Chapter

Ten

Project Analysis and

Evaluation

.

© 2003 The McGraw-Hill Companies, Inc. All rights reserved.

Chapter Outline

•

•

•

•

Evaluating NPV Estimates

Scenario and Other What-If Analyses

Break-Even Analysis

Operating Leverage

1

.

Evaluating NPV Estimates

• NPV estimates are just that – estimates

• A positive NPV is a good start – now we need to

take a closer look at:

– Forecasting risk – how sensitive is our NPV to

changes in the cash flow estimates; the discount

rate, etc.

• What about the sales forecast?

• Can be manufactured at lower costs?

• What about the discount rate?

– Sources of value – why does this project create

value?

2

.

10-2 sensitivity analysis

• Types of Analysis

• Sensitivity

• Analyzes effects of changes in sales, costs, etc., on

project

• Scenario

• Project analysis given particular combination of

assumptions

• Simulation

• Estimates probabilities of different outcomes

• Break Even

• Level of sales (or other variable) at which project

breaks even

.

Sensitivity Analysis

• What happens to NPV when we vary one

variable at a time?

• The greater the volatility in NPV in relation to a

specific variable, the larger the forecasting risk

associated with that variable

• Sensitivity analysis begins with a base-case

situation.

• Then answer “what if” questions, e.g. “What if

sales decline by 10%?”

4

.

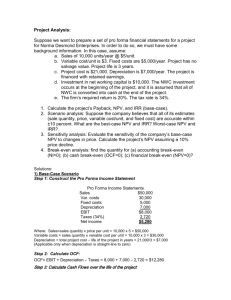

Net Cash Flows Example

Year 0

Init. Cost

At 10%

Year 3

Year 4

0

0

0

0

0

$106,680

$120,450

$93,967

$88,680

-$30,000

-$900

-$927

-$956

$32,783

0

0

0

0

$15,000

-$270,000

$105,780

$119,523

$93,011

$136,463

Salvage CF

Net CF

Year 2

-$240,000

Op. CF

NWC CF

Year 1

NPV=

88k

.

Sensitivity Analysis,

Change from

Base Level

-30%

-15%

0%

15%

30%

Resulting NPV (000s)

r

Unit Sales Salvage

10%

1250

$25000

$113

$100

$88

$76

$65

$17

$52

$88

$124

$159

$85

$86

$88

$90

$91

.

NPV

(000s)

Unit Sales

Salvage

88

r

-30

-20

-10 Base 10

Value

20

30

(%)

.

Results of Sensitivity Analysis

• Steeper sensitivity lines show greater risk.

That means small % changes in an input

variable result in large changes in NPV.

• Unit sales line is steeper than salvage value

or ‘r’ lines,

• For this project, we should worry most about

the accuracy of sales forecast.

.

Advantages - Disadvantages

• Advantages:

– Gives some idea of stand-alone risk.

– Identifies ‘dangerous’ variables.

– Gives some breakeven information.

• Disadvantage:

– Ignores relationships among variables.

.

Scenario Analysis

• What happens to the NPV under different cash

flow scenarios?

• At the very least look at:

– Best case – high revenues, low costs

– Worst case – low revenues, high costs

– Measure of the range of possible outcomes

• Best case and worst case are not necessarily

probable, but they can still be possible

• Provides a range of possible outcomes.

10

.

Scenario Analysis - Example

• Best scenario: 1,600 units @ $240

Worst scenario: 900 units @ $160

Scenario

Best

Base

Worst

Probability

0.25

0.50

0.25

E(NPV) = $101.5

(NPV) = 75.7

CV(NPV) = (NPV)/E(NPV) =

NPV(000)

$ 279

88

-49

0.75

.

Advantages - Disadvantages

• Advantages:

• More realistic than sensitivity analysis.

• Disadvantages:

• Only considers a few possible outcomes.

• Assumes that inputs are perfectly correlated-all “bad” values occur together and all “good”

values occur together.

.

Simulation Analysis

• Simulation is really just an expanded sensitivity

and scenario analysis

• Simulation can estimate thousands of possible

outcomes quickly:

– Variables are defined with probability distributions,

for example a normal distribution for sales.

– Computer selects values for each variable based on

given probability distributions for each “run” and

the NPV is calculated.

– Process is repeated many times (in 1,000’s).

13

.

Simulation Example

• Assume:

– Normal distribution for unit sales:

•Mean = 1,250

•Standard deviation = 200

– Triangular distribution for unit price:

•Lower bound = $160

•Most likely

= $200

•Upper bound = $250

.

Simulation Process

• Pick a random variable for unit sales and sale

price.

• Substitute these values in the spreadsheet and

calculate NPV.

• Repeat the process many times, saving the input

variables (unit sales and price) and the output

(NPV).

• Display the NPV values in graphical format, verify

the probabiliy of ending up with negative NPVs.

.

Histogram of Results

Probability

-$60,000

$45,000

$150,000

$255,000

$360,000

NPV ($)

.

Break-Even Analysis

• The crucial variable for a project is sales volume.

