T1-1 Why Study Financial Markets

advertisement

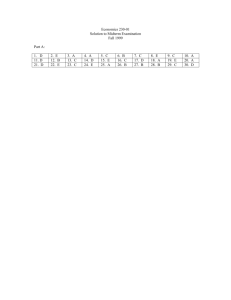

THE RISK AND TERM STRUCTURE OF INTEREST RATES • Risk Structure of Interest Rates •Default risk •Liquidity •Income Tax Consideration • Term Structure of Interest Rates •Pure Expectation Theory •Market Segmentation Theory •Liquidity Premium Theory Risk and Term Structure of Interest Rates -- Fin 331 1 Risk Structure of Long Bonds in the US Risk and Term Structure of Interest Rates -- Fin 331 2 Puzzling Phenomenon 1. Riskfree bonds have a lower return than risky bonds 2. High risk bonds have a higher return than low risk bonds 3. Municipal bonds have a lower return than US Government long term bonds Risk and Term Structure of Interest Rates -- Fin 331 3 Increasing Default Risk on Corporate Bonds Risk and Term Structure of Interest Rates -- Fin 331 4 Bond Ratings Risk and Term Structure of Interest Rates -- Fin 331 5 Decrease in Liquidity of Corporate Bonds Risk and Term Structure of Interest Rates -- Fin 331 6 Why bonds have different liquidity • US Treasury bonds are the most liquid because they are widely traded • Corporate bond are less liquid because fewer bonds are traded and it’s costly to sell bonds in an emergency Risk and Term Structure of Interest Rates -- Fin 331 7 Tax Advantages of Municipal Bonds Risk and Term Structure of Interest Rates -- Fin 331 8 Term Structure Facts to Be Explained 1. Interest rates for different maturities move together 2. Yield curves tend to have steep upward slope when short rates are low and downward slope when short rates are high 3. Yield curve is typically upward sloping Risk and Term Structure of Interest Rates -- Fin 331 9 Interest rate maturities Risk and Term Structure of Interest Rates -- Fin 331 10 Three Theories of Term Structure 1. Pure Expectations Theory 2. Market Segmentation Theory 3. Liquidity Premium Theory A. Pure Expectations Theory explains 1 and 2, but not 3. B. Market Segmentation Theory explains 3, but not 1 and 2 C. Solution: Combine features of both Pure Expectations Theory and Market Segmentation Theory to get Liquidity Premium Theory and explain all facts Risk and Term Structure of Interest Rates -- Fin 331 11 Interest Rates on Different Maturity Bonds Move Together Risk and Term Structure of Interest Rates -- Fin 331 12 Yield Curves Risk and Term Structure of Interest Rates -- Fin 331 13 Pure Expectations Theory Key Assumption: Bonds of different maturities are perfect substitutes Implication: RETe on bonds of different maturities are equal Investment strategies for two-period horizon 1. Buy $1 of one-year bond and when matures buy another one-year bond 2. Buy $1 of two-year bond and hold it Risk and Term Structure of Interest Rates -- Fin 331 14 Pure Expectations Theory it i i 2t 2 e t 1 See definitions on page 131 Risk and Term Structure of Interest Rates -- Fin 331 15 More generally for n-period bond: i t i 1 i 2 ... i n 1 i nt n In words: Interest rate on long bond = average of short rates expected to occur over life of long bond Risk and Term Structure of Interest Rates -- Fin 331 16 More generally for n-period bond: Numerical example: One-year interest rate over the next five years 5%, 6%, 7%, 8% and 9%, Interest rate on two-year bond: Interest rate for five-year bond: Interest rate for one to five year bonds: Risk and Term Structure of Interest Rates -- Fin 331 17 Another example (on future short-term rate): The interest rates for 1-year through 5-year bonds are 5%, 6%, 7%, 8% and 9%, Expected interest rate of a 1-year bond in year 2: Expected interest rate of a 1-year bond in years 3, 4, and 5 Risk and Term Structure of Interest Rates -- Fin 331 18 Pure Expectations Theory and Term Structure Facts Explains why yield curve has different slopes: 1. When short rates expected to rise in future, average of future short rates = int is above today's short rate: therefore yield curve is upward sloping 2. When short rates expected to stay same in future, average of future short rates same as today's, and yield curve is flat 3. Only when short rates expected to fall will yield curve be downward sloping Risk and Term Structure of Interest Rates -- Fin 331 19 Pure Expectations Theory and Term Structure Facts Pure Expectations