Template for Introductory report & Application for listing

advertisement

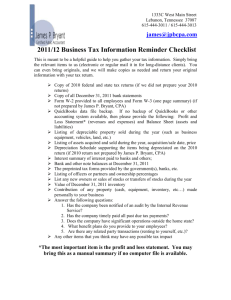

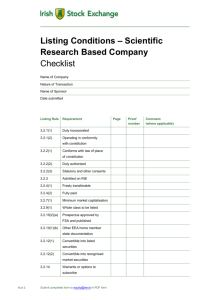

August 2015 Template for Introductory report / Application for listing Table of contents A. Introductory report / Application for listing ....................................................................... 3 1.1 Introduction .................................................................................................................... 3 1.2 Brief summary of the company – the enterprise, activities, financials etc. ...................... 3 1.3 Listing criteria ................................................................................................................. 5 1.3.1 Financial criteria .............................................................................................................................. 5 1.3.2 Requirements for the company’s activities and management ....................................................... 9 1.3.3 Listing requirements for the shares .............................................................................................. 16 1.4 Other requirements for listing ....................................................................................... 21 1.4.1 Transactions with close associates, patents, legal proceedings, corporate governance, mineral companies ................................................................................................................... 21 1.4.2 Share issue prior to admission to listing ....................................................................................... 23 1.4.3 Due diligence ................................................................................................................................. 23 1.4.4 Other ............................................................................................................................................. 24 1.5 Listing conditions to be fulfilled just prior to the first day of trading ............................. 25 1.6 General listing criteria ................................................................................................... 25 1.6.1 Public interest, regular trading and suitability for listing .............................................................. 25 1.6.2 The company’s legal standing ....................................................................................................... 25 1.7 Specific requirements for the listing of foreign companies and secondary listing .......... 26 1.7.1 Primary listing of foreign companies ............................................................................................. 26 1.7.2 Specific requirements for secondary listing .................................................................................. 27 1.8 Listing of shares in respect of pre-issue allotment rights .............................................. 28 1.9 Timetable and contact persons ...................................................................................... 28 1.10 Attachments .................................................................................................................. 29 1.11 Concluding remarks - signature ..................................................................................... 29 B. Checklist to be attached to the introductory report and (updated) to the application .................................................................................................................................. 30 C. Documents to be attached to the introductory report ....................................................... 32 D. Documents to be enclosed with the listing application ...................................................... 33 2 A. Introductory report / Application for listing 1.1 Introduction Please address the following items, with full appropriate text: 1.2 - Name of company applying for listing - If relevant, whether the company is a spin-off (demerger) from a company already listed on Oslo Børs or Oslo Axess - If relevant, whether the company is seeking a transfer from a listing on Oslo Axess to a listing on Oslo Børs - Whether the company wishes to apply for listing on Oslo Børs, or on Oslo Axess - If relevant, whether the company wishes to apply primarily for listing on Oslo Børs, secondarily on Oslo Axess - Whether this letter is an introductory report, an updated introductory report or an application for listing - Whether the company aims for a normal, flexible or fast-track listing process - Whether attachments are attached to this letter or sent in a separate e-mail. (Regarding required attachments please see section B, C and D of this document. Note that section D is only to be addressed – and attachments enclosed - when this document is an application. For companies seeking a transfer from Oslo Axess to a listing on Oslo Børs, the attachments C and D are not relevant) Brief summary of the company – the enterprise, activities, financials etc. Please fill in the table below. Legal status of entity: Domicile: Share capital: Market capitalisation (or estimate thereof): Date of incorporation: Type of business: Business address: Number of employees: Auditor of the company: Legal advisor (if any) of the company in connection to the listing: The company’s corporate advisors (if any) in connection with the listing: Legal due diligence carried out by: Financial due diligence carried out by: Exemption from financial/legal due diligence has been sought (covered by sec. 1.4.3 below) Expected first date of listing (if this is decided): 3 Brief summary of the company’s business activity Please provide a brief description of the company’s business concept and activities. Please provide a brief description of the history/other relevant information for the company. Brief presentation of the group Please briefly present the structure of the group, if relevant. (If not a group, state this). If complicated, include a chart. Please specify percentage of ownership and the domicile of the companies, including the subsidiaries. Brief summary of the financial accounts Please state which accounting principles the company applies, such as IFRS, etc. (The Regulations to the Norwegian Securities Trading Act section 5-11 sets out accounting policies equivalent to IFRS). Please set out - in the table below - the main figures from the company’s financial accounts for the last three financial years, plus the last interim period with comparable figures. (If the company has less than three years of history, or if any figures are pro forma, please provide further details). MNOK (or TUSD) Turnover Operating result Result for the period Total assets Equity Q1 - QX 201X Q1 - QX 201X 201X 201X 201X Brief summary of the company’s listing advisors Please identify the company’s advisors in relation to the listing process (note that contact details for the advisors are to be included in section 1.9 below). Optional for the introductory report (required for the listing application) Information on whether the company’s shares are listed on another regulated market, or whether admission to such listing has been applied for. If this is the case, information must be given on where and in what manner the shares are listed or are the subject of an application for listing (cf. Listing Rules, section 3.4, third paragraph, item 5). 4 1.3 Listing criteria 1.3.1 Financial criteria 1.3.1.1 Market value Listing Rules section 2.2.1 The market value of the shares for which admission to Oslo Børs is sought must be assumed to be at least NOK 300 million. The market value of the shares for which admission to a listing on Oslo Axess is sought must be assumed to be at least NOK 8 million. The assumed market value must satisfy these requirements at the time of admission to stock exchange listing. If the market value cannot be estimated, the company’s balance sheet equity capital in the last published annual accounts must be of at least the required value. If the company has issued an interim report since its last published annual accounts and Oslo Børs deems the report to be satisfactory, the book equity shown in the interim report may be used. Please provide details of the market value of the company (or an estimate thereof), and how this value is calculated. Please provide details of recent share capital issues, and (if relevant) capital issues in relation to the listing, and any secondary offerings. Specific listing rules for primary listing of foreign companies (if relevant) Please provide details of whether the company has a market value (or an estimate thereof) in line with Listing Rules for foreign companies applying for a primary listing on Oslo Børs or on Oslo Axess (cf. section 1.7.1 below, and Listing Rules section 9.1, second paragraph, item 1). 1.3.1.2 Equity capital Listing Rules section 2.2.2 The company’s equity capital situation must be satisfactory. When evaluating the company’s equity capital situation, Oslo Børs will take into account the normal situation for companies in the same industry, covenants set out in the company’s loan agreements and any other relevant matters. Please fill in the table below. Equity ratio at [date]: Interest bearing debt at [date]: Planned share capital issue (if any): Expected equity ratio after share issue (if any): [XX] % MNOK (or TUSD) [amount] MNOK (or TUSD) [amount] [XX] % Please provide further details to whether the company has an equity capital situation which is satisfactory, or whether this will be in place prior to listing. Please describe any possible increases in share capital, distribution sales of shares etc. that the company expects to carry out (prior to first day of trading). 5 Please describe any loan conditions that relate to the equity ratio, and whether the company is in compliance with these. 1.3.1.3 Liquidity Listing Rules section 2.2.3 The company must demonstrate that it will have sufficient liquidity to continue its business activities in accordance with their planned scale of operation for at least 12 months from the planned listing date. Any loan agreements that are material to satisfying the requirements of the preceding or following paragraphs must be signed by the parties at the time the application for admission to listing is submitted. Oslo Børs may grant an exemption from the first sentence in special circumstances. Please describe the financial situation of the company (including available cash and draw-down facilities), including any terms and conditions attached to the company’s borrowing which may represent a material restriction on its freedom of action, or that may represent an obstacle to the free transfer of the company’s shares (this includes any change of control clauses, parent company guarantees, guarantees on behalf of other entities, and other material loan covenants and guarantees). Optional for the introductory report (required for the listing application) Please provide an account of the company’s available liquid assets and undrawn credit facilities at the time of the application. An account must also be provided of planned cash flow and financing over the period of one year from the