LAFHA Update

advertisement

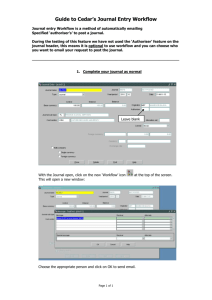

Finance Forum 20 June 2013 Overview • Welcome, Overview, and Budget Solutions Forum • Student Load Planning • Research Office – some recent changes • FBT Return 2013 Appropriations • Travel – a system approach • OCR Roll-out update David Sturgiss Melissa Abberton Kathrin Kulhanek Luke Beckett Maggie Ma/Leo Lai Jaya Ganasan • Morning tea • General Discussion Topics Everyone Welcome, Overview and Budget Solutions Forum – what happens next? • David Sturgiss Student Load Planning Melissa Abberton 4 Research Office – some recent changes Kathrin Kulhanek NHMRC Funding rules changes Email distributed to RM and FMs on 12th June • • • • • The intention is to provide flexible funding arrangements that will assist researchers to achieve the aims of their projects more efficiently and effectively. Proposed changes are expanded in attachment A but include: a) Allowing the equipment component of a grant to be applied to Direct Research Costs, including supplementing differences between the Personnel Support Package salary component and the institutional salary level; b) Allowing grant funds from all research funding schemes to be spent on supplementing differences between the Personnel Support Package salary component and the institutional direct salary level; c) Allowing Independent Research Institutes Infrastructure Support Scheme (IRIISS) funds to be transferred between Independent Medical Research Institutes; and d) Moving guidance on Direct Research Costs from a prescriptive list to a principlesbased approach (see Attachment B). 6 AI33 Audit Findings • • All staff should review the Admin requirement for IS Federally funded projects. https://researchservices.anu.edu.au/osr/programs/docs/US%20Federal%20Funds%2 0Administrative%20Requirements.pdf • • • • • Timesheet and salary monitoring processes Air travel funded by project must be US air Flow through of US requirement into sub agreements – generate a standard clause Financial statements and timing of transaction into period reports As of January 2013 by which all recipients of US federal funding grants will be required to certify time commitments to US Federally Funded Projects to the RSD on quarterly basis to ensure time spent on grants is captured in formal documentation. 7 HERDC Submission data Draft data 2012 • The HERDC income data is likely to increase by 7.9% (from $207.2m to $223.5m). Table 1 :The breakdown by HERDC income category. • The HREDC pubs there are 3405 verified weighted HERDC points (11% more than last year’s total of 3078). 8 Grant Management Framework Working Group Email distributed to RM and FMs and the URC distribution list on 30th May. ToR • overarching framework informing business practices, that will enable effective research budgeting and costing; • to develop and/or revise policies and procedures Principles: • Clear policy guidance to assist implementation and adapt behaviour. • Costing principles reflect all direct and indirect costs. Full project costs are visible in tools and templates. • Tools and templates support projects that are funded by multiple sources including R, S, Q and E, and from both private and government, national and international sources. • Budget approval processes allow effective central monitoring. • A reference group made up of academic and professional staff is used to test the framework recommendations. • An education and communication program will be run to assist implementation and adapt behaviour. 9 FBT Return 2013 Appropriations Luke Beckett 10 Total FBT Payable 2004-2013 $1,400,000 1,321,544 1,278,984 $1,200,000 1,170,517 1,149,106 1,079,294 1,065,510 1,071,399 1,054,598 2008 2009 2010 1,188,932 1,063,253 $1,000,000 FBT ($) $800,000 $600,000 $400,000 $200,000 $2004 2005 2006 2007 Year 2011 2012 2013 11 Normalised Benefit By Type Analysis 2004-2013 700,000 600,000 486,553 Taxable Value ($) 500,000 400,000 344,636 300,000 128,477 200,000 100,000 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 45,586 46,550 1,959 Expense payment Fringe Benefits Entertainment Fringe Benefits Loan/Debt Waiver Fringe Benefits Motor Vehicles (less Sal Pack) Property & Residual Housing, LAFHA Benefit Type 12 Appropriations • A payment will not be subject to GST if all of the following apply: 1. the payment is made by a Government Related Entity (GRE) to another GRE 2. the payment is covered by an appropriation under an Australian law 3. the payment satisfies the non-commercial test Generally Government Department/Agency 13 Appropriations • Agreements – need to see if they confirm or deny appropriation and treat accordingly • Check with the customer if unsure • If still unsure – apply normal GST rules – Supply, consideration, connected with Aust. and registered for GST 14 Appropriations • Collaborating Agreements – Receive money from Government as GST Free (such as ARC) – Pass on funds should have GST unless the collaborator signed the