FIN 335 Summer 2014 Test 1

advertisement

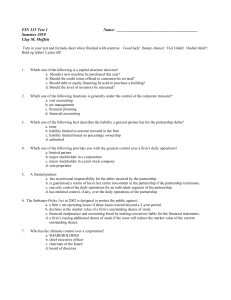

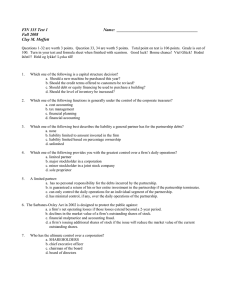

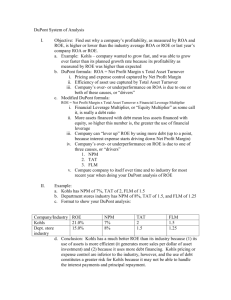

FIN 335 Test 1 Summer 2011 Clay M. Moffett Name: _______________________________________ Turn in your test and formula sheet when finished with scantron. Good luck! Bonne chance! Viel Glück! Hodně štěstí!! Held og lykke! Lycka till! 1. Which one of the following is a capital structure decision? a. Should a new machine be purchased this year? b. Should the credit terms offered to customers be revised? c. Should debt or equity financing be used to purchase a building? d. Should the level of inventory be increased? 2. Which one of the following functions is generally under the control of the corporate treasurer? a. cost accounting b. tax management c. financial/cash planning d. financial accounting 3. Which one of the following best describes the liability a general partner has for the partnership debts? a. none b. liability limited to amount invested in the firm c. liability limited based on percentage ownership d. unlimited 4. Which one of the following provides you with the greatest control over a firm’s daily operations? a. limited partner b. major stockholder in a corporation c. minor stockholder in a joint stock company d. sole proprietor 5. All stocks that trade on the New York Stock Exchange are: a. over-the-counter securities. b. Primary market securities c. AMEX securities d. Listed securities e. Privately placed securities 6. Which of the following statements regarding agency problems and costs are correct? a) An agency problem exists when there is a conflict of interest between the stockholders and the shareholders of a firm. b) An agency problem exists when there is a conflict of interest between a principal and an agency of the Federal government. c) An agency cost occurs when firm management avoids risky projects that would favorably affect the stock price because the managers are worried about keeping their jobs. d) An agency cost occurs when management chooses an action that benefits the shareholders but reduces management compensation. e) None of the above. 7. 8. An asset that can be converted into cash quickly by greatly reducing the selling price is: a. Marketable but not liquid b. Liquid and marketable, c. Liquid but not marketable d. Liquid only e. none of the above Which one of the following is a primary market transaction? a. Theo, the president of ABC, sells some of his shares in ABC on the NYSE b. ABC offers newly issued shares to the general public c. Tom instructs his broker to sell all of his shares in ABC, Inc. d. Mary gifts shares of ABC stock to her son Use these financial statements to answer questions 9 through 13. Balance Sheet 2007 2008 Cash $1,700 $1,600 Accounts receivable 14,300 17,400 Inventory 22,500 23,700 Net fixed assets 82,900 81,600 Total assets $121,400 $124,300 2007 Accounts payable $13,800 Long-term debt 47,500 Common stock 17,000 Retained earnings 43,100 Total liabilities and equity $121,400 Income Statement Net Sales $163,700 Costs 108,200 Depreciation 14,100 EBIT 41,400 Interest 3,800 Taxable income 37,600 Taxes 13,200 Net Income $ 24,400 9. 