Standard Insurance Company Stable Asset Fund I

advertisement

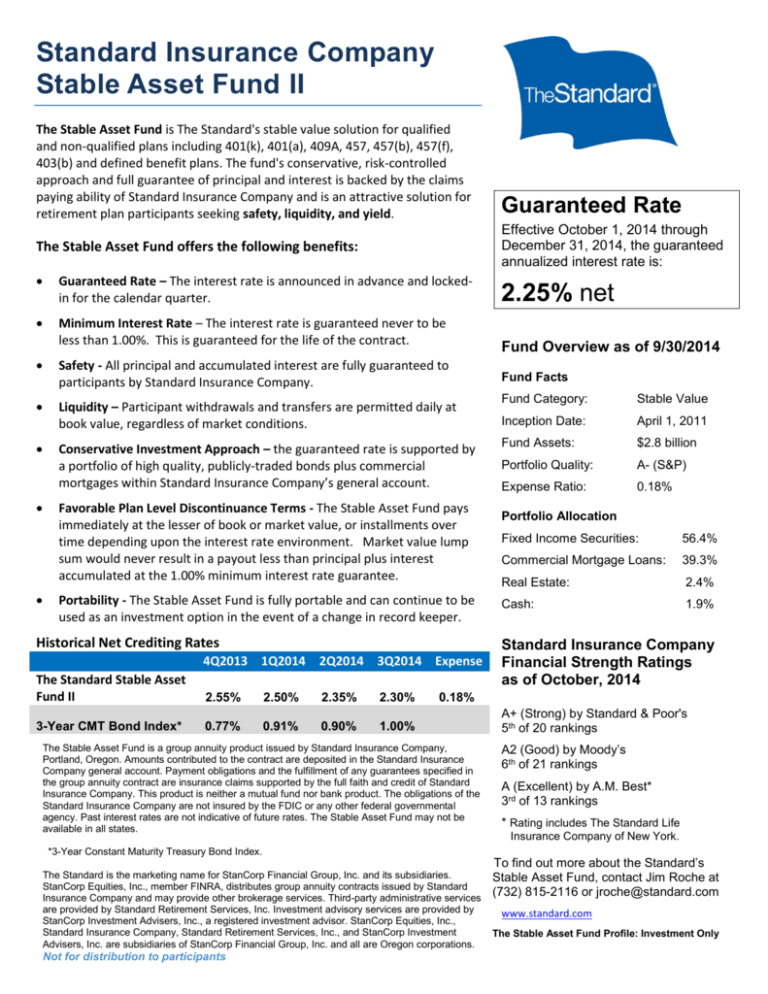

Standard Insurance Company Stable Asset Fund II The Stable Asset Fund is The Standard's stable value solution for qualified and non-qualified plans including 401(k), 401(a), 409A, 457, 457(b), 457(f), 403(b) and defined benefit plans. The fund's conservative, risk-controlled approach and full guarantee of principal and interest is backed by the claims paying ability of Standard Insurance Company and is an attractive solution for retirement plan participants seeking safety, liquidity, and yield. Effective October 1, 2014 through December 31, 2014, the guaranteed annualized interest rate is: The Stable Asset Fund offers the following benefits: Guaranteed Rate – The interest rate is announced in advance and lockedin for the calendar quarter. Minimum Interest Rate – The interest rate is guaranteed never to be less than 1.00%. This is guaranteed for the life of the contract. Safety - All principal and accumulated interest are fully guaranteed to participants by Standard Insurance Company. Liquidity – Participant withdrawals and transfers are permitted daily at book value, regardless of market conditions. Conservative Investment Approach – the guaranteed rate is supported by a portfolio of high quality, publicly-traded bonds plus commercial mortgages within Standard Insurance Company’s general account. Favorable Plan Level Discontinuance Terms - The Stable Asset Fund pays immediately at the lesser of book or market value, or installments over time depending upon the interest rate environment. Market value lump sum would never result in a payout less than principal plus interest accumulated at the 1.00% minimum interest rate guarantee. Portability - The Stable Asset Fund is fully portable and can continue to be used as an investment option in the event of a change in record keeper. Historical Net Crediting Rates 4Q2013 1Q2014 2Q2014 3Q2014 Expense The Standard Stable Asset Fund II 2.55% 2.50% 2.35% 2.30% 3-Year CMT Bond Index* 0.77% 0.91% 0.90% 1.00% 2.25% net Fund Overview as of 9/30/2014 Fund Facts Fund Category: Stable Value Inception Date: April 1, 2011 Fund Assets: $2.8 billion Portfolio Quality: A- (S&P) Expense Ratio: 0.18% Portfolio Allocation Fixed Income Securities: 56.4% Commercial Mortgage Loans: 39.3% Real Estate: 2.4% Cash: 1.9% Standard Insurance Company Financial Strength Ratings as of October, 2014 0.18% The Stable Asset Fund is a group annuity product issued by Standard Insurance Company, Portland, Oregon. Amounts contributed to the contract are deposited in the Standard Insurance Company general account. Payment obligations and the fulfillment of any guarantees specified in the group annuity contract are insurance claims supported by the full faith and credit of Standard Insurance Company. This product is neither a mutual fund nor bank product. The obligations of the Standard Insurance Company are not insured by the FDIC or any other federal governmental agency. Past interest rates are not indicative of future rates. The Stable Asset Fund may not be available in all states. *3-Year Constant Maturity Treasury Bond Index. The Standard is the marketing name for StanCorp Financial Group, Inc. and its subsidiaries. StanCorp Equities, Inc., member FINRA, distributes group annuity contracts issued by Standard Insurance Company and may provide other brokerage services. Third-party administrative services are provided by Standard Retirement Services, Inc. Investment advisory services are provided by StanCorp Investment Advisers, Inc., a registered investment advisor. StanCorp Equities, Inc., Standard Insurance Company, Standard Retirement Services, Inc., and StanCorp Investment Advisers, Inc. are subsidiaries of StanCorp Financial Group, Inc. and all are Oregon corporations. Not for distribution to participants Guaranteed Rate A+ (Strong) by Standard & Poor's 5th of 20 rankings A2 (Good) by Moody’s 6th of 21 rankings A (Excellent) by A.M. Best* 3rd of 13 rankings * Rating includes The Standard Life Insurance Company of New York. To find out more about the Standard’s Stable Asset Fund, contact Jim Roche at (732) 815-2116 or jroche@standard.com www.standard.com The Stable Asset Fund Profile: Investment Only