Style Guide - U.S. Clay Producers Traffic Association

advertisement

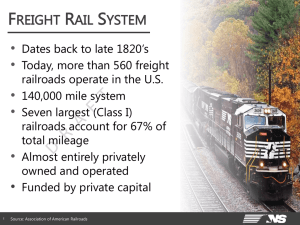

Rail Capacity & Economic Recovery

Scott D. McGregor

Group Vice President

Paper, Clay & Forest Products

March 22, 2011

Railway Volume

2010 Volume vs. 2009

4Q 2010 Volume (000) & y-o-y Percent Change

Coal

395.3

+12%

Fourth quarter volume of 1,708,800

Merchandise

558.5

+3%

Intermodal

755.0

+13%

–

Increase of 141,600 units, or 9%

–

Record Agriculture volume

–

52-week high loadings for Agriculture,

Coal & Intermodal

2010 volume of 6,764,100

2010 Volume (000) & y-o-y Percent Change

Coal

1,556.7

+10%

Intermodal

2,927.1

+16%

Merchandise

2,280.3

+14%

–

Increase of 806,800 units, or 14%

–

Record Agriculture volume

Strong project growth

Corridor initiatives

Conversions from the highway

Economic recovery

Merchandise Comparisons

Fourth Quarter 2010 vs. 2009

4Q 2010 Volume (000) & y-o-y Percent Change

Total Merchandise revenue of $1.2 billion, up $117

million, or 10%

Total Merchandise volume of 558,500 carloads up

16,600, or 3%

–

Agriculture

162.0

+4%

Automotive

73.5

(20%)

–

–

MetCon

147.3

+16%

–

–

MetCon volume growth driven by new business & 11%

increase in domestic steel production

Record Agriculture volume led by fertilizer and corn

Chemicals growth led by gains in petroleum, plastics and

industrial intermediates

Paper volume led by newsprint, pulpboard & lumber

Automotive comparisons impacted by network redesign

and quality holds

Year-over-Year Change

Paper

79.1

+1%

Chemicals

96.6

+9%

10%

7%

3%

Revenue

Volume

Rev/Unit

Coal Comparisons

Fourth Quarter 2010 vs. 2009

4Q 2010 Volume (000) & y-o-y Percent Change

Utility

275.3

+16%

Industrial

18.0

(4%)

Metallurgical

52.7

+36%

Total Coal revenue of $685 million, up $105

million, or 18%

Total Coal volume of 395,300 carloads, up

40,800 or 12%

– Utility volume increased due to stockpile rebuilding

– Metallurgical volume was up due to new

business & increased steel production

– Export volume was impacted by strong 4Q

2009 comparisons

Year-over-Year Change

Export

49.3

(18%)

18%

12%

6%

Revenue

Volume

Rev/Car

Intermodal Comparisons

Fourth Quarter 2010 vs. 2009

4Q 2010 Volume (000) & y-o-y Percent Change

Domestic

351.5

+22%

Triple Crown

74.8

+4%

Premium

70.3

+14%

Total Intermodal revenue of $471 million, up $64

million or 16%

Total Intermodal volume of 755,000 units up

84,200 or 13%

– Domestic volume up 22%, led by highway

conversions

– International volume up 4%, driven by

improving global demand

– Premium volume up 14%, driven by gains in

parcel and LTL markets

Year-over-Year Change

International

258.4

+4%

16%

13%

3%

Revenue

Volume

Rev/Unit

Outlook – Business Portfolio

Chemicals

• Manufacturing recovery

Agriculture

• Build out of ethanol network and export grain

growth

Domestic Intermodal

• Highway conversions

International Intermodal &

Export Coal

• Improving imports/exports

Domestic Met Coal & Steel

• Recovery in global steel production

Utility Coal

• Falling stockpiles and increased electricity

generation

Automotive

• New business, improved auto production and

sales

Forest Products

• Uncertainty in housing, but improving paper

markets

NS 2011 Capital Improvement Budget

Total Capital Program = $2.2B in 2011

Capital Expenditures

$146M

$763M

$334M

$212M

Maintenance of Way

Facilities & Terminals

Freight Cars

Positive Train Control

$244M

$79M

Infrastructure

Locomotives

Technology

Other Projects

Baseline Capital Program

– $1.7B; 19% more than 2010 total

– Maintain Safety; Support Business Growth

– Maintenance of Way; Facilities & Terminals;

