investment - Manulife Financial

advertisement

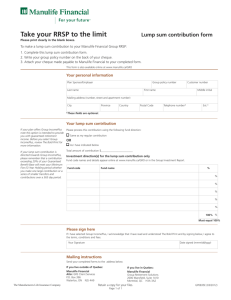

Welcome to your <ABC Company Ltd.> Group RRSP Agenda 2 Why plan for retirement? The benefits of a Group RRSP Investment options Steps to get you started Service and support available Who is Manulife? A Canadian company operating worldwide More than 115 years of strength and stability Consistently receives top ratings from various rating agencies Strong and Secure! 3 Responsibilities <ABC Company> Manulife Investment Managers You Your Employer Service Provider Fund Managers Plan Member Develop member education/planning tools Provide member assistance Prepare and mail statements Offer investments Perform research Create funds Select stocks and bonds Buy and sell securities Select service provider Send contributions Monitor the plan Provide information • Understand your plan and investments • Choose investments • Make contributions • Monitor your account • Update personal information Take Control of Your Retirement 4 Why save for retirement? One third of Canadians age 60 or older are worried they’ll outlive their retirement savings1 Two thirds of Canadian households expecting to retire in 2030 are not saving enough to meet necessary living expenses2 5 1 2007 Decima Research Poll 2 2007 Study by University of Waterloo and Canadian Institute of Actuaries Why save for retirement now? To ensure you have enough money for the lifestyle you want to enjoy Saving in your sock drawer may not be enough The longer you save, the more you can accumulate 6 Sources of retirement income Canadians generally rely on three distinct sources of income: 1. Government Pensions Canada Pension Plan (CPP) Old Age Security (OAS) 2. <ABC Company Ltd.> Group RRSP 3. Personal Savings RRSPs, GICs, Mutual Funds Home equity Other investments 7 Starting early pays more Starting 10 years earlier gives Terry $35,000 more than Chris – even though he saved for only 10 years Assumptions: Contributions made at the beginning of each year, compounded annually, at an 8% rate of return. 8 Learn about your Group RRSP 9 Who is eligible to join this plan? You are eligible to join this Group RRSP. Do I have to join? This Group RRSP is voluntary, which means you can choose whether or not to participate. <Remember, if you don’t participate, you won’t receive contributions from your employer> When can I join? <Insert eligibility from the Plan Design Template> Who contributes and how much? Who will contribute to this Group RRSP? May I make additional contributions throughout the year? <Insert Contribution Formula from the Plan Design Template> Yes. In addition to your payroll deductions, you may make lump-sum deposits at any time. You can do this by logging on to your account at www.manulife.ca/GRO and selecting ‘Make a lump sum contribution’. You are responsible for managing your own RRSP contribution limits. 10 Learn about your Group RRSP continued… 11 Who decides how my contributions will be invested? You decide how your contributions will be invested. Can I transfer money into this RRSP? Yes, you may transfer money into the Group RRSP at any time using the Transfer Form found on page 21 of your Enrolment Guide. May I withdraw money from this RRSP? <Insert Withdrawal rules from the Plan Design Template> Learn about your Group RRSP continued… 12 What happens if I leave the company? Your assets will be transferred to the Manulife Personal Plan. What happens if I retire from the company? You may choose to start your retirement income at any time prior to the end of the calendar year in which you reach age 71. Your assets will be transferred to the Manulife Personal Plan. What happens if I die? Manulife Financial will pay a death benefit to your designated beneficiary. Advantages of your Group RRSP <Contributions from the Employer> A convenient way to save Immediate tax reduction Tax-deferred growth Leading fund managers Lower investment management fees A way to consolidate your savings 13 Tax Advantage – Your contributions Employee earning $40,000 per year: No RRSP Contribution Bi-Weekly Pay With RRSP contribution $1538.46 RRSP Contribution (3%) $1538.46 $46.15 Less: Provincial Tax Federal Tax Net Pay $88.90 $84.70 $161.95 $151.85 $1287.61 $1255.76 Your net pay only changes by $31.85 14 Investment Management Fees (IMF’s) Take advantage of your group’s purchasing power $10,000 Year 5 Year 10 Year 15 $9,000 Potential fee savings for a $5,000 investment over 20 years = $1,353 $9,388 Year 20 $8,000 $8,035 $8,020 $7,000 Lower fees leave more of your money in your account to grow for your retirement 15 $7,136 $6,851 $6,338 $6,000 $5,853 $5,629 $5,000 Group Plan Investment Retail Investment MER IMF 1.80% 2.60% Decide how to enroll Two choices: Web <delete web if e-enrolment codes are not yet available> — Go to www.manulife.ca/GRO/enroll — Enter policy number and access code — Remember to print, complete and sign your Beneficiary Confirmation – then return it to Manulife Paper — Tear out the Application Form on page 3 of your Enrolment Guide. 