head agreement with the Government – Linkage Partners – Some will be Government bodies 15 Appropriations - Examples Funding General funding ARC Partner Funding Other government entities Appropriation Reason Yes Will satisfy all 3 tests Yes Should pass all appropriation tests (note: if government organisation requests GST be applied because the funds cannot be treated as an appropriation, GST should apply). The payment is unlikely to be covered by an appropriation under an Australian law Corporates are not GRE therefore will not pass the first test Other universities No Corporates Contract research / consultancies Funding research between the ANU and other Gov. entities No Other general research. Eg. Funding provided by Diabetes Australia. Could be No Need to check if there is a profit margin. This will determine whether the funding will pass the 3 tests. If there is a profit to be made then it will fail the non-commercial test and will not be an appropriation. If no profit then it will be an appropriation, if passing the other 2 tests. Funding provided to the ANU from other entities, such as Diabetes Australia will not satisfy the appropriation tests. Therefore the normal GST rules will apply. 16 Travel & Expenses Maggie Ma & Leo Lai Travel & Expenses • What is a Travel & Expense System? – Integrated solution for Travel Request-Approval and Expense Management – Standardise and automate travel requests and approvals, cash advances, reimbursements, per diems and corporate card acquittals. – All transactions related to a travel event will be handled electronically • Why was it decided to proceed? – Internal audit have identified various potential risks and inefficiencies in relation to Purchase Card transactions and the management of travel information and travel related purchases. • The audit review has recommended that • ‘a travel management system need to be implemented across the University which allows for travel expenditure and other related information to be linked to an instance of travel and that strategies also be developed to promote its use as widely as possible. – A number of areas across campus are have manual paper based processes – A few different systems exist – standardise & consolidate into an enterprise system Phased Approach Phase 1 Purchase Card (Completed) Phase 2 Travel Requests & Approvals Phase 3 & 4 Reimbursement, Cash Advance Per-diems and Reconciliation Phase 2 – Travel Requests & Approvals • In Scope: – Self Service data entry for travel request – Capture details such as person travelling, purpose, destination, costs, itinerary…… – Workflow to support approval process – Link/Reference to the OH&S Risk Assessment System – project currently underway to upgrade this system – Details of teaching/administrative arrangements whilst travelling – Reporting – yet to be determined but will include reports such as: • Who is travelling between certain dates • Who is at a specified location for a given date range • Other adhoc reporting to be determined Phase 2 – Travel Requests & Approvals • In Scope – Continued - Ability to attach supporting documentation Advance and Per Diem integration into the AP Workflow • Out Of Scope for this phase but to be addressed later – – – – Travel diary FBT Calculations Reconciliation between travel budget and actuals costs incurred Reimbursements & Per Diems (Calculations) Phase 2 – Progress To Date • • • • • • Project Scope agreed Business expert group formed and met Standardised Business Process agreed Specifications completed Development commenced College identified for pilot - CAP Phase 3 Onwards • Not clearly defined yet but broadly – Integrated FBT & Per-Diem calculation tools – Self service functionality for requesting reimbursements – Reconciliation reporting between travel budget and actuals costs incurred Proposed Travel Request & Approval Business Process Questions/Comments? Accounts Payable Workflow Jaya Ganasan Agenda 1. AP Workflow Overview Background Expected Benefits Process Flow 2. JCSMR Pilot Outcomes and Lessons Learned 3. Roll-out Strategy – whole of ANU 28 AP Workflow - Background 12 Month Transaction Volumes 29 Current Situation • Manual Creation of AP Voucher • Disparate processes between Colleges and between schools within College • Slow turnaround times from Invoice Receipt to payment • High volume of invoices paid after due date • Lost documents and multiple handling of documents • Inefficient manual storage and retrieval of invoices • Lack of accountability for delays and bottlenecks • Expensive (storage and retrieval, late payment penalties, processing costs…) 30 Solution Improvement Outcome Eliminate/reduce Paper invoices Solution ANU Response Electronic invoices Automated process for emails Electronic File Capture & Imaging Automated process for emails OCR at header level Eliminate/reduce Manual data entry OCR Streamline Inefficient processes and manual routing of invoices Workflow Standardised Workflow 1 step for