planned listing date. This account must summarise the current and expected scale of activities and expected cash flows, liquid assets and available credit facilities. A cash flow budget should be attached to the application. (Cf. 3.4, third paragraph, item 19/20 Oslo Axess/Oslo Børs in the Listing Rules). Provide information on interest-bearing debt, and information on conditions or covenants in the company’s loan agreements, including an account of the company’s current and expected compliance with such conditions and covenants. Please provide details about any change of control covenants. Please describe any loan covenants that are not in line with normal market practice for the sector. Please set out what financial commitments the company has, primarily in the 12 month period after listing, but also uncovered financial commitments after the 12 month period if any projects (such as new builds etc) are to be finalized/commercialized after the 12 month period. Furthermore, how the company intends to have these commitments financed. Please briefly describe the cash flow from operations last year (if relevant). Please describe whether the company intends to arrange any equity issue prior to the first day of trading, and the purpose of the issue. 1.3.1.4 Annual accounts and interim accounts Listing Rules section 2.2.4 Listing criteria for listing on Oslo Børs: The company must have produced annual accounts and annual reports in accordance with the legislation on accounting for the last three years prior to the application for stock exchange listing. The annual accounts and annual reports must be audited. 6 The company must have produced an interim report in accordance with the requirements set out in Section 4.2 of Continuing Obligations for the most recent quarter before the application for admission to listing is submitted. The most recent interim report must be subject to a limited scope audit. However, this will not be necessary if the most recent interim period is part of the period covered by the audited annual accounts. Listing criteria for listing on Oslo Axess: The company must have produced at least one annual or interim report in accordance with the accounting legislation that will apply to the company’s annual accounts following admission to listing. Such annual or interim report must be subject to an ordinary audit. The company must have produced an interim report in accordance with the requirements set out in Section 4.2 of Continuing Obligations for the most recent quarter before the application for admission to listing is submitted. The most recent interim report must be subject to a limited scope audit. However, this will not be necessary if the most recent interim period is part of the period covered by the audited annual accounts. Please state whether financial accounts have been prepared for the last three years, or less. Please state whether an interim report has been/will be prepared in line with the continuing obligations for the last quarter before any listing application is submitted. Furthermore, state whether the interim report will be subject to limited audit. An exemption from such financial reporting can be granted (cf. sections 1.3.2.1 and 1.3.2.2 below). Please state whether the company is planning to apply for such an exemption. Optional for the introductory report (required for the listing application) Copies of the annual report and accounts and audit report for the last three financial years, or such shorter period as the company has been in existence, and the latest interim report with the auditor’s statement in respect of the limited scope audit of this report must be attached to the application (cf. section 3.4, third paragraph, item 10 of the Listing Rules). 1.3.1.5 Auditor’s report Listing Rules section 2.2.5 A company will not normally be admitted to listing if the auditor’s report on the most recent annual accounts expresses a qualified opinion. If the auditor’s report does not express a qualified opinion but includes comments on specific points, Oslo Børs will consider whether these comments are of such a serious character that the company cannot be deemed suitable for listing. Alternatively, regarding listing only on Oslo Axess If the company has produced an interim report prepared in accordance with the rules and principles that will apply to the company's annual reports once it is admitted to listing pursuant to section 2.2.4, first paragraph in the Listing Rules for Oslo Axess, the paragraph above shall apply similarly to the audit report on this interim report. Please state the company’s auditor for the last three years (or less), and any qualifications or emphasis of matters in the audit opinions on the financial statements. Please state whether the latest interim report has been subject to limited audit. 