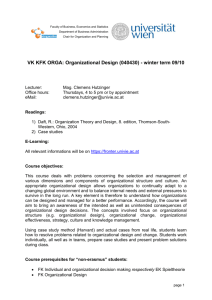

Jersey Expert Funds - The Guernsey Investment Fund Association

advertisement

FRS 23, 25, 26 and all that ! John Clacy 19th October 2006 ©2005 Deloitte & Touche. Private and Confidential Agenda • How are your funds effected? • So what? - Valuation of portfolios - Functional currencies - Transactional costs - Accounting for shareholders equity - Cashflow vs. FV hedge - Effective interest rate accounting - Segmental report - Other points • Questions ©2005 Deloitte & Touche. Private and Confidential How are investment funds impacted by IFRS/FRS 23, 25&26? Most are affected in some way… • IFRS v Non IFRS – Various considerations but….. • UK GAAP convergence Listed FRS 23, 25&26 (IAS 32/39) Not Listed FRS 25 (IAS 32) • EU incorporated, listed funds with subsidiaries - as listed groups, need to adopt IFRS directly as a consolidated group under EU law for accounting periods commencing on or after 1 January 2005. • EU Listed single company funds (i.e. NOT CISX) - as listed companies, need to adopt FRS 23 (IAS 21) FRS 25 (IAS 32) and FRS 26 (IAS 39) as converged UK GAAP for listed companies for accounting periods commencing on or after 1 January 2005. • Unit trusts/OEICs/Other funds - as unlisted entities, need to adopt FRS 25 (presentation) (IAS 32) from 1 January 2005. FRS 23, 25 (disclosure) and 26 does not, as currently drafted, appear to include unit trusts/OEICs/other funds within its scope. … albeit through different routes and different timescales. ©2005 Deloitte & Touche. Private and Confidential Valuation of portfolios (FRS 26/IAS39) Instrument classification Measurement Interest income using effective interest method Fair value changes Fair value through Fair Value profit and loss Required where interest income disclosed separately Yes – P&L Held to maturity Yes No Amortised cost Impairment test? FX ? No FX and investment in one line through P&L Yes No FX adjustment Loans and receivables Amortised cost Yes No Yes No FX adjustment Available for sale Fair value (except Yes where fair value cannot be determined) Yes-Equity Yes FX separately through P&L ©2005 Deloitte & Touche. Private and Confidential Valuation of portfolios (FRS 26/IAS 39) • Most seem minded to choose fair value through profit and loss account (“FVTPL”) as designation for investment portfolio. • Either held for trading or designate but need to hit further criteria including: “a group of financial assets, financial liabilities or both is managed and its performance is evaluated on a fair value basis, in accordance with a documented risk management or investment strategy, and information about the group is provided internally on that basis to the entity's key management personnel”. • Need to consider liabilities/gearing and their designation. • Fund administrators generally seem comfortable with move to bid pricing (or last trade in certain overseas markets). • If FVTPL is the designation, transaction costs must be expensed rather than capitalised. • Question of whether mark down to bid after purchase at offer is a “transaction cost” rather than unrealised loss? Consensus - not a transaction cost. • If AFS is selected as designation, foreign exchange and market movements must be separated. Foreign exchange movements go to the Profit & Loss/Income Statement • Cannot “alternate” account under FRS26, e.g. with profit policies. ©2005 Deloitte & Touche. Private and Confidential Retail funds - Valuation of portfolios (continued) Derivatives raise their head too … • Geared funds with interest rate swaps will need to FV on balance sheet and take movements to P&L unless steps to designate, document and measure effectiveness are implemented. (i.e. hedge accounting). • Certain instruments may be considered “embedded derivatives” (e.g. index linked loan stock), and require debt and equity components to be split and measured separately, with equity portion FV. … these are just highlights ©2005 Deloitte & Touche. Private and Confidential Functional currencies New concept – possible difference between functional (in which you record transactions) and presentational currency (in which you present financial statements) • IAS 21 sets out requirements. UK GAAP has converged (only where entities are applying FRS 26 (FRS 23)). • Series of indicators to be considered when determining functional currency. • Where indicators are mixed, directors judgement required to determine appropriate functional currency. • However, guidance in place in terms of appropriate priority to be given to different indicators, means it is not a free choice. … some funds may need to change functional currency. ©2005 Deloitte & Touche. Private and Confidential Functional currencies Exchange gains and losses • Exchange differences between functional and other currency taken to profit and loss account. Exchange differences between functional and presentational currency – if different – taken to equity. Series of indicators to be considered when determining functional currency • Primary economic environment of operations in which it generates & expends cash. • Currency in which financing activities are denominated (debt and equity issues). • Currency in which receipts from operating activities are usually retained. e.g. Fund, equity and gearing in sterling, but all investments in Japanese Yen … indicators mixed - argument that Yen is the functional currency, but fund may choose to present results in sterling. … case-by-case consideration required. TALK TO YOUR AUDITORS ©2005 Deloitte & Touche. Private and Confidential Transaction costs The standard says: “Transaction costs are incremental costs that are directly attributable to the acquisition, issue or disposal of a financial asset or financial liability. An incremental cost is one that would not have been incurred if the entity had not acquired, issued or disposed of the financial instrument.” What are transactions costs in respect of investment funds? “Transaction costs include fees and commissions paid to agents (including employees acting as selling agents), advisers, brokers and dealers, levies by regulatory agencies and securities exchanges, and transfer taxes and duties. Transaction costs do not include debt premiums or discounts, financing costs or internal administrative or holding costs.” How are