PO within tolerance 4 steps fro Non PO invoice Eliminate/minimise lost or missing documents Secure document, storage & audit trail Electronic storage and retrieval. Full Audit trail of all invoices received – even cancelled documents are tracked 31 Solution (continued) Improvement Outcome Improve turnaround times Solution Invoice tracking ANU Response Improve Internal Controls Electronic signature and audit trail Reminders, Escalations and Alerts Monitoring tools Electronic signature and audit trail within ERP Exception reports (HR system vs AP approval discrepency report) 32 Benefits • Elimination of Accounts Payable header data entry • Elimination of paper based storage system and manual retrieval processes • Full transparency of end to end process, enabling accountability for and elimination of delays and bottlenecks • Accuracy in reporting and efficiency gains for end of year financial statement preparation and audit process. • More robust internal controls (routing of invoices for payment authorization based on a business unit’s authorization matrix) 33 OCR AP Workflow – High Level Overview Invoices Mailed Invoices Faxed KOFAX scanning/OCR OCR Voucher Worklist Scanned Invoice Workflow AP Voucher Approval Framework - Vouchers Invoices Emailed Shared Services Kofax Scanning/OCR + OCR Voucher Worklist JCSMR JAG Finance Scanned Invoice Workflow Steps 1 - 4 Scanned Invoice Workflow Step 5 + AP Voucher + Voucher Approval Workflow 34 35 36 Managing Delegations Financial delegations not currently electronically updated from HR system Short Term Workaround - delegations will be maintained by F&BS based on exception alerts from HR v AP table mismatches. Long Term Solution – HR delegation be configured to hold data in a format that lends itself to integration with Financial and other Enterprise systems 37 38 39 40 Monitoring Tools – Aged Workflow Report 41 Monitoring Tools – Aged Workflow Report Business Unit Overdue Category (All) (All) Count of Scan Days Outstanding Category WF Step # 5 4 7 6 2 18 13 14 7 2 81 1 97 79 175 110 198 44 30 4 2 337 1 418 A - Pending for 0 Days B - Pending for 1 to 3 Days C - Pending for 3 to 5 days D -Pending for > 5 Days Grand Total 4 74 81 107 266 2 4 4 28 38 13 18 41 72 6 97 7 110 22 198 42 418 2 2 13 Grand Total Business Unit (All) Count of Scan Days Outstanding Category C-Payment less than 2 weeks overdue D-Overdue more than 2 weeks Grand Total 7 13 D -Pending for > 5 Days Grand Total B - Pending for 1 to 3 Days 1 2 3 4 5 5.3 Overdue Category A- Don't Panic B-Payment due within 4 days C - Pending for 3 to 5 days A - Pending for 0 Days 42 Future Enhancements • Built in wizard for FBT calculation • Defaulting charge codes based on vendor or invoice owner (eg drop down list of projects for Principal Investigators) • Funds availability checking (soft or hard controls) • Drag and drop reports, exception reports • Introduce preventive controls (Expense wizards – assets, checkboxes …) • Integration between Travel System and Accounts Payable workflow for advances and per-diems. • Integration between Student & Finance System for student refunds • Post implementation review improvements 43 JCSMR Vouchers processed through pilot 44 JCSMR Proof of Concept/Pilot Rationale: • Significant concerns raised by stakeholders during the early consultation phases on the viability of the proposed model. • FMIS Refresh Program Management Group concluded that a demonstrable pilot and proof of concept was needed to ensure stakeholder confidence and acceptance in the proposed solution. • Following a successful pilot and a demonstrable automated work flow solution, F&BS would then work with the management of each College and Service Division to agree on a roll-out strategy for the individual business units. 45 JCSMR Proof of Concept/Pilot Issue Response Activate Tolerance Thresholds for PO Done Erroneous documents in workflow Training reinforcement and checklist for Shared Services staff Easy access to scanners required for document attachment To be addressed in roll out strategy Suggest trial within each College before full roll-out To be addressed in roll out strategy Role specific user manual In progress Suggested enhancements to screens and functionality ITS development nearing completion. Testing required. Targeted training Role specific training material and on the job during roll-out. Refine communication strategy To be agreed with GM’s 46 Rollout Strategy (Next Steps) • Timetable: - JCSMR, RSPH, Shared Services July - Rest of College of Science - Shared Services Clients (CECS, F&S, ITS …) Aug/Sep - CBE, CAPS, CASS, LAW June • Agreement with each College GM and Finance Manager on: – – – – Rollout/communication strategy College Executive presentations Training audience, frequency, and on site support Team and User configuration 47 Questions? 48 Morning Tea Recommence in 20 minutes General Discussion All Participants Next Finance Forum Tuesday 20 August 2013 1:30 pm to 4:00 pm Close!