York University - Faculty of Liberal Arts & Professional Studies

advertisement

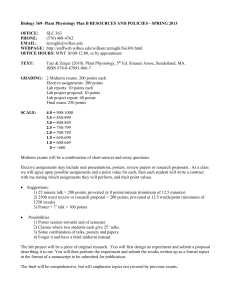

York University School of Administrative Studies AP/ADMS 3541 Personal Financial Planning Sections M and N and O Course Outline Supplement – Winter 2015 Section N Tuesday 4:00-7:00pm Section M Thursday 2:30-5:30pm Section O Wednesday 7:00-10:00 pm CLH M HNE 031 ACE 003 Dr. Jodi Letkiewicz Dr. Jodi Letkiewicz Dr. Chris Robinson Course Description The course introduces students to financial planning techniques used in professional practice, and follows through the steps and methods involved in developing personal financial plans. Topics include time value of money, personal financial statements, family law, tax planning, debt management, mortgage financing and home investment, risk management and insurance, investment, and an introduction to retirement planning. Learning Outcomes Be able to solve simple, individual problems in personal financial planning Understand the fundamentals of the financial planning process Calculate, interpret, and apply time value of money concepts Specify financial goals and create personal financial statements; including a balance sheet, income and expense statement, and budget. Identify wise debt management practices and compare/contrast debt alternatives. Apply tax planning strategies to meet financial goals Demonstrate decision making skills used to make a major consumer purchase such as a home or automobile. Classify potential risks faced by individuals and families and identify strategies for handling these risks, including how much insurance to buy and what specific types of insurance Distinguish between the most common banking and investment products and assess the suitability of a portfolio for a family. Solve basic pre-retirement planning problems. Explain the basic use of wills and powers of attorney to a client. Prerequisite: AP/ADMS 3530 Required Texts Ho, Kwok and Robinson, Chris. Personal Financial Planning. 5th Ed., Captus Press, 2012. (HR) Evaluation Scheme Group Assignments (2) Midterm Exam Final Exam 20% 30% 50% 100% 1 Each class will be divided into groups of two students to discuss course material outside the classroom and to work on the assignments jointly and submit them on the due dates. Late assignments cost you marks. No assignments will be accepted after the last class. Course Policies Communication Policy: All email communication must follow the following guidelines to ensure prompt and accurate responses: Responses will be provided to emails for which the email subject heading begins with “ADMS 3541” Clearly identify who you are and which section you are enrolled in at the start of each message. Prior to sending an email, please review the syllabus carefully. Questions with answers that are contained in the syllabus are not likely to receive a response. Questions regarding course content will only be addressed in class or during office hours. Responses will be sent within 3 business days (a business day is Monday through Friday, excluding holidays). For reasons of privacy and confidentiality, please email me from your @yorku.ca account. Conduct in the Classroom: No laptops, iPads, tablets, cell phones, or other electronic devices (pocket translation devices and calculators are exceptions) will be permitted for use during class. These devices serve as a distraction to both you and your classmates. Exceptions may be made in order to accommodate students with special circumstances and as permitted by the instructor. Financial Calculator A financial calculator is required. Students are responsible for learning how to use their own financial calculator. Several models are in common use in finance: The Sharp EL-733A; the Hewlett-Packard 10BII and the Texas Instruments BAII Plus. Instructions for these three models are given in the ADMS 3530 textbook. Chapter 2 of HR includes some examples using the BAII Plus. If you will someday pursue the Chartered Financial Analyst designation, note that only two calculators are currently allowed for the CFA exams: the TI BAII Plus (including the BA II Plus Pro), and a different Hewlett-Packard model, the HP-12C. The Financial Planners Standards Council, which administers the Certified Financial Planner exams in Canada, specifies only that calculators must be noiseless, non-programmable and not be able to store text. Examinations There will one mid-term exam and a final exam, common to all sections. Exams are as follows: Midterm: Saturday, February 7 at 9:00am The final examination will be scheduled by the registrar’s office There will be no make-up mid-term examinations. Students who cannot write due to legitimate reasons (an attending physician’s statements (APS) is required) will have their midterm examination mark pro-rated using a method that does not penalize you if the final is relatively harder than the midterm, and does not give you an advantage if the final is relatively easier. 