Part 3 - Unicredit Bank

advertisement

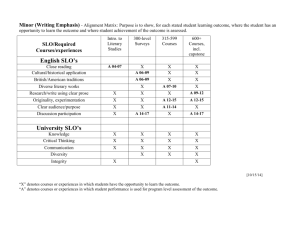

EBRD Annual Meeting Retail banking on the move: the latest trends and developments in CEE Andrea Moneta, Managing Board Member, BA-CA Martin Mayr, Market Research, BA-CA London, 21 May 2006 Agenda Part 1: The Group in CEE (A. Moneta) The leading banking network in CEE Retail banking is the growth driver in CEE business Part 2: Market research – the latest trends and developments (M. Mayr) Banking penetration Usage of products and services Summary and outlook Part 3: A strong force in retail banking (A. Moneta) The name of the game is innovation UniCredit is a Truly European Bank … Banking operations in 20 core countries Thinking globally and operating on multilocal basis Creating sustainable long-term value Exploiting complementary nature of Group's best practices Developing the best of local cultures and brands already recognized and established 28 million customers 7,184 branches 148,000 employees Net profit: € 3.4 bn1 Total assets: € 782 bn Deposits and debt certificates: € 462 bn Loans: € 427 bn Global player in asset management: approx. € 272 bn AuM with coverage in 20 countries in 5 continents 25th European company in terms of capitalization2 Note: 2005 data 1 Consolidated 2005 pro forma for UniCredit Group including HVB Group stand alone 12 months results, integration effects and other one-off costs 2 Ranking as at 16 March 2006 - Source: Datastream 3 … with the by far most extensive CEE banking network... Ranking, total assets and number of offices of BA-CA and UniCredit in CEE as of 31 December 2005 Poland No. 1 €31.7bn 1,281 Lithuania No. 8 €385mn 2 Latvia No. 10 €358mn 1 Estonia No. 6 €74mn 1 CEE region1 €4.7bn 30 €92.7bn total assets Czech Rep. No. 4 €7.4bn 66 Ukraine €259mn 8 Slovakia No. 4 €3.4bn 93 Romania No. 3 €3.1bn 128 Hungary No. 7 €4.1bn 54 Slovenia No. 7 €1.9bn 13 Russia No. 8 2,932 offices 60,722 employees ~17million customers Bulgaria No. 1 €3.5bn 322 1 Croatia No. 1 €8.9bn 145 Bosnia No. 1 €1.5bn 172 Macedonia Rep.Office Serbia No. 5 €529m 42 4 Turkey No. 3 €21bn 574 including - Banca Tiriac (Romania) - NBB (Bosnia/Rep.Srpska) - Yapi Kredi (Turkey) excluding - HVB Splitska banka (Croatia) … where it operates as the undisputed leader. Central & Eastern Europe – Top Financial Groups (2004) Revenues (Euro m) Total Assets (Euro bn) 4,982 83.7 34.8 1,715 1,660 Branches (no.) 33.3 1,420 1,6591 19.7 1,110 18.0 16.4 N.A. 1,5361 1,017 875 1,245 39.71 24.7 1,126 826 2,864 814 722 498 237 14.8 UniCredit Group has a particularly strong competitive advantage in CEE. Its size – in terms of revenues, total assets and branches – is more than double that of the second player. Source: Internal data - as at end of 2004 1 Including on a pro-forma basis the recently acquired Banca Comerciala Romana 5 CEE markets offer a huge potential... Inhabitants 2005 •Armenia 3 •Azerbaijan 8.3 •Bosnia 3.8 •Bulgaria 7.8 •Croatia 4.4 •Cyprus 0.8 •Czech Rep. 10.2 •Estonia 1.4 •Georgia 4.7 •Greece 10.6 •Hungary 10.1 population about 440 m •Kazakhstan 15.1 •Latvia 2.3 •Lithuania 3.5 •Macedonia 2 •Moldavia 4.5 •Poland 38.2 •Romania 21.7 •Russia 143.6 •Serbia 10.6 •Slovakia 5.4 •Slovenia 2 •Turkey 69.6 •Ukraine 47.6 •Belarus 9.9 population about 160 m 6 ...especially in retail banking: CEE revenue potential REVENUE POOLS 2004 IN EURO MILLION 26% 100% Investment Banking 1,024 1,315 22% 453 17% 960 9% 312 3% 9% 4% 8% 3% 22 65 60 12 60 225 70 19 5 11% 277 Corporate Banking 714 2,122 2,618 960 1,727 3,503 415 397 123 395 