Sarsia Seed Management AS

advertisement

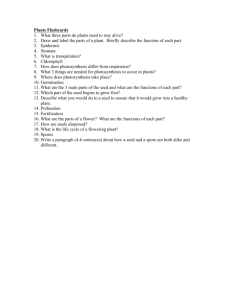

Sarsia Seed November 2012 - web Sarsia Seed Management AS Sarsia Seed Basic Facts Sarsia Seed One of four national seed funds in Norway The Task Investment areas Structure Team o Invest in approximately 25 early-stage technology-based companies o Development of selected companies through active board membership o Investment realization typically through trade sale or IPO o Energy/Oil/Gas o Biotechnology/Pharma/Medtech/Marine o Only invest in Norwegian companies o Capital base of €45 m and 15 year horizon (2018 2021) o 50% public financing, public loss fund of €5.3 m o IRR hurdle of 7%, goal of 9% o Management team of five partners o Broad management and Board experience from Norway, Europe and the USA o Qualifications include PhDs, MBAs and financial analyst Sarsia Seed Management - Confidential 3 Sarsia Seed Management Sveinung Hole Managing Partner MBA Erlend Skagseth Partner BioLife Sciences & Financial Control MBA Jon Trygve Berg Partner Energi/Cleantech / Investments M.Phil. MBA, CEFA Øivind Enger Partner PhD Microbiology Farzaad Abdi-Dezfuli Partner PhD Pharmacology Sarsia Seed Management - Confidential 4 Sarsia Seed AS Investors Board Statoil ASA Sigurd Moe Paulsen, Investment Director, Statoil New Technology AS BKK Sarsia Innovation AS Sparebanken Vest DnB NOR ASA L. Meltzers Høyskolefond Stiftelsen Unifob Viken Shipping AS GC Rieber AS Bergens Tidende AS Bergens Forskningsstiftelse Bergens Medisinske Forskningsstiftelse EGD Holding AS Lise Reinertsen, VP Business Development, BKK Bjørg Marit Eknes, VP, Sparebanken Vest Elisabeth Teigland Gjesdahl, VP, DnB ASA Kåre Rommetveit, Director, Bergen Medisinske Forskningsstiftelse Wenche Rolfsen, Rolfsen Consulting Mowinckel Management AS J. E. Greve AS B. Friele & Sønner AS Sarsia Seed Management AS Innovasjon Norge Election Committee Jan Einar Greve, Barrister Norwegian Supreme Court, Chairman up to 2009. Current head of election committee. Sarsia Seed Management - Confidential 5 Investment criteria for initial investments BUSINESS MODEL Scalable An initial investment is usually in the region of 0.2 to 1 mUSD, and typically made in several milestone-based tranches PRODUCT/ SERVICE Unique technology / idea 10 m invest x 10 value TEAM Business oriented Coachable MILESTONES AND EXIT Clearly visible Phase Contact ~2-5 days Goal Identify degree of suitability Analysis MARKET Attractive /growth Decision Duediligence ~4-8 weeks ~3-6 weeks ~3-12 weeks Verification of investment/ business plan Investment terms and formalisation Audit of terms for investment Investment ~ 3-> years Injection of financial and human capital Sarsia Seed Management - Confidential 6 Key figures As of November 2012 92 mEUR procured to 22 early stage technology based companies over 6 years o 21 mEUR invested by Sarsia Seed in 22 companies o 33 mEUR invested from >40 investors from six countries o 38 mEUR in softmoney/R&D support funds granted to 20 companies o Team in Sarsia Seed Management of 5 persons, 100% continuity o More than doubled patent base in the companies o In total more than 4.3 times Sarsia Seed’s total investments is injected into the companies o 109 Directors on the Boards of the companies, 16 international and 33 industry experts o Analyzed 372 potential investments over the last six years Sarsia Seed Management - Confidential 8 Portfolio The companies Portefølje – Energy/Oil/Gas Shaping windfarms o Global leader as providers of simulation software for optimal location of turbines in wind farms. Water purification o Process water treatment; produced water, shale gas, oil sand, shale oil and slop water. Cellulostic ethanol o Global pioneer in large-scale production of industrial sugar from cellulostic sources. Forecasting of Wind Power production o Forecasting solution for Wind Farm production to minimize imbalance costs. Radar technology o Novel, game changing high performance radar technology with petromaritime, geological and military applications. Ballast water treatment o Novel treatment unit for inactivation of marine organsims, particularly microorgansisms, in ballast water. Sarsia Seed Management - Confidential 10 Portefølje – Marine Aquaculture feed technology o Unique feed concept as an alternative to live feed (eg. Artemia) for early stage sea-food animals including farmed fish, crustaceans and shellfish. Fish feed technology o Means of incorporating and retaining water and supplements in fish feed; enabling natural salinity, increased growth and reduced mortality. Omega 3 marine oil formulation/delivery o Microencapsulated omega 3 marine oils in user friendly effervescent powder and tablett format. Sarsia Seed Management - Confidential 11 Portfolio – Biotechnology/Pharma Fighting inflammation o Optimal Anti-Inflammatory Therapy - Small Molecules Targeting GIVA PLA2 Novel antibiotics o New chemistry products applied to antibiotics against resistant infectious bacteria Novel vaccine technology o APC targeted vaccine delivery affording potent adjuvant-free