7 Optional for the introductory report (required for the listing application) If the company has changed its auditor within the last three years, the company must state this and explain the reason for the change (cf. Listing Rules, section 3.4, third paragraph, item 21/22 for Oslo Axess/Oslo Børs). Conclusion financial listing criteria --------------------------- Reserved for Oslo Børs --------------------------- 8 1.3.2 Requirements for the company’s activities and management 1.3.2.1 Requirement for three years’ history (for listing on Oslo Børs) Listing Rules section 2.3.2 for Oslo Børs Note: Only a requirement for listing on Oslo Børs. Not relevant for listing on Oslo Axess The company must have existed for at least three years prior to the date of the application for admission to stock exchange listing. Oslo Børs may grant an exemption from the requirement in the first paragraph where it deems that this is in the interest of the general public and investors, and where investors have access to sufficient information to carry out a well-informed assessment of the company, its activities and the shares for which admission to stock exchange listing is sought. Such an exemption can be granted if the company can demonstrate continuity in its actual activities for at least three years and its activities are presented by way of relevant financial information in accordance with the prospectus rules in force at the time, including any pro forma information. Oslo Børs reserves the right in special circumstances to require information and undertakings additional to the information and undertakings required in the prospectus. The first paragraph does not apply if Oslo Børs has granted an exemption for the requirement for three years’ activity pursuant to section 1.5.2.2 (see below). Only relevant for listing on Oslo Børs Please state when the company was incorporated and whether it has existed for 3 years minimum. Alternatively, state whether an exemption will be requested (this has to be substantiated in line with the listing criteria set out above in section 1.3.2.1). 1.3.2.2 Requirement of three years’ activity (for listing on Oslo Børs) Listing Rules for Oslo Børs section 2.3.3 Note: Only a requirement for listing on Oslo Børs. Not relevant for listing on Oslo Axess. The company must have operated the major part of its activities for at least three years prior to the date of the application for admission to stock exchange listing. Oslo Børs may grant an exemption from the requirement in the first paragraph where it deems that this is in the interest of the general public and investors, and where investors have access to sufficient information to carry out a well-informed assessment of the company, its activities and the shares for which admission to stock exchange listing is sought. If an exemption is granted pursuant to the second paragraph, Oslo Børs reserves the right to require the company to produce a soundly based forecast for the next year’s earnings. Oslo Børs may also require the company to produce relevant financial information in accordance with the prospectus rules in force at the time, including any pro forma information. Oslo Børs reserves the right in special circumstances to require information and undertakings additional to the information and undertakings required in the prospectus. Only relevant for listing on Oslo Børs Please state whether the company has three years of activities, and financial reports for the same period. Alternatively, state whether an exemption will be requested (this has to be substantiated in line with the listing criteria (cf. Listing Rules for Oslo Børs section 2.3.3). If the company has been through any material changes/transactions over the last three years, please provide brief details. 9 1.3.2.3 Management Listing Rules Oslo Børs/Oslo Axess, section 2.3.4/2.3.1 respectively The individual members of the company’s executive management must not be persons who have acted in such a manner as to make them unfit to participate in the management of a stock exchange listed company. The company must have sufficient expertise to satisfy the requirements for the correct and proper management and distribution of information. The company should also be organised so that Oslo Børs has access at all times to the officers of the company responsible for contact with Oslo Børs or some other representative of the company’s management, and should ensure that the persons in question can be reached without undue delay. The company must have procedures in place and be organized to ensure that the company’s management and the officers responsible for disclosing information to the market become aware of essential information without undue delay. The company must have sufficient expertise to produce financial accounts in accordance with the current rules and regulations. The company must in addition have organised its financial management to ensure that financial reporting is produced with sufficient quality and with sufficient speed. Overview of management Please fill in the table below with the details of the management of the company. Expand or reduce the table if needed. Name Position Shareholding in company (%) Options and/or warrants? (yes/no) Also a board member? (yes/no) Any comments Please state the resources the company has available to comply with the reporting and information obligations placed upon a stock exchange listed company, including the resources devoted to the accounting function. Please describe whether there are any conditions that would make anyone in the management team unfit for management of a stock exchange listed company. Please provide information on whether any members of the management have been involved in matters that have resulted in, or may result in, criminal convictions or other sanctions for breaches of Norwegian or foreign securities trading and accounting laws. In addition, information shall be provided on any breaches of other laws related to financial matters, as well as any involvement in bankruptcy or corporate insolvencies, which may be material to the assessment of whether such a person satisfies the suitability requirement pursuant to Listing Rules Oslo Børs sections 2.3.4 (1) / Oslo Axess 2.3.1 (1). 