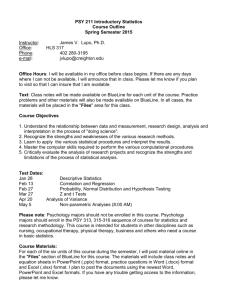

eBricks_com - Tony Gauvin's Web Site

advertisement

1-1 internet business models text and cases eBricks.com Donatas Sumyla © 2005 UMFK. 1-2 Content • • • • • • • Overview of the company; Goals & strategies; eBricks.com; Construction industry; Blueline Online Inc.; GBF; Success or Failure? © 2005 UMFK. 1-3 Overview of the Company • Was started in November of 1998; • 5 co-founders: – – – – – Tawfik Hammoud; Jorge Henriquez; Nikitas Koutoupes; Enrique Macotela; Tim Perini; • All second-year students in Harvard Business School’s MBA program. © 2005 UMFK. 1-4 Overview of the Company • eBricks.com was an online market maker facilitating the procurement of construction materials; • Company’s business plan had been honored as one of four finalists among over 80 entrants in the HBS Business Plan Competition; • In July 1999, eBricks.com had secured its first round of VC, raising $3M from Warburg Pincus Ventures, StarMedia, Covad, and Intuit; • By November 1999, eBricks.com had 25 employees; • Planned launching the website during the first quarter of 2000, initially focusing on customers based in the Northeast region and on the electrical and mechanical segments of the construction industry. © 2005 UMFK. 1-5 Overview of the Company • Management team had extensive construction and IT industry experience: – Tim Perini – Co-Founder, CEO, Perini Corporation, Kaiser, Harvard College, HBS; – Steve Fan – CTO, McGraw-Hill CIG, Sweets, Digital, Lockheed; – James Chou – VP Engineering, Andersen Consulting, JP Morgan, Apple Computers; – Ali Mohamedi – VP Operations, Lehrer McGovern Bovis, JA Jones; – Enrique Macotela – Co-Founder, VP Product Development , Liwerant, – – – Macotela, Serrano Architects and Contractors, HBS; George Henriquez – Co-Founder, VP Sales and Marketing, Groupo Acerero del Norte, Autrey, Agromex, HBS; Tawfik Hammoud - Co-Founder, VP Strategy, Bain & Company, Bain Capital, HBS; Nikitas Koutoupes – Co-Founder, CFO, McKinsey & Company, Princeton University, HBS; © 2005 UMFK. 1-6 Advisory board • Construction: – Dan P.Armstrong – Director, Worldwide Procurement, Raytheon Engineers and Constructors; – Thomas E. Daily – frm. National President, Association of General Contractors; Vice Chairman, National Construction Employers Council; – James Becker – President and CEO, Beacon-Skanska; – Lorenzo Enaudi – Chairman, Techint Foundation; – Tony Mon – Chairman, Maywood Investment Company; Co-Founder, Vice Chairman, Pacific Greystone; – David Perini – Chairman Emeritus, Perini Corporation; © 2005 UMFK. 1-7 Advisory board • Business: – Kevin Clark – CEO, ScreamingMedia.net, frm Chairman and CEO, Poppe Tyson, Chairman, KMC Holdings; – Tom Eisenmann – Professor, HBS, frm. Partner, McKinsey & Company; (author of our book!!!) – Ananth Raman – Professor, HBS, supply chain management expert; – Donald P. Madden – Senior Partner, White & Case, LLP; © 2005 UMFK. 1-8 Investors • Warburg Pincus Ventures: – $12B assets under management; – 300 investments across diverse industries since 1971; – 66 professionals, 35 partners; – Chemdex, StarMedia, BEA Systems, Cobalt Group, Covad, Intuit, Radnet, TradeCard, Veritas Software, Workspace; – $500M in fees to Wall Street annually; © 2005 UMFK. 1-9 Goals & Strategies • Goals: – To be a B2B market maker that will leverage the Internet to provide the construction supplies industry with an outstanding and costcompetitive way to carry out procurement transactions. © 2005 UMFK. 1-10 Goals & Strategies • Strategies: – Focus on product flow; – Create extranets for subcontractors and their exiting suppliers; – Connect manufacturers to distributors and subs; – Combine the two into seamless exchange; – Construction portal end-vision through partnerships; © 2005 UMFK. 1-11 Goals & Strategies eBricks.com faced 2 major strategic issues: 1. Merger proposal from Blueline Online Inc. (Internet company that provided project management tools for architects and contractors); 2. Faced a fundamental decision about where in the construction industry value chain to compete; © 2005 UMFK. 1-12 eBricks.com • Procurement process: 1. Pre-bid estimation/Buyout: – 2. Bidding: – 3. Reduce procurement cost, negotiation time; better prices; access to more customers; Delivery/Payment: – 5. Obtain prices for more products – more accurate bids and lead time cut by 30% - 50%; Post-bid Procureme Buyout: – 4. Reduce estimation cost by 20-25%; reduce estimation time from average of 3 weeks to 1-2 days; Control over information, money and product flow; guarantee payments to suppliers; Resale: – Access to more buyers of resale materials and equipment; © 2005 UMFK. 1-13 eBricks.com • Services – the ABC approach: – Auctions: – – Bidding: – – One-stop shop for product information and ordering; Content: – – Real-time dynamic pricing exchange; Catalog: – – Promotions, liquidations; Resale; News, events, directories, product information, product specifications; Community: – Customizable space with secure e-mail and live chat technology for information exchange; © 2005 UMFK. 1-14 eBricks.com • Financial highlights: – Projections: • • • • Financing needs of $15-$20M in second round; Round to be closed by January 30, 2000; Cash positive by 2001; Profitable by 2001; – Strategy: • Invite investors bringing more than cash; • Option for mezzanine 2nd round; • Complete 2nd round concurrently with launch of bidding capabilities; – Key Sensitivities: • • • • • Pricing strategy; Time-to-market; Customer adoption pace; Sales expenditures; Technology investment; © 2005 UMFK. 1-15 Issues with Construction business • Large construction projects - enormous volume of blueprints, technical plans, non-stop flow of messages about design and schedule changes between architects, engineering firms, contractors, etc.; • Managing this information - time consuming and error-prone task; • Failure to accurately send or receive this kind of info was expensive and time consuming; • Online project management companies like Blueline Online were there to help; © 2005 UMFK. 1-16 Blueline Online Inc. • Founded in 1997, based in Palo Alto, was one of several firms pursuing the market for web-based construction project management solutions; • Engineering giant Bechtel – equity investor and largest customer; • In late 1999 the company had 100 employees; • $10M venture capital; was in midst of raising another $30-40M, which would help them merge with eBricks.com; • Competitors: Bidcom and buzzsaw.com; © 2005 UMFK. 1-17 Some of the biggest questions • Should it merge with Blueline Online? – If it did, would it be more difficult to capture procurement transactions from contractors that used project management tools from Bidcom or buzzsaw.com? – If it didn’t, how would it fare in competition against Bidcom, buzzsaw.com and Blueline? – If it did, what share of the equity in the combined entity should eBricks.com’s shareholders receive? © 2005 UMFK. 1-18 Where to compete? • Need for an online market maker positioned between distributors and the manufacturers who supplied them with materials; • eBricks.com’s managers were intrigued: – Should they pursue this market in addition to, or perhaps instead of, the downstream market? • The programming work required to create an online catalog for the downstream market might be leveraged in creating an online market upstream; • Would distributors accept the same company as both a downstream and upstream market maker? • Could a startup with twenty-five employees conceivably target both the downstream and upstream opportunities? © 2005 UMFK. 1-19 GBF • Network effect: – Strong; – More buyers, more sellers – more products, better prices, etc. • Economies of scale: – Significant; – Site development costs are fixed; – Direct selling and system integration costs vary with number of market participants (but not with volume) • Customer retention rates – High CR rates because the network effect is strong; – Database development and interface design; © 2005 UMFK. 1-20 Success or Failure? • I think success. Reasons: – Important VCs; – Huge amount of experienced members in management and advisory teams; – Focused on a certain region, not the whole US; – Management’s experience in construction and IT industries; – Business plan; © 2005 UMFK. 1-21 Latest update • In January 2000, Palo Alto’s Blueline Online Inc. and eBricks merged to form a new company called Cephren. It was backed with $41.5M from a unit of GE Capital, Goldman Sachs & Co. and the Bechtel Group; • In October 2000, Cephren Inc. and Bidcom Inc. confirmed that they were merging and formed a new company called Citadon; © 2005 UMFK. 1-22 Citadon, Inc. • Provides project management, document management, and business process management software and services for the online design, construction, and operation of complex projects, such as dams and public transit projects. The company targets clients in the construction, oil and gas, energy, transportation, drug discovery, legal, and government sectors, among others. Customers include Alcoa, Bechtel, and Halliburton. Citadon counts Insight Venture Partners and Warburg Pincus among its investors. © 2005 UMFK. 1-23 Citadon, Inc. • Citadon’s application services are currently being used in more than 30 countries, by more than 30,000 active users on projects with construction values in excess of $120 billion; © 2005 UMFK. 1-24 Questions??? © 2005 UMFK.