ACCT 4303 - International Accounting

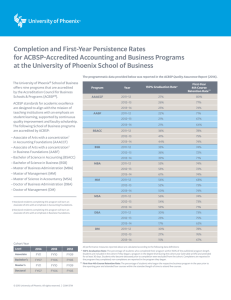

advertisement

Northwestern Oklahoma State University - Alva, OK – Department of Business ACCT 4303 International Accounting Fall 2010 Instructor: Dr. Ralph Bourret Office: 227 Jesse Dunn Office Hours: Monday 4:30pm - 6:30pm Wednesday 10:00am - 11:30am & 1:30pm - 5:30pm Thursday 2:15pm - 4:45pm or by appointment Phone Number: 327-8504 E-Mail: rebourret@nwosu.edu Credit: Three credit course Description: Provides understanding of accounting issues related to the global business environment. Prerequisite: ACCT 3103. Required Materials: International Accounting second edition, by Doupnik and Perera. McGraw-Hill Irwin. ISBN: 978-0-07-337962-3. www.mhhe,com/doupnik2e. Other materials may be assigned during the semester. ACBSP Competencies/Standards: The following ACBSP learning outcomes are addressed in this class: ACBSP.1.A: Learning Outcomes Use correct grammar and vocabulary that is appropriate to the intended audience and is unbiased. ACBSP.1.B: Learning Outcomes Apply writing and reporting conventions appropriate to a business setting in the organization of a cohesive, accurate, and politically correct product with an identifiable structure and a wellarticulated purpose. ACBSP.2 Learning Outcomes Critical Thinking: Graduates of business programs identify problems, analyze information, and form conclusions within the business context. ACBSP.2.C: Learning Outcomes Evaluate, synthesize, and organize information to form a position and create a coherent set of conclusions to support the decisions and solutions. ACBSP.7: Learning Outcomes International and Global Perspective: Graduates of business programs have an international and global perspective appropriate to a progressive business community that engages in international business activities. ACBSP.7.A: Learning Outcomes Demonstrate knowledge and awareness of environmental similarities and differences with other countries (e.g., culture, government, political and economic issues) that impact interaction with multinational companies, buyers, and clients. ACBSP.7.B: Learning Outcomes Analyze company operations for consistency with international business practices and requirements, e.g. monetary policy, capital markets, labor markets, transport of goods, tariffs, and international law. ACBSP.7.C: Learning Outcomes Analyze company use of existing and potential international opportunities in terms of environmental differences, business success potential, and anticipated problems. Course Goals/Course Objectives: The primary objective of this course is to introduce students to international accounting concepts. This course is conceptually based in order to foster meaningful comprehension of accounting fundamentals. One result that is expected is to produce students who can explain how different accounting methods affect international accounting standards. This understanding allows the student to truly comprehend the fundamental relationships present in international accounting. 1. Introduce the students to the International Accounting Standards. Learning objectives: 1.1 know the international financial reporting standards (Ch. 4) 1.2 Know how to translate foreign currency financial statements (Ch. 7) 1.3 Know how to compare international auditing and corporate governance (Ch. 13) 2. Introduce the students to the diversity in financial reporting around the world. Learning objectives: 2.1 Summarize international accounting (Ch. 1) 2.2 Describe worldwide accounting diversity (Ch. 2) 2.3 Be able to analysis foreign financial statements (Ch. 9) 2.4 Discuss strategic accounting issues in multinational corporations (Ch. 12) 3. Introduce the students to attempts to converge the various standards into the International Financial Reporting Standards (IFRS). Learning objectives: 3.1 Explain the international convergence of financial reporting (Ch. 3) 4. Introduce the students to the different accounting environments around the world. Covering foreign exchange rates and accounting for the changing rates. Learning objectives: 4.1 Interpret comparative accounting (Ch. 5) 4.2 Intrepret foreign currency transactions and hedging foreign exchange risks (Ch. 6) 4.3 Explain the effect of translation on foreign currency financial statements (Ch. 7) 4.3 Discribe additional financial reporting issues (Ch. 8) 4.4 Compare international auditing and corporate governance (Ch. 13) 5. Introduce the students to account for foreign taxes and intra-company transfers. Learning objectives: 5.1 Describe the effects of international taxation (Ch. 10) 5.2 Demonstrate international transfer pricing (Ch. 11) Performance Assessment: Your performance in this class will be measured using the following methods. Exams: There will be three exams given during the semester. Forty-five percent (45%) of your grade is determined by the results of these exams. Exams may consist of problems, short essay questions, multiple choice questions, and/or true/false questions. They may cover all material assigned, whether discussed in class or not. Exams must be taken at the scheduled time except in extreme emergency or official school organization conflicts (Test 1 & 2 will have a 7 hour window to take a 90 minute test. The final has a 5 day + window due to scheduling a proctor.). Written request from the organization faculty advisor is required prior to the test date may be accepted at my discretion, or a grade of “0" (ZERO) will be given on the exam. In case of emergency, the instructor must be notified as soon as possible. Some acceptable form of written verification will be expected. See the class schedule for exam dates. All of the tests are online. All online tests will be open book and open note except for the IFRS section of the final. The online tests will display one question at a time and will not allow you to go back once you have entered an answer. Once you start the test you must finish the test in the allotted time (no time-out or pause). The final test will be a proctored test and it is your