negotiated

advertisement

Negotiable Instruments

1

I.

GENERAL IDEAS & FUNCTIONS

A.

To make like “money”

1.

Originated with merchants before paper currency

a.

b.

Allowed “trade” without having any thing to trade

Allowed transfer of cash without carrying coins

2.

Created in a time when many did not read, merchants created

their own rules, provided their own security

3.

Now paper currency is the “model”

4.

Limitations

»

»

Relies on the credit and integrity of the issuer

Requires physical document/writing

5.

May involve numerous parties (not really “standard”)

6.

Checks (cheques) are negotiable instruments but not all nego

tiable instruments are checks

2

B.

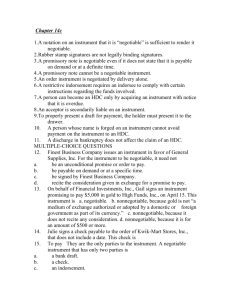

Legalistic Requirements

1.

2.

Two types:

a.

____________ to pay (“promissory note” or “note”)

b.

__________ to pay (“draft”)

» A check is a draft drawn on a bank.

» “Drawn on” means the bank (drawee) is ordered to pay

Negotiable documents (“instruments”) are “FORMAL” contracts

a.

If the format (form) requirements are met:

» The instruments is contract (consideration not needed)

» Legal obligations are automatic (imposed by law)

b.

If format requirements are not met, may still be a regular

contract – if all contract-law requirements satisfied

3

3.

4.

Formal requirements – To be negotiable, document must:

a.

In writing (on relatively permanent medium)

» Size and shape are not important

» Language is not important

b.

Signed by __________ [note] or ____________ [draft]

c.

Make _____________ promise [note] or order [draft] to pay

d.

State a _____________________ of money

» “Money” is any currency adopted by a government (or

group – like E.U.) as a medium of exchange

» Interest is “definite” if objective means of calculation

is stated

e.

Payable on ___________ or at a definite time (date)

f.

Payable “to ___________” or “to _____________”

Determined at the time of issue

» Subsequent events, indorsements, do not change status

4

C.

Steps in establish “negotiable instrument” legal result

1.

Note/draft issued by maker/drawer

»

Normally given as “payment” for something (can be gift)

»

Recipient is subject to any related contract obligations

2.

Note/draft negotiated by original recipient (“issue-ee”)

a.

Bearer instruments negotiated by __________________________

b.

Order instruments must also be _______________________

(1) Regular indorsement = sign name on back

»

Converts order instrument to _____________ instrument

(2) Special indorsement = “Pay to . . . .” with signature

(3) Restrictive indorsement = limits what can be done by

recipient

»

“For deposit only”

»

“Without recourse”

»

“Payment in full”

c.

Recipient is a “_________________”

5

3.

Holder can be “Holder in Due Course” (HDC) if:

a.

Is a “holder” (received by negotiation) who takes:

b.

“For ____________”

» Some thing or legal right exchanged for instrument

» Promise to do something is not “for value” until done

c.

“In ____________________”

» Did not actually know of any related problems

» Acquisition appeared commercially reasonable

d.

“______________________” of claims or defects

» Outstanding claims

» Forgery or alteration

» Overdue or not paid on demand

NOTE: There is no need for a prospective holder to investigate

beyond normal inquiries to current holder. Most of the things

that would create “notice” would be apparent on the face of the

document and the prospective holder would not accept the

instrument. Almost anything that would make an acquisition be

in “bad faith” would also give “notice” of claims or defects.

6

II.

HOLDER IN DUE COURSE

A. “Step 2” in making like money

1.

HDC _______________ to most (in occurrence) contract defenses

2.

All persons who take after HDC are treated like HDC under

the “______________________”

» Excluding persons who held before HDC or participated in

creating the problem (e.g. forgery, fraud, theft etc.)

3.

Special limitation in “consumer” situation

»

»

Federal law prevents holder from claiming HDC status in

collecting from a consumer who made/issued the document

Same federal law requires consumer noted to contain

language (as above) that prevents holder from claiming HDC

status. They have “notice” of special status

7

B.

HDC subject ONLY to defenses of:

1.

Fraud _____________ (did not know it was a negotiable instrument)

»

Fraud “in inducement” is normal fraud defense – issue was

defrauded about the quality, identity, etc., of goods or

services purchased with instrument.

2.

Incompetence (including minority if a defense where issued)

»

An incompetent person cannot intentionally create any

legal obligation

3.

__________________ = credible threat of immanent physical harm to

issuer or other human (not just family members)

»

“Blackmail” is not extreme duress

»

Difficult financial situation is not extreme duress

4.

Forgery – still can collect against ____________________________

5.

Alteration – can still collect _________________ of instrument

»

If maker/issuer’s negligent or intentional act made alteration

possible (or very easy), he/she cannot use this defense

90+% of defenses in contract cases = failure to perform

8

C.

Enforcing Payment

1.

2.

{not in text}

Two types of liability

a.

________________ [ contract ] liability

»

Person must pay the instrument as stated on its face

(including interest, etc.)

b.

___________________ liability

»

Person must pay all damages suffered as a result of the

breach of warranty

»

Usually the face amount (or portion unpaid) plus cost

incurred to enforce

Signature liability

a.

Imposed on every person who signed the instrument

(maker/drawer, indorser)

b.

Runs in favor of any person who takes instrument after the

person signed

c.

Disclaimed by indorsement “without recourse”

9

3.

Warranty liability

a.

Made by anyone who transfers or presents item for payment

b.

Warranties include

(1) Transferor has ___________ (or agent) with right to transfer

(2) All ________________ authentic / authorized (no forgery)

(3) Instrument has not been _________________

(4) No defense on the instrument good against warrantor

(5) No knowledge of ______________________ proceedings

against maker/drawer

c.

Warranties cannot be disclaimed

d.

Average transferor would not know if any warranty except

(5) were actually breached

e.

Warranties go to ______________________________

10

D.

Effect of signature & warranty liability

1.

If note/draft is not paid, holder can collect from previous holders

» If the maker/drawer is the “bad guy” this does no good for

the person who received it from the maker/drawer

–

The disagreement between these two is the most likely

reason why a maker/drawer would not pay

2.

Liability runs “back up the chain”

a.

If there is a problem (e.g. forgery) the person left holding

the instrument is the person who dealt with the forger

b.

If there is a dispute at some point, the person left holding

the instrument is one of the persons involved

The U.C.C. generally is set up so that if disputes arise or there is a “bad

guy” involved somewhere, the person left “holding the bag” is the one

who was in the best position to prevent the problem from occurring in the

first place. That encourages persons to take reasonable care in all their

business practices.

11