479 287 753 38% 51% Retail Banking 4,873 3,563 4,457 2,768 1,746 1,308 417 319 126 662 414 127 400 299 0% Note(s): Percentages on top of chart reflect share of country in total CEE revenue pools Source(s): National banks; Economic Research Department BA-CA; BCG analysis 7 Household loans and deposits have grown strongly in recent years... Increase since 2000: household loans +62%, household deposits +26% p.a. compared to 5% in the euro area 2.500 2.000 Household loans in CEE Household deposits in CEE (Dec. 2000=100, local currency) (Dec. 2000=100, local currency) NMS (PL,CZ,HU,SK,SL) SEE(RO,BG,HR,SCG,BiH) Euro area Russia Region total 600 Russia 90% cagr 500 SEE 77% cagr NMS (PL,CZ,HU,SK,SL) SEE(RO,BG,HR,SCG,BiH) Euro area Russia Region total Russia 42% cagr SEE 36% cagr 400 1.500 1.000 300 Total 62% cagr 200 500 0 100 NMS 25% cagr Euro area 5% cagr Total 26% cagr NMS 6% cagr Euro area 5% cagr 0 2001 2002 2003 2004 2005 2006 2001 2002 2003 2004 2005 2006 8 ...and the outlook for the retail sector remains positive Household deposits and loans (2000 and 2007 in EUR per capita) PL 7000 HU +7% cagr CZ +17% cagr SK +12% cagr HR +11% cagr BG +17% cagr RO +30% cagr RU +29% cagr Euro area 2005 CEE +44% cagr +20% cagr +4.4% cagr* 6000 Deposits 2000 Loans 2000 2.198 5000 3.019 13.600 loans Deposits 2007 Loans 2007 4000 2.004 3000 1.408 406 14.100 deposits 1.208 4.331 2000 240 1000 1.761 1.329 0 710 210 478 1.255 887 3.446 683 2.542 2.503 617 2.175 1.539 453 1.410 36 237 1.056 5 182 1.082 631 Source: BA-CA Economics Department, UCG New Europe Research Network 9 9 122 127 1.417 524 * 2000 to 2005 Agenda Part 1: The Group in CEE (A. Moneta) The leading banking network in CEE Retail banking is the growth driver in CEE business Part 2: Market research The latest trends and developments (M. Mayr) Banking penetration Usage of products and services BA-CA loan barometer Part 3: A strong force in retail banking (A. Moneta) The name of the game is innovation Market research: design of the studies Study 1: Basic Tracking Retail Banking Markets Universe: adult population aged 15 years and older Methodology: personal face-to-face interviews Samples: 5000 interviews/country Fieldwork time: January 2005 – November 2005 Agencies: Fessel&GfK (CZ, SK, CRO, BG, RO, UA, RU), RmPLUS (SLO, BiH, SCG), TNS MODUS (HU) and SMG_KRC (PL) Study 2: “ Loan Barometer“ - initiated by BA-CA Universe: adult population aged 15 years and older Samples: 1000 interviews/country Methodology:personal face-to-face interviews Fieldwork time: January 2006 Agencies: Fessel&GfK (CZ, SK, BG, RO), RmPLUS (SLO, BiH, SCG), TNS MODUS (HU) 11 Banking penetration of retail clients at end 2005 % of the population aged 15+ who have a business relation with a bank 120 2001 100 98 99 2004 2005 average new EU markets 2005: 78% 83 81 84 97 98 97 98 81 80 average candidates & west Balkans 2005: 52% 83 80 62 68 65 64 62 57 60 51 50 40 51 37 34 37 33 19 20 0 SLO CZ SK H PL RO BG CRO SCG BiH UA RU Source: BA-CA Market Research, Fessel&GfK (A, CZ, SK, RO, BG, CRO, UA, RU), RmPlus (SLO, SCG, BiH), TNS MODUS (HU); SMG_KRC (PL) 12 A D Size of population and number of bank clients BG BiH CRO CZ Population aged 15yrs+ (in m) Have bank relationship 6.7 3.1 3.7 8.2 H 8.5 PL RO SCG SK SLO 29.9 17.9 6.7 4.2 1.7 37% 37% 83% 81% 65% 62% 50% 64% 81% 99% A D 6.7 64.7 98% 98% Banked in m 2.5 1.1 3.1 6.6 5.5 18.5 8.9 4.3 3.4 1.7 6.6 63.4 Not banked in m 4.2 1.9 0.6 1.6 3.0 11.4 8.9 2.4 0.8 0.0 0.1 1.3 13 Penetration with banking products/services % of population aged 15+ who use this service/product by end 2005 BG Banked population BiH CRO CZ H PL RO SCG SK SLO A D 37 37 83 81 65 62 50 64 81 99 98 98 27*) 33 79 68 56 48 35 60 63 89 93 97 Current account 27 28 78 67 55 46 20**) 53 62 86 93 97 Bank card 26 15 66 64 44 40 28 27 49 86 78 82 E/I-Banking 0 0 5 8 2 6 0 1 6 9 24 17 Phonebanking 0 0 2 5 3 2 0 1 2 4 4 5 Account overdraft 0 3 46 10 6 8 1 15 7 51 N/A Any account *) 27% of adult Bulgarians have an account (current account or debit card account) N/A **) RO: 15% use “card accounts“ Source: BA-CA Market Research, HypoVereinsbank, Fessel&GfK (A, CZ, SK, RO, BG, CRO, UA, RU), RmPlus (SLO, SCG, BiH), TNS MODUS (HU); SMG_KRC (PL) 14 Penetration with banking products/services % of population aged 15+ who use this service/product by end 2005 BG BiH CRO CZ H PL RO SCG SK SLO A D Banked population 37 37 83 81 65 62 50 64 81 99 98 98 Any deposits 12 5 26 56 16 23 10 9 56 46 85 78 Sight deposits (savings book) 8 4 20 17 4 3 4 6 37 22 69 70 Time deposits 2 1 9 6 5 7 8 2 10 15 Securities 0 0 1 3 0 2 2 0 4 4 14 24 Any loans excl. overdraft 7 7 22 9 12 15 16 9 7 22 20 24 Consumer loan 6 6 21 8 8 14 15 9 3 21 9 12 Mortgages 1 0 2 1 1 1 1 0 2 1 11 14 Source: BA-CA Market Research, HypoVereinsbank, Fessel&GfK (A, CZ, SK, RO, BG, CRO, UA, RU), RmPlus (SLO, SCG, BiH), TNS MODUS (HU); SMG_KRC (PL) 15 Trends in use of banking services/products note: figures do not represent volumes in € % of population aged 15+ who have ... 100 2001 80 60 40 20 2003 2005 ...any type of account 78 68 64 63 60 56 48 27 48 39 33 24 81 35 89 63 52 38 16 0 BG BiH CRO 80 2001 60 2003 CZ 62 2005 H PL RO SCG ...any type of deposits (excl. account) SK SLO 67 56 56 64 46 38 40 26 12 20 8 20 23 16 23 16 10 5 9 9 0 BG BiH CRO 25 20 15 10 5 22 2001 2003 2005 CZ H PL RO 12 11 3 7 5 SK SLO ...any type of loan (excl. account overdraft) 9 5 20 22 16 15 7 SCG 12 9 7 3 3 7 3 0 BG BiH CRO CZ H PL RO SCG SK Source: BA-CA Market Research, Fessel&GfK (A, CZ, SK, RO, BG, CRO, UA, RU), RmPlus (SLO, SCG, BiH), TNS MODUS (HU); SMG_KRC (PL) 16 SLO Planned investments Basis: Total Q: In which of the following items do you or our family plan to invest in the next 12 months? CEE BG BiH CZ HU RO SCG SK SLO Holiday trip, sport activities 30 15 30 47 20 10 23 27 66 Education (own, of children, ...) 18 17 20 17 8 15 21 25 21 Larger household appliances (fridge, dish washer, ...) 17 10 21 17 8 13 25 20 26 Health (operations, teeth corrections, ...) 17 16 28 10 7 16 18 20 19 Larger electronical items (PC, TV set, ...) 15 11 19 13 7 10 23 14 22 Family events (weddings, big birthday parties, ...) 14 5 16 15 9 13 15 16 25 Furniture 14 8 15 13 2 9 18 18 23 Car 10 4 14 7 4 9 16 10 13 Plastic operation 1 0 2 1 0 1 1 1 0 Don’t know / No answer 32 48 25 31 47 52 18 13 13 in % Source: BA-CA Market Research, Fessel&GfK (A, CZ, SK, RO, BG, CRO, UA, RU), RmPlus (SLO, SCG, BiH), TNS MODUS (HU), SMG_KRC (PL) 17 Way of financing Basis: plan to invest in the following item Q: How do you plan to finance these items? Mainly by savings •Holiday trip, sport activities •Health (operations, teeth corrections, ...) •Education (own, of children, ...) •Family events (weddings, big birthday parties, ...) % savings % loans 78 75 76 78 7 9 10 7 By savings or loans •Furniture 58 •Larger household appliances (fridge, dish washer, ...) 54 32 •Larger electronical items (PC, TV set, ...) 