2004 Interim Results

advertisement

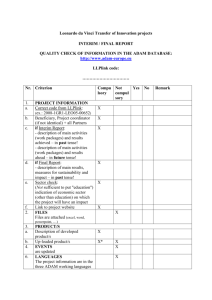

ANGLO AMERICAN A WORLD OF DIFFERENCE 5 August 2004 This presentation is being made only to and is directed only at (a) persons who have professional experience in matters relating to investments falling within Article 19(1) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 (the “Order”) or (b) high net worth entities, and other persons to whom it may otherwise lawfully be communicated, falling within Article 49(1) of the Order (all such persons together being referred to as “relevant persons”). Any person who is not a relevant person should not act or rely on this presentation or any of its contents. 2004 Interim Results Highlights Record H1: - Earnings up 52% at $1,304m - EPS up 49% at 91c per share EBITDA up by $1bn to $3,433m Record performances from Base and Ferrous Metals Cost cutting and efficiencies of $248m (2003:$127m) Interim dividend up 27% at 19c per share 2 2004 Interim Results Headline earnings by business unit H1 2003 H1 2004 5% 16% 11% 13% 24%* 10% 29% 13% 7% 13% Platinum 5% Gold Industrial Minerals 17% 17% 9% 11% 35% Diamonds Coal Paper & Packaging Base Metals Ferrous & Industries *NB:Headline earnings for Paper and Packaging have been adjusted for the 6 months ended 30 June 2003 as net interest for wholly owned operations in Paper and Packaging is now accounted for centrally within Corporate Activities 3 2004 Interim Results Geographic headline earnings mix H1 2003 H1 2004 15% 28% 15% 30% 29% 12% 41% 30% 4 Europe South Africa Americas Rest of World 2004 Interim Results EBITDA – up 40% Strong cash generation into 2004 $3,433 $2,377 H1 2001 5 $2,237 H1 2002 $2,444 H1 2003 H1 2004 2004 Interim Results The economic cycle - where are we? OECD industrial production % 8.0 6.0 4.0 2.0 0.0 1996 1997 1998 1999 2000 2001 2002 2003 2004 -2.0 -4.0 -6.0 Source: MSU 6 2004 Interim Results Falling inventories, rising prices Total LME inventories & MG base metals index LME inventories (kt) 3555 MG base metals MG base metals 260 3055 240 LME inventories (kt) 2555 220 200 2055 180 1555 160 1055 140 555 55 1984 Source: UBS 7 120 100 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 MG Base Metal Index Cash – Price Index Nickel, Aluminium, Copper LME inventories 2004 Interim Results H1:Robust commodity prices H1 2004 260 Coal * 240 220 Copper 200 180 160 140 Platinum Zinc H1 2003 120 Gold 100 80 Jan Feb Mar Apr May Jun Source: MSU 8 Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul * API4 FOB Richards Bay 2004 Interim Results Strategy for growth Growth through projects Growth through acquisitions Value from cost cutting and efficiencies 9 2004 Interim Results Approved $6bn project portfolio Kleinkopje $56m Buxton $173m Richards Bay $235m Skorpion $454m Collahuasi $288m Merebank $150m Isibonelo $65m HBMS 777 $276m ACP Project $250m Siguri $52m Copebras $22m Ruzomberok $233m PMR Expan. $99m 2004 TauTona $52m Kroondal $138m Ticor 1 $137m Chagres $21m Grasstree $106m 2005 2006 W.L. Tailings $186m Cerrejón $17m Black Mtn $110m BRPM $317m Dartbrook $55m Finsch $130m Ticor 2 $54m Unki $84m El Soldado $80m RPM Ph 2 $444m Mponeng $191m RPM Ph 1 $210m Twickenham $343m 2007 Selected major authorised projects. 