Provision (Flip CRT) Charitable Remainder Unitrust, with private stock redemption Charitable Remainder Annuity Trust (CRAT) Charitable Lead Annuity Trust, Grantor (GCLAT) Charitable Lead Annuity Trust, Nongrantor (CLAT) Charitable Lead Annuity Trust, Super CLAT Charitable Lead Unitrust, Grantor (GCLUT) Charitable Lead Unitrust, Nongrantor (CLUT) Common Trust Fund Costless Collar Defined Benefit Pension Plan Disability Income Trust Dynasty Trust Education Trust Leveraged Employee Stock Ownership Plan with Synthetic Equity Ge ner ate Per Ge son ner al I ate nc o Bus me De ine Tax fer ss Tax De Inc duc abl om tion Ge e In eT ner a s c x o me ate De duc Fut Mi n tion ure imi s Tax ze -Fa Ca v pita ore Mi n d In lG imi ai n ze c om Est Inc e om ate Acc e Tax um ula es te P Pro ers tec ona t As lW s et eal Inc s th from rea se Cre Cu dito rren Inc rs rea t Sp se e nda Cu rren ble Inc rea Inc tC om har se e Fut itab u Co l e r e G ord C i v har ing ina itab te/ le G Bal Re anc duc ivin eE eE g sta sta te D Ma te E nag istr x pe eF ibu nse tion a s m Ma and ily s inta Bus D e in M ine l a ys ss ax i Ma Suc mu xim c m e ssi ize Leg on Co al C Div ntro o n ers l t r o o ify ver l ov Inv So er A es t Pro cia sse m l vid C e ts n api e In tA t a s c l s et ent Lev s ive era s fo ge rC Qu hild Acq alif ren ied uire R Ass etir e e Tools/Benefits Grid (partial) 0 0 0 0 0 3 0 0 3 3 2 3 2 2 2 2 2 2 3 0 3 3 0 3 0 0 0 0 0 0 0 0 0 3 3 0 0 0 0 0 0 0 0 0 0 0 0 0 3 0 0 3 0 3 0 3 3 0 0 3 3 3 0 3 3 0 3 0 2 1 0 0 1 1 1 1 1 0 0 0 0 0 0 1 0 3 3 0 0 1 0 0 3 0 2 0 3 0 3 3 0 0 1 1 1 1 1 1 0 0 0 0 0 0 0 0 0 0 0 1 0 3 0 0 0 2 0 1 3 3 0 3 3 3 3 3 3 3 0 0 2 0 0 3 0 0 0 0 0 3 0 0 0 3 0 1 1 0 3 3 3 3 3 3 3 3 3 3 2 3 3 2 3 0 0 0 0 3 1 3 2 2 0 0 3 0 3 3 2 0 0 0 2 1 2 2 1 0 0 0 0 0 0 2 0 3 3 0 1 1 © Tim Voorhees, JD, MBA 1996-2005 0 0 0 1 1 1 3 0 3 2 1 3 1 2 2 2 2 2 2 2 2 2 2 1 0 3 2 3 2 2 2 2 2 0 0 1 0 0 3 3 3 3 2 2 2 3 3 3 0 0 0 0 0 2 0 0 0 0 0 2 0 0 0 0 0 0 0 0 3 2 1 2 0 1 1 1 1 1 3 3 3 3 3 1 0 0 0 0 0 1 1 1 0 0 0 2 1 0 3 1 3 2 3 3 3 3 3 3 2 2 2 2 2 1 0 1 1 0 0 1 1 1 0 2 1 0 1 0 1 1 1 1 2 2 2 2 2 2 1 1 1 1 1 0 0 1 0 2 2 2 1 1 0 2 1 1 2 0 2 2 2 2 1 1 1 1 1 1 1 1 1 1 1 1 0 1 0 1 1 1 2 1 0 2 1 0 2 0 1 1 1 2 0 0 0 0 3 0 0 1 0 0 1 0 0 1 1 2 0 3 2 2 0 1 1 3 2 1 1 1 1 2 1 1 1 1 1 1 1 0 0 1 0 1 0 3 3 0 0 0 1 1 0 0 0 2 0 0 2 2 2 3 3 3 3 3 3 3 3 3 3 3 3 0 0 0 0 0 0 0 2 3 0 0 0 1 2 3 2 2 2 2 2 3 3 3 3 3 1 1 1 1 1 2 0 2 2 0 0 3 0 1 0 1 0 0 0 0 1 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 14 0 1 3 3 3 0 0 0 1 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2 2 2 1 1 3 1 1 0 0 2 1 1 1 1 1 1 1 1 1 1 1 1 1 0 1 0 2 0 2 0 3 0 0 0 0 0 0 0 0 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 3 Summarize the Value Proposition sample diagram Example: Current Proposed Estate Taxes $14,300,000 $100,000 Benefit to Heirs $15,200,000 $18,900,000 Income Tax Savings $0 $200,000 Benefit to Charity $0 $21,300,000 15 © Tim Voorhees, JD, MBA 1996-2005 1. 2. 3. 4. 5. 6. 7. 8. 9. Engaging clients for retreats Asking practice management questions Discussing goals and tools Upgrading a Discovery Session into a Retreat Conducting a Retreat Differentiating Personal, Corporate, and Family Wealth Planning Addressing challenging situations Drafting a Family Wealth Statement Accessing the best resources 16 © Tim Voorhees, JD, MBA 1996-2005 Upgrading a Discovery Session into a Retreat Provide Clear Value Before Upgrading the Level of Service Offer an optional Family Retreat and Family Wealth Statement (for $3,500+) before agreeing to do the VPL. 17 © Tim Voorhees, JD, MBA 1996-2005 Integrating Retreats into Your Practice • Offer a service not available elsewhere in your community. • Cover Discovery Session materials in much greater details. • Deliver indispensable value • Turn clients into lifelong partners • Establish a foundation for Wealth Blueprinting • Address issues that can only be addressed in a 4-6 hour session. 