Old

advertisement

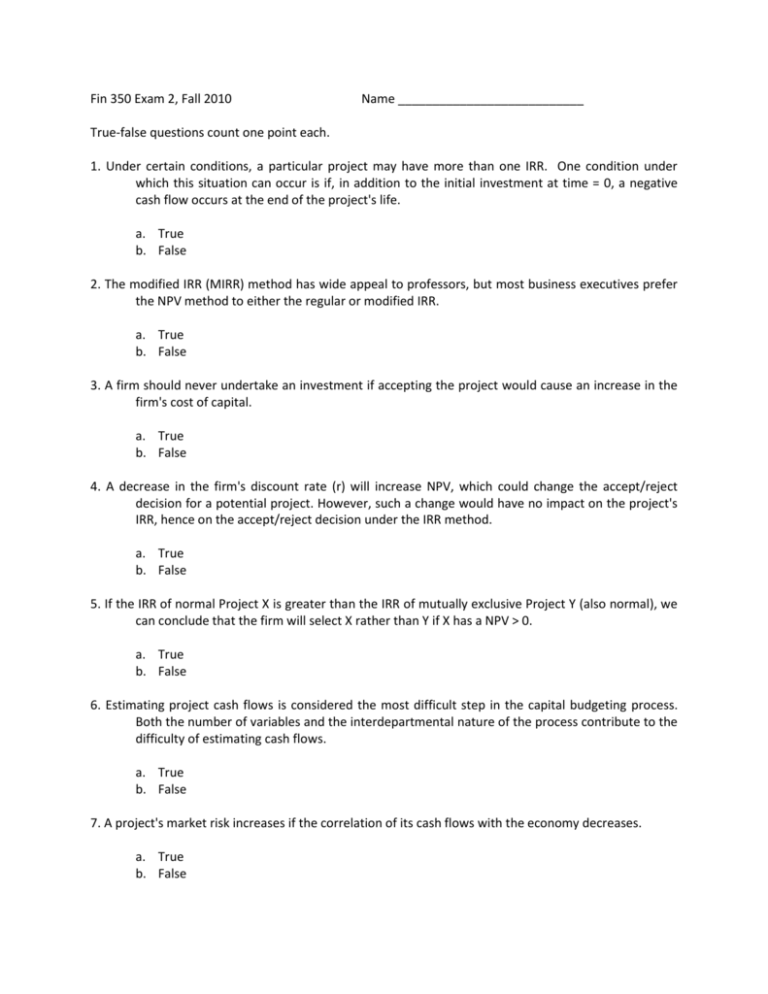

Fin 350 Exam 2, Fall 2010 Name ___________________________ True-false questions count one point each. 1. Under certain conditions, a particular project may have more than one IRR. One condition under which this situation can occur is if, in addition to the initial investment at time = 0, a negative cash flow occurs at the end of the project's life. a. True b. False 2. The modified IRR (MIRR) method has wide appeal to professors, but most business executives prefer the NPV method to either the regular or modified IRR. a. True b. False 3. A firm should never undertake an investment if accepting the project would cause an increase in the firm's cost of capital. a. True b. False 4. A decrease in the firm's discount rate (r) will increase NPV, which could change the accept/reject decision for a potential project. However, such a change would have no impact on the project's IRR, hence on the accept/reject decision under the IRR method. a. True b. False 5. If the IRR of normal Project X is greater than the IRR of mutually exclusive Project Y (also normal), we can conclude that the firm will select X rather than Y if X has a NPV > 0. a. True b. False 6. Estimating project cash flows is considered the most difficult step in the capital budgeting process. Both the number of variables and the interdepartmental nature of the process contribute to the difficulty of estimating cash flows. a. True b. False 7. A project's market risk increases if the correlation of its cash flows with the economy decreases. a. True b. False 8. Risky projects can be evaluated by discounting expected cash flows using a risk-adjusted discount rate. a. True b. False 9. Opportunity costs include those cash inflows that could be generated from assets the firm already owns, if those assets are not used for the project being evaluated. a. True b. False 10. Suppose a firm is considering production of a new product whose projected sales include sales that will be taken away from another product the firm also produces. The lost sales on the existing product are a sunk cost and are not a relevant cost to the new product. a. True b. False 11. Capital can be defined as the funds supplied by investors. a. True b. False Multiple choice questions count 2 points each. 1. Which of the following statements is most correct? a. The NPV method assumes that cash flows will be reinvested at the cost of capital while the IRR method assumes reinvestment at the IRR. b. The NPV method assumes that cash flows will be reinvested at the risk free rate while the IRR method assumes reinvestment at the IRR. c. The NPV method assumes that cash flows will be reinvested at the cost of capital while the IRR method assumes reinvestment at the risk-free rate. d. The NPV method does not consider the inflation premium. 2. A company is considering an expansion project. The company’s CFO plans to calculate the project’s NPV by discounting the relevant cash flows (which include the initial up-front costs, the operating cash flows, and the terminal cash flows) at the company’s cost of capital (WACC). Which of the following factors should the CFO include when estimating the relevant cash flows? a. b. c. d. e. Any sunk costs associated with the project. Any interest expenses associated with the project. Any opportunity costs associated with the project. Answers b and c are correct. All of the answers above are correct. 3. Adams Audio is considering whether to make an investment in a new type of technology. Which of the following factors should the company consider when it decides whether to undertake the investment? a. The company has already spent $3 million researching the technology. b. The new technology will affect the cash flows produced by its other operations. c. If the investment is not made, then the company will be able to sell one of its laboratories for $2 million. d. All of the factors above should be considered. e. Factors b and c should be considered. 