ACCT 3133 - Individual Income Tax

advertisement

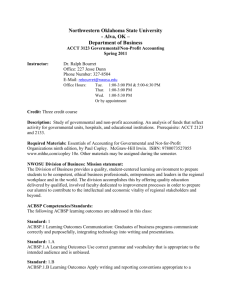

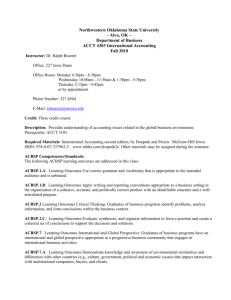

ACCT 3133 INDIVIDUAL INCOME TAX COURSE SYLLABUS SCHOOL: DEPARTMENT: HOURS, CREDIT NUMBER/TITLE INSTRUCTOR: School of Professional Studies Division of Business 3 Hours, 3133, Income Tax Mrs. Dana K. Roark, (580) 327-8512 Office Number: Room 216 Jesse Dunn-Alva Office Hours: Posted E-Mail: dkroark@nwosu.edu TEXTBOOK McGraw-Hill’s Taxation of Individuals and Business Entities 2011 edition Spilker, Ayers, Robinson, Outslay, Worsham, Barrick, Weaver COURSE DESCRIPTION AND PREREQUISITES Theory of individual taxation. Examination of income tax problems; federal and state tax forms; and preparation of individual tax returns both manually and using basic tax software. ACBSP COMPETENCIES/STANDARDS The following ACBSP learning outcomes are addressed in this class: ACBSP.1.A - Use correct grammar and vocabulary that is appropriate to the intended audience and is unbiased. ACBSP.1.C Learning Outcomes Demonstrate use of current technology in composition and in visual and oral presentation of work to an audience. ACBSP.2.A - Identify business problem(s) by analyzing the impact of contextual factors, the validity of information (relevancy, sufficiency and accuracy), and the influence of assumptions. ACBSP.2.B - Collect additional information, as needed, independently, using a variety of relevant sources, to resolve the problem. ACBSP.3 - Business Knowledge and Technical Skills: Graduates of business programs demonstrate knowledge from a variety of sub-disciplines and apply the knowledge and skills to reach solutions to business needs. ACBSP.3.D - Incorporate appropriate forms of technology usage in all solutions proposed. OBJECTIVES AND GOALS CLASS GOALS 1. Students will demonstrate knowledge of general accounting and business principles in accounting and/or business related setting. 2. To provide accounting majors with generally accepted accounting principles and/or generally accepted auditing principles. 3. To provide business administration majors with general management, marketing, and accounting principles. GENERAL OBJECTIVES By the completion of ACCT 3133 Individual Income Tax, a student should be able to: 1. 2. 3. 4. 5. 6. 7. Describe the role played by the IRS and the courts in the evolution of the Federal tax system. Locate and work with electronic and paper tax preparation and tax research process. Apply the rules and requirements of exemptions, standard deductions, and proper filing status. Use the proper method for determining the tax liability. Differentiate between deductions for and from adjusted gross income and know the relevance of the differentiation. Identify tax planning opportunities for maximizing deductions and minimizing the disallowance of deductions. Realize the rationale, determine the amount, and be able to apply the concepts for depreciation, ACRS, MACRS, amortization, and depletion. PERFORMANCE ASSESSMENT The following homework and tests will focus on the above General Objectives. Homework: The student will be expected to read and study the chapter and have the assigned problems completed on the due dates. The student will be expected to correct his/her own papers. THE ONLY WAY TO LEARN THE MATERIAL IS TO COMPLETE ALL HOMEWORK. Homework, audits or quizzes will be given for a total of 200 points Tests: Three 100-point tests will be given. Tests will be objective and problem-type. The exams will come from the textbook and assignments covered. Exams will be given on campus. Students will be asked to bring their student ids for admission to the exam. Dates for exams will be given once the semester starts. The student must furnish scantron answer sheets which can be purchased in the bookstore. There will be NO MAKE-UP for unexcused absences. Make-up exams are only given for unavoidable reasons and if arrangements are made in advance at the discretion of the instructor. A grade of zero will be assigned for a missed test. PERFORMANCE ASSESSMENT Chapter Exercises: Turn in assignments when they are due unless you make prior arrangements with the professor at least one school day before the assignment is due. Late assignments are not accepted nor graded. Major storms, proven emergencies or professor notification are the only exceptions. Assignments are due on or before the scheduled due date unless prior arrangements have been made by the student and approved by the instructor. Each assignment will be submitted by midnight on the due date. Assignments must be the student’s work. Assignments shall not be copied, plagiarized, or otherwise derived from someone else’s efforts. Copying assignments from someone else’s work will result in a zero for that assignment for all students involved. ADDITIONAL COURSE REQUIREMENTS 1. This course will utilize the University’s Blackboard system. Each student shall be responsible for understanding the basic operations of Blackboard. Each student must maintain a valid NWOSU email account. Quizzes, assignments, and announcements shall be given and received through the Blackboard system and Connect. You may enter the Blackboard system at www.nwosu.edu. You may also view the Blackboard Orientation Information at this site for information on how to use Blackboard. 2. When contacting the instructor by email, it is necessary to provide the following information in the subject line: Tax-online_(your last name)_(subject matter). Example: Tax_online_smith_question about assignment #3 3. The instructor reserves the right to add, delete, or modify the course and its requirements, at any time and for any reason. EVAULATION AND GRADING Grades will be based on a percentage of the total possible points. Semester grades are determined by dividing the student’s accumulated points by the total possible points and applying the result to the following table of percentages. Please keep track of your scores. Grading Scale: 90 - 100% 80 - 89% 70 - 79% 60 - 69% Below 60% A B C D F SERVICES FOR STUDENTS WITH DISABILITIES Any student needing academic accommodations for a physical, mental or learning disability should contact the Coordinator of Services for Students with Disabilities, or faculty member personally, within the first two weeks of the semester so that appropriate accommodations may be arranged. The location for ADA assistance is the Fine Arts building room 126 on the Alva Campus. The location for ADA assistance on the Enid campus is Room 102 and the contact is Lori Coonrod. The location for ADA assistance on the Woodward campus is the Main Office and the contact is Dr. Deena Fisher. The location for ADA assistance at the University Center at Ponca City campus is the Main Office and the contact is Dr. Brenda Stacy. WEBSITES http://connect.mcgraw-hill.com/class/d_roark_fall_2010-online www.irs.gov