18 © Tim Voorhees, JD, MBA 1996-2005 Learning from the Models • • • • • Scott Fithian – The Family Financial Philosophy Jay Link – Family Wealth Letter of Intent Scott Farnsworth – Family Wealth Declaration Esperti Peterson – Discovery Document Tim Voorhees – Family Wealth Statement 19 © Tim Voorhees, JD, MBA 1996-2005 1. 2. 3. 4. 5. 6. Engaging clients for retreats Asking practice management questions Discussing goals and tools Upgrading a Discovery Session into a Retreat Conducting a Retreat Differentiating Personal, Corporate, and Family Wealth Planning 7. Addressing challenging situations 8. Drafting a Family Wealth Statement 9. Accessing the best resources 20 © Tim Voorhees, JD, MBA 1996-2005 Developing Wealth Counseling Skills? • • • • • Understanding both the emotional and technical issues Drawing out the client’s purpose Briefly explaining relevant planning tools Mediating conflicts efficiently Facilitating interaction of retreat attendees 21 © Tim Voorhees, JD, MBA 1996-2005 Identifying the Right Clients • • • • • Choosing the right clients Considering influence of existing advisers Understanding dysfunctional environments Involving children in the retreat process Screening for emotional issues or potential litigation 22 © Tim Voorhees, JD, MBA 1996-2005 Explaining the Process • • • • • • Deciding which advisers will provide wise counsel Sharing case histories of successful families Giving references if necessary Discussing roles of existing advisers Obtaining a commitment of time and money Scheduling a retreat 23 © Tim Voorhees, JD, MBA 1996-2005 Motivating Clients to Schedule a Retreat • • • • Executive Officer and Emotional Officer need agreement One day in a lifetime The Power of Purpose: Genesis 11:6 The need to overcome problems – Affluenza – Lawsuit risks – Etc. 24 © Tim Voorhees, JD, MBA 1996-2005 Establishing the Price • • • Explain how the cost is much less than the benefits Discuss business topics to qualify for deduction Choose the appropriate engagement letter 25 © Tim Voorhees, JD, MBA 1996-2005 Preparing the Client • • • Husband and wife complete the questionnaires separately Husband and wife should not compare notes Urge the client to schedule at least a half day without interruptions. ― Schedule 4 to 6 hours for the retreat ― Schedule ample time after the retreat 26 © Tim Voorhees, JD, MBA 1996-2005 Preceding the First Retreat • • • • • • • Prepare the client(s) Choose a location Decide which family members to include Schedule one or two days Bring an assistant Prepare an agenda Prepare a list of questions 27 © Tim Voorhees, JD, MBA 1996-2005 During the Retreat • • • • − − − − − − Discuss the power of purpose and mission Review questions Use Soft Data Questionnaire Prepare custom list of questions Examine common problems for families with wealth Clarify who owns what. Address emotional ownership versus legal ownership Look for common communication and trust breakdowns Spot indications that family members lack a common mission Spot differing, but undisclosed, standards Look for unprepared heirs 28 © Tim Voorhees, JD, MBA 1996-2005 Story-telling • • • • • Harness emotional energy Encourage a free-flowing discussion Cover all the questions without sticking to a rigid agenda. Reflect on who inspired husband and wife they were 10 years old. Clarify a story that has a beginning in youth, positive influence today, and great hope for the future. 