10 Please describe whether the company has reviewed internal routines and organization to make sure that relevant information will, without any delay, come to the attention of the member of the executive management who is responsible for reporting to Oslo Børs. 11 1.3.2.4 Board Listing Rules Oslo Børs/Oslo Axess, section 2.3.5/2.3.2 respectively At least two of the shareholder elected members of the board of directors shall be independent of the company's executive management, material business contacts and company’s larger shareholders. The board of directors shall not include representatives of the company’s executive management. If required by special circumstances, representatives of the company's executive management may represent up to one-third of the shareholder elected members of the board. The company shall have a board of directors comprising of individuals who have not acted in such a manner as to make them unfit to be a member of the board of a listed company. All members of the board of directors must have satisfactory expertise in respect of the rules that apply to companies listed on Oslo Børs/Oslo Axess. Oslo Børs may grant exemptions from the first and second paragraphs in special circumstances. Overview of the board Please fill in the table below. Expand or reduce the table if needed. Name of board member Board position Committees (nomination, remuneration, audit committees etc) Shareholding (%) Options and/or warrants? (yes/no) Indepen-dent of management and material business associates? (yes/no) Independent of major shareholder? (yes/no) Any comments Chairman Board member Board member Board member Board member Board member Board member – employee representative Board member – employee representative Details about each board member Please provide brief details for each board member (brief CV, formal background, experience etc, often to be found in the prospectus). Further details about each board member’s expertise in rules that apply for companies listed on Oslo Børs/Oslo Axess Please provide an account of the relevant expertise of each member of the board of directors related to these rules. If any of the board members do not have satisfactory expertise in respect of these rules, please describe planned measures in order to satisfy this requirement. 12 Further details about the board’s independence Please provide details about the board’s independence Further details about the suitability of the members of the board Please state whether there are any circumstances that would make any board members unfit to be part of the board. Please provide information on whether any members of the board have been involved in matters that have resulted in, or may result in, criminal convictions or other sanctions for breaches of Norwegian or foreign securities trading and accounting laws. In addition, information shall be provided on any breaches of other laws related to financial matters, as well as any involvement in bankruptcy or corporate insolvencies, which may be material to the assessment of whether such a person satisfies the suitability requirement pursuant to Listing Rules Oslo Børs sections 2.3.5 (3)/ Oslo Axess 2.3.2 (3). Management represented on the board If any member of the executive management is will/be represented on the board, please provide details. Please explain any special circumstances that might lead Oslo Børs to grant exemptions from the requirement that the board shall not include representatives of the company’s executive management. Optional for the introductory report (required for the listing application) Please provide an account of the composition of the board of directors and any relationship between individual members of the board and the company’s executive management, major business connections or larger shareholders (cf. section 2.3.5 (1) in the Listing Rules for Oslo Børs, section 2.3.2 (1) in the Listing Rules for Oslo Axess). 13 1.3.2.5 Audit Committee Listing Rules Oslo Børs/Oslo Axess, section 2.3.6/2.3.3 respectively The company must have an audit committee or equivalent corporate body with the duties and composition mentioned in Article 41 of the Statutory Audit Directive 2006/43/EC. If the company is a Norwegian public limited company, it must have an audit committee with the duties and composition mentioned in the Public Limited Liability Companies Act, Sections 6-41 to and including 6-43. The company may stipulate in its articles of association that the entire board of directors shall act as the company's audit committee subject to the following conditions being satisfied14: 1. The board of directors must at all times satisfy the requirements that no executive personnel of the company shall at any time be elected as a member of the audit committee, and that the audit committee as a whole shall have a level of competence in the context of the company's organisation and activities that is sufficient for it to carry out its duties. 2. At least one member of the audit committee must be independent and have competence in accounting or auditing. The following types of issuer are exempt from the first and second paragraphs: 1. Companies registered in another EEA country that have established an audit committee or equivalent corporate body in accordance with the statutory requirements imposed in respect of the requirements of the Statutory Audit Directive 2006/43/EC in the country in which the company is registered. 2. An issuer that is a state, a regional or local authority of a state, a public international body or organisation of which at least one EEA state is a member, an EEA central bank or the European Central Bank. 3. A borrower that is a wholly-owned subsidiary, if the parent company has established an audit committee that satisfies the requirements that would apply to an audit committee for the subsidiary. 