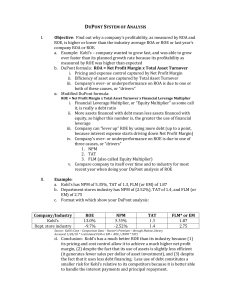

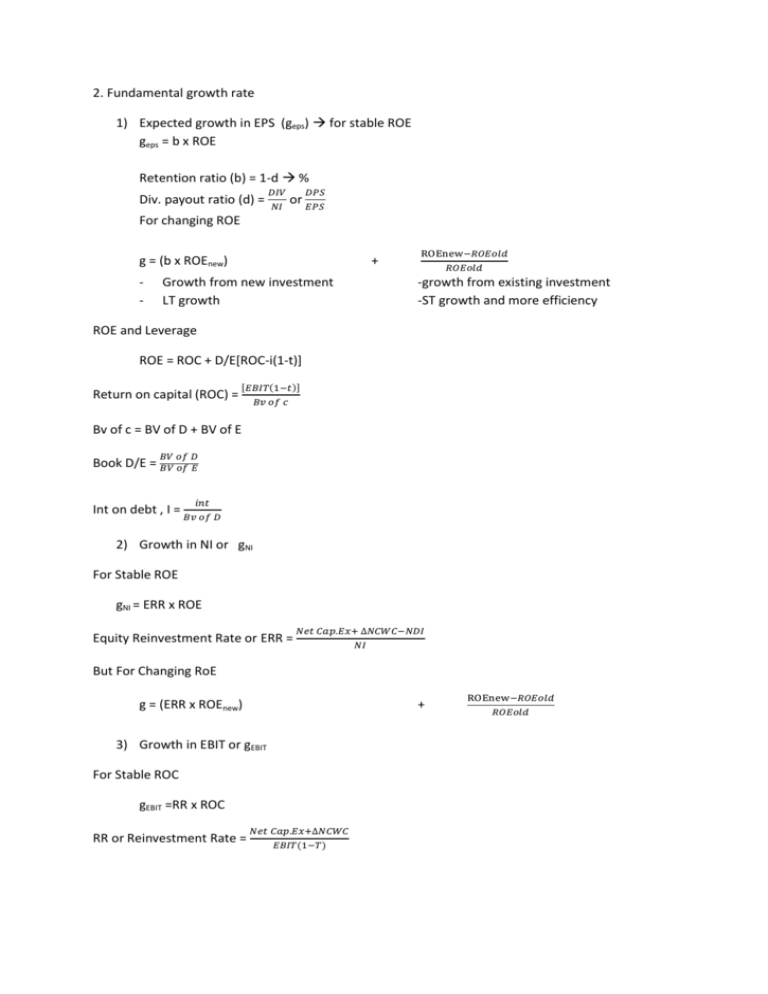

2. Fundamental growth rate 1) Expected growth in EPS (g eps

advertisement

2. Fundamental growth rate 1) Expected growth in EPS (geps) for stable ROE geps = b x ROE Retention ratio (b) = 1-d % Div. payout ratio (d) = or For changing ROE g = (b x ROEnew) - + Growth from new investment LT growth -growth from existing investment -ST growth and more efficiency ROE and Leverage ROE = ROC + D/E[ROC-i(1-t)] Return on capital (ROC) = [ ( )] Bv of c = BV of D + BV of E Book D/E = Int on debt , I = 2) Growth in NI or gNI For Stable ROE gNI = ERR x ROE Equity Reinvestment Rate or ERR = But For Changing RoE g = (ERR x ROEnew) + 3) Growth in EBIT or gEBIT For Stable ROC gEBIT =RR x ROC RR or Reinvestment Rate = ( ) But For Changing ROC g = (RR x ROCnew) + Choosing Models 1. CF to Equity=> use Div If is about 80% -110% use FCFE If For - Ve and Stable Leverage 2. CF to Firm=> use FCFF For – Vf and Changing Leverage Match CF with r 1.CF to Equity =>Ke CF to Firm=>WACC 2.US.CF =>US r Local CF => local r 3.Norminal CF => Nornimal r Real CF =>Real r Growth Pattern Model Stable Growth Model 2- stage 3-Stage Where : Ke=Rf+β(Rp) b=1-d where d= Terminal Valuen = Frim Large Large Small g Low, g<gecon or5% Moderate,g<gecon+10% High, g>gecon+10% Length of Period Since year0 5yrs 10yrs For Stable Growth Model g is stable since yr0 which is 5% use it to find terminal value where Ve= And Use DPS1 to Find Ve For 2-Stage Model Find g for high growth period by g=b x ROE (depend on what kind of g us use) Use that g for high growth period but use5 % for stable growth period which is after yr5 to find next CF or DPS Ke for each period also different And finally use DPS6,Ke and g in stable period to find terminal value Discount each CF or dps with each of its Ke For 3-Stage Model Do just the same as 2-Stage model but there are Transition period between high and stable growth section. All Variable such as Ke g d b are changed over time. You have to calculate the change of each by use this , change/yr= . Then you use chang/yr adjust year by year until the last year to stable growth session. To check whether you done it correctly the last adjustment will be perfectly equal to stable growth session. For example yr5, g is 10% and yr10 is5%, decrease by 1%then yr6 is 9, yr7 is 8, yr8 is 7, yr9 is 6 and last decreament, answer is perfectly equal to stable growth session which is 5% TeeHee. Thank you for you kindness, have a great time during you preparation for your exam. See you next term in different subject. jubjub ik