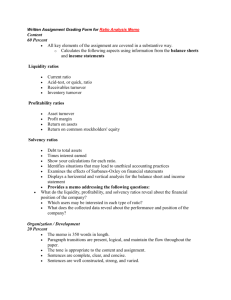

Chapter 5, Introduction to Financial Statement Analysis

advertisement

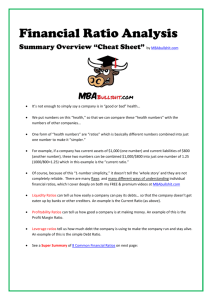

Chapter 5 -- Introduction to Financial Statement Analysis FINANCIAL ACCOUNTING AN INTRODUCTION TO CONCEPTS, METHODS, AND USES 12th Edition Clyde P. Stickney and Roman L. Weil Learning Objectives 1. Understand the relation between the expected return and risk of investment alternatives, and the role financial statement analysis can play in providing information about returns and risk. 2. Understand the usefulness of the rate of return on assets (ROA) as a measure of a firm’s operating profitability independent of financing and the insights gained by disaggregating ROA into profit-margin and assets-turnover components. Learning Objectives 3. Understand the usefulness of the rate of return on common shareholders’ equity (ROCE) as a measure of profitability that incorporates a firm’s particular mix of financing and the insights gained by disaggregating ROCE into profit-margin, assets-turnover, and capital-structureleverage-ration components. 4. Understand the strengths and weaknesses of earnings per common share as a measure of profitability. Learning Objectives 5. Understand the distinction between shortterm liquidity risk and long-term liquidity risk and the financial statement rations used to assess these two dimensions of risk. 6. Develop skills to interpret an analysis of profitability and risk. 7. (Appendix) Develop skills to prepare pro forma financial statements. 8. (Appendix) Understand the usefulness of pro forma financial statements in the valuation of a firm. Chapter Outline 1. Objectives of financial statement analysis 2. Analysis of profitability 3. Analysis of risk 4. Limitations of ratio analysis 5. International perspective Chapter Summary Appendix 5.1: Pro Forma Financial Statements Purpose of Financial Statement Analysis To understand the economics of a firm and To help forecast its future define profitability and risk – Profitability is an increase in wealth – Risk is the probability that a specific level of profitability will be achieved. Relationship between Financial Statement Analysis and Investment Decisions Past Present Future Financial Statement Analysis Profitability Expected Return Risk (Short-term and long-term Liquidity) Risk Investment Decision What is the Usefulness of Ratios? Helps compare different firms, and Helps compare the firm against its past performance Standards against which to compare ratios 1. The planned ratio for the period 2. The corresponding ratio from a prior period 3. The corresponding ratio for another firm in the same industry 4. The average ratio for other firms in the same industry Analysis of Profitability Profitability is subtle and complex concept. Doing well may be measured by different standards. Three concepts of profitability are given by: 1. Return on assets 2. Return on common equity 3. Earnings per common share Each of these are discussed in turn. Return on Assets (ROA) ROA presents profitability independent of the source of financing – Does not consider leverage – Measure of how well the firm uses its assets to generate income Disaggregating ROA -- ROA can be defined as the product of two other ratios 1. Profit margin ratio, and 2. Total assets turnover Return on Assets (Cont.) Notice that when these two ratios are multiplied, Sales cancel out, giving the definition of ROA Thus ROA = (profit margin ratio)*(total sales turnover) Profitability Ratios (Figure 5.3) Rate of return Level 1 on assets Profit Level 2 margin for ROA Level 2 = Rate of return to creditors and preferred shareholders Total assets turnover ratio Various expense-tosales percentages Profit margin for ROCE A.R. turnover, inv. turnover, plant asset turnover Rate of return on + common shareholders’ equity Total assets turnover ratio Various expense-tosales percentages Leverage ratio A.R. turnover, inv. turnover, plant asset turnover Profit Margin Ratio Profit margin ratio measures a firm's ability to control its expenses relative to its sales. We expect expenses to grow as sales grow, but not as fast. A high profit margin ratio is preferred to a low one. Total Assets Turnover Total assets turnover measures a firm's ability to generate sales from a given level of assets. A large asset turnover is preferred to a low one. Total assets turnover is related to three similar ratios a. Accounts receivable turnover b. Inventory turnover c. Fixed asset turnover Accounts Receivable Turnover Measures how quickly a firm collects cash. If A.R. turn over twice a year, then they average one half of a year in collection. Less time is preferred to more. A high turnover is preferred to a low one. Accounts Receivable Turnover Sales = Ave. Accts. Rec. Inventory Turnover Indicates how fast firms sell merchandise. If inventory turn over twice a year, then they average one half of a year in inventory. Holding inventory is costly because the funds invested in inventory could be used elsewhere. A high turnover is preferred to a low one. Inventory Turnover Cost of Goods Sold = Ave. Inventory Fixed Asset Turnover Measures the relation between investment in longterm or fixed assets (such as property, plant, equipment) and sales. Efficient use of fixed assets would be associated with high sales. If fixed assets turn over every four years, then each dollar invested in fixed assets is generating a quarter of a dollar in sales per year. A high turnover is preferred to a low one. Return on Common Equity The numerator measures return as net income reduced by any payments to preferred shareholders as these dividends are not available to the common shareholder and have not been deducted from net income. The denominator is the average amount contributed by common shareholders which includes – Common stock at par, – Additional paid in capital, and – Retained earnings. Relation between ROA and ROCE (Cont.) ROCE is the residual return which goes to the common shareholders. Since it may be low in poor years but high in good years, it has a risk, that is, the residual return is not known. Debt is characterized by a definite schedule of payments, so there is little risk to the debt holders. Preferred stock is like debt, the dividends are specified. However, debtors must be paid before preferred shareholders and if the money runs out, then they aren't paid. Relationship between ROA and ROCE (Cont.) ROA can be divided into – Return to creditors or debtors – Return to preferred shareholders, and – Return to common shareholders (ROCE) Because the return to debtors and preferred shareholders are fixed, in