prophylactic and active immunotherapy Anti-cancer therapy o Peptide-drug potentiating chemotherapeutic agents through pan-synthetic lethality Drug discovery services and anticancer therapy o First in class anticancer treatments targeting tumour escape and drug resistance. RNAi-based discovery platform yielding novel Targets for drug therapy Anti-thrombocytopenia therapy o Prophylactic treatment against neonatal platelet-loss caused by fetus/mother genetic differences Marine sourced drug o High-value marine-sourced heparin and/or improved process for current heparin production Sarsia Seed Management - Confidential 12 Portfolio – Medtech/Diagnostics Pain measurement o Instrument for objective measurement of pain based on changes in skin conductancy. Monitoring respiratory function o Noninvasive and easily applicable means of evaluating respiratory function in neonates and infants without need for mask or sedation. Bacterial infection profiling o Web based rapid diagnosis of bacterial infections from clinical sources; based on gene sequencing software technology. Gene sequencing o High throughput DNA sequencing technology based on state of the art molecular biology and low-cost commodity electronics components. Cancer screening o Best practice cancer screening tests combined with follow-up systems to ensure compliance and efficacy . Sarsia Seed Management - Confidential 13 What we do And contribute to the companies Sarsia Seed Management - Confidential 14 Active ownership through the Board • Development of business concept and business plan • Establish best possible board composition for the different phases • Recruitment of management and key personnel • Search for industrial partners and coinvestors • Financing and applications for R&D funding • Assistance in negotiations and contractual development • Establish business systems and processes for execution of plans • Identify, develop and negotiate Exit possibilities, i.e. Trade Sale o Two dedicated partners from Sarsia Seed Management follow each company o Weekly problem solving and quarterly ranking in Sarsia Seed Management Sarsia Seed Management - Confidential 1 5 The Sarsia Seed Management (SSM) Team Experience (excerpt) Education • INSEAD, Top Management Program, Telenor • Master of Int. Management (Siv.øk), HH BI, 1991 • Officers Cand. School Military Police, best pupil, 1986 Sveinung Hole • • • • Siv.øk. NHH, 1981 Studfag BHG, 1975 Navy U-båt 75--76 Realartium , Os Gymnas 1974 • 2006-, Partner SSM, CFO, 6 board positions in portfolio companies • 2005-2006 Project Director, Sarsia Innovation AS • 1999-2005 CEO Forinnova AS, project development, financing early stage technology development • 1986-1999 CFO Chr. Michelsen Research AS • • • • • Siv.Ing ,Off. Eng, Heriot WU 1991 M.Phil, Polar St. Cantab 1992 MBA NHH,MASTRA, 2000 AFA NHH, 2006 Certified Financial Analyst • 2006-, Partner SSM, 6 board positions in portfolio companies • 2002-2005, CEO PE&C –Drilling & Well consultancy, advisor drilling technology, field development and drilling costs • 2000-2002 CTO NST – responsible for 120 person techn. dev. org.. In 3 countries, responsible for big partners, IBM, AT&T • 1995-2000, CEO GexCon- technology spinoff startup, CMR Erlend Skagseth Jon T. Berg 2006-, Managing Partner SSM, 6 board positions in portfolio companies 2010 -, Board member NVCA – Norwegian Venture Capital Association 2005-2006, Director Anesthesia & SOP, Haukeland University Hospital 2000-2005, Telenor: Man. Director Nextra N, Strategy Dir. Telenor BS Europe, Market-/Strategy director all Norway operations • 1997-2007, Man.Director. Berlitz Nordic region (NYSE), Berlitz GLobalNet, VP Americas/member of Executive Committee • • • • • Dr. Scient in micro biology, UiB • Cand. Scient in micro biology UiB • Organizational science . ODH • • • • 2009 - Expert panels, Jury Member Venture Cup 2006-, Partner SSM, responsible for bio deal flow and IPR 1997-2006, Project manager – business development Forinnova/Sarsia Innovation 1992-1998, researcher , UNIFOB/førsteamanuensis UiB • Financing Entrepreneurial Business: London Business School – 2008 • Postdoc HUS 1992-1994 • PhD University of Edinburgh 1992 • • • • 2009 –, Expert Panels Norges Forskningsråd 2006-, Partner SSM, responsible bio/pharma 2002-2005, Forinnova/Sarsia Innovation. Investment Advisor Biotech 1995-2002, Eli Lilly- Team Leader, part of Lilly Medical Nordic Strategy Group/admin and man respon. /Nordic Point Person & European Clinical Trial Management Trainer Øivind Enger Farzad Abdi-Dezfuli Sarsia Seed Management AS Sarsia Seed AS Postal address: Visitor’s address: Thormøhlensgate 51 N-5006 Bergen Norway Fax: +47 5559 5948 Vitensenteret (VilVite) Marineholmen, second floor Thormøhlensgate 51 N-5006 Bergen Norway Phones and e-mails: Sveinung Hole +47 47 90 01 11 sveinung@sarsia.com Erlend Skagseth +47 90 93 28 72 erlend@sarsia.com Øivind Enger +47 90 06 23 03 oivind@sarsia.com Farzad Abdi-Dezfuli +47 90 59 72 90 farzad@sarsia.com Jon Trygve Berg +47 95 23 76 49 jon@sarsia.com Sarsia Seed Management 17