Accounts Briefing Slides

advertisement

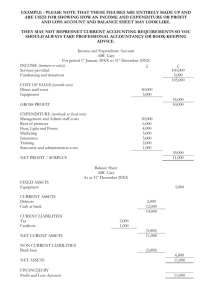

Audit Committee 28 June 2011 Financial Accounts 2010-11 Claire Cook -Assistant Finance Director and Joanne Watts – Head of Finance Accountancy Services www.hertsdirect.org Overview • • • • • • • Format of Accounts Key changes for 2010-11 Background to IFRS and key adjustments Walk through the key financial statements Segmental Reporting Next steps Questions www.hertsdirect.org Format of Accounts • Explanatory Foreword (page 4) • Four primary statements: – – – – Comprehensive Income & Expenditure account (page 20) Balance sheet (page 21) Movement in Reserves Statement (page 22) Cash flow Statement (page 23) • Statement of Accounting Policies (page 24) • Notes to the accounts (page 39) • Pensions Accounts (page 127) – Local Government Pension Fund Accounts – Fire-fighter's Pension Fund Accounts • Glossary of Terms (page 160) www.hertsdirect.org Key changes for 2010-11 • Financial year 2010/11 is first year actual IFRS based accounts produced • Note 1 to the accounts provides details of the adjustments involved in the restatement exercise www.hertsdirect.org Key changes for 2010-11 • Required: – Restatement of 2009/10 financials for comparative purposes – Review & revision of accounting policies to ensure full compliance with IFRS – New formats for key financial statements – Presentation of 3rd balance sheet (this year only) www.hertsdirect.org What is IFRS and why change? • Consistent set of standards for financial reporting • Governs approach to accounting across the public & private sector • Allows comparability of accounts at global level • One set of accounting rules www.hertsdirect.org Overview of Main Changes from UK GAAP to IFRS Significant IFRS changes Substantially the same Financial Statements Greater flexibility – new statements & amended layouts New formats consist with those used in the SORP Salaries & Pensions Compensated Absences: Untaken holiday pay and similar items accrued for at year end Everything else Govt. Grants & Contributions Capital grants recognised immediately (unless unmet conditions) rather than deferred and matched to expenditure Same for capital grants if there are unmet conditions Property, Plant & Equipment (Fixed Assets) Component accounting, new class of ‘assets held for sale’ and impairments taken initially to Revaluation Reserve rather than CI&E Everything else Leases Removal of 90% test, separate leases of land & buildings and need to assess whether other arrangements contain lease arrangements Everything else – concept of finance and operating leases unchanged Cash & Cash Equivalents Inclusion of investments held to meet short term liabilities and bank overdrafts Everything else www.hertsdirect.org Walkthrough: Things to consider in reviewing financial statements • Comparison with previous year – significant movements up or down? • Are you happy with the reasons for those movements? – should be set out in the notes • Are the results and changes from previous year in line with your understanding with events in year? • Do figures seem reasonable including those that are zeros? www.hertsdirect.org Walkthrough: Comprehensive Income and Expenditure statement (CI&E) • CI&E Statement format covers the equivalent of • the SORP’s Income & Expenditure Account; and • the SORP’s STRGL • Details:• Cost of Services: Gross Income and Expenditure costs incurred • Surplus or deficit on Provision of Services • Other Comprehensive Income and Expenditure • Sets out how the costs are financed (see Note 11 – page 72) • Government grants • Income from taxpayers www.hertsdirect.org Walkthrough: CI&E 2010/11 2010/11 Note Cost of Services Gross Expenditure Gross Income Net Expenditure £000s £000s £000s 1,948,426 (1,377,660) 570,766 Other Operating expenditure 9 5,092 (13,812) (8,720) Financing and Investment Income & Expenditure 10 192,459 (141,263) 51,196 Taxation and Non-Specific Grant Income 11 - (815,787) (815,787) 2,145,977 (2,348,522) (202,545) (Surplus) or Deficit on Provision of Services (A) Surplus or Deficit on revaluation of Property, Plant and Equipment 23 (8,630) Actuarial gains / loses on pension assets / liabilities 23 (292,487) Other Comprehensive Income & Expenditure (B) Total Comprehensive Income & Expenditure (A+B) www.hertsdirect.org (301,117) (503,662) Page 20 Note 28 Segmental Reporting provides a bridge to budget Financing of services from tax and grants Surplus for 2010/11 Walkthrough: Balance sheet • Shows the value as at 31st March 2011 of the assets and liabilities recognised by the Council • Provides details of: – – – – Long term Assets Current Assets Long term Liabilities Current Liabilities • Net Assets matched by the reserves held (£1,824.560 m) : – Usable reserves, www.hertsdirect.org – Unusable reserves Walkthrough: Balance sheet extract Page 21 31 March 2011 Note £000s Long Term Assets • – – – – £000s 2,980,662 Current Assets 176,188 Current