Corporate Procedure A312, Foreign Corrupt Practices Act Provides

advertisement

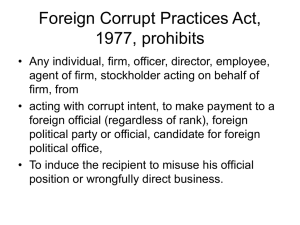

0 Overview of the Foreign Corrupt Practices Act and Related Corporate Procedures (A312, A312A and A301) 1 Northrop Grumman has had a long-standing commitment to the letter and spirit of the U.S. Foreign Corrupt Practices Act (“FCPA”). All employees must be well-informed regarding the FCPA and various international anti-bribery laws that have been enacted since the FCPA was introduced in the U.S. Completion of this module should enable you to identify issues that require the attention of the Law Department. 2 Risk of Prosecution or Investigation Reducing bribery and increasing transparency has become an important topic in the international community and has moved to the top of the global and political agenda. The number of investigations and prosecutions is increasing and the likelihood of being brought before a foreign court for violations of international anti-bribery laws has increased dramatically. Ronald D. Sugar, Chairman and CEO of Northrop Grumman has stated that FCPA compliance is a top priority for the company and that the consequences of non-compliance would represent a huge and unacceptable risk. 3 What is the FCPA? U.S. law passed in 1977 to prohibit bribery of foreign officials Two main components: (1) Anti-bribery Provisions: prohibits bribes (or offers to bribe) made to foreign officials, political parties, candidates for public office whether made directly or through a third party (2) Accounting Provisions: requires accurate books and records and adequate accounting and financial controls Violations can result in both criminal and civil penalties including imprisonment, fines, loss of export licenses and suspension from competing on government contracts 4 Who does the FCPA apply to? Any U.S. person or company, as well as any officer, director, employee or agent of the company and any stockholder acting on behalf of the company All foreign persons who commit an act in furtherance of a foreign bribe while in the U.S. Employees of foreign subsidiaries of U.S. companies can be liable for acts committed while in the United States Also, foreign subsidiaries can cause liability for U.S. parent for acts outside of the U.S. 5 Corporate Procedure A312, Foreign Corrupt Practices Act Provides a general description of the FCPA, defines responsibilities and guidelines for identifying potential compliance issues All employees are responsible for compliance and must notify the Law Department of any potential or actual violation In addition to criminal and civil penalties under the FCPA, violations of A312 can lead to termination of employment 6 Corporate Procedure A312A, Business Expenditures for Foreign Officials All business courtesies (gifts, travel or hospitalities) provided to a foreign official must adhere to the guidelines and requirements in A312A. Requests for such courtesies must be submitted to the International Legal Group of the Law Department for pre-approval using Form C-591 (Request for International Legal Group Approval of Business Expenditures for Foreign Official(s)). The Law Department will review the proposed courtesy for compliance with the FCPA and the relevant local law. 7 Corporate Procedure A301, Consultants, Representatives, and Lobbyists Companies like Northrop Grumman can be held liable under the FCPA and similar international anti-bribery laws for the acts of third parties, including commercial intermediaries and other agent representatives and joint venture partners. To mitigate this risk, any company element intending to utilize the services of a third party must conduct a thorough due diligence to identify any “red flags” that may indicate a potential violation of the FCPA. 8 Corporate Procedure A301 – continued Examples of “red flags”: Requests for unusually large or up-front commissions Refusal to sign FCPA certification Requests for payment in a third country Refusal to disclose owners, partners or principals Use of shell companies, holding companies or blind trusts 9 Corporate Procedure A301 - continued Corporate Procedure A301 provides the requirements for engaging third parties to represent the company or provide advice or lobbying services. No commissioned sales representative or consultant may be tasked or retained without the review and approval of the Law Department! The Law Department reviews the ownership, financial viability, government relations, and reputation of the proposed agent or consultant, as well as local law requirements, if any. 10 Where to Get More Information Employees with specific questions about this module or Corporate Procedure A312, A312A or A301 should contact the Law Department. For more information on the topics discussed in this module please contact: James Gormley (1-410-765-3124) David Morris (1-410-765-0097) Jannette Hasan (1-410-765-6654) Employees who wish to discuss a matter confidentially should contact either the Law Department or the Ethics OpenLine at 1-800-247-4952. 11 Test Yourself Click the link below to take the required on-line training and test 2006 FCPA Training