ACCT 3123 - Governmental/Non-Profit Accounting

advertisement

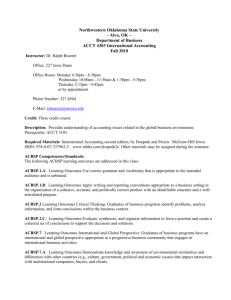

Northwestern Oklahoma State University - Alva, OK – Department of Business ACCT 3123 Governmental/Non-Profit Accounting Spring 2011 Instructor: Dr. Ralph Bourret Office: 227 Jesse Dunn Phone Number: 327-8504 E-Mail: rebourret@nwosu.edu Office Hours: Tue. 1:00-3:00 PM & 5:00-6:30 PM Thur. 1:00-3:00 PM Wed. 1:00-5:30 PM Or by appointment Credit: Three credit course Description: Study of governmental and non-profit accounting. An analysis of funds that reflect activity for governmental units, hospitals, and educational institutions. Prerequisite: ACCT 2123 and 2133. Required Materials: Essentials of Accounting for Governmental and Not-for-Profit Organizations ninth edition, by Paul Copley. McGraw-Hill Irwin. ISBN: 9780073527055 www.mhhe,com/copley 10e. Other materials may be assigned during the semester. NWOSU Division of Business: Mission statement: The Division of Business provides a quality, student-centered learning environment to prepare students to be competent, ethical business professionals, entrepreneurs and leaders in the regional workplace and in the world. The division accomplishes this by offering quality education delivered by qualified, involved faculty dedicated to improvement processes in order to prepare our alumni to contribute to the intellectual and economic vitality of regional stakeholders and beyond. ACBSP Competencies/Standards: The following ACBSP learning outcomes are addressed in this class: Standard: 1 ACBSP.1 Learning Outcomes Communication: Graduates of business programs communicate correctly and purposefully, integrating technology into writing and presentations. Standard: 1.A ACBSP.1.A Learning Outcomes Use correct grammar and vocabulary that is appropriate to the intended audience and is unbiased. Standard: 1.B ACBSP.1.B Learning Outcomes Apply writing and reporting conventions appropriate to a business setting in the organization of a cohesive, accurate, and politically correct product with an identifiable structure and a well-articulated purpose. Standard: 2 ACBSP.2 Learning Outcomes Critical Thinking: Graduates of business programs identify problems, analyze information, and form conclusions within the business context. Standard: 2.C ACBSP.2.C Learning Outcomes Evaluate, synthesize, and organize information to form a position and create a coherent set of conclusions to support the decisions and solutions. Standard: 3 ACBSP.3 Learning Outcomes Business Knowledge and Technical Skills: Graduates of business programs demonstrate knowledge from a variety of sub-disciplines and apply the knowledge and skills to reach solutions to business needs. Standard: 3.A ACBSP.3.A Learning Outcomes Demonstrate core-level knowledge common to all disciplines in an applied problem solving setting by reviewing major factors that could account for the problem and proposing a solution in any affected areas. Course Goals/Course Objectives: The primary objective of this course is to introduce students to governmental, non-profit, and educational institution accounting concepts. This course is conceptually based in order to foster meaningful comprehension of accounting fundamentals. One result that is expected is to produce students who can explain how different accounting methods affect governmental, non-profit, and educational institutional standards. This understanding allows the student to truly comprehend the fundamental relationships present in governmental, non-profit, and educational institution accounting. 1. Introduce the students to the Governmental Accounting Standards. Learning objectives: 1.1 Learn the financial reporting for state and local governments (Ch. 2) 1.2 Learn how to account for budgets for general and special revenue funds (Ch. 3) 1.3 Learn accounting for the general and special revenue funds (Ch. 4) 1.4 Learn to account for other governmental fund types (Ch. 5) 1.5 Learn how to account for proprietary funds (Ch. 6) 1.6 Learn how to account for fiduciary funds, interfund transactions (Ch. 7) 1.7 Learn how to construct government-wide statements (Ch. 8) 2. Introduce the students to Non-profit Accounting Standards. Learning objectives: 2.1 Learn to account for a private not-for-profit organizations (Ch. 10) 2.2 Learn to audit tax-exempt organizations, and evaluate performance (Ch. 13) 3. Introduce the students to Educational Accounting Standards. Learning objectives: 3.1 Learn to account for special purpose entities (Ch. 9) 3.2 Learn to account for private colleges and universities (Ch. 11) 4. Introduce the students to accounting for health care providers. Learning objectives: 