From Saving for Retirement to Spending in

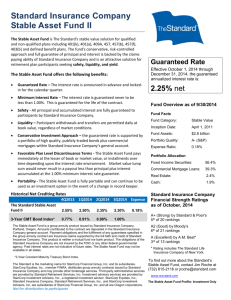

advertisement

From ‘Saving for Retirement” to ‘Spending in Retirement” - Income solutions that work Ian Kerr, Investment Products Specialist Presentation for use with advisors only 1 Trying to dodge retirement planning? I’m too young It’s too late I don’t have enough money to put away There are other expenses 2 Retirement can’t be avoided • Canadians 45 years and older hold $2.3 trillion (or 79%) of 1 Canada’s wealth • By 2017, 7.7% of Canadians will have moved from saving 1 money to retirement income • Those without pensions are vulnerable – Percentage of Canadian labor force with defined benefit plans dropped from 51.9% in 1980 to 31.8% in 2011 1Source: Investor Economics: Household balance sheet 2011 3 Accumulation planning has needs and solutions Accumulate 25 Transition 45 Income 65 Age Needs Solutions Pay expenses Variability of income Savings risk Savings rate Mortality risk Life insurance Market risk Asset allocation 4 100 Income planning is different than accumulation planning Accumulate 25 Transition 45 Income 65 100 Age Needs Solutions Pay expenses Sustainability of income Longevity risk Guaranteed income products Estate values Life insurance Market risk Asset allocation and principal protected products 5 99-0533C What happens when inflation picks up? Purchasing power of $1 in 25 years 1% inflation 2% inflation 4% inflation $0.78 $0.61 $0.38 6 Facing significant challenges • People spending more years in retirement • Pensions playing smaller role • Savings rates at all-time low • Canada pension plan and stock market uncertainty • Increasing life expectancy • Gaps between desired lifestyle and income sustainability 7 Striking the right balance is important 8 Take a look at clients who ask: • Will I have enough retirement income to last my lifetime? • I already have a pension plan – Will I need more guaranteed income? • How much retirement income is enough? • How do I grow my investments without risk and losing my capital? Retirement income market will continue to seek out solutions from the advice-driven channel 9 Case study – meet James • Client profile: – – – – 57 years old Advanced investor On track to retire at 65 Non-registered savings total: $1,109,000 10 Investing for growth in retirement • Low-risk, low-return funds limit income variability and possibly sustainability • Inflation erodes purchasing power 11 Recommendations for James • Investment funds – Invest for growth – Canada Life segregated funds • Draw income efficiently using a reservoir fund strategy • Protect estate values – immediate and up to 100% death benefit guarantee 12 Invest for growth 1. Professionally developed single-fund solutions – – Asset allocation funds Partner managed solutions 2. Stand-alone funds for customized portfolios – – 74 funds including specialty and 100 per cent equity funds 12 investment managers 13 Reservoir fund strategy Draw income when needed 14 Protect estate values 15 Key opportunities with investment funds • Keep more of the growth – Aggregate assets – Preferred series segregated funds – Lower overall management fees • Introducing new income fund options 16 Keep more of the growth - preferred series • Equity fund fees as low as 1.35% • Fixed income fund fees as low as 1.10% • Specialty class fund fees as low as 1.70% 17 Why place high-net-worth clients in segregated funds? Scenario: $2.5 million portfolio 2.50% 2.00% Trust administration 1.50% Trust set-up Management fee Advisory and management service fee 1.00% 0.50% 0% 18 Defer taxes with a prescribed annuity For illustration purposes only. Comparison between a prescribed single-life annuity and a non-prescribed single-life annuity that is indexed at 2.5 per cent annually. Both scenarios are based on a 60 year old male, non-smoker with $250,000 to invest, receiving income payments annually using a marginal tax rate of 40 per cent. The prescribed annuity bar reflects the fixed annual after-tax amount and annual taxes payable for the duration of the prescribed annuity. Annuity quotes as of June 9, 2010. 