16 Paper application form <Insert Number> <Company Name> January 1, 1998 Not Applicable Male Not Applicable January 1, 1998 ON Brett R Sawyer 123 Any Street Anytown May 25, 1970 English 17 ON CA 123 456 789 519-876-1212 N7T 2M0 Married BRS@gmail.com Name your beneficiary Martha Sawyer 18 Wife 100% Spousal RRSPs Tax planning – before and after retirement How it works Contributor – you Spousal member – your spouse or common-law partner Tax receipt – sent to you Contribution room used - yours 19 Decide how to invest A 20 B C How interested are you in selecting investments for your retirement savings? I am not interested. I have some interest. I am very Interested. How likely are you to monitor and rebalance your investments on an annual basis? I don’t want to review my investments. I review my investments annually. I check my investments on a regular basis (at least quarterly). How would you rate your investment knowledge? I have little to no knowledge about investing. I understand the basics of investing. I am confident in my investment knowledge. If you chose two or more from The best investment for you is Column A A Retirement Date Fund Column B An Asset Allocation Fund Column C Individual funds (‘Build your own portfolio’) Look for this symbol… Retirement Date Funds Series of nine Manulife Retirement Date funds: Each fund: Provides a well-balanced investment portfolio inside a single fund Represents a future retirement date Automatically rebalances to become more conservative as retirement date approaches Eight funds available, with dates of 2015, 2020, 2025, 2030, 2035, 2040, 2045, 2050. 21 Retirement Date Funds Hypothetical portfolios. Example is for illustration purposes only. Automatic rebalancing; “Gentle Slope” approach 22 Retirement Date Funds 23 Retirement Date Funds 24 Asset Allocation Funds and ‘Build your own’ portfolio Complete the 8-question Investor Style Questionnaire Tally your score to learn your investor style 25 Asset Allocation Funds Ready-made portfolios in a single fund Simple and easy – little homework Diversified by asset class, style, manager Manulife is responsible for monitoring and periodic re-balancing 26 Asset Allocation Funds 27 Asset Allocation Funds Match your investor style to the corresponding Asset Allocation Fund 28 Asset Allocation Funds 29 ‘Build your own’ portfolio 17 Market Based Funds and 3 Guaranteed Investments Follow the suggested investment mix 30 ‘Build your own’ portfolio Match the coloured segment of the pie to the colour of the corresponding fund page 31 ‘Build your own’ portfolio 32 Investment information Individual information sheets for each fund available in your group retirement program 33 Default investment If you do not choose fund(s) for your contributions, your money will be invested in the ‘plan default’ until you provide instructions. Your plan’s default investment: 1st – A Retirement Date Fund (if your birth date is on file) 2nd – Manulife Moderate Asset Allocation (if no birth date on file) 34 Step 4 – Transfer Assets to your Group RRSP Consider transferring your existing registered assets to your Group RRSP Why? Low fees help your retirement savings grow faster Member Reward Program — IMFs reduced and GIA rates increased by… $25 – 40,000 – 0.10% $40 – 60,000 – 0.20% $60,000+ - 0.25% Transfer form included on page 21 of your enrolment guide 35 Education and Communication Secure website available 24 hours a day, 7 days a week www.manulife.ca/GRO — Current account balances — Plan information — Investment information — Retirement planning tools 36 Ongoing Support and Services Annual Account Statements Internet site: www.manulife.ca/GRO Steps Retirement Program® Telephone: 1-888-727-7766 (toll-free) IVR Customer Service Representatives Financial Education Specialists Email: gromail@manulife.com 37 Thank you 38