4. A company that satisfies at least two of the following three criteria in its most recent financial year: a. Average number of employees less than 250, b. Total assets less than NOK 300 million at the close of the financial year, c. Net annual turnover less than NOK 350 million. Details about the audit committee Please state whether – in the company’s view - an audit committee is required according to the listing rules. Please describe any actions that will be taken to set up an audit committee prior to listing, if relevant. Optional for the introductory report (required for the listing application) Please provide confirmation that the audit committee is in accordance with the listing criteria (cf. Listing Rules section 2.3.6 for Oslo Børs, section 2.3.3 for Oslo Axess). Please name the committee members and who is considered to be independent. 1.3.2.6 Management companies Listing Rules Oslo Børs/Axess, section 2.3.7/2.3.4 respectively If any party is to carry out management duties for the company (management company), such company shall be obliged to comply with the provisions to which the issuer company would be subject were it to have carried out the functions itself. The issuer company shall guarantee that any breaches of the Stock Exchange Rules caused by the party that carries out the borrower’s operations or activities shall be dealt with as if the breach was caused by the issuer company. Prior to submitting an application for listing, the management company and the company applying for admission to stock exchange listing must enter into a contractual agreement with Oslo Børs to regulate the responsibilities and duties of the issuing company and the management company vis-à-vis Oslo Børs. In the event that the issuer company, or management company, or guarantor, breaches the terms of an agreement as 14 mentioned in the second paragraph, Oslo Børs reserves the right to impose sanctions on such party in accordance with Section 15 of Continuing Obligations. If a third party is to carry out management functions on behalf of the company (cf. section 2.3.7 in the Listing Rules for Oslo Børs, section 2.3.4 for Oslo Axess), please state which management functions are to be carried out by such party and which are to be carried out by the company itself. Where appropriate, set out the resources and capacity of the third party in respect of satisfying the duties of a stock exchange listed company in respect of financial reporting and disclosure of information (cf. section 2.3.4 in the Listing Rules for Oslo Børs, section 2.3.1 for Oslo Axess). To the extent that such duties are to be carried out by a third party, indicate if a management agreement will be prepared. Conclusion regarding the company’s activities and management --------------------------- Reserved for Oslo Børs --------------------------- 15 1.3.3 Listing requirements for the shares 1.3.3.1 25% spread of share ownership Listing Rules section 2.4.1 At least 25% of the shares for which admission to stock exchange listing is sought must be distributed among the general public. The first paragraph is deemed to be satisfied if, at the time of admission to stock exchange listing, the proportion of the shares mentioned is distributed among persons who do not have such an association with the company as is mentioned in the fourth paragraph, and who each hold shares with a value of at least NOK 10,000. In case of doubt, Oslo Børs determines whether the requirement set out in first sentence is fulfilled. Shares held by persons who hold, individually or together with their close associates, more than 10% of the share capital or voting capital of the company (“larger shareholders”) are not included. Close associates means such persons and companies as mentioned in Section 2-5 of the Securities Trading Act. Shareholders that are associated with the company are defined as follows: - - Members of the company’s board of directors, corporate assembly, board of representatives, committee of representatives or control committee, the company’s auditor, the company’s chief executive and other members of the company’s executive management, the spouse of a person mentioned in item 1 or a person with whom such a person cohabits in a relationship akin to marriage, the under-age children of a person mentioned in item 1 or 2, an undertaking in which a person mentioned in item 1 or 2, either singly or together with other persons mentioned, exercises influence as mentioned in Section 1-3, second paragraph, of the Public Limited Liability Companies Act and other companies in the same group, and a party with whom a person mentioned in item 1 or 2 must be assumed to be acting in concert in the exercise of rights accruing to the owner of shares Oslo Børs may waive the 25% threshold at the time of admission to listing if the required spread of share ownership can be expected within a short period of time through trading on the stock exchange, or if a sufficient spread of share ownership can nonetheless be assumed to be assured because the company has issued a large number of shares of the same class that are widely distributed among the public. Please state the percentage of the shares that is distributed among the general public, and whether this is in line with the requirements set out above in section 1.3.3.1. If necessary, also state what steps will be taken to fulfill the listing criteria. If any exemption from the 25% spread of share ownership is sought, please indicate this. Specific requirements for secondary listing (if relevant) Please confirm if the requirement for 25% spread of share ownership is fulfilled for the company’s entire share capital (cf. section 1.7.2 below). Optional for the introductory report (required for the listing application) Please state the number of shares for which stock exchange listing is sought that are owned by any party associated with the company as defined in section 2.4.1, fourth paragraph in the Listing Rules (cf. Listing Rules, section 3.4, third paragraph, item 14). 