29 © Tim Voorhees, JD, MBA 1996-2005 Bonding with the Client • • • • • Listening to the client's personal history Connecting to the client’s current opportunities and threats Inspiring the client to build on strengths and overcome weaknesses Uniting family members around a common vision Clarifying “WOTS MOST IMPORTANT?” 30 © Tim Voorhees, JD, MBA 1996-2005 1. 2. 3. 4. 5. 6. Engaging clients for retreats Asking practice management questions Discussing goals and tools Upgrading a Discovery Session into a Retreat Conducting a Retreat Differentiating Personal, Corporate, and Family Wealth Planning 7. Addressing challenging situations 8. Drafting a Family Wealth Statement 9. Accessing the best resources 31 © Tim Voorhees, JD, MBA 1996-2005 Family Wealth Planning Blends Personal and Corporate Planning PERSONAL PLANNING FAMILY WEALTH PLANNING Passions/ Purpose/ Priorities Vision for Shared Purposes Vision/ Mission/ Objectives Personal Prayer Process Management Principles Principles Creed Planning Resources Legacy Benefits for Beneficiaries Legacy Directives CORPORATE PLANNING Profits/Losses Succession Plan 32 © Tim Voorhees, JD, MBA 1996-2005 Personal Planning Paradigm: Passions, Purpose, Priorities, Planning Resources, and Planning Tools Your Planning Resources 33 © Tim Voorhees, JD, MBA 1996-2005 Clarifying Planning Resources • • • • • Review financial capital − Before and after bar charts − Control over financial and social capital Uncover emotional resources − Empowering through a family mission − Addressing conflicts Discuss spiritual resources − The power of purpose − The harmony of principles − The impact of a legacy Identify wasted social capital Identify valuable intellectual capital 34 © Tim Voorhees, JD, MBA 1996-2005 Explaining Benefits of the Planning Tools • • • Clarifying root issues and suggesting financial, legal, or tax tools Integrating tools to create a zero-tax plan Drafting documents in light of spiritual, intellectual, emotional, and other issues 35 © Tim Voorhees, JD, MBA 1996-2005 Matching Planning Tools with Benefits • • • See the tools/benefits grid See the sample plans Discuss scenarios • Income tax deductions this year? • Exercising stock options? • Making lifetime wealth transfers? • Etcetera 36 © Tim Voorhees, JD, MBA 1996-2005 Personal Corporate • Passions • Vision • Purpose • Mission • Priorities • Objectives • Principles (Cardinal Virtues) • Creed (Core Values) 37 © Tim Voorhees, JD, MBA 1996-2005 Corporate Planning Paradigm: WOTS MOST IMPORTANT? • Review the Weaknesses, Opportunities, Threats, and Strengths (“WOTS”) • Clarify the Mission, Objectives, Strategies, and Tactics (“MOST”). MISSION OBJECTIVES STRATEGIES TACTICS ™ 38 © Tim Voorhees, JD, MBA 1996-2005 Family Wealth Planning Paradigm: Vision, Mission, and Shared Purposes • • • • • Vision is bigger than mission Mission is coalesced from individual purpose statements Mission is a summary of shared purposes Mission Statement has 3 critical elements − Who we are − What we do − Whom we serve Purpose Statements are individual and often hard to define but purpose statements should be defined before preceding with Family Wealth Planning. Proverbs 20:5 - The purposes of a man's heart are deep waters, but a man of understanding draws them out. 39 © Tim Voorhees, JD, MBA 1996-2005 Family Wealth Planning Blends Personal and Corporate Planning PERSONAL PLANNING FAMILY WEALTH PLANNING CORPORATE PLANNING Passions/ Purpose/ Priorities Vision for Shared Purposes (Summarized in a Family Mission) Vision/ Mission/ Objectives Personal Prayer Process Management Principles Principles Creed Planning Resources Legacy Benefits for Beneficiaries Legacy Directives © Tim Voorhees, JD, MBA 1996-2005 Profits/Losses Succession Plan 40 1. 2. 3. 4. 5. 