FINALWhatEveryInsideCounselNeedstoKnowAbouttheFCPA

advertisement

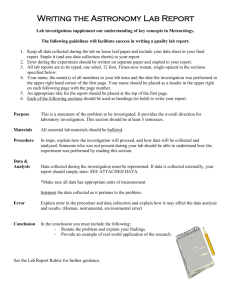

What Every Inside Counsel Needs to Know About the FCPA Presented for the Association of Corporate Counsel, Washington Chapter, March 31, 2015 Panelists • • • • • • • Gina Culbert, Counsel, BakerHostetler Jimmy Fokas, Partner, BakerHostetler Kathryn Zunno, Partner, BakerHostetler Mark Gerber, Partner, Forensic Services, Pricewaterhouse Coopers John E. Frank, Vice President, Deputy General Counsel and Chief of Staff, Office of the General Counsel, Microsoft Corporation Monica Reinmiller, J.D., M.B.A., C.R.I.S.C., C.C.E.P., Senior Legal Risk Management and Compliance Professional Neil Moir, Director, Business Ethics and Compliance, Legal and Corporate Affairs, Starbucks Corporation 2 What is the FCPA? Commercial anti-corruption statute enforced by U.S. criminal and civil authorities with three components: – Anti-bribery provisions. – Accurate accounting books and records requirements. – Effective internal controls requirements. 3 Anti-Bribery Provisions 4 Anti-Bribery Provisions Prohibits corruptly giving, paying, promising, offering, or authorizing payment of anything of value Directly or Indirectly Through third parties To foreign officials, political parties, or candidates For the purpose of influencing an official in his or her official capacity or to secure and improper advantage in order to obtain or retain business 5 Who is a “Foreign Official?” • Any officer or employee of a foreign (non-U.S.) government or any department, agency or instrumentality thereof, or any person acting in an official capacity on behalf of any such government or department, agency, or instrumentality. • Any official or employee of a public international organization or person acting on its behalf. • Includes employees of state-owned entities. • FCPA also prohibits corrupt payments to any foreign political party, official thereof, or candidate for foreign political office. 6 Foreign Officials • • • • Foreign Ministers. Heads of Agencies and Departments. Procurement Officials. Every Government Employee: – Elected. – Appointed. – Career Officials. – Executive Branch Officials. – Legislators. – Judges. – Part Time. – Unpaid. • • • • Political Parties, Party Officials, and Candidates for Political Office. Officials of Public International Organizations: – International Monetary Fund. – International Finance Corporation. – United Nations. – Organization of American States. – International Red Cross. Doctors and Employees of StateOwned Hospitals or Medical Clinics. Scientists and Employees at StateOwned Research Facilities or Institutions. 7 “Anything of Value” • • • • • • • • • • • Cash. Car. Seat on Company Aircraft. Surplus Equipment. Art. Contract Rights. Personal Gifts. Purchasing Goods and Services at Above Market Rates. Job for Relative. Donation to Charity. Lavish Gifts. • Travel Expenses. • Accommodations, Meals, Entertainment. • Per Diems. • Services. • Carried Interests. • Loans. • Excessive Discounts. • Preferential Options. • Selling at Less than Fair Market Value. • Scholarship for Family Member. 8 U.S. Regulators Broadly Interpret Words “to obtain or retain business” • The FCPA prohibits more than just bribes to obtain or retain a government contract. • The FCPA prohibits any bribe to secure any advantage, such as obtaining a permit, license or tax break. 9 The Foreign Corrupt Practice Act: Criminal & Civil Enforcement Penalties FCPA Provision Individual/Entity Corporate Liability Anti-Bribery Criminal Penalties Civil Penalties • The higher of $2,000,000 or 2x the • $16,000 per violation benefit from the corrupt conduct • Up to five years in prison Individuals AND • $16,000 per violation • The higher of $250,000 or 2x the benefit from the corrupt conduct • Disgorgement Corporate Liability Books & Records Individuals • The higher of $25,000,000 or 2x the benefit from the corrupt conduct AND • Up to twenty years in prison • Disgorgement AND AND • The higher of $5,000,000 or 2x the benefit from the corrupt conduct • The higher of the total gains from the corrupt conduct or $150,000 • The higher of the total gains from the corrupt conduct or $725,000 10 Defense to Anti-Bribery Provisions 1. Local Law Defense (payment was lawful under the written laws of the foreign country). 2. Reasonable and Bona Fide Business Expenditure Defense (money was spent as part of demonstrating a product or performing a contractual obligation). 11 Subsidiary Liability under Anti-Bribery Provisions Companies are directly liable for the actions of their agents, employees, and subsidiaries: “…a company is liable when its directors, officers, employees, or agents, acting within the scope of their employment, commit FCPA violations intended, at least in part, to benefit the company…” 12 Potential Liability for Actions of Foreign Agents, Consultants, and Intermediaries • • • Company and individuals may be liable for payments made by a third party – such as a consultant, agent, or joint venture participant if the third party gives money or something of value to a foreign official and: – the money or thing of value had been paid by the company or the third party received reimbursement from the company, and – the company knew or authorized the payment, or understood there was a high probability that such a payment would be made. FCPA imputes knowledge of the violation where factual information possessed by the person/company indicates a “high probability” that prohibited conduct will result. Therefore, it is critical to exercise due diligence to search for, and react appropriately to “red flags.” 