100% of subsidiaries and AA plc’s share of JV’s and associates. Full production dates. Anglo Platinum 10 Diamonds AngloGold Ashanti Coal Base Metals Industrial Minerals Paper & Packaging Ferrous Metals 2004 Interim Results Longer term unapproved project portfolio South America South Africa Rest of the World $2.5bn $2.0bn $2.6bn Quellaveco Copper (Peru) Pandora Hope Downs* Iron ore (Australia) Morro Sem Bone Nickel (Brazil) Western Complex Obuasi Deeps (Ghana) Barro Alto Nickel (Brazil) Gamsberg Zinc Dawson Valley (Australia) Los Bronces expansion Copper (Chile) Sishen South Iron ore Lake Lindsay (Australia) Collahuasi expansion Copper (Chile) Sishen Expansion Iron ore Snap Lake (Canada) *It is anticipated that final Kumba Board approval to proceed will be sought before the end of the year Anglo Platinum 11 Diamonds AngloGold Ashanti Coal Base Metals Industrial Minerals Paper & Packaging Ferrous Metals 2004 Interim Results Actively managing the asset base • Mining acquisitions for cash at current H1 cash acquisitions and disposals ($bn) stage in the cycle unlikely • But opportunities in IMD/Paper & 1.3 0.9 Packaging: – Acquisition of Frantschach minority • Sale of Gold Fields stake ($1.18bn) Acquisitions 12 Disposals 2004 Interim Results Cost savings and efficiency improvements: $248m $188m $116m $60m $52m $40m $1m $3m $4m $22m $10m Procurement Operating efficiencies Maintenance 13 Admin & overhead Labour Materials & supplies 2004 Interim Results REVIEW OF FINANCIALS Tony Lea 2004 Interim Results Headline earnings $m H1 ’04 Profit for the financial period 1,709 Exceptional items (535) 7 112 98 18 (9) Amortisation of goodwill Related tax & minority interests Headline earnings for the financial period H1 ’03 %ch 760 125% 1,304 856 52% EPS (cents per share) 91 61 49% DPS (cents per share) 19 15 27% 15 2004 Interim Results Headline earnings variances $m 2,000 866 1,800 1,600 75 1,304 (216) 1,400 (40) (105) 1,200 1,000 (28) (20) (31) (53) 856 800 600 400 200 0 H1 2003 16 Price Exchange Inflation Volume Cash cost Non-cash Interest cost DBI Structural H1 2004 & Other 2004 Interim Results Headline variance: Exchange Group total = -$216m Platinum Base Metals Gold Coal Corporate & Ferrous & Exploration Industries Industrial Minerals Paper & Packaging 5 7 Total - (50) (100) (100) (150) (37) (36) (200) (35) (250) (17) (3) (216) $m 17 2004 Interim Results Headline variance: Price Group total = +$866m $m 1,000 82 900 800 700 600 39 15 120 866 (71) 172 509 500 400 300 200 100 0 Base Metals 18 Platinum Coal Ferrous & Industries Gold Industrial Minerals Paper & Packaging Total 2004 Interim Results Balance sheet $m Shareholders’ Funds 30/06/2004 31/12/2003 22,531 19,772 Net Debt: South Africa 2,702 Rest of World 6,028 Minority Interests 19 3,145 8,730 5,488 8,633 4,160 3,396 Total Capital 35,421 31,801 Net Debt/Total Capital 24.6% 27.1% ROCE 13.7% 10.7% EBITDA/Total Capital 20.4% 17.3% 2004 Interim Results Cash flow analysis EBITDA Share of EBITDA of JVs & associates Increase in working capital Provisions & other non cash Operating cash flow Dividends from JVs & associates Operating cash flow including dividends from JVs & associates Net interest & other dividend income Taxation Disposal of fixed assets Available cash flow Dividends paid - company & minorities Net acquisitions & disposals Capital expenditure - maintenance - expansionary Other Increase in net debt 20 H1 ‘04 3,433 (938) (467) 47 2,075 147 H1 ‘03 2,444 (800) (375) 17 1,286 203 2,222 (140) (246) 56 1,489 (75) (413) 40 1,892 (686) 618 (673) (724) 427 (524) (97) 1,041 (739) (315) (547) (625) (1,185) (226) (1,411) 2004 Interim Results REVIEW OF OPERATIONS Tony Trahar 2004 Interim Results Highlights – Base Metals • Higher prices, acquisitions and new projects boost performance Headline earnings up 658% ($m) 455 • Minera Sur Andes contributes $194m • Commissioning of Collahuasi Rosario project ($654m) ahead of schedule and under budget • Skorpion at 