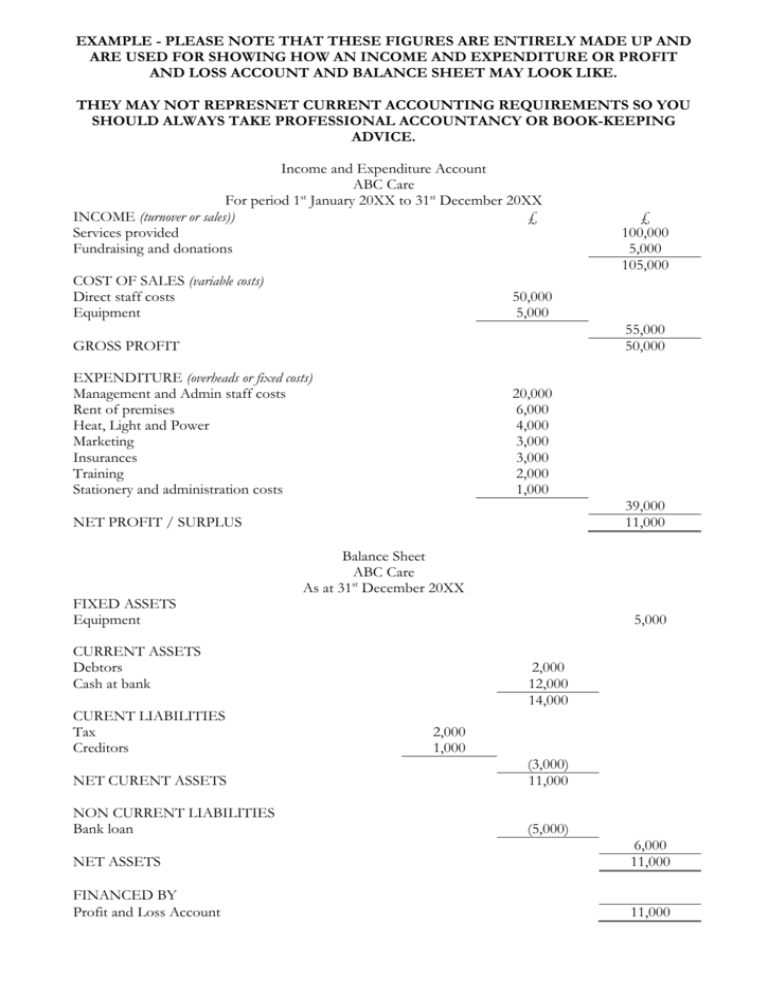

Example Income & Expenditure and Balance Sheet 58kb

advertisement

EXAMPLE - PLEASE NOTE THAT THESE FIGURES ARE ENTIRELY MADE UP AND ARE USED FOR SHOWING HOW AN INCOME AND EXPENDITURE OR PROFIT AND LOSS ACCOUNT AND BALANCE SHEET MAY LOOK LIKE. THEY MAY NOT REPRESNET CURRENT ACCOUNTING REQUIREMENTS SO YOU SHOULD ALWAYS TAKE PROFESSIONAL ACCOUNTANCY OR BOOK-KEEPING ADVICE. Income and Expenditure Account ABC Care For period 1st January 20XX to 31st December 20XX INCOME (turnover or sales)) £ Services provided Fundraising and donations COST OF SALES (variable costs) Direct staff costs Equipment 50,000 5,000 55,000 50,000 GROSS PROFIT EXPENDITURE (overheads or fixed costs) Management and Admin staff costs Rent of premises Heat, Light and Power Marketing Insurances Training Stationery and administration costs 20,000 6,000 4,000 3,000 3,000 2,000 1,000 39,000 11,000 NET PROFIT / SURPLUS FIXED ASSETS Equipment Balance Sheet ABC Care As at 31st December 20XX 5,000 CURRENT ASSETS Debtors Cash at bank CURENT LIABILITIES Tax Creditors £ 100,000 5,000 105,000 2,000 12,000 14,000 2,000 1,000 NET CURENT ASSETS (3,000) 11,000 NON CURRENT LIABILITIES Bank loan (5,000) NET ASSETS 6,000 11,000 FINANCED BY Profit and Loss Account 11,000