13 Books & Records and Internal Controls Provisions 14 Books & Records Provisions • The FCPA requires SEC-registered “issuers” to maintain books, records, and accounts which in reasonable detail accurately reflect transactions and the disposition of its assets. • No materiality requirement for a violation. • Requires reasonable level of detail that would satisfy prudent officials in the conduct of their affairs. 15 Accurate Books and Records Provisions • FCPA books and records violations typically involve: – Unrecorded transactions. – Falsified or mislabeled transactions. Bribery transaction is described as something innocuous. – Mischaracterization of payments. – Improper general ledger characterization for payment. • Note:“facilitating payments” must be accurately described. 16 FCPA Internal Controls Provisions • • Section 13(b)(2)(B) of the Exchange Act requires “Issuers” to devise and maintain a system of internal accounting controls to provide reasonable assurance that transactions are authorized by management, that assets are accounted for, and that financial statements are in conformity with GAAP. No materiality requirement for a violation. 17 Adequate Internal Controls • Should ensure: – – – • Appropriate management authorization for transactions. Accountability for company’s assets. Systems to identify possible FCPA violations and assure compliance. Should prevent: – – – The failure to record illegal transactions. The falsification of records to conceal illegal transactions. The creation of records that are quantitatively accurate but may mislead by failing to specify qualitative aspects of transactions. 18 Current Enforcement Trends 19 Current Trends • Focus on the Life Sciences and Healthcare Industry • U.S. vs. Esquenazi – Definition of Instrumentality • Alstom Settlement – Guilty Pleas and Record Fines 20 Increased Penalties and Settlement Amounts Total FCPA Criminal and Civil Fines Imposed on Corporations 2000 1782 Amounts in Milliions ($) 1800 1600 1400 1200 1000 803 720.6 800 511.2 600 508.8 400 260.57 155.1 200 2.7 0 28.2 36.3 2003 2004 2005 87.2 13.4 67.8 2008 2009 0 2002 2006 2007 Non-Siemens/KBR Siemens 2010 2011 2012 2013 KBR 21 Prosecutions of Individuals FCPA Proceedings Brought Against Individuals by Year 2002-2013 45 Number of Proceedings Commenced 40 35 30 25 20 15 10 5 0 2002 2003 2004 2005 2006 2007 DOJ SEC 2008 2009 2010 2011 2012 2013 Total 22 Risks & Red Flags 23 General Red Flags Country has a reputation for a high risk of corruption (CPI Map). Foreign official has a reputation for corruption. Use of mandated third party agents or distributors. Third party is suggested or recommended by government official. Party objects to FCPA representations and warranties in agreement. 24 Red Flags (continued…) Party is too important, busy or insulted to engage in due diligence. Close personal or family relationship with government official. Requests for unusual compensation arrangements such as cash payments or payments to offshore accounts. Unusually high commissions or fees in relation to the services provided. Unusual bonuses paid to foreign operational managers. 25 Red Flags (continued…) Lack of objective qualification in intermediaries hired to facilitate a transaction. Unusual invoicing, payment patterns, or financing— absolutely no “accommodation” billing. Success fees. Lack of transparency in expense records and accounting. Suggestion that a particular payment, gift or form of hospitality or entertainment would help or assist in attaining a particular goal. 26 Transparency International Corruption Perceptions Index (CPI) 27 Recent FCPA Settlements 28 Avon (2014) • Avon is a major international beauty and cosmetics company. • Between 2004 and 2008, Avon’s subsidiary in China improperly gave or provided “$8 million worth of payments in cash, gifts, travel, and entertainment to Chinese officials.” • The payments were intended to gain access to officials with oversight of new “direct selling regulations.” In turn, Avon was the first company to receive a direct selling business license in China. • As a result of the misconduct, the company settled with the SEC whereby it agreed to disgorgement in the amount of $52,850,000, in addition to prejudgment interest of $14,515,013. • On December 17, 2014, the DOJ filed criminal informations against Avon and Avon China, its subsidiary; Avon China thereafter entered a guilty plea. As a result of its plea, the Avon entities will be required to pay $67,648,000 in criminal penalties. • In total, the violations resulted in prejudgment interest, penalties, and disgorgement in the amount of $135,013,013. Alcoa (2014) • • • • • Alcoa World Alumina is a mineral and chemical company, a subsidiary of Alcoa Inc., which deals in the production and acquisition of Alumina. On January 9, 2014, Alcoa World Alumina pleaded guilty to resolve charges connected to its bribery, through a third-party agent, to foreign officials in Bahrain. In conjunction