85% of design capacity full production set for end 2004 • ROCE (annualised) of 23.5% 60 H1 '03 22 H1 '04 2004 Interim Results Highlights – Paper and Packaging • European markets impacted by strong Euro and slower growth • Bauernfeind (€344m) and Frantschach minority (€320m) acquired Headline earnings up 10% ($m) 226 205* • Structure: creation of single global UCWF and packaging businesses • Ruzomberok and Mondi SA expansions on track and within budget • Previous reporting basis 2004: headline earnings of $174m (H1 2003: $178m*) H1 '03 H1 '04 *NB:Headline earnings for Paper and Packaging have been adjusted for the 6 months ended 30 June 2003 as net interest for wholly owned operations in Paper and Packaging is now accounted for centrally within Corporate Archives 23 2004 Interim Results Highlights – Diamonds • Solid performance from De Beers • DTC sales of $2.98bn up 2% Headline earnings down 13% ($m) 248 • Operating cashflow of $870m 217 • Net Debt (including preference shares) reduced by 34% to $1,169bn • Preference share redemption of $175m • US Department of Justice settlement in July H1 '03 24 H1 '04 2004 Interim Results Highlights – Ferrous Metals and Industries • Improved prices for iron ore, steel, manganese, ferrochrome and vanadium Headline earnings up 405% ($m) 207 • Strong performances from Highveld, Scaw and Samancor; improved results from Boart and Terra • First fully consolidated contribution from Kumba • Kumba: attractive iron ore growth opportunities 41 H1 '03 25 H1 '04 2004 Interim Results Highlights – Coal • South African & South American earnings up significantly (+116%) Headline earnings up 37% ($m) 147 • Australian earnings impacted by – A$ strength – Moranbah – production resumption in H2 107 • H2 realised prices higher than H1 • Proposed Western Complex joint venture announced in May 2004 • Drilling commenced on Xiwan Lease Area (China) on 1 July 2004 H1 '03 26 H1 '04 2004 Interim Results Highlights – Platinum • Revenues increased due to higher prices and greater sales volumes • Platinum production up 26.6% at 1.16m oz (excluding pipeline movements, up 7.8%) Headline earnings up 30% ($m) 139 107 • Cost initiatives gain momentum • Target of 2.45m oz in 2004 remains on track H1 '03 27 H1 '04 2004 Interim Results Highlights – Industrial Minerals • Solid performance despite difficult UK markets • Strengthening market conditions in Czech Republic and Poland Headline earnings stable ($m) 113 114 H1 '03 H1 '04 • Copebrás operating profit doubled due to market strength and contribution from new Goiás plant • New Buxton cement plant (UK) operating at capacity 28 2004 Interim Results Highlights – Gold • Lower earnings on the back of strong rand and lower production at Morila Headline earnings down 20% ($m) 82 • Cash costs of $260/oz 66 • AngloGold Ashanti transaction completed in April - integration of assets progressing well • Acquisition of 29.9% stake in TransSiberian Gold H1 '03 29 H1 '04 2004 Interim Results Outlook Positive global environment for commodities US/Japan GDP growth encouraging China set for soft landing? European growth remains sluggish Anglo’s product and geographic diversity to underpin performance 30 2004 Interim Results ANGLO AMERICAN ADDING VALUE TO NATURAL RESOURCES 5 August 2004 This presentation is being made only to and is directed only at (a) persons who have professional experience in matters relating to investments falling within Article 19(1) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 (the “Order”) or (b) high net worth entities, and other persons to whom it may otherwise lawfully be communicated, falling within Article 49(1) of the Order (all such persons together being referred to as “relevant persons”). Any person who is not a relevant person should not act or rely on this presentation or any of its contents. 