4. Assume a project has normal cash flows (i.e., the initial cash flow is negative, and all other cash flows are positive). Which of the following statements is most correct? a. b. c. d. e. All else equal, a project's IRR increases as the cost of capital declines. All else equal, a project's NPV increases as the cost of capital declines. All else equal, a project's MIRR is unaffected by changes in the cost of capital. Answers a and b are correct. Answers b and c are correct. 5. If a company uses the same discount rate to evaluate all projects, the firm will most likely become a. b. c. d. e. Riskier over time, and its value will decline. Riskier over time, and its value will rise. Less risky over time, and its value will rise. Less risky over time, and its value will decline. There is no reason to expect its risk position or value to change over time as a result of its use of a single discount rate. 6. Risk in a revenue-producing project can best be adjusted for by a. b. c. d. e. Ignoring it. Adjusting the discount rate upward for increasing risk. Adjusting the discount rate downward for increasing risk. Picking a risk factor equal to the average discount rate. Reducing the NPV by 10 percent for risky projects. 7. Suppose the firm's WACC is stated in nominal terms, but the project's expected cash flows are expressed in real dollars. In this situation, other things held constant, the calculated NPV would a. b. c. d. e. Be correct. Be biased downward. Be biased upward. Possibly have a bias, but it could be upward or downward. More information is needed; otherwise, we can make no reasonable statement. 8. Which of the following statements about the cost of capital is incorrect? a. A company's target capital structure affects its weighted average cost of capital. b. Weighted average cost of capital calculations should be based on the after-tax-costs of all the individual capital components. c. If a company's tax rate increases, then, all else equal, its weighted average cost of capital will increase. d. The cost of retained earnings is equal to the return stockholders could earn on alternative investments of equal risk. e. Flotation costs can increase the cost of preferred stock. 1. (12 points) You have estimated the following cash flows for Project X: Year CFX 0 (125,000) 1 80,000 2 40,000 3 20,000 The cost of capital for the project is 12%. a. Calculate the internal rate of return for the project. b. Calculate the NPV for the project. c. Calculate the MIRR. 2. (28 points) Pasta and Pizza, Inc. owns a chain of restaurants. It is considering marketing its own brand of pasta in grocery stores. It will require purchasing equipment with a cost of $2,400,000. Delivery and installation of the equipment will cost an additional $300,000. The project will require an increase in net operating working capital of $200,000 at the beginning of the project. The firm’s tax rate is 40 percent. a. (4 points) Calculate the initial investment for the project. b. (2 points) Depreciation for tax purposes will be straight line to zero over the three year life of the equipment. Calculate annual depreciation expense for the project. c. (5 points) At the end of 3 years the equipment will be sold for an estimated $800,000 and funds invested in net working capital will be recovered. Calculate the terminal cash flows. Problem 4, continued. d. (9 points) The project is expected to generate sales revenue of $3 million per year, based on the expected sales price at t = 0. Cash expenses are 45 percent of sales revenue. The sale price and cash expenses are expected to increase at 4 percent annually due to inflation. Calculate the annual operating cash flows for each year of the project, taking into consideration the effects of inflation on sales revenue and cash expenses. e. (8 points) Briefly explain how the increase in net operating working capital affects the cash flows at the beginning (i.e., at t=0) and at the end of the project. 