4.1 Learn to account for hospitals and other health care providers (Ch. 12) Performance Assessment: Your performance in this class will be measured using the following methods. Exams: There will be three exams given during the semester. Forty-five percent (45%) of your grade is determined by the results of these exams. Exams may consist of problems, short essay questions, multiple choice questions, and/or true-false questions. They may cover all material assigned, whether discussed in homework or not. Exams must be taken at the scheduled time, except in extreme emergency or official school organization conflicts. Written request from the organization faculty advisor is required prior to the test date may be accepted at my discretion, or a grade of “0" (ZERO) will be given on the exam. In case of emergency, the instructor must be notified as soon as possible. Some acceptable form of written verification will be expected. See the class schedule for exam dates. Details of the exam will be announced prior to the test. (Test 1 & 2 will have a 11 hour window to take a 90 minute test. The final has a 7 day window due to scheduling a proctor.). All of the tests are online. All online tests will be open book and open note Except for the “Accounting Standards Test”. The “Accounting Standards Test” (60 minute test) will be given at the same time as the final and is a “Closed Book and Closed Note” test. The online tests will display one question at a time and will not allow you to go back once you have entered an answer. Once you start the test you must finish the test in the allotted time (no time-out or pause). The final test will be a proctored test and it is your responsibility to arrange for an acceptable proctor one week prior to the release of the final test (4/21/11). The final is an open book open note test. Except for the “Accounting Standards” Test which is “Closed Book / Closed Notes” test. Exam Dates: Test One is scheduled for 2/16 (anytime between Noon and 11pm) and Test Two is scheduled for 3/30 (anytime between Noon and 11pm). The Final Exam (Proctored) is scheduled anytime between Noon April 28, 2011 and Noon May 5, 2010. Quizzes are given for each chapter. Five percent (5%) of the course grade is based on quizzes. The open book quiz must be completed before the date scheduled for the next chapter or before each scheduled test. Homework is crucial to success in accounting courses. It is important that all assigned material be turned in a timely manner. Thirty percent (30%) of the course grade is based on homework. Homework is to be turned in through the Blackboard "Assignment" page. If Blackboard is down you should send me your homework through my regular University e-mail account. Otherwise always use the Blackboard site. The file name that you upload must begin with your last name and first initial along with a course number and chapter designation. Failure to label files can result in the loss of points. Example: BourretR_3123_Ch1P (this would be for chapter 1 problems, a Q would imply answers to the questions). If you are sending an updated file end the file name with a letter (a for the first update, b for the second, etc.). Class Discussion Questions should be in a word document. The Exercises and Problems have both problems that require calculations and others that are explanations and opinions. The calculations should be done using Excel which will be provided. When Excel is provided you are required to use the supplied formatted files. You must have your name located at the top of the homework. Homework is due at 9:00 am of the day due which is stated on the class schedule. Once the answers are released homework will not be accepted. As in the business world, missed assignments will reflect poorly on your performance and you may not like the results. Remember it is results that count, not excuses. When you go out into the business world you will have to answer questions and I want this class to help you with defining the issues and making a strong case for the actions that you will be recommending. Take time to organize your thoughts, and lead the reader through your thought process to reach your conclusion. In some problems you are required to give an opinion. You must make a case that leads me to your opinion. Discussion Board: Ten percent (10%) of the course grade is based on the discussion board. The discussion board is allows the students to expand their knowledge by giving in depth answers and responses to differing ideas. You are to choose one of each Chapters questions and expand your answer into several paragraphs. Pick a question that you either strongly agree with or strongly