2004 Interim Results ADDITIONAL INFORMATION Handout only 2004 Interim Results Key Dates • Currency Conversion • Ex-dividend (JSE) 2 August 2004 16 August 2004 • Ex-dividend (LSE) 18 August 2004 • Record date 20 August 2004 • Payment of Interim Dividend • Annual Results 33 21 September 2004 23 February 2005 2004 Interim Results Market Prices H1 ‘04 H1 ‘03 Gold 401 349 Platinum 850 654 Palladium 248 207 Rhodium 696 557 Copper 125 75 Nickel 619 379 48 35 49.15 25.75 $m Zinc Coal: thermal (RSA - API 4 index average) 34 2004 Interim Results Headline Earnings Sensitivities US$m 10% change in gold price 10% change in platinum price 10% change in palladium price 10% change in coal price 10% change in copper price 10% change in nickel price 10% change in zinc price 10% change in pulp price 10% movement in SA rand/US$ 10% movement in AUD/US$ 10% movement in Euro/US$ 10% movement in £/US$ ± 36 ± 51 ±7 ± 81 ± 77 ±9 ± 20 ±4 ± 249 ± 29 ± 14 ± 17 Estimated sensitivities represent 6 month outlook. Excludes the effect of any hedging activities. Stated after tax at marginal rate. Pulp sensitivity depends on recoveries. 35 2004 Interim Results Projects Gold Approved Life of mine production1 Production commences Full prod. Approved capex $m2 Mponeng 4.8m oz 2004 2007 191 TauTona - Expansion project 0.5m oz 2004 2006 52 TauTona - VCR A & Pillar & CLR <120L 2.4m oz 2005 2010 117 Moab Khotsong 4.9m oz 2003 2011 690 Siguri 2.1m oz 2005 52 - CIP project Total Industrial Minerals 14.7m oz 1,102 Total additional production3 Production commences Full prod. Approved capex $m Buxton Cement Plant 500,000 t 2004 2004 173 Copebras 121,000 t 2005 2005 22 Approved Total 1 2 3 195 Gold incremental production is total additional capacity over life of project. Capex converted to US$ on date of project approval. Nominal. Incremental production is a per year amount once full production is reached. Capex converted at date of project approval. 36 2004 Interim Results Projects Platinum Total additional production1 Full prod. Approved capex $m2 2004 250 PMR Plant Expansion Meet expansion 2005 121 Rustenburg UG2 Phase 1 360,000 oz 2007 210 Bafokeng Rasimone Mine (BRPM) 250,000 oz 2005 317 W. Limb Tailings Retreatment 120,000 oz 2008 186 Rustenburg UG2 Phase 23 306,000 oz 2009 444 Twickenham 160,000 oz 2009 343 Kroondal 280,000 oz 2006 138 58,000 oz 2008 84 Approved ACP Convertor Phase 1 Unki Total 1 2 3 2,093 Incremental production is a per year amount once full production is reached. Capex converted at date of project approval. Replacement ounces. 37 2004 Interim Results Projects Coal Approved Kleinkopje Expansion Greenside Expansion Cerrejón Isibonelo German Creek - Capcoal (Grasstree)2 Dartbrook (Kayuga) Total Base Metals Approved HBMS 777 Project3 Black Mountain Deeps Collahuasi Rosario Project Skorpion El Soldado pit extension4 Codemin II Total 1 2 3 4 Total additional production1 Production commences Full prod. Approved capex $m2 1.3m tpa 1.0m tpa 2.0m tpa 5.0m tpa 3.9m tpa 3.7m tpa 16.9m tpa 2004 2003 2005 2005 2006 2004 2004 2004 2007 2006 2006 2004 56 17 17 65 106 55 316 Total additional production Production commences Full prod. Approved capex $m 2003 2004 2004 2003 2008 2005 2004 2006 2004 2004 2008 2005 276 110 288 454 80 67 1,275 150,000 t Zn 4,000 t Ni Incremental production is a per year amount once full production is reached. Capex