6. Engaging clients for retreats Asking practice management questions Discussing goals and tools Upgrading a Discovery Session into a Retreat Conducting a Retreat Differentiating Personal, Corporate, and Family Wealth Planning 7. Addressing challenging situations 8. Drafting a Family Wealth Statement 9. Accessing the best resources 41 © Tim Voorhees, JD, MBA 1996-2005 Picking Scabs? • • • Does somebody refuse to develop a mission and vision? Is somebody avoiding accountability? Is somebody undermining the family? (See, e.g., Proverbs 6:16-19) BEHAVIOR EXAMPLE Haughty eyes Unwilling to listen to counsel A lying tongue Misrepresenting facts Hands that shed innocent blood Slandering associates or leaders A heart that devises wicked schemes Cheating on taxes Feet that are quick to rush into evil Compromising corporate vision and objectives for personal gain A false witness who pours out lies Bad-mouthing A man who stirs up dissension Engaging in peace-breaking and peacefaking rather than peacemaking 42 © Tim Voorhees, JD, MBA 1996-2005 Addressing Challenging Situations • • • • • The disinherited child The child from a past relationship Sons fighting for control of the family business Unmotivated kids Intra-family lawsuits 43 © Tim Voorhees, JD, MBA 1996-2005 Involving Professional Help • • • Wealth Counselor Network Peacemaker Ministries – Certified Christian Conciliators™ Others − Roy Williams − Rick Harig − Etc. 44 © Tim Voorhees, JD, MBA 1996-2005 Collecting Relevant Documents • • • Ideally have balance sheet before retreat begins Get commitments during the retreat to collect documents Get permission to work with CPA to gather documents 45 © Tim Voorhees, JD, MBA 1996-2005 Preparing the Client for After the Retreat • • • • Discuss phases of the CAPABLE model Offer ideas about forming a team with unique abilities relevant to the client Discuss roles of insurance agent, attorney, CPA, and other existing advisers. Establish checks and balances for team members 46 © Tim Voorhees, JD, MBA 1996-2005 Following the First Retreat • • • • Develop Family Wealth Statement and goal statement Prepare report card to show if current plan achieves goals Prepare Value Proposition Letter Prepare the family for periodic Family Meetings 47 © Tim Voorhees, JD, MBA 1996-2005 1. 2. 3. 4. 5. 6. Engaging clients for retreats Asking practice management questions Discussing goals and tools Upgrading a Discovery Session into a Retreat Conducting a Retreat Differentiating Personal, Corporate, and Family Wealth Planning 7. Addressing challenging situations 8. Drafting a Family Wealth Statement 9. Accessing the best resources 48 © Tim Voorhees, JD, MBA 1996-2005 Drafting the Family Wealth Statement • • Develop a meaningful structure Use Covenant model? − Purpose − Process − Principles − Beneficiaries − Vision and Directives 49 © Tim Voorhees, JD, MBA 1996-2005 Clarifying the Purpose • • • • Start by reflecting back statements that impassion the client Crystallize statements about passion into a purpose Meld purpose statements into a Family Mission Be sure that family members have ownership in the mission 50 © Tim Voorhees, JD, MBA 1996-2005 The Purpose Statement is Important Because It… • • • • • • • • • • • Inspires unity Articulates unique characteristics Clarifies functions Establishes direction Guides decision-making Shapes strategy Enhances effectiveness Facilitates evaluation Focuses the future Summarizes complex concepts concisely Promotes long-term thinking 51 © Tim Voorhees, JD, MBA 1996-2005 Affirming Principles in the FWS • • • • • • • • • • • Financial Security Wealth Accumulation Cash Flow and Income Budgeting Liquidity Investment Time Horizons Taxes Charitable gifts of money Charitable gifts of time Diversification