3. (10 points) Flagstaff Mfg. has a corporate WACC of 12 percent. You are evaluating two mutually exclusive projects, X and Y, each of which has a lifetime of 6 years. Use the information provided to answer the questions below. Project X: Initial investment Expected NPV @ 12% Standard deviation of NPV $126,700 17,321 15,112 Project Y: Initial investment Expected NPV @ 12% Standard deviation of NPV $126,700 17,321 15,112 a. What type of risk does the standard deviation measure (circle one)? stand-alone risk within-firm risk market risk The cash flows from project X are positively correlated with the firm’s existing cash flows, while the cash flows of Y are negatively correlated with the firm’s existing cash flows. b. Based on the information provided, which project has the lower within-firm (or corporate) risk (circle one)? Project X Project Y c. Which project should the firm accept? Be specific. 4. (12 points) Projects J and K mutually exclusive. Project J costs $100 dollars and provides positive cash flows of $50 per year over its 3 year life. Project K costs $180 and provides cash flows of $50 per year over its 6 year life. The cost of capital is 10 percent for both projects. Project NPV @ 10% IRR J $24.34 23.38% K $37.76 16.88% a. Calculate the replacement chain NPV for J. b. The Equivalent Annual Annuity for Project K is $8.67. Calculate the Equivalent Annual Annuity for project J. c. Which project should be chosen? State what your decision is based on. Be specific. 5. (14 points) The following information was obtained from the Wall Street Journal, Oct. 19, 2010, p. B2: Vehicle Power Type Purchase cost Annual Fuel Cost Chevrolet Cruze Gas powered $16,995 $1,457 Nissan Leaf All electric $26,380 $396 a. You plan to keep the vehicle 8 years. You believe maintenance costs and salvage values will be equal for the two vehicles. Your only objective is to minimize the cost of transportation and the annual opportunity cost of funds is 6%. Which vehicle should you buy? b. If you believe the Nissan Leaf is a riskier choice because of its relatively new technology, how should you alter your analysis to reflect that? Explain your answer. (This requires no additional calculations.) 6. (12 points) Fox, Inc. has issued and sold one hundred thousand bonds with a par value of $1,000 each. The market price of the bonds is $920. Its only current liabilities are accounts payable and accruals. It has no other interest bearing debt. Fox has 4 million shares of common stock outstanding with a market price of $80. The bonds and common equity are its only sources of capital. a. Calculate the percentage of capital from each source using the market values (that is, the market value weights). b. Fox can issue new bonds with a coupon rate of 6% to be sold at par. Fox has a 30% tax rate. Calculate the after-tax cost of debt financing. c. The stock’s beta is 0.80. The risk-free rate is 4% and the expected return on the market is 11%. Calculate the required return on common stock using CAPM. d. Fox does not plan to sell any additional shares of common stock this year and anticipates adding $20 million to retained earnings this year. Use the market value weights and your answers above to calculate the weighted average cost of capital (WACC). e. What is the maximum capital budget that Fox can finance in the coming year (without selling new shares of common stock)?