FBT Update 2015 - ATM Consultants

advertisement

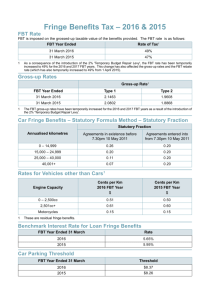

FBT shake up in 2015 The new FBT year starts on 1 April 2015. Here’s what you need to know. Keeping on top of your Fringe Benefits Tax (FBT) obligations this year will be a little more onerous with a temporary increase in the FBT rate from 47% to 49% on 1 April 2015. The FBT rate will then stay at 49% until 31 March 2017. The change in the FBT rate for the next 2 years has a number of implications particularly to those employers with salary sacrifice agreements in place or where fringe benefits form part of your employment agreements. FBT gross up rates have also changed in line with the rate change. The new rates are: FBT year 1 April 2014 to 31 March 2015 1 April 2015 to 31 March 2017 1 April 2017 onwards FBT rate 47% 49% 47% Type 1 gross up rate 2.0802 2.1463 2.0802 Type 2 gross up rate 1.8868 1.9608 1.8868 The FBT rate change is a by-product of the introduction of the 2% Debt Tax (Temporary Budget Repair Levy) on high income earners. The debt tax is payable at a rate of 2% on every dollar of a taxpayer’s annual taxable income over $180,000. In effect, the top marginal tax rate became 49% from 1 July 2014. The change to the FBT rate is to discourage high income earners from using the FBT system to lower their taxable income. If your executives and high-income earners have not put in place any arrangements to manage the debt tax, there are still some planning opportunities available. Review all salary sacrifice agreements It’s essential that you review all salary sacrifice agreements. Providing employee benefits is more expensive and potentially less attractive now and over the next few years unless that cost is passed through to employees. And, in some cases, the salary sacrifice agreement may not achieve the intended goals and simply create an administrative burden for little to no benefit. FBT change and not-for-profit entities For employees of charities, not-for-profits and certain other entities, the exemption threshold from FBT will increase to ensure that the total value of cash benefits received by these employees are not affected. This will mean that: For public benevolent institutions and health promotion charities the exemption from FBT for benefits will increase to a grossed-up annual cap of $31,177 per employee (currently $30,000) from 1 April 2015. For public and not-for-profit hospitals and public ambulance services the exemption from FBT for benefits will increase to a grossed-up annual cap of $17,667 per employee (currently $17,000) from 1 April 2015. 02330 Page 1 of 3 Changes to FBT planning opportunities It seems that as soon as someone promotes a new way to utilise the FBT system for planning purposes or a significant number of taxpayers start using a planning method, the Government or the ATO closes that opportunity. This is the case with: Living away from home allowances - reforms from 22 October 2012 severely limit access to FBT concessions for living away from home (LAFH) allowances particularly for non-residents. The reforms introduce a higher level of substantiation, limit the time the FBT concessions can apply to a LAFH to 12 months (in most cases), and dictate strict conditions such as maintaining a home in Australia for their personal use (no rentals). Special rules exist for fly-in-fly-out and drive-in-drive-out employees. Salary sacrificing goods or services that your business provides – for many businesses, there was once a tangible financial benefit to packaging up goods or services they provide as part of the remuneration offered to employees. Retailers providing discounted clothes to employees and private schools discounting school fees for children of employees, are just two examples. On 22 October 2012, the FBT concessions that were previously available in this situation were removed. ATO targets Travelling or living away from home - what’s the difference? Another issue that comes up is determining whether someone is living away from home, relocating or just travelling. The ATO is looking closely at Australian taxpayers claiming living away from home (LAFH) allowances to make sure they are not incorrectly accessing the FBT concessions. If somebody is living in Sydney but travelling to Melbourne on an ad hoc basis every other week for work, they are simply travelling. They may be entitled to travel deductions but are not entitled to the FBT concessions that can apply to LAFHAs. If the person relocates temporarily to Melbourne, keeps their home in Sydney for their use (can’t be rented out), then it’s more likely they can access the living away from home allowance concessions. You need to double check to get the distinctions right. Motor vehicles Where a motor vehicle owned or leased by the business is used by an employee for private purposes (including travelling between home and the workplace), then FBT is an issue that needs to be managed. Interaction between FBT, income tax and GST If you pay FBT on a benefit relating to entertainment then the business can generally claim a deduction for the costs associated with providing the entertainment as well as the GST credits. However, if FBT does not apply to the benefit then no deduction or GST credits can generally be claimed. Entertainment can be almost anything from food, drink, recreation such as movie tickets, to non-work based travel. If you provide any entertainment benefits to employees, such as an employee attending a business lunch, then FBT might apply. Structuring employee salaries through a unit trust The ATO has warned employers against complex structuring arrangements designed to channel benefits to employees using an employee remuneration trust. The most recent ATO alert looks at arrangements where the employer repays an employee’s loan through a trust. Under these arrangements, employees acquire units in a unit trust funded by a loan from the trustee. The loan is repaid by the employer using 02330 Page 2 of 3 amounts salary sacrificed by employees. The result is that the taxable value of the benefit provided to the employee skirts the FBT system – a big no, no from the ATO’s point of view. How do I know if I need to pay FBT? If you are not sure whether you are providing fringe benefits to your employees, here are some key questions you should ask yourself: Do you make vehicles owned or leased by the business available to employees for private use? Does your business provide loans at reduced interest rates to employees? Has your business forgiven any debts owed by employees? Has your business paid for, or reimbursed, any private expenses incurred by employees? Does your business provide a house or unit of accommodation to employees? Does your business provide employees with living-away-from-home allowances? Does your business provide entertainment by way of food, drink or recreation to employees? Do any employees have a salary package (salary sacrifice) arrangement in place? Has your business provided employees with goods at a lower price than they are normally sold to the public? What is exempt from FBT? Certain benefits are excluded from the scope of the FBT rules. The following work related items are exempt from FBT if they are provided primarily for use in the employee’s employment: Portable electronic devices (e.g. laptop, tablet, mobile, PDA, electronic diary, notebook computer, GPS navigation device) that are provided primarily for use in the employee’s employment (limited to the purchase or reimbursement of one portable electronic device for each employee per FBT year); An item of computer software; Protective clothing required for the employee’s job; A briefcase; A calculator; A tool of trade. 02330 Page 3 of 3