10 What is the amount of the operating cash flow? a. $24,400 b. $30,500 c. $38,500 What is the cash flow to stockholders for 2008? a. $5,000 b. $19,400 c. $21,700 11. What is the net new borrowing for 2008? a. -$2,700 b. $200 c. $1,100 d. $42,300 d. $29,400 d. $4,900 12. What is the change in net working capital for 2008? a. $5,100 b. $6,300 c. $24,700 d. $25,200 13. What is the cash flow to creditors for 2008? a. -$2,700 b. -$1,100 c. $1,100 d. $2,700 2008 $12,900 48,600 22,000 40,800 $124,300 14. A firm currently has an average tax rate of 20 percent and a marginal tax rate of 25 percent based on its current taxable income of $36,600. What will the firm’s average tax rate be if it increases its taxable income by $1,100? a. 20 percent b. 20.05 percent c. 20.09 percent d. 20.15 percent 15. Redding Industrial Supply had common stock of $6,800 and retained earnings of $4,925 at the beginning of the year. At the end of the year, the common stock balance is $7,000 and the retained earnings account balance is $5,498. The net income for the year is $938. What is the retention ratio? a. 17.59 percent b. 38.91 percent c. 61.09 percent d. 82.41 percent 16. Ann is interested in purchasing Ted's factory. Since Ann is a poor negotiator, she hires Mary to negotiate a purchase price. Identify the parties to this transaction. a. Mary is the principal and Ann is the agent. b. Ted is the principal and Ann is the agent. c. Ted is the agent and Ann is the principal. d. Ann is the principal and Mary is the agent. 17. If a firm uses cash to purchase inventory, its quick ratio will increase. a. True b. False 18. Use the following tax table to answer this question. Taxable Income $0-50,000 $50,001-75,000 $75,001-100,000 $100,001-335,000 Tax Rate 15% 25% 34% 39% Pools, Inc., has taxable income of $77,000 for the year. Which one of the following statements is correct concerning Pools' tax situation? a. Pools' average tax rate is 18.74 percent. b. Pools' average tax rate is 34.00 percent. c. Pools' marginal tax rate is 15.00 percent. d. Pools' marginal tax rate is 18.74 percent. 19. You currently have $7,200 in your investment account. You can earn an average rate of return of 11.7 percent per year. How long will you have to wait until your account is worth $50,000? a. 9.47 years b. 11.28 years c. 14.67 years d. 17.51 years 20. Your savings account is currently worth $1,200. The account pays 4.5 percent interest compounded annually. How much will your account be worth 6 years from now? a. $1,524.00 b. $1,562.71 c. $1,611.18 d. $1,627.19 21. You purchased a new 1972 Plymouth Barracuda Ragtop with a 426-Hemi 36 years ago at a cost of $3,900. You took care of this car, realizing its divine nature. Today in 2010, you sold that car for $1,750,000 in order to afford tuition and meals and buy a little gas for your moped. What annual rate of return did you earn on this vehicle? a. 1.42 percent b. 18.48 percent c. 8.48 percent d. 8.38 percent 22. The corporate officer responsible for the accounting function is the ___________? a. Treasurer b. Controller c. Grand Poohbah d. Marketing dude. 23. The cost of capital for a firm… a. should approximate 0. b. equals the interest rate c. rate demanded by the market on shares d. is irrelevant 24. Over the past 30 years your parents saved money each month for their retirement. They retired this week and expect to live another 28 years. Their investment account is currently valued at $487,300 and is expected to earn 7 percent annually in the future. How much money can they withdraw annually if they wish to spend all of their money during their lifetime? a. $5,158.75 b. $6,038.59 c. $39,269.75 d. $40,149.59 25. Suzie has $16,000 in her investment account today. She saves $500 a quarter and earns 8 percent interest, compounded quarterly. How much money will she have in her account three years from now? a. $16,821.87 b. $18,509.53 c. $22,300.16 d. $26,997.91 26. Tom invested $150 at the beginning of each month for the last 14 years and earned 6 percent interest, compounded monthly. Julia invested $300 at the end of each month for the past 7 years and earned 6 percent interest, compounded monthly. Today, Tom has ______ than Julia. a. $8,164.15 less b. $8,320.26 less c. $8,164.15 more d. $8,320.26 more 27. A series of equal