Locomotives; Technology

– Infrastructure (Mid - America; Crescent

Corridor, CREATE)

Additional Capital Program

– $480M

– Freight Car Purchases – historically leased

{$334M}

– Positive Train Control – upgrades to system

and track structure {$146M}

Hot Topics in Rail Transportation: Capex

2011 – Large Rail Capex

U.S. Class I Railroad Capital Spending

$10.2

($ Billions)

$10.0

$9.9

$9.2

$8.5

$5.4

$5.7

$5.9

2001

2002

2003

$6.2

$6.4

2004

2005

2006

2007

2008

2009

2010e

2011

e - preliminary AAR estimate

Source: AAR

NS Corridor Strategy

Mechanicville

Ayer

Detroit

Bethlehem

Chicago

NY/NJ

Greencastle

Philadelphia

Columbus

Cincinnati

Pritchard

Lynchburg

Roanoke

Norfolk

Charlotte

Memphis

Corinth

Birmingham

Corridor Volume

Increases

Atlanta

Shreveport

Meridian

Jacksonville

New Orleans

Titusville

4Q 2010

vs. 2009

2010 vs.

2009

Premier Route

13%

18%

PanAm Southern

21%

32%

Crescent Corridor

33%

31%

Meridian

Speedway

27%

36%

Titusville

78%

146%

NS has made significant progress on network

investments targeting Intermodal growth

• Meridian Speedway:

$300mm

– Complete 2010

• Heartland Corridor:

$290mm

– Service Launched Sept. 2010

• Pan Am Southern:

$140mm

– Complete 2010 / 2011

• Ph I Crescent Corridor:

– Launched 2008

$600mm

NS Infrastructure

Investment

Claypool,

IN IN

Claypool,

Northeast PA PA

Northeast

Sidings

Sidings

Cleveland,

OHOH

Cleveland,

Dayton

Dayton

District

District

Croxton,

NJ NJ

Croxton,

New

NewCastle

Castle

Harrisburg,

PA PA

Harrisburg,

Illinois

Illinois

CNOTP

CNOTP

Mt.

IL

Mt.Carmel,

Carmel,

Atlanta

AtlantaNorth

North

IL

Alloy,

Alloy,WV

WV

Charleston

Charleston

Corridor

Corridor

Memphis - Memphis

Chattanooga

Chattanooga

Eastern

Eastern

N.

N.Carolina

Carolina

B’ham

B’ham- Atlanta

- Atlanta

Savannah,

GAGA

Savannah,

Burstall,

ALAL

Burstall,

Macon

Macon- Jacksonville

- Jacksonville

Meridian,

MSMS

Meridian,

Atlanta

Atlanta

Jacksonville

Jacksonville

The Rail Market Ahead

• Complexity - multiple markets, channels, and shifting industrial

production/global trade patterns

• Motor carrier costs will continue to rise and capacity will decline or

remain static

• Approximately 80% of intercity freight tonnage originates or

terminates within the NS service area

• Highway conversions and continued yield management will be key

drivers

• Environmental advantages of rail shipping will become more

prominent

Our Goal: Be the safest, most customer-focused

and successful transportation company in the world

Revenue Growth

from New

Business

• Industrial

Development

• Market research

• Growth markets

Market Reach

Extension

Customer

Satisfaction

Resource

Management

• Corridor

development

• Public Private

Partnerships

• Truck Diversions

• Coal sourcing

network

• Distribution

Network

• Customer

survey

• Communication

and outreach

• Continuous

improvement in

service

• Technology

• Locomotives

• Employees

• Track

• Structures