with its guilty plea, the company agreed to $223 million in criminal fines and forfeiture. In addition to the resolution of its criminal charges, Alcoa World Alumina also settled with the SEC. The company agreed to pay $175 million in disgorgement (of which $14 million would be counted towards the criminal forfeiture). As a result of its misconduct, Alcoa World Alumina will pay penalties and disgorgement in the amount of $384 million. Cooperation – Is it worth it? 31 Goodyear Tire & Rubber Co. (2015) • • • Goodyear’s subsidiaries in Kenya and Angola paid bribes of over $3.2 million to, among others, employees of the Kenya Ports Authority, Armed Forces Canteen Organization. As a result of the misconduct, the SEC and Goodyear entered into a settlement whereby Goodyear is required to pay disgorgement in the amount of $14,122,525, and prejudgment interest in the amount of $2,105,540—for a total of $16.2 million. SEC highlighted Goodyear’s cooperation and significant remedial measures, which presumably led to the decision not to impose a civil penalty, including: – – – – Promptly halting the improper payments and self-reporting to the SEC; Voluntary production to the staff, including materials from the company’s internal investigation; Significant enhancements to its Global Compliance program; and Divested itself of the subsidiaries that made the improper payments. 32 Ralph Lauren Corp. (2013) • • • • As a result of bribes paid by its Argentine subsidiary, Ralph Lauren entered into a Non-Prosecution Agreement (“NPA”) with, and agreed to pay substantial financial penalties to, the SEC ($593,000 in disgorgement and $141,845 in prejudgment interest). The SEC indicated that its willingness to enter the NPA was in large part a product of the company’s cooperation and disclosure of the wrongdoing: – Reporting preliminary findings of its internal investigation to the staff within two weeks of discovering the illegal payments and gifts. – Voluntarily and expeditiously producing documents. – Providing English language translations of documents to the staff. – Summarizing witness interviews that the company's investigators conducted overseas. – Making overseas witnesses available for staff interviews and bringing witnesses to the U.S. The company also agreed to pay $882,000 in penalties to the DOJ. In total, the FCPA violation resulted in over $1.58 million in penalties, disgorgement, and prejudgment interest for the company. 33 Alstom S.A. (2014) – The Price of Not Cooperating • • • • • • Alstom S.A. is a French power and transportation company. On Monday, December 22, 2014, the company pleaded guilty to a two count information to resolve criminal charges relating to its bribery of foreign officials in, among other countries, Indonesia, Saudi Arabia, Egypt, and the Bahamas. In addition to the actual bribery, the company also retained consultants to act as intermediaries and to conceal the bribes. As a result of its illicit conduct, Alstom S.A. agreed to a fine in the amount of $772,290,000. In addition to the charges against the company, at least five individuals have already been charged in connection with the misconduct, with 4 guilty pleas to date. The plea agreement highlighted the reasons for the record-breaking fine, including: – – – – Failure to voluntarily disclose the conduct once the company was aware of it; Failure to cooperate with the government’s investigation until the government charged several former Alstom employees; Lack of an effective compliance and ethics program; and Alstom’s prior criminal misconduct. Best Practices 35 Examples of Leading Compliance Practices Examples of leading compliance practices: Adequate due diligence of agents. Annual FCPA risk assessment, training, and due diligence review of agents; Use of consistent agent and distributor contracts: Anti-corruption clauses. Representation and warranties for corruption clauses and FCPA compliance. Right to inspect books and audit payments. Required annual written attestation of compliance with the FCPA and anti-corruption clauses. No success fee based contracts. Document provision of FCPA training and compliance materials to agents. Monitor charitable and political contributions. Commissions and bonuses should be in expected and reasonable ranges. Identify and track government contracts. Regular procedures to identify unusual payments, such as offshore holding companies, and appropriately review. Closely evaluate favorable or abnormal credit terms. Adequate whistleblower procedures. 36 Foreign Considerations • Foreign countries, including Canada, the U.K, Russia, Brazil, and China, have all implemented local anti-bribery and/or anti-corruption laws. – The enforcement of foreign anti-bribery/anticorruption laws is on the rise. – Use of carbon-copy or parallel prosecutions increases potential costs of FCPA non-compliance. – Industry “sweeps” by the DOJ and SEC are also on the rise. 37 Protecting the Privilege 38 Maximizing Privilege Protections During Internal Investigations: The Basics Attorney-Client Privilege • A communication; • Made between privileged persons; • In confidence; • For the purpose of seeking, obtaining, or providing legal assistance to the client. Work Product Protection [tracking FRCP 26(b)(3)] • Documents or tangible things otherwise discoverable; • Prepared in anticipation of litigation or trial; • Sought by another party in the litigation; • With greatest protections given to attorney thoughts and impressions, but; • Consideration of undue hardship if the material is not otherwise discoverable. 