55 •Plastic operation 32 48 33 34 40 54 Mainly by loans •Car 18 Planned financing Basis: plan to invest in the following item Q: How do you plan to finance these items? Holidays, sports 100 80 78 80 60 60 40 40 19 20 7 Health 100 75 18 20 2 0 9 3 0 savings gift loan CZ HU SLO RO SK BG SCG BiH RO SCG BiH BG CZ HU SLO CZ HU SK DK/NA savings gift loan CZ HU SLO HU RO BG SCG HU RO SCG BG CZ HU SCG SLO CZ SK Source: BA-CA Market Research, Fessel&GfK (A, CZ, SK, RO, BG, CRO, UA, RU), RmPlus (SLO, SCG, BiH), TNS MODUS (HU); SMG_KRC (PL) 19 DK/NA Planned financing Q: How do you plan to finance these items? Basis: plan to invest in the following item Large household appliances Cars 100 100 80 80 60 55 60 33 40 40 40 17 20 54 13 20 2 0 6 0 savings gift loan DK/NA savings gift loan CZ SK SLO BG RO SCG BiH CZ SK HU RO SCG BG SLO RO SCG BG CZ SLO CZ SK SLO RO SCG BG HU SLO HU CZ Source: BA-CA Market Research, Fessel&GfK (A, CZ, SK, RO, BG, CRO, UA, RU), RmPlus (SLO, SCG, BiH), TNS MODUS (HU); SMG_KRC (PL) 20 DK/NA Summary and outlook Gaps in banking penetration between countries in the CEE region still exist, but are becoming smaller. Usage of consumer loans as well as demand for credits is significantly increasing. The strongest need for loans to finance consumer goods was reported in Romania, Serbia and Montenegro, Bosnia and Herzegovina, and Bulgaria, while Czechs, Slovenes and Slovaks are more likely to use own savings. “Saving discipline“ has become weaker; tendency to satisfy own needs is growing. 21 Agenda Part 1: The Group in CEE (A. Moneta) The leading banking network in CEE Retail banking is the growth driver in CEE business Part 2: Market research – the latest trends and developments (M. Mayr) Banking penetration Usage of products and services Summary and outlook Part 3: A strong force in retail banking (A. Moneta) The name of the game is innovation The name of the game is innovation CEE is a huge market with high potential. With a clear strategy, every CEE country offers excellent opportunities for further growth in retail business. The CEE region has big advantages compared to the “old” EU markets: It’s a new and “learning” market - CEE does not repeat the mistakes international banks made in their “old” home markets. Development processes are much faster. UniCredit Group’s approach: 1) Innovation: Quick reaction to trends in the banking market Example: Introduce more diversified savings products (asset management, etc.). 2) New ways of distribution: Mobile Sales Force and Cooperation Channel to enlarge the sales capacity leveraging on new network structure Examples: – Retail loans in Romania (almost 40% of the monthly new retail loan business comes from this channel) – Mortgages in Bulgaria (around 25% of the new mortgage business is based on this channel) 3) Factory centralisation: getting benefits from economies of scale and sharing best practice in production process – Example: Card Centre in Prague currently servicing the Czech Republic, Slovakia and Hungary 23 Customer satisfaction is the winning strategy Customer acquisition is the game all banks play, but: Customer satisfaction is the winning strategy. We emphasise tailored service models for our customers and leverage the strengths and the knowledge of the Group’s network: Wide and innovative product offering, proven by our leading positions - e.g.: Number 1 in mutual funds (Poland), Number 1 in mortgage loans (Croatia), Number 1 in credit cards (Turkey), Number 1 in custody (Slovenia) Service models with dedicated divisions Physical proximity to our clients and 24 hour availability through state-of-the-art IT services and call centres Special focus on recruitment and staff development 24