A Close Look at Subchapter S Corporations

advertisement

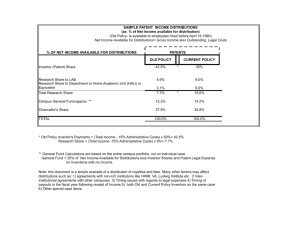

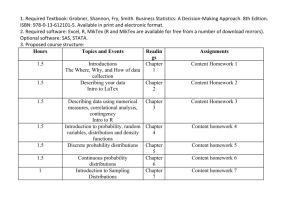

A Close Look at Subchapter S Corporations Presented by: Bill Parrish (oneplusone)3 Those Pesky Disclaimers This Information is copyright protected by (oneplusone)3 and may not be reproduced or otherwise distributed without the written consent of (oneplusone)3 This presentation is for informational purposes only and should only be implemented by a practitioner after appropriate due diligence has been performed Not all of the concepts and strategies proposed in this presentation may be appropriate for all practices. Careful study must be undertaken by anyone considering the implementation of these concepts and special attention should be given to individual state laws governing the practice of professionals. Most Popular Business Entity LLCs Are Not Overtaking Blend of Features of Partnership and C Corps Restricted Ownership Rules Election Requirements Compensation Issues Reasonable Compensation - Too Little - Family Income Shifting Excessive Compensation Constructive Distributions Government Compliance Initiatives Shareholder Benefit Issues 2% Shareholder Status - Medical Benefits - Health & Accident Insurance Premiums - Health Savings Accounts Payroll Taxes on Benefits to Shareholders Office in Home Different Than Sole Proprietorship Treated as Itemized Deduction Subject to 2% AGI Limit Circumstances Must be Factual Distributions Earnings & Profits Account (E&P) Accumulated Earnings & Profits Account (AEP) Accumulated Adjustments Account (AAA) Distributions With No AEP Distributions With AEP Other Schedule M2 Accounts Undistributed Taxable Income Previously Taxed (PTI) - Earnings as S Corp between 1958 & 1982 Other Adjustments Account (OAA) - Catch All Account Ordering of Distributions (Layers of a Sandwich) All S Corps to the Extent of AAA To Shareholders with pre-1983 PTI S Corporations with AEP All Other Distributions Basis Issues Inside Basis - Usually Tracked at the Corp Level - Equity Basis - Loan Basis Outside Basis - Usually Tracked at the Shareholder Level - Stock Basis - Other Basis S Corporation Pitfalls Disproportionate Distributions Distributions in Excess of Basis Limits on Benefits to 2% Shareholders Limitations on Pass Through of Losses Separately Stated Items Interest Income Dividend Income Capital Gains Charitable Contributions Section 179 Depreciation Certain Losses Advantages of S Corporation Status Avoid Double Taxation on Profits Allows Limited Pass Through of Losses Provides Planning Opportunities Want to Participate in a Discussion Blog on S Corporations? You are invited to become part of a discussion blog on S Corporations at www.oneplusone3.com. Just go there, click on “join” from the home page, and when you are given Subscription Type, enter “WEBINAR” as your code and you will be given a free affiliation through May 31, 2009. Once signed up, you will be contacted with specific information about the S Corporation Blog. For Information About ConnectEd: Jodi Goldberg, Director of Member Services National Society of Accountants 800-966-6679 Ext 1304 jgoldberg@nsacct.org About the Presentation Bill Parrish, Founder & CEO (oneplusone)3 800-867-0065 Ext 1013 billparrish@oneplusone3.com www.oneplusone3.com C P E Credit Jodi Goldberg with NSA has sent you an email with the qualifying questions for today’s webinar. Complete that questionnaire and submit to NSA. They will then provide you with the CPE credit certificate.