disagree with. Make a case for your position. Your "Title" should first give the "Question Number" and make a short title to distinguish your submission from the others. Also you are to add a thread to another student’s response to a question, either agreeing or disagreeing. You are expected to add either additional support or points of disagreement to the other student’s response. You may add additional threads to the responses of other students. You may also respond to threads that disagree with your position. Results are graded for grammar and how well you make your case. Additional responses can result in bonus points for new ideas or information. Practice Set: The Practice Set is on Blackboard. You will be provided with a formatted Excel spreadsheet. You will be required to use the supplied spreadsheet. Fifteen percent (15%) of the course grade is based on this project Grading Points: 2 exams @100 points each 20% Final (Proctored) exam 20% Accounting Standards Test 5% Quizzes 5% Homework 25% Practice Set 15% Discussion Board 10% Total 100% Scale A = 90% B = 80% C = 70% D = 60% F = Below 60% The time to be thinking about your final grade is now. This class will be conducted in an online learning environment that requires discipline to meet the deadlines. This approach places the burden of learning on the student. In order to be successful, the student must be prepared and actively participate in each week’s “Discussion Board”. This course will be made up of a number of Questions and problems. I expect that the solutions will reflect careful analysis of the problem, with thoughtful solutions, presented in a well organized report. I expect you to make a decision and be able to make a case for it. No short answers, I expect each case to be presented in a profession manor, with logical, thought through, organized solutions. I expect the same concise answers from you that I would from my accountant. You are expected to check the Blackboard every weekday. Before working the homework I want you to both go read each chapter being covered and go through the assigned PowerPoint presentation. Approximately, sixty (60%) percent of the course grade is based on quizzes, in-class work, homework and a practice problem. The interactive approach to learning will make the class more interesting and relevant and facilitate the learning process. The hope is to make this class an enjoyable experience. Policies: Students with Disabilities: Any student needing academic accommodations for a physical, mental or learning disability should contact the Coordinator of Services for Students with Disabilities, or faculty member personally, within the first two weeks of the semester so that appropriate accommodations may be arranged. The location for ADA assistance is the Fine Arts building Room 126. Withdrawing from the Course: The last day to withdraw from this course without a grade is January 24, 2011 (1/24/11). The last day to withdraw from his course with a “W” is March 7, 2011 (3/7/11). The last day to withdraw from this course with a “W” or a “F” is April 27, 2011 (4/27/11). Academic Honesty: Ethical Standards: The Division of Business has adopted a Student Code of Ethics applicable to all students majoring, minoring or taking courses offered by the Division of Business. The Student Code of Ethics may be found online at: http://www.nwosu.edu/businessstudent-code-of-ethics. All students taking this class are governed by this code of ethics. All occurrences of academic misconduct during tests, quizzes, and projects will be dealt with in accordance with guidelines and procedures outlined in the http://www.nwosu.edu/businessstudent-code-of-ethics. Sexual Harassment: Sexual harassment is not tolerated at this institution. If anyone in this class feels that they are being harassed by me or another student I would like to know about it. The classroom is to be a place of learning. As students you are a captive audience and I will not tolerate anyone who uses this opportunity to make someone else uncomfortable. Read each chapter at least twice. Read the chapter once prior to going over the lecture notes and PowerPoint in which the material will be covered, and read the chapter again after the chapter has been covered. (You may also need to read all or parts of the chapter as the material is covered.) Website: I maintain a Blackboard site that has the current assignments, syllabus, PowerPoint slides, grades and class schedule. Subject to Change: The professor reserves the right to use discretion in interpreting and applying the class rules in a fair manner. The syllabus is subject to change at the discretion of the professor. Revised: 1/10/11