Education funding • • • • • • • • • • Control Complexity Risk Management and insurance Asset Protection Trustee and fiduciary selection Loans to family members and close friends Providing for medical needs Retirement planning Grant-making Stewardship training 52 © Tim Voorhees, JD, MBA 1996-2005 • • • • • • • • Writing the FWS Efficiently Use boilerplate templates Use color-coding Code the husband’s answers in blue, code wife’s answers in pink, and code similar answers in yellow Develop pink-blue-yellow “PBY” document Combine His and Her answers Add in retreat notes using a colored font Use the client’s actual words Reference trustee, executor, guardian, and beneficiary language in legal documents 53 © Tim Voorhees, JD, MBA 1996-2005 Preparing the Family for Meetings Following the First Retreat • • • • • • • Conducting investment seminars Training board members Providing stewardship education Clarifying authority, power, and influence Using observable and measurable standards Tracking success in realizing goals Updating the Financial Checkup and VPL 54 © Tim Voorhees, JD, MBA 1996-2005 Access Seven Levels of Service 55 © Tim Voorhees, JD, MBA 1996-2005 1. 2. 3. 4. 5. 6. Engaging clients for retreats Asking practice management questions Discussing goals and tools Upgrading a Discovery Session into a Retreat Conducting a Retreat Differentiating Personal, Corporate, and Family Wealth Planning 7. Addressing challenging situations 8. Drafting a Family Wealth Statement 9. Accessing the best resources 56 © Tim Voorhees, JD, MBA 1996-2005 Best Practices CD - Session D Resources 4 5 6 7 8 9 10 34 35 36 40 Case Study: CRT Case Study: Super CLAT Case Study: ESOP Case Study: GDOT Case Study- Comprehensive Family Wealth Blueprint Engagement Kit Soft Data Questionnaire Engagement Kit Hard Data Questionnaire - Long Short Soft Data Fact finder Short Hard Data Fact finder Qualified Plan Fact finder 200 Tools List 57 © Tim Voorhees, JD, MBA 1996-2005 Best Practices CD - Session D Resources 41 42 44 45 71 89 114 119 124 240 309 812 100 Goals List 70 Best Tools Descriptions Tools Benefit Grid - Simple Tools Benefit Grid - Comprehensive How to charge fees (article) Prospecting Letter - Discovery Session Best Practices Session D Consent to Share Info - Permission Grid Steps to develop Family Wealth Statement Follow-up Letter -- offer retreat Conducting a Family Retreat FAQs regarding free Discovery Sessions 58 © Tim Voorhees, JD, MBA 1996-2005 Best Practices Training Session A Adapting to Planning Trends and Presenting Valuable Deliverables to Clients Session B Charging Fees and Using Appropriate Engagement Letters Session C Delegating Technical Work to a Virtual Back Office and Advanced Sales Department Session D Developing the Value Proposition Letter after a Discovery Session, and Preparing the Family Wealth Statement During/After a Client Retreat Session E Developing Relationships With CPAs, Bankers, Lawyers, Charitable Development Officers, and Other Referral Sources Session F Presenting Your Materials During Client Seminars, Training Workshops, and One-OnOne Presentations Session G Complying with IRS, SEC, NASD, AICPA, ABA, FPA, and Other Relevant Guidelines Session H Focusing on Your Unique Talents by Delegating “Administrivia” to a Relationship Manager Session I Conducting a Strategy Session to Integrate Tools Needed to Achieve All of Your Clients' Wealth Optimization Goals Session J Tracking cases and portfolios with web-based project management and CRM systems 59 © Tim Voorhees, JD, MBA 1996-2005 Contacting Family Office Services Phone: Fax: Voicemail: Email: 800-447-7090 (949-453-2900 in CA) 866-447-7090 877-447-7090 Tim@VFOS.com 60 © Tim Voorhees, JD, MBA 1996-2005