Theory explains Fact 1 that short and long rates move together 1. Short rate rises are persistent 2. If it today, iet+1, iet+2 etc. average of future rates int 3.Therefore: it int , i.e., short and long rates move together Risk and Term Structure of Interest Rates -- Fin 331 20 Pure Expectations Theory and Term Structure Facts Explains Fact 2 that yield curves tend to have steep slope when short rates are low and downward slope when short rates are high 1. When short rates are low, they are expected to rise to normal level, and long rate = average of future short rates will be well above today's short rate: yield curve will have steep upward slope 2. When short rates are high, they will be expected to fall in future, and long rate will be below current short rate: yield curve will have downward slope Risk and Term Structure of Interest Rates -- Fin 331 21 Pure Expectations Theory and Term Structure Facts Doesn't explain Fact 3 that yield curve usually has upward slope Short rates as likely to fall in future as rise, so average of expected future short rates will not usually be higher than current short rate: therefore, yield curve will not usually slope upward Risk and Term Structure of Interest Rates -- Fin 331 22 Market Segmentation Theory Key Assumption: Bonds of different maturities are not substitutes at all Implication: Markets are completely segmented: interest rate at each maturity determined separately Explains Fact 3 that yield curve is usually upward sloping People typically prefer short holding periods and thus have higher demand for short-term bonds, which have higher prices and lower interest rates than long bonds Does not explain Fact 1 or Fact 2 because assumes long and short rates determined independently Risk and Term Structure of Interest Rates -- Fin 331 23 Liquidity Premium Theory Key Assumption: Bonds of different maturities are substitutes, but are not perfect substitutes Implication: Modifies Pure Expectations Theory with features of Market Segmentation Theory Investors prefer short rather than long bonds must be paid positive liquidity premium, lnt, to hold long term bonds Risk and Term Structure of Interest Rates -- Fin 331 24 Liquidity Premium Theory Results in following modification of Pure Expectations Theory i nt l nt it i e t 1 i e t 2 ... i e t n 1 n Risk and Term Structure of Interest Rates -- Fin 331 25 Relationship Between the Liquidity Premium and Pure Expectations Theory Risk and Term Structure of Interest Rates -- Fin 331 26 Liquidity Premium Theory: Explains all 3 Facts Explains Fact 3 of usual upward sloped yield curve by liquidity premium for long-term bonds Explains Fact 1 and Fact 2 using same explanations as pure expectations theory because it has average of future short rates as determinant of long rate Risk and Term Structure of Interest Rates -- Fin 331 27 Numerical Example: 1. One-year interest rate over the next five years:5%, 6%, 7%, 8% and 9% 2. Investors' preferences for holding short-term bonds so liquidity premium for one to five-year bonds: 0%, 0.25%, 0.5%, 0.75% and 1.0%. Risk and Term Structure of Interest Rates -- Fin 331 28 Numerical Example: Interest rate on the two-year bond: Interest rate on the five-year bond: Interest rates on one to five-year bonds: Comparing with those for the pure expectations theory, liquidity premium theory produces yield curves more steeply upward sloped Risk and Term Structure of Interest Rates -- Fin 331 29 Calculate future short term rate 1. Interest rates for one- to five-year bonds are:5%, 6%, 7%, 8% and 9% 2. Investors' preferences for holding short-term bonds so liquidity premium for one to five-year bonds: 0%, 0.25%, 0.5%, 0.75% and 1.0%. 3. Calculate 1-year short-term rate over the next five years. Risk and Term Structure of Interest Rates -- Fin 331 30 Market Predictions of Future Short Rates Risk and Term Structure of Interest Rates -- Fin 331 31 Forward Rate The expected future short-term rate is also known as forward rate, as opposed to the current short-term rate, known as the spot rate. Two ways to compute forward rates: (1) Using the formula covered in the class (2) Formula in the text book (page 123-126, not required) Risk and Term Structure of Interest Rates -- Fin 331 32