Roger-Bennett-Gov-Energy

advertisement

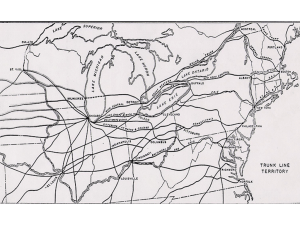

Coal Comparisons FREIGHT RAIL SYSTEM Third Quarter 2012 vs. 2011 • Dates back to late 1820’s • Today, more than 560 freight • • • • 1 1 railroads operate in the U.S. 140,000 mile system Seven largest (Class I) railroads account for 67% of total mileage Almost entirely privately owned and operated Funded by private capital Source: Association of American Railroads GENERAL CHARACTERISTICS OF U.S. FREIGHT RAILROADS • Vast majority privatelyowned, tax-paying firms • Same company usually owns the track and operates trains over it • No automatic access to another’s tracks • Little government funding • Don’t carry passengers • Regulation not as onerous as it once was, but still substantial (FRA for safety; STB for rates, service, etc.) 2 Source: Association of American Railroads ENVIRONMENTAL STEWARD • Moves a ton of freight 469 miles per gallon. • One train = hundreds of trucks. • 4 times more fuel efficient than trucks. • Reduces greenhouse gases by 75% compared with trucks. • Diverting 10% of longdistance truck traffic to rail would be like taking 2 million cars off the road or planting 280 million trees. 3 Source: Association of American Railroads HIGHWAY CONGESTION Forecasted Daily Freight Truck Volume 2012 4 Source: U.S. DOT 2035 KEY FACTORS FAVORABLE TO RAIL • • • • • 5 Highway congestion Fuel efficiency Driver availability and turnover, and aging truck fleet Increasing cost structure for trucking Focus on sustainability NORFOLK SOUTHERN SYSTEM MAP 6 Comparisons NCoal ORFOLK SOUTHERN Third Quarter 2012 vs. 2011 • Class I railroad • Safest railroad in North America • Winner of the E.H. Harriman Memorial Gold Medal Award for 23 consecutive years • Originator of more finished vehicles shipments than any other North American railroad • Largest Intermodal franchise in the eastern U.S. • Largest metals franchise of any Class I railroad • Annual Capital Investment $2 Billion 7 7 NS BUSINESS MIX IN 2012 Volume Revenue Agriculture MetCon 8% 10% Intermodal 47% Paper 4% Chemicals 6% Automotive 5% Coal 20% 7.1 Million Units 8 Agriculture 13% Intermodal 20% MetCon 12% Paper 7% Chemicals 14% Coal 26% Automotive 8% $11.0 Billion in Revenue Coal Comparisons ECONOMIC DEVELOPMENT 101 Third Quarter 2012 vs. 2011 • Sites and Buildings • Appropriate Infrastructure • Utility – Electric, Gas, Water, Sewer, Telecomm • Transportation – Highway, Rail, Port • Labor Force • Community Support • Tax Environment • Speed to Market 9 9 Coal Comparisons TRENDS Third Quarter 2012 vs. 2011 • Warehouse Logistics Parks • Intermodal Logistics • Private Sector Site Development • Foreign Direct Investment • Port Related Development • Energy Related Development • Ethanol • Shale Gas & Shale Oil • Coal • Petrochemical Projects 10 10