ACC Austin Roundtable

advertisement

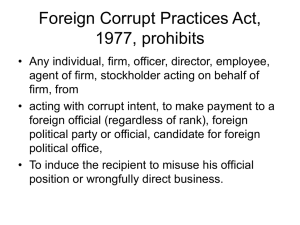

ACC Austin Roundtable FCPA Compliance & Enforcement: Assessing Market Access Risks in Global Business December 2013 Mark Rochon Matteson Ellis 1 FCPA ENFORCEMENT TRENDS 2 FCPA Notable Corporate Penalties 2013 Corporate penalties: Criminal and civil fines, disgorgement of profits, prejudgment interest, imposition of monitorship or reporting requirements – Total S.A. -- $398 million; 3 year monitorship – Weatherford -- $152 million (plus additional $100 million relating to sanctions); 18 month monitorship + 18 months self-reporting – Stryker (SEC only) -- $13.3 million disgorgement – Diebold -- $48 million combined penalties and disgorgement; 18 month monitorship 3 Significant Penalties Under the FCPA Largest FCPA Settlements (Combined Penalties/Disgorgement) $900 © Miller & Chevalier Chartered. Please do not reprint or reuse without permission. $800 $700 Millions $600 $500 $400 $300 $200 $100 $0 $149 M $152.6 M Jeffrey Tesler Weatherford (2011) (2013)* Amount in Millions $149 $153 $185 M Daimler (2010) $218.8 M JGC (2011) $338 M Technip (2010) $365 M Snamprogett i / ENI (2010) $398 M Total SA (2013) $400 M BAE (FCPArelated) (2010) $579 M Halliburton / KBR (2009) $185 $219 $338 $365 $398 $400 $579 $800 M Siemens (2008) $800 *Weatherford was assessed an additional $100 million in penalties relating to sanctions violations. 4 Prosecution of Individual Corporate Officials Overview of Enforcement Activity Involving Individuals 40 36 35 30 24 25 18 20 15 10 24 14 13 7 5 8 4 8 4 9 8 4 3 11 6 2 5 6 2 0 2007 2008 New individuals charged 2009 2010 2011 SEC enforcement actions 2012 2013 DOJ enforcement actions Note: Updated through October 2013. The column “new individuals charged” includes all such individuals, irrespective of whether they have resolved the charges. Individuals charged by both agencies are included in this column twice. These statistics include the guilty plea of James Giffen, although this technically did not involve an FCPA charge.. 5 FCPA ELEMENTS 6 Two Primary FCPA Elements Anti-Bribery Provisions Accounting Provisions – Books and Records Requirements – Internal Controls Requirements 7 FCPA Anti-Bribery Provisions: Elements of a Violation No issuer, domestic concern, person with sufficient U.S. nexus May corruptly Take any action in furtherance of a payment or a promise, offer, or authorization of a payment Of a bribe or anything of value Directly or indirectly (with “knowledge”) To a foreign official To obtain or retain business or improper advantage 8 Affirmative Defenses / Exception Local Law Defense: Payments permitted under the written laws and regulations of the host country Expenditures on Behalf of Foreign Officials: Payments must be bona fide, reasonable, AND directly related to the: – Promotion, demonstration, or explanation of products or services, or – Execution or performance of a contract with a foreign government or agency thereof Facilitating Payment Exception: Small payments to secure non-discretionary “routine governmental action” 9 FCPA Accounting Requirements Maintain books, records, and accounts that, in reasonable detail, accurately reflect transactions and the disposition of assets Maintain a system of internal accounting controls sufficient to reasonably assure that transactions are: – – Consistent with management authorizations Recorded so that financials can conform with GAAP Primarily civil/administrative penalties, but criminal for willful violations 10 NOTABLE CORPORATE RESOLUTIONS 11 Notable Corporate Resolutions What they tell us about... Voluntary Disclosure and Cooperation Third Party Risk Parent Liability Effective Anti-Corruption Compliance 12 Model of Benefits of Cooperation Ralph Lauren NPA April 2013 Ralph Lauren enters into NPAs with DOJ and SEC (first ever) – $1.6 million in combined penalties, interest, and disgorgement Allegation that GM and others in Argentina approved over $500,000 in payments to customs inspectors through broker/freight forwarder Agencies lauded RL disclosure and cooperation – Payments disclosed to agencies within 2 weeks of being discovered – SEC later cited “exemplary cooperation” including providing English translations of documents – Discovery triggered global review of operations confirming Argentina was “isolated incident” 13 Parent Liability Weatherford DOJ brought single count criminal information alleging criminal violation of Internal Controls provisions of FCPA – DOJ: “The company failed to implement these internal controls despite operating in an industry with a substantial corruption risk profile, and despite growing its global footprint in large part by purchasing existing companies, often themselves in countries with high corruption risks.” Corrupt conduct of subsidiaries included: – Phony JV with partners in Africa controlled by officials – Sham consulting payments to fund payments to African official with power to renew contract – Improper “volume discounts” to supplier in Middle East, used to create slush fund to bribe officials at NOC – Oil for Food kickbacks $152.6 million in penalties, interest and disgorgement (additional $100 million in fines relating to sanctions violations) 14 Diverse FCPA Risks Stryker Corp. Investigation began in 2007 as part of DOJ/SEC industry sweep. Stryker subsidiaries in Argentina, Greece, Mexico, Poland, and Romania allegedly made approx. $2.2M in illicit payments. – Payments channeled through 3rd parties and reportedly generated $7.5M in illicit profits. – Recorded as legitimate expenses (e.g., consulting, services, travel, charitable donations). Highlights broad range of risks under FCPA, including: – Diverse 3rd parties. Bribes in Mexico allegedly channeled through fees to local law firm. – Charitable donations. Donation to fund lab at public university in Greece allegedly a quid pro quo in exchange for an HCP’s promise to direct business to Stryker. – Sponsorships/travel. Stryker allegedly provided unjustified travel and accommodations to officials in several countries under guise of legitimate sponsorship / promotional efforts. In settling with SEC, Stryker agreed to penalty/disgorgement of nearly $13.3M. DOJ reportedly advised Stryker that it had closed its investigation. Despite DOJ declination and (relatively) modest SEC amount, Stryker reported to have spent $75 million on internal investigation 15 KEY TAKEAWAYS 16 How companies get in trouble... Access to markets Crossing the border with goods or people Getting the business Getting out of trouble 17 It’s not just about the U.S. anymore... U.K. Bribery Act of 2010 Developments in Latin America, Canada, Europe Very local risk 18 Contact Information Mark Rochon (202) 626-5819 mrochon@milchev.com Matteson Ellis (202) 626-1477 mellis@milchev.com 19