19 Cashable annuity • Clients may avoid annuities because of lack of liquidity • Cashable payout annuity provides guaranteed income AND access to cash 20 Canada Life cashable annuity Registration type Non-registered only Features/options Tax treatment options Accrual only Variability of income None (if cashable feature is not used) Income sustainability For a term or life (if cashable feature is not used) Liquidity Yes (income will be reduced within the guarantee period) Indexation Available 21 How it works 22 Lifetime income benefit – add when ready 23 Building an income plan - meet Diane and Mark • • • • • Diane (62), Mark (65) Married couple transitioning to retirement Self employed with no pension Non-registered savings $731,000 Annual desired family income: $70,000 • Current guaranteed family income: $40,000 • Balanced investors 24 Goals • Needs – Sustainable retirement income – No change to guaranteed income if one dies unexpectedly • Wants – Variability of income – Retirement to include more travel • Willing to trade for needs and wants : – Some estate protection – Some liquidity 25 Build and show them their income solution 26 Recommended product allocation Income Assets Lifetime income benefit (based on joint-life rates) $12,950 $350,000 Life annuity (based on joint-life rates) $5,400 $100,000 Systematic withdrawal plan $12,280 $281,162 The guaranteed income from the lifetime income benefit assumes no income resets or excess withdrawals. 27 Protect both spouses’ incomes 28 “Investors haven’t really changed their desire, which is to increase wealth, but they are more conscious of protecting wealth.” Earl Bederman President, Investor Economics 29 New funds. Strong managers. Enhanced portfolios. Boosting the breadth and depth of Canada Life investment shelf Ambitious year for Canada Life investments • Strategic investing with new fixed income mandates – New mandate from Putnam Investments – New short- and long-term mandates from Portico Investment Management • Investing in dividends beyond the Canadian border – New U.S. Dividend Fund (GWLIM) from GLC • Enhanced asset allocation funds from Portfolio Solutions Group Full complement of fixed-income mandates 32 Consistent performance High yield bonds have provided positive returns 17 of the last 20 years Source: Barclays Global High Yield TR CAD U.S. dividend mandate expands our options Enhanced Dividend (Laketon) Dividend (London Capital) U.S. Dividend (GWLIM) Invest in the largest economy in the world Top 10 dividend yielding stocks in the US as of April 30, 2013 Stock Current price Estimated dividend 2013 Dividend yield (%) AT&T 38.73 1.8200 4.70 Intel 22.88 0.9450 4.13 Verizon 52.19 2.1050 4.03 General Electric 21.35 0.8200 3.84 Merck 47.92 1.7400 3.63 Cisco Systems 20.59 0.7100 3.45 Dupont 50.41 1.7200 3.41 Chevron 116.57 3.8800 3.33 Microsoft 30.83 1.0000 3.24 McDonalds 99.32 3.2200 3.24 5-year GIC 2.20 Source: Dow Jones Asset allocation funds: professionally managed single fund solutions • When you invest in the asset allocation funds you get the value of Portfolio Solutions Group – Full-time professional overlay management • Provides portfolio allocation and fund manager oversight services 36 Fund performance remains strong Internal equity funds • 80% of internal funds in the top two quartiles over three years • Global Equity (Setenta) in top two quartiles over one, three and five years Source: Wealth Management Financial Management. Quartile rankings are weighted by number of Funds and includes target date funds. As of March 31, 2013. Fund performance remains strong Mackenzie and external equity funds • Global Future (Mackenzie) ranked 1st quartile over one, three, five, 10 years • Canadian Equity (Bissett) and Small Cap Equity (Bissett) ranked 1st quartile over one, three, five years and second quartile over 10 years Source: Wealth Management Financial Management. Quartile rankings are weighted by number of Funds and includes target date funds. As of March 31, 2013. Great opportunities right now • Competitive advantage in savings and income markets • Unique fund solutions to meet more clients’ needs • Well positioned to make most of current economic environment