cash flows that occur at the beginning of each time period for a limited number of time periods is called a(n): a. ordinary annuity. b. beginning annuity. c. annuity due. d. perpetuity. e. perpetuity due. 28. In Canada and the United Kingdom, a perpetuity is also called a(n): a. consul. b. infinite bond. c. infinity flow. d. dowry. e. forever bond. 29. Suppose KLM, Inc., just received a patent on a new anti-cholesterol drug. This patent is an: a. intangible fixed asset. b. Can be depreciated c. Is a R&D Liability d. Is worthless to me b/c I use Metamucil e. This answer shouldn’t be selected. 30. Which one of the following is a breakdown of the ROE into its three component parts? a. equity analysis b. efficiency breakout c. Du Pont identity d. sustainable growth e. profitability ratios 32. Suppose given NI= $132,186, Sales = $2,678,461, TA = $784,596 and Debt/Asset = 0.48062. Calc ROE. a. 32.44 b. 44.32 c. nope d. not this one either. 33. Depreciation: a. allocates the expense incurred by use of a new asset based on it’s market value b. Was invented by Pee Wee Herman c. Affects the liquidity ratio d. is a type of humble humor in Finance e. is mythical Formula Sheet. Cash Flow From Assets = Operating Cash Flow – Net Capital Spending – Changes in NWC ROE = PM * AT * EM Internal Growth Rate t = ln(FV / PV) / ln(1 + r) ROA b 1 - ROA b Sustainabl e Growth Rate r = (FV / PV)1/t – 1 ROE b 1 - ROE b FIN 335 Test 1 Summer 2014 Answer Sheet 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A A B B B B B B B B B B B B B B B B B B B B B B B B B B B B B B B B B Name: _______________________________________ C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C D D D D D D D D D D D D D D D D D D D D D D D D D D D D D D D D D E E E E E E E E E E E E E E E E E E E E E E E E E E E E E E E E E Answer Sheet: 1. c 2. c 3. d 4. d 5. d 6. e 7. a 8. b 9. d 10. c 11. c 12. a 13. d 14. d 15. c 16. d 17. b 18. a 19. d Operating cash flow $41,400 + $14,100 − $13,200 = $42,300 Dividends paid = $24,400 − ($40,800 − $43,100) = $26,700 Cash flow to stockholders = $26,700 − ($22,000 − $17,000) = $21,700 Net new borrowing = $48,600 − $47,500 = $1,100 Change in net working capital = ($1,600 + $17,400 + $23,700 − $12,900) − ($1,700 + $14,300 + $22,500 − $13,800) = $5,100 Cash flow to creditors = $3,800 − ($48,600 − $47,500) = $2,700 Average tax = [($36,600 × .20) + ($1,100 × .25)] / ($36,600 + $1,100) = 20.15 percent Retention ratio = ($5,498 − $4,925) / $938 = .61087 = 61.09 percent $50,000 = $7,200 × (1 + .117)t 6.94444 = 1.117t ln6.94444= t × ln1.117 1.93794 = .11065t t = 17.51 Enter N Solve for 20.. b 11.7 I/Y -7,200 PV PMT 4.5 I/Y -1,200 PV PMT 50,000 FV 17.51 FV = $1,200 × (1 + .045)6 FV = $1,562.71 Enter 6 N Solve for FV 1,562.71 21. b 22. b 23. c 24. d 1 1 / 1 .07 28 $487 ,300 x ; $487,300 = x 12.137111; APV = $40,149.59 .07 Enter 28 N 7 I/Y 487,300 PV 3×4 N 8/4 I/Y -16,000 PV Solve for 25. d Enter Solve for PMT FV 40,149.59 -500 PMT FV 26,997.91 26.. d .06 1412 1 1 12 1 .06 ; A FV = $150 × 263.616290; A FV = Tom: A dueFV $150 due due .06 12 12 $39,542.44 Enter 14×12 N 6/12 I/Y PV Solve for -150BGN PMT FV 39,542.44 .06 712 1 1 12 Julia: AFV $300 ; AFV = $300 × 104.073927; A FV = $31,222.18 .06 12 Enter 7×12 N 6/12 I/Y PV Solve for -300 PMT FV 31,222.18 Difference: $39,542.44 − $31,222.18 = $8,320.26; Tom has $8,320.26 more than Julia. 27. 28. 29. 30. 31. 32. c a a c c A/A – D/A = E/A =>> .51937. 1/(E/A) = A/E = 1.9254. Using the Du Pont identity to calculate ROE, we get: ROE = (Profit margin)(Total asset turnover)(Equity multiplier) ROE = (Net income / Sales)(Sales / Total assets)(Total asset / Total equity) ROE = ($132,186 / $2,678,461)($2,678,461 / $784,596)($784,596 / $407,490) ROE = 0.3244 or 32.44% 33. e