they accounted? “Included in the initial measurement of financial assets and financial liabilities other than those at fair value through profit or loss.” ©2005 Deloitte & Touche. Private and Confidential Transaction costs (continued) How should this requirement be applied in practice? • For financial instruments that are measured at FVTPL, transaction costs are not added to the fair value measurement at initial recognition. • For available-for-sale financial assets - recognised in equity as part of a change in fair value at the next remeasurement. • If an available-for-sale financial asset has fixed or determinable payments and does not have an indefinite life, the transaction costs are amortised to profit or loss using the effective interest method. If an available-for-sale financial asset does not have fixed or determinable payments and has an indefinite life, the transaction costs are recognised in profit or loss when the asset is derecognised or becomes impaired. • For financial instruments at amortised cost (i.e. not at fair value through profit or loss) included in the calculation of amortised cost using the effective interest method and, in effect, amortised through profit or loss over the life of the instrument. • Materially? TALK TO YOUR AUDITORS! ©2005 Deloitte & Touche. Private and Confidential Accounting for shareholders’ equity Treatment of Redeemable Preference Shares • “Many non-equity shares, including participating redeemable preference shares, will be classified as liabilities under IAS 32/FRS 25 and deducted from assets in the balance sheet, rather than included as part of shareholders’ funds. Implications? • Net Asset Values • Income statement – treatment of preference share dividends as an interest cost rather than appropriation from profits • Debt covenants and shareholder expectations Solution? • The revised IAS32/FRS 25 (within its appendices) gives suggested balance sheet and income statement formats for unit trusts which show net assets and profits before deductions for these shares. Reversal? • Exception currently buy looked at! ©2005 Deloitte & Touche. Private and Confidential Cash Flow vs Fair Value Hedge 1. Floating rate debt – 5 years @ 5% £100 Have a floating to fixed IRS £100 principal 5 year duration. 2. Fixed rate debt – 5 years @ 5% £100 Have a fixed to floating IRS £100 principal 3 year duration Interest rates go to 10% !!!! 1. Debt stays in BS @ £100 but also have £50 in BS re FV of Hedge. The FV of the Hedge taken to equity and released over 5 years. It is a cash flow hedge. 2. IRS is FV’d in the BS at negative £50 and take a hit to the Income Ac. The FV of the Hedge comes on to the BS by fair valuing the debt to £50 and the £50 credit nets off the £50 loss in the Income Ac. What about fixed rate debt? Possible problem as likely to be treated at amortised cost which is different to 1 above. ©2005 Deloitte & Touche. Private and Confidential The Effective Interest Method of Calculation Illustrative examples - Example 1 ABC Fund Plc Buy a bond of 1/1/2005 with 5 years remaining to maturity - Fair value cost is €1,000 Nominal/maturity value is €1,250 fixed interest rate of 4.7% (i.e. €59 per annum) ABC Fund PLC Year Amortised cost at beginning of year Interest Income (10%) – Internal rate of return of cash flows Cash flows Amortised cost at end of the year 2005 1,000 100 59 1,041 2006 1,041 104 59 1,086 2007 1,086 109 59 1,136 2008 1,136 113 59 1,190 2009 1,190 119 1,250 + 59 0 Source: FRS 26 Implementation Guide B.26 Comments – The interest rate of 10% is calculated by taking the cash flows (including the initial €1,000 purchase cost) and calculating the internal rate of return. Sample Journal Entries Year 1: Dr. cost of bond Cr. Bank For purchase of bond Dr. cost of bond Dr. Bank (interest rec’d) 59 Cr. Interest Income For year 1 income on bond Dr 1,000 Cr 1,000 41 100 Within the financial statements, it is possible to disclose the amortisation proportion separately from the interest ©2005 Deloitte & Touche. Private and Confidential portion The Effective Interest Method of Calculation •Can be very awkward to calculate and difficult to do systematically •Answer maybe FVTPL as one line / lump but possible tax split issues (distribution status etc) •Materiality Call ? •TALK TO YOUR AUDITORS ©2005 Deloitte & Touche. Private and Confidential Segmental reporting (IAS only) Principles • IAS 14 applies to listed entities only. • IAS 14 identified business and geographical segments, and requires identification of which one is the primary and secondary segment (based on dominant source of risks and returns). UK GAAP not yet converged. • Considerably more detail is required to be disclosed for primary segments (includes result by segment, segment assets and liabilities, and reconciliation to the income statement). Investment funds • Argument that these only have one operation (investment activities) and therefore may not need detailed segmental analysis. • Alternatively, any segmental analysis (e.g. geographic, security type) is likely to correspond to fund portfolio data generally included in annual reports, so changes will be presentational. ©2005 Deloitte & Touche. Private and Confidential Other matters Yes, there is more … • IFRS7/FRS29 – other disclosures – periods 1 Jan 07 onwards (FRS 23,25,26 criteria) – sensitivity analysis is the big gap • Components, FRS28 (IAS1) need full components??, potential set out on %s re portfolio statement but umbrella funds watch-out! • Dividends can only be recorded in the period they are approved – so planning issues and care around compliance (IAS 10/FRS21)? Income ? • Final “profit figure” will not necessarily equate to legally distributable profit – Tech 21/05 - Distributable profits implications of IFRS • Only Earnings per share figures calculated in accordance with FRS 22/IAS 33) may be shown on the primary statements – others relegated to the notes. • Going concern, issue for limited life funds? • Impact of Share options provided to service providers? • Netting off, FRS25, right and INTENTION to get set off. • Transitional arrangements, do not need to rework comparatives for FRS26 first time around. ©2005 Deloitte & Touche. Private and Confidential Questions? A member firm of Deloitte Touche ©2005 Deloitte & Touche. Private andTohmatsu Confidential