Chapter 3 Hooley

advertisement

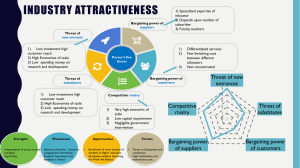

Marketing Strategy MKT 460 Chapter 3 Environmental Analysis Taufique Hossain Learning Objectives To define the marketing environment and discuss the relevant types of market information that are required for market scanning and analysis. To review the analytical models and frameworks that can be used in the analysis stage. Environment Macro-environment Social, political, economic, technological contexts Competitive environment Company, immediate competitors, customers Internal environment Resources, capabilities PEST Analysis of the Macro-Environment Economic Social Political Technological Legal The Economic and Political Environment Economic growth rates and the business cycle Interest rates, consumer and business confidence Taxation and fiscal policy Regional trade and trading areas Employment and unemployment National and supranational governments Internationalisation and globalisation The Social and Cultural Environment Demographic Change The Grey Market Multi-ethnic societies The Youth Market Changing life-styles and living patterns Technological Environment Technological changes impact every industry Shortening of commercialization times Short product life cycles Impact of internet Legal Environment Laws, regulations and codes of practice emanating from national governments, EU, local governments, statutory bodies, trade associations etc. New Strategies for Changing Environments Global positioning The master brand The integrated enterprise and end user focus Best in class processes Mass customization Breakthrough technology The Shift in Strategy for Delivering Shareholder Value Focus on core competencies The new strategic imperative Domestic focus Global focus Portfolio approaches Analysis of the Competitive Environment Porter’s five forces model Strategic groups Industry evolution and forecasting Environmental stability Five Forces Driving Competition Threat of new entrants Rivalry among existing firms in the industry Bargaining power of buyers Threat of substitutes Source: Adapted from Porter (1986, 1988) Rivalry Among Existing Firms Competitors are roughly evenly balanced Low market growth Exit barriers are high Product differentiation is low Fixed costs are relatively high Threat of Market Entry Costs of entry are low Existing or new distribution channels are open to use Little competitive retaliation is anticipated Differentiation is low There are gaps in the market Threat of Substitutes Making existing technologies redundant Incremental product improvement Bargaining Power of Suppliers Suppliers are more concentrated than buyers Costs of switching suppliers are high Suppliers’ offerings are highly differentiated Bargaining Power of Buyers More concentrated than sellers Alternative supply sources are readily available Buyer switching costs are low Strategic Groups Firms within an industry following similar strategies aimed at similar customers or customer groups E.g. Coca cola and Pepsi Map of Strategic Groups in the US Automobile Market Broad line The Faded Champions The Big Three GM, Ford, Chrysler VW Audi, Rover Group The Samurai Toyota, Nissan, Honda, Mazda Degree of Specialisation Luxury cars Mercedes, BMW, Volvo*, Saab* Jaguar* Specialists Narrow line Rolls-Royce*, Ferrari*, Aston Martin*, Lamborghini*, Lotus*, Morgan, McLaren High Low Local Content (*brands now owned by large-scale American or European manufacturers) Industry Evolution Reading Hooley et al. Chapters 3 and 6. Day and Schoemaker (2005), ‘Scanning the Periphery’, Harvard Business Review, 83, 11, pp. 135-148. Kangis and O’Reilly (2003), ‘Strategies in a Dynamic Marketplace: A Case Study in the Airline Industry’, Journal of Business Research, 56, pp. 105-111.