39 Maximizing Privilege Protections During Internal Investigations: Key Considerations • The purpose of the investigation. • At whose direction is the investigation undertaken and conducted. • The privilege laws in any non-U.S. jurisdictions that touch the investigation. • Whether an internal audit or risk assessment by outside counsel or consultants would be protected by the privilege. • How to ensure the work of experts or consultants engaged during the investigation is protected. 40 Maximizing Privilege Protections During Internal Investigations: Recent Case Wultz v. Bank of China, 2014 WL 362667 (S.D.N.Y. Jan. 21, 2015) Relevant Facts: NY branch of Bank of China (“BOC”) received a demand letter threatening to file a suit against BOC for knowingly providing material assistance to a terrorist group that had caused terrorists attacks by executing wire transfers to the group’s senior member. In response, BOC’s head office in China conducted an internal investigation primarily by employees in China. • Plaintiffs eventually filed suit in federal district court and, in discovery, sought documents created during BOC’s internal investigation. • BOC argued the documents were privileged because the investigation was conducted in response to the demand letter “with the expectation” that U.S. counsel would ultimately use the documents to provide legal advice. Holding: BOC was ordered to produce the documents created during the investigation. • The attorney-client privilege did not attach merely because BOC planned later to turn the documents over to a U.S.-based attorney; BOC could not establish the documents were created at the direction of counsel for the purpose of providing legal advice. • The work product protection did not apply because BOC could not show that the materials were prepared “because of” its anticipation of litigation. For protection to apply, party asserting it must show that material at issue would not have been created in essentially similar form had no possibility of litigation existed. 41 Maximizing Privilege Protections During Internal Investigations: Tips • • Establish protocols and procedures as early as possible – ideally, before the investigation begins – to ensure privilege is preserved and work product protection is triggered. The Basics: ‾ ‾ ‾ • • • • • • Mark written materials confidential, attorney-client privileged, and prepared at the direction of counsel. Limit the circulation of attorney-client or work product material. Ensure those who will be conducting investigation understand how to give proper Upjohn warnings. Document and communicate the legal purpose of the investigation as often as possible. Put protocols in place to ensure any potential wrongful conduct is escalated to the legal department as early as possible. Involve U.S. counsel in internal investigations that may have consequences in the U.S. As a best practice, engage U.S. outside counsel. Ensure attorney direction and oversight at all stages of the investigation. Differentiate the investigation from standard procedures per company policy. Understand and solicit advice regarding the privilege laws in any non-U.S. jurisdiction relevant to the investigation. 42 Privilege Considerations When Dealing With The Government: The Dilemma To disclose or not to disclose privileged information or work product? Important Considerations • Disclosure of facts vs. privileged material. • Likelihood that selective waiver doctrine will apply. • Potential benefits: • Prevent prosecution entirely. • Maximize cooperation credit. • Potential pitfalls: • Government pursues case anyway and disclosed material helps agency build its case. • Impact of waiver on subsequent litigations concerning same subject matter. 43 Privilege Considerations When Dealing With The Government: Tips • Assume any disclosure of privileged material to the government is effectively full disclosure to any subsequent litigant. • Clearly identify and segregate purely factual matter from attorney-client and work product material. • Consider presenting factual findings in an oral attorney proffer. • Even though the trend is to disfavor selective waiver, you can still increase your chances of its application by: – Establishing a record showing the purpose of conducting the internal investigation is to receive legal advice. – Negotiating an express confidentiality and non-waiver agreement with the government agency requesting the documents. • If you do end up in ancillary litigation, be generous with producing non-privileged documents. 44 Atlanta Chicago Cincinnati Cleveland Columbus Costa Mesa Denver Houston Los Angeles New York Orlando Philadelphia Seattle Washington, DC www.bakerlaw.com These materials have been prepared by Baker & Hostetler LLP for informational purposes only and are not legal advice. The information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. Readers should not act upon this information without seeking professional counsel. You should consult a lawyer for individual advice regarding your own situation.