2 Finance Area policy on DSA (Deferred Standing Agreement) It is the policy of the Admin Studies finance area that instructors will NOT sign a DSA form if you miss both midterms and the final exam. Students in this situation will need to petition for deferred exam, late withdrawal, or a remedy appropriate to their circumstances. Submitting Assignments Each of the two assignments will be posted on the course website at least one week before the due date. Each group must submit the assignment to the instructor at the beginning of class on the date the assignment is due. However, there are times when this is impossible, and the assignment must be submitted at the main office (there is a large mail slot outside the office if the office is closed). This is acceptable ONLY if you have approval from the Course Director and your report is submitted on time. Assignments submitted without pre-approval will not be accepted. When completing your assignment, please observe the following rules and guidelines: 1. Textual portions must be typed and double-spaced. This does not include variables, labels and brief notes of explanation. Use at least one inch margins all around. 2. Double-sided is preferred, if you can do it with your printer. 3. Use 8 ½ X 11 paper only. 4. Do not use report covers. 5. Staple your assignment prior to handing it in. 6. Be sure to write clearly your names, student numbers, section, and due date on the cover page. 7. Spelling and grammar will affect your marks. 8. No assignments will be accepted after the last class. Marking of Assignments 1. Marking will be done on the basis of percentages as outlined in the Faculty calendar. 2. Assignments will be marked, graded and returned in about two weeks. 3. Assignments will be taken up during class time, or the solutions will be posted online. Retain a copy for your reference. 4. Extensions for submitting an assignment after the due date with penalty may be granted on a case-by-case basis. Approval must be obtained from the course director prior to the due date of the assignment. Late assignments, if approved, will be penalized by one grade point (e.g. assignment graded as a B+ or 75% will be reduced to a C+ or 65%). Topical Coverage (tentative) Each week has some assigned problems in addition to readings. You should attempt all the problems assigned by the instructor, and all the multiple choice questions, before the class. During the lecture, the instructor will solve the problems and discuss what you should have learned from them. Week Topics Readings Problems Assigned* 1: Introduction to the course Personal Finance Financial Planners The process of Financial Chapters 1 and 3 Ch. 3: Problems 1, 2 3 Assignments Due/Reminders 2: 3: 4: Planning: - Goals, Action Plan, Implementation Goal Setting Time value of money Financial Statements: - Statement of Net Worth, Income Statement, Budgets - The Life Cycle Hypothesis Family Law Personal Income Taxation Chapter 2 Chapters 4 and 6 Ch. 2: Problems 1, 3, 5, 14, 18, 19 Ch. 2: Problems 17, 20 Ch. 4: Problem 2 Chapters 5 and 7 Problem 4 Problems 1, 4, 6, Ch. 5: Ch. 7: 8 Chapters 7 Ch. 7: and 8 Ch. 8: 5: Tax Planning Tax Shelter Investments 6: Chapter 12 Ch. 12: Problems 3, 4, 9 Feb. 14-20 7: Debt and Credit Management Reading Week Risk Management I Chapters 9 and 10 Ch. 9: Problem 1 8: Risk Management II 9: Mortgage Financing Homeownership, valuation and financing Investment Principles and basic investment instruments Chapters 10 and 11 Chapter 13 Ch. 10: Problems 6, 7, 9 Ch. 11: Problems 3, 4 Ch. 13: Problems 3, 4, 7, 11, 13 Chapters 14 - 16 Ch. 14: Problem 2 Ch. 15: Problems 2, 6 Ch. 16: Problems 3, 4, 7, 9 Ch. 17: Problems 4, 6, 7, Assignment #2 8 Chapter 18: Problems 1, 4(a) 10: 11: Retirement Planning Chapter 17 12: Problems 9, 10 Problems 1, 3 Midterm Exam Saturday, Feb 7 at 9am Assignment #1 Elements of Estate Chapter 18 Planning Course Review for the examination. April 8 - 24 Final Exam: To be scheduled by the registrar’s office *Problems assigned each week are subject to change. Announcements will be made in class. Other Course Forms and Policies The Senate Academic Standards, Curriculum and Pedagogy (ASCP) provides a Student Information Sheet that includes: York's Academic Honesty Policy and Procedures / Academic Integrity Web site Access/Disability Ethics Review Process for Research Involving Human Participants Religious Observance Accommodation Student Code of Conduct 4 Additional information: Academic Accommodation for Students with Disabilities Alternate Exam and Test Scheduling Grading Scheme and Feedback Policy The Senate Grading Scheme and Feedback Policy stipulates that (a) the grading scheme (i.e. kinds and weights of assignments, essays, exams, etc.) be announced, and be available in writing, within the first two weeks of class, and that, (b) under normal circumstances, graded feedback worth at least 15% of the final grade for Fall, Winter or Summer Term, and 30% for ‘full year’ courses offered in the Fall/Winter Term be received by students in all courses prior to the final withdrawal date from a course without receiving a grade. Important University Sessional Dates: You will find classes and exams start/end dates, reading/co-curricular week, add/drop deadlines, holidays, University closings and more. Final course grades may be adjusted to conform to Program or Faculty grades distribution profiles. Services for Mature and Part-time Students: The Atkinson Centre for Mature and Parttime Students (ACMAPS) maintains and strengthens York University’s ongoing commitment to welcome and to serve the needs of mature and part-time students. For further information and assistance visit: http://www.yorku.ca/acmaps Attending Physician's Statement form, for missed midterm or missed final exam: http://www.yorku.ca/laps/council/students/documents/APS.pdf DSA Form, for missed final exam: http://www.registrar.yorku.ca/pdf/deferred_standing_agreement.pdf 5