responsibility to arrange for an acceptable proctor one week prior to the release of the final test. The final is an open book open note test with the exception of a section that tests your knowledge of IFRS standards; this is a closed book part of the test. Exam Dates: Test One is scheduled for 9/22 and Test Two is scheduled for 10/27. The Final Exam is scheduled between noon 11/30, and 9:00 am December 6, 2010. Quizzes are given for each chapter. Ten percent (10%) of the course grade is based on online quizzes. The open book quiz must be completed before the date scheduled for the next chapter or before each scheduled test. You will have 1 hour to answer 20 questions Homework is crucial to success in accounting courses. It is important that all assigned material be turned in a timely manner. Twenty-five percent (25%) of the course grade is based on homework. Homework is to be turned in through the Blackboard "Assignment" page. If Blackboard is down you should send me your homework through my regular University e-mail account. Otherwise always use the Blackboard site. The file name that you upload must begin with your last name and first initial along with a chapter designation. Failure to label files can result in the loss of points. Example: BourretR_1P (this would be for chapter 1 problems, a Q would imply answers to the questions). If you are sending an updated file end the file name with a letter (a for the first update, b for the second, etc.). Class Discussion Questions should be in a word document. The Exercises and Problems have both problems that require calculations and others that are explanations and opinions. The calculations should be done using Excel which will be provided. When Excel is provided you are required to use the supplied formatted files. You must have your name located at the top of the homework. Homework is due at 9:00 am of the day due which is stated on the class schedule. Once the answers are released homework will not be accepted. As in the business world, missed assignments will reflect poorly on your performance and you may not like the results. Remember it is results that count, not excuses. When you go out into the business world you will have to answer questions and I want this class to help you with defining the issues and making a strong case for the actions that you will be recommending. Take time to organize your thoughts, and lead the reader through your thought process to reach your conclusion. In some problems you are required to give an opinion. You must make a case that leads me to your opinion. Discussion Board: Twenty percent (20%) of the course grade is based on the discussion board. The discussion board is allows the students to expand their knowledge by giving in depth answers and responses to differing ideas. You are to choose one of each Chapters questions and expand your answer into several paragraphs. Pick a question that you either strongly agree with or strongly disagree with. Make a case for your position. Your "Title" should first give the "Question Number" and make a short title to distinguish your submission from the others. Also you are to add a thread to another student’s response to a question, either agreeing or disagreeing. You are expected to add either additional support or points of disagreement to the other student’s response. You may add additional threads to the responses of other students. You may also respond to threads that disagree with your position. Results are graded for grammar and how well you make your case. Additional responses can result in bonus points for new ideas or information. Grading Points: 2 exams @100 points each Final exam @ 100 points IFRS standards test Homework Quizzes Discussion Board Total 20% 20% 5% 25% 10% 20% 100% Scale A = 90% B = 80% C = 70% D = 60% F = Below 60% The time to be thinking about your final grade is now. This class will be conducted in an online learning environment. This approach places the burden of learning on the student. In order to be successful, the student must be prepared by the test dates. PowerPoint slides, lecture notes, solutions to the homework can be utilized in the students test preparation Policies: Students with Disabilities: Any student needing academic accommodations for a physical, mental or learning disability should contact the Coordinator of Services for Students with Disabilities, or faculty member personally, within the first two weeks of the semester so that appropriate accommodations may be arranged. The location for ADA assistance is the Fine Arts building Room 126. Withdrawing from the Course: The last day to withdraw from this course without a grade is August 27, 2010 (8/27/10). The last day to withdraw from his course with a “W” is October 11, 2010 (10/11/10). Academic Honesty: All occurrences of academic misconduct during tests, quizzes, and projects will be dealt with in accordance with guidelines and procedures outlined in the Policy on Academic Integrity. Sexual Harassment: Sexual harassment is not tolerated at this institution. If anyone in this class feels that they are being harassed by me or another student I would like to know about it. The classroom is to be a place of learning. As students you are a captive audience and I will not tolerate anyone who uses this opportunity to make someone else uncomfortable. Read each chapter at least twice. Read the chapter once prior to going over the lecture notes and PowerPoint in which the material will be covered, and read the chapter again after the chapter has been covered. (You may also need to read all or parts of the chapter as the material is covered.) You should also review all discussion questions and be sure that you can answer them. Website: I maintain a Blackboard site that has the current assignments, syllabus, PowerPoint slides, grades and class schedule. Subject to Change: The professor reserves the right to use discretion in interpreting and applying the class rules in a fair manner. The syllabus is subject to change at the discretion of the professor. Revised: 8/13/10