• Break-even analysis is a common tool for analyzing the

relationship between sales volume and profitability

• There are various break-even measures

– Financial break-even –> sales volume at which NPV= 0

– Accounting break-even –> sales volume at which net

income = 0

• Goal: How bad do sales have to get before we actually begin

to lose money?

17

.

Example

• Consider the following Project:

– A new product requires an initial investment of $5

million and will be depreciated to an expected book

value of zero over 5 years

– The price of the new product is expected to be $25,000

and the variable cost per unit is $15,000

– The fixed cost is $1 million. Tax rate = 0.3

– If we assume that we can sell 300 units each year,

what would be the NPV? (discount rate 20%)

• EBIT= [(P-v)Q – FC – D]= (10,000)300 –1,000,000 –1,000,000 =

1,000,000

• OCF = EBIT (1-T)+ D = 1,000,000 (0.7)+1,000,000 = 1,700,000

• NPV = -5,000,000 + 1,700,000 (PVAF 5-yr, @20%) =

• NPV = -5,000,000 + 1,700,000 (3) = 100,000$

18

.

Ex: Financial Break-Even Analysis

• Question: At which sales level ‘NPV = 0’?

CF stream:

5,000,000 OCF OCF OCF OCF OCF

NPV = 0= -5,000,000 + OCF [PVAF 5y; 20%]=

5,000,000 = OCF (3)

OCF = 1,672,240

OCF = 1,672,240= NI+D ; NI= 672,240 $

NI= 672,240= [(P-v)Q-FC-D]=10,000Q–1,000,000–1,000,000

10,000Q = 672,240+2,000,000

Q=267.2units

19

.

Accounting Break-Even

• The quantity that leads to a zero net income.

• Project Net Income set equal to 0:

• NI => (Sales – VC – FC – D)(1 – T) = 0

• Divide both sides by (1-T), when NI is zero, so is

the pre-tax income:

• [Sales - VC - FC – D] = 0

• Sales - VC = FC + D

• (QP – vQ) = FC + D

• Q = (FC + D) / (P – v)

20

.

Ex: Accounting break-even each year?

Depreciation = 5,000,000 / 5 = 1,000,000

Q = (FC + D) / (P – v)

Q = (1,000,000 + 1,000,000)/(25,000 – 15,000) = 200 units

• Verify EBIT and OCF at Q=200

EBIT= [(P-v)Q – FC – D]= (10,000)200 – 1,000,000 – 1,000,000 = 0

OCF= EBIT + D = 0 +1,000,000 = 1,000,000

NPV = -5,000,000 + 1,000,000 (3) = -2,000,000

• Observations:

• If a firm just breaks even on an accounting basis, NPV < 0

• If a firm just breaks even on an accounting basis, OCF = Depr

.

Using Accounting Break-Even

• Easy to calculate

• Accounting break-even is often used as an early

stage screening number

• If a project cannot break even on an accounting

basis, then it is not going to be a worthwhile

project

• Accounting break-even gives managers an

indication of how a project will impact accounting

profit

22

.

Summary table(in 000s except Q)

Q= 200

Q= 267,2

Sales

FC

VC

Depr

5,000

6,680

1,000

1,000

3,000

4,008

1,000

1,000

EBIT

0

672

TAXES

0

0

NI

0

672

OCF=NI+Depr

1,000

1,672

NPV

-2,000

0

Account B_E

Financial B_E

.

Operating Leverage

• Operating leverage is the degree to which a

project/firm is committed to fixed production

costs.

• Heavy investment in plant equipment means high

degree of operating leverage

• Such projects are said to be capital intensive.

24

.

Operating Leverage

• One way of measuring operating leverage:

• How much % change in OCF occurs for a %

change in sales.

• % change in OCF= DOL x % change in Q

• ‘Degree of operating leverage’ (DOL):

• DOL = 1 + (FC / OCF)

– The higher the fixed costs, the higher the DOL

– The higher the DOL, the greater the variability in

operating cash flow

25

.

Example: DOL

• Consider the previous example

• Suppose sales are 300 units

– This meets all three break-even measures

– What is the DOL at this sales level?

– OCF = 1,700,000

– DOL = 1 + 1,000,000 / 1,700,000 = 1.59

• What will happen to OCF if unit sales increases by 1%?

– % change in OCF

= DOL* % change in Q

– % change

= 1.59*(1%) = 1.59%

– New OCF

= 2,000,000(1.0159) =2,031,800

26

.

Financial Break-Even Analysis with taxes

Let us solve the financial break-even problem with taxes.

What OCF (or payment) makes NPV = 0?

Actually OCF does not change, let us see:

PV = 5,000,000= OCF [PVAF 5-7;20%]= OCF (2.99)

OCF = 1,672,240

However, the break-even quantity will change:

OCF = [(P-v)Q – FC – D](1-T) + D=

OCF=(P-v)Q(1-T) – (FC + D)(1-T) + D

Q= OCF+[(FC+D)(1-T)-D] / (P-v)(1-T)

Q=(1672240+(2000.000)0.7 - 1000.000)) + 10000)0.7

Q= (1672240+400.000) / 7000 = 296

The question now becomes: Can we sell at least 296 units per year?

27

.