converted at date of project approval. To maintain & expand production levels at German Creek & Dartbrook. Incremental tonnes - German Creek (1.6m tpa) & Dartbrook (0.9m tpa). Extends HBMS life to 2018. Extends El Soldado life to 2027 38 2004 Interim Results Projects Paper and Packaging Total additional production1 Production commences Full prod. Approved capex $m1 Ruzomberok: Pulp Mill 105,000 t 2004 2005 129 Ruzomberok: PM18 Expansion 100,000 t 2003 2004 104 Richards Bay: BEKP Line 145,000 t 2004 2005 235 Merebank: PM31 Rebuild 160,000 t 2005 2006 150 Approved Total Approved Ybbstal: Flex 05 618 Total converting capacity3 Production commences Full prod. Approved capex $m 60,000 t³ 2004 2005 51 Total 51 1 Incremental production is a per year amount once full production is reached. Capex converted at date of project approval. Made up of 20,000t pulp and 10,000t paper. 3 60,000 t increase in cut size capacity plus 16,000t additional production of UCWF paper. 2 39 2004 Interim Results Projects Diamonds Current projects Total additional production1 Production commences Full prod. Approved capex $m2 Finsch Block 4 17m carats 2004 2006 130 BB1E Cullinan 5m carats 2004 2007 12 Elizabeth Bay Upgrade 2m carats 2004 2004 27 Total 24m carats 169 Estimated capex $m2 Under review / awaiting approval C-Cut Cullinan 97m carats 2009 2014 473 C-Cut BA West Lower Cullinan 18m carats 2009 2012 45 Finsch Block 5 16m carats 2009 2010 180 2m carats 2006 2007 32 19m carats 2007 2008 282 Victor 6m carats 2008 2008 321 Total 158m carats Finsch Plant Upgrade Snap Lake 1 2 1,333 Total additional production shown for the life of the project. Shown on a 100% basis. Approved capex is AA plc’s effective attributable share (48.65%). 40 2004 Interim Results Projects Ferrous Metals and Industries Total additional production1 Production commences Full prod. Approved capex $m1 Sishen – up current classifier 1 000 ktpa 2004 2004 13 Ticor: Mineral Sands Furnace 1 125 kt slag 2003 2006 137 Ticor: Mineral Sands Furnace 2 125 kt slag 2003 2007 54 Approved Total 204 Estimated capex $m Awaiting approval Hope Downs Sishen Expansion Sishen South 1 41 25 mtpa 10 mtpa 9 mtpa 300 Incremental production is a per year amount once full production is reached. Capex converted at date of project approval. 2004 Interim Results Analysis of Headline Earnings H1 ‘04 H1 ‘03 139 107 66 82 Diamonds 217 248 Coal 147 107 Base Metals 455 60 Industrial Minerals 114 113 Paper and Packaging¹ 226 205 Ferrous Metals 207 41 Exploration (42) (39) Corporate Activities¹² (225) (68) Headline Earnings 1,304 856 $m Platinum Gold ¹Headline earnings for Paper and Packaging have been adjusted for the 6 months ended 30 June 2003 as net interest for wholly owned operations in Paper and Packaging is now accounted for centrally within Corporate Activities ² Includes Gold Fields 42 2004 Interim Results Analysis of Operating Profit H1 ‘04 H1 ‘03 Platinum 320 204 Gold 133 180 Diamonds 350 378 Coal 196 172 Base Metals 565 98 Industrial Minerals 145 136 Paper and Packaging 320 357 Ferrous Metals and Industries 387 104 Exploration (56) (50) Corporate Activities1 (112) (45) Operating Profit2 2,248 1,534 $m 1 2 includes Gold Fields. after operating exceptional items. 