good years when the firm has high returns, there is a lot of profit left over for the common shareholders; in poor years when returns are low, there is little or maybe no profit left over. Relation between ROA and ROCE (Cont.) Thus, if ROCE and ROA were both linear, then ROCE would have a greater slope than ROA, that is, it is more highly levered. A prudent firm will borrow funds only when the return on those marginal funds exceed the cost of borrowing giving a net positive return to the common shareholder. Relationship between ROA and ROCE (Cont.) ROCE can be disaggregated into three related ratios 1. Profit margin ratio 2. Total assets turnover 3. Leverage ratio Relationship between ROA and ROCE (Cont.) The first two have been previously defined. Leverage ratio indicates the relative proportion of capital provided by common shareholders as distinct from that provided by creditors (debtors) or preferred shareholders. Relationship between ROA and ROCE (Cont.) A high leverage ratio means that the firm has a lot of assets at its command, but that the shareholders have less of their own investments at risk. This is good in good years because the common shareholders capture all profits over what is needed to service the debt. This bad in poor years because the debt has to be serviced whether or not the common shareholders make a profit. Earnings/Share of Common Stock This ratio is the profit that goes to each share of common stock. It would be simply the net income less preferred dividends divided by the number of common shares. However, the number of common shares is complicated by certain securities that may become (converted to) a common share. How to account for these is a complex issue. Earnings/Share of Common Stock For example, if there are 100 common shares but 50 preferred shares that could convert to 50 common shares, do you divide earnings by 100 or 150? The answer depends on how likely it is that the convertible securities will convert. Earnings Per Share (EPS) (Cont.) EPS does not consider the amount of assets or capital required to generate earnings. EPS is of limited use in comparing two firms. For investment purposes, the price to earnings (P/E ratio) ratio is sometimes used. This is the return to the purchaser of a share. – P/E = (market price of a share of stock)/(EPS) – A low P/E is preferred to a high P/E. Analysis of Risk Factors that affect risk of a firm – Economy-wide factors such as inflation – Industry-wide factors such as competition – Firm-specific factors such as potential for a labor strike Questions or issues a. Can the firm pay short-term obligations like workers' wages? That is, what are measures of short term risk? b. Can the firm pay long-term obligations like debt? That is, what are long-term measures of risk? Measures of Short-Term Risk Measures of short-term liquidity risk Current ratio – = (current assets)/(current liabilities) – Measure of ability of the firm to pay short-term liabilities on time Quick ratio – = (current highly liquid assets)/(current liabilities) – Current highly liquid assets are assets that are quickly and easily converted into cash – This includes bank accounts but not inventories Measures of Short-Term Risk (Cont.) Cash flow from operations to current liabilities ratio – = (cash flow from operations)/(current liabilities) – Measures the ability of the firm to pay current liabilities without borrowing or additional investments. Working capital turnover ratios – Working capital is a broad definition of cash that includes cash and other assets that are highly liquid such as marketable securities. – Ratios that use working capital show the short-term liquidity of the firm including near-cash assets. Measures of Long-Term Risk Debt-to-equity ratio – = (total liabilities)/(total equities) – total equities = total liab. + shareholders’ equity – Percentage of total financing provided by debtors or creditors. – A firm is said to be highly leveraged when this ratio is large. Cash from operations to total liabilities ratio – Measures the ability of the firm to pay all liabilities from cash without new debt or additional investment. Measures of Long-Term Risk (Cont.) Interest coverage ratio= (Earnings before interest and income tax) (interest expense) Number of times interest is covered by income Indicates the relative protection that operating profitability provides to debtors Some analysts use cash flows instead of income Limitations of Ratio Analysis 1. Ratios based on financial data share the same problems of financial data (such as timeliness). 2. Changes in many ratios correlate with other ratios so a direct interpretation of a change in a ratio is not always apparent. 3. Comparing ratios over time is complicated by the fact that economic conditions may change also. 4. Comparing ratios between two firms is complicated by the fact that the firms may have different economic environments or production technologies even though they produce the same product. An International Perspective The format and terminology of financial statements in different countries often differ making it difficult to find comparable numbers Economic, political and cultural factors affect the way ratios are interpreted Foreign accounting principles may be subtly and substantially different from U.S. GAAP Chapter Summary This chapter presents ratios that allow for the comparison of a firm's performance overtime, against competitors and against industry averages. The concept of risk is introduced and presented as an integral part of financial statement analysis. Specific ratios are discussed and some limitations of ratio analysis are presented. Appendix 5.1 -- Pro Forma Financial Statements Pro forma refers to a projection of what the financial statements might look like if certain future conditions prevail. Of course, a pro forma statement is only as good as the forecast of the future conditions. Appendix 5.1 -- Pro Forma Financial Statements In order to prepare a set of pro forma statements: 1. Project operating revenues 2. Project operating expenses given the level of revenues 3. Project assets required to support the revenues 4. Project financing for the additional assets 5. Project the cost of the financing 6. Project the cash flow statement based on assumptions about the timing of revenues and payments on debt and for expenses. Rapid Review – Name that Ratio 1. (Net Income – Preferred Dividends) / (Weighted Average Commons Shares Outstanding) 2. (Earnings before Interest and Income Tax) / (Interest Expense) 3. (Current Assets) / Current Liabilities) 4. (Market Price of a Share of Stock) / (Earnings Per Share)