Liabilities (223,472) Long Term Liabilities (1,108,818) Net Assets 1,824,560 Provides details of: - • Long term Assets Current Assets Long term Liabilities Current Liabilities Net Assets (£1,824.560 m) are matched by the reserves held by the Council : – Usable reserves (see Note 23 – page 86) Usable Reserves 23 201,534 Unusable Reserves 24 1,623,026 Total Reserves www.hertsdirect.org – Unusable reserves (see Note 24 – page 87) 1,824,560 Walkthrough: Movement in Reserves Statement Page 22 • Important consideration is whether Council has a surplus of deficit compared to its budget for the year – Council achieved a surplus – Other CI&E is predominately driven from actuarial position on pensions • Adjusts for differences between Accounting Basis and Funding Basis under Regulation • (see Note 7 page 63). Transfers to / from Earmarked Reserves (see Note 8 page 67). www.hertsdirect.org General Fund Total Reserves £000s £000s 32,140 1,320,894 Surplus or (deficit) on the provision of services 202,545 202,545 Other Comprehensive Income and Expenditure 301,117 301,117 Total Comprehensive Income and Expenditure 503,662 503,662 Balance at 31 March 2010 carried forward Movement in reserves during 2010/11 Adjustments between accounting basis & funding basis under regulations Note 7 (498,488) - 5,170 503,662 Transfer to / from Earmarked Reserves (19,344) - Increase / Decrease in 2010/11 (14,170) 503,663 17,973 1,824,556 Net Increase / Decrease before Transfers to Earmarked Reserves Balance at 31 March 2011 carried forward Links to CI&E Note 8 Walkthrough: Cash flow statement Page 24 2010/11 Note £000s £000s Net surplus or (deficit) on the provision of services 202,545 Adjustments to net surplus or deficit on the provision of services for non cash movements (39,587) Adjustments for items included in the net surplus or deficit on the provision of services that are investing and financing activities (98,889) (see Note 19 page 82) Net cash flows from Operating Activities 25 64,069 Investing Activities 26 (46,894) Financing Activities 27 (7,323) Net increase or decrease in cash and cash equivalents 9,852 Cash and cash equivalents at the beginning of the reporting period 16,126 Cash and cash equivalents at the end of the reporting period www.hertsdirect.org • Details changes in cash & cash equivalents during the reporting period. 19 25,978 • Shows how the Council generates and uses cash by classifying cash flows as: – Operating; – Investing; and – Financing activities. Walkthrough: Cash flow statement – The amount of net cash flows arising from operating activities is a key indicator of the extent to which the operations of the Council are funded by way of taxation and grant income or from the recipients of services provided by the Council. (£64,069K) (see Note 25 page 91) – Investing activities represent the extent to which cash outflows have been made for resources which are intended to contribute to the Council’s future service delivery. (£46,894K) (see Note 26 page 91) – Cash flows arising from financing activities are useful in predicting claims on future cash flows by providers of capital (i.e. borrowing) to the Council. (£7,323K) (see Note 27 page 92) www.hertsdirect.org Segmental Reporting (Note 28) Page 92 • Based on internal management structures • Prepared on a different basis from the financial statements. – No charges are made in relation to capital expenditure – Retirement benefits are only reflected at the end of the year – Some centrally budgets not charged to services – Various adjustments are not reflected (e.g. contributions to/ from reserves) • Reconciles the management accounts www.hertsdirect.org (monitor) to the financial accounts (CI&ES) Segmental Reporting Extract (Note 28) Page 92 • This extract shows the reconciliation to the CI&ES, where the analysis of income and expenditure by service is that specified by the Best Value Accounting Code of Practice (BVACOP) 2010/11 £000s • Other reconciling items are – Depreciation, amortisation and impairment (capital charges) – Other service expenses – Net Pension Costs Net Expenditure in the Segmental Analysis 841,247 Amounts included in the Segmental analysis and included below the Net Cost of Services on the Comprehensive Income & Expenditure Statement (31,012) Amounts included in the Segmental analysis and not included in the Comprehensive Income & Expenditure Statement (24,594) Amounts in the Comprehensive Income & Expenditure Statement not included in the segmental analysis (214,875) Cost of Services in Comprehensive Income & Expenditure Account Per CI&ES page 20 www.hertsdirect.org 570,766 Next steps 30th June Audit Committee Meeting: Review of Statement of Accounts July - Sept Audit of Accounts Mid Sept Consider Audit Commission Annual Governance Report and details of any material mis-statements End Sept Audit Opinion published Audited Statement of Accounts published www.hertsdirect.org Questions? www.hertsdirect.org