43 2004 Interim Results Capital Expenditure H1 ‘04 H1 ‘03 Platinum 292 394 Gold 227 117 Coal 64 74 Base Metals 127 155 Industrial Minerals 127 136 Paper and Packaging 409 233 Ferrous Metals and Industries 144 59 Other 7 4 Total 1,397 1,172 $m 44 2004 Interim Results Headline variance: Volume Group total = +$75m $m 120 5 14 27 100 (17) 80 29 75 (20) 60 40 37 20 0 Platinum 45 Paper & Packaging Base Metals Ferrous Metals & Industries Industrial Minerals Gold Coal Total 2004 Interim Results Operating Profit Variance Operating profit after operating exceptional items $m 3,000 1,195 2,500 106 107 (411) 2,000 (33) (188) 1,534 2,248 (62) 1,500 1,000 500 H1 2003 46 Price Exchange Inflation Volume Cash Cost Non-cash Structural H1 2004 Cost & Other 2004 Interim Results Regional Analysis Operating profit H1 ‘04 H1 ‘03 South Africa 777 548 Rest of Africa 241 299 Europe 416 409 Americas 723 187 91 91 2,248 1,534 $m Australasia 47 2004 Interim Results Operating Cost Reconciliation Subsidiary & JV Operating Costs H1 2003 operating costs Subsidiaries JVs (share of turnover less operating profit) Inflation Exchange Volume Depreciation & amortisation Structural changes Operating impairments Costs higher than inflation & other H1 2004 operating costs before cost savings Cost saving initiatives H1 2004 Operating costs Subsidiaries JVs (share of turnover less operating profit) 48 $m (7,979) (386) (10,279) (329) (8,365) (247) (945) (279) (81) (775) 12 (176) (10,856) 248 (10,608) 2004 Interim Results Anglo Platinum Reconciliation $m IAS net profit (published) STC adjustment Movement on unrealised profit on FECs Exploration Profit on assets exchanged not recognised for UK GAAP Net exceptional items Weighted average exchange impact Other Minority interest Depreciation on assets revalued on acquisition 217 (9) (9) 11 (10) 22 3 4 229 (58) (32) UK GAAP contribution to headline earnings 139 49 2004 Interim Results AngloGold Ashanti Reconciliation $m IAS Headline earnings (published)1 Exploration (excluding joint ventures) Amortisation on bond discount Depreciation on assets revalued on acquisition Minority interest UK GAAP contribution to headline earnings 1 111 19 5 (5) (64) 66 Before unrealised non-hedge derivatives and fair value losses on interest rate swaps 50 2004 Interim Results De Beers Reconciliation 51 $m Total Ordinary shares DBI headline earnings – IFRS (100%) GAAP adjustments DBI headline earnings - UK GAAP (100%) AA plc’s 45% ordinary share interest Additional 3.65% ordinary share interest AA plc’s portion of preference shares AA plc headline earnings 424 (14) 410 161 13 43 217 357 161 13 174 Preference shares 53 43 43 2004 Interim Results EBITDA by Business: H1 ‘04 $m Operating Profit (incl JVs & Associates) Platinum Gold Diamonds Coal Base Metals Industrial Minerals Paper & Packaging 320 133 350 196 565 145 320 Ferrous Metals & Industries 387 Other (168) Total 2,248 52 Exclude Exceptional Items Add Back Subsidiaries Depreciation Add Back Subsidiaries Amortisation Add Back JVs & Associates Depr. & Amort. EBITDA - 149 143 68 118 105 184 127 7 901 8 18 2 30 14 3 12 87 2 23 45 20 35 1 14 46 11 197 479 317 395 286 718 281 532 563 (138) 3,433 2004 Interim Results EBITDA by Business: H1 ‘03 $m Operating Profit (incl JVs & Associates) Platinum Gold Diamonds Coal Base Metals Industrial Minerals Paper & Packaging 204 180 378 172 98 136 357 Ferrous Metals & Industries 104 Other (95) Total 1,534 53 Exclude Exceptional Items 12 12 Add Back Subsidiaries Depreciation Add Back Subsidiaries Amortisation Add Back JVs & Associates Depr. & Amort. EBITDA 90 87 64 109 86 148 43 6 633 8 16 2 26 9 3 11 75 1 28 33 18 28 2 9 54 17 190 303 323 411 256 235 250 523 204 (61) 2,444 2004 Interim Results ANGLO AMERICAN ADDING VALUE TO NATURAL RESOURCES 5 August 2004 2004 Interim Results

![[Type text] Fill in a fictional “headline from the future” above](http://s3.studylib.net/store/data/008674091_1-c12eeba0d4bd6938777e08ea064ad30a-300x300.png)