16 Please provide any information on shareholder resolutions or decisions, shareholder agreements etc., of which the company is aware and which may have a bearing on the suitability of the company’s shares for stock exchange listing, including any lock-up arrangements (cf. Listing Rules, section 3.4, third paragraph, item 16). 1.3.3.2 Spread of share ownership - number of shareholders Listing Rules section 2.4.2 The number of shares for which stock exchange listing is sought must be spread among the following number of shareholders (each holding shares with a value of at least NOK 10,000 at the time of admission to stock exchange listing): Oslo Børs Oslo Axess 500 shareholders 100 shareholders Shareholders that are associated with the company, cf. section 2.4.1, fourth paragraph, in the Listing Rules cannot be included in the number of round lot holders stipulated in the first paragraph above. Please state the number of shareholders, and also the number of shareholders who each hold shares equal to a value of NOK 10,000 or more. Please provide the same number reduced by the shareholders that are associated with the company (shareholders that cannot be included). If the requirement is not met, please describe how this will be fulfilled prior to listing. Table showing the 20 largest shareholders Please provide a table showing the 20 largest shareholders, and the date of the table. Optional for the introductory report (required for the listing application) Please provide information on any known intention by any larger shareholder or shareholders to reduce their holdings in connection with the admission to stock exchange listing, including information on the procedures that will apply to such sales. If the above is not relevant, please state this. Specific listing rules for primary listing of foreign companies (if relevant) Please provide details to whether the company has – or will achieve - a 25 % spread and spread of ownership in line with the listing criteria for foreign companies applying for a primary listing. (Cf. section 1.7.1 below, and Listing Rules section 9.1, second paragraph, item 1). Specific requirements for secondary listing of the company (if relevant) Please confirm if the requirements for spread of share ownership are – or will be - fulfilled for the company’s entire share capital (cf. section 1.7.2 below). 17 1.3.3.3 Other listing requirements regarding shares Listing Rules sections 2.4.3-2.4.7 Shares in the same share class An application for stock exchange listing must include all the shares issued in the same share class. If the company has more than one class of shares, the criteria for admission to listing must be satisfied for each class of shares for which listing is sought. Oslo Børs may grant an exemption from the provisions of the first sentence. Free transferability of shares Stock exchange listed shares shall be freely transferable. If the company pursuant to its articles of association, law or regulations made pursuant to law, has been given a discretionary right to bar a share acquisition or to impose other trading restrictions, such right may only be exercised if there is sufficient cause to bar the acquisition or to impose other trading restrictions and such imposition does not cause disturbances in the market. Voting rights for shares If the company pursuant to its articles of association, law or regulations made pursuant to law, has been given a discretionary right to bar the exercise of voting rights, such discretionary right may only be exercised if there is sufficient cause. Minimum market value at the time of admission to stock exchange listing The shares for which admission to stock exchange listing is sought must have an expected market value at the time they are admitted to stock exchange listing of at least NOK 10. Registration of share capital with a Central Securities Depository The company’s shares must be registered with a Central Securities Depository authorised pursuant to Section 3-1 of the Securities Register Act. Shares in the same share class Please comment on whether the shares contemplated for listing are in one or more classes Optional for the introductory report (required for the listing application) Please state the number of shares for which stock exchange listing is sought (cf. Listing Rules, section 3.4, third paragraph, item 13). Please state whether the company has one share class, or several share classes (cf. Listing Rules, section 3.4, third paragraph, item 13). Please state whether the application refers to one or more than one share class (cf. Listing Rules, section 3.4, third paragraph, item 13). Please provide information on any loans that give the right to the company to issue shares and of any subordinated debt or transferable securities issued by the company (cf. Listing Rules, section 3.4, third paragraph, item 6). Free transferability of shares Please comment on whether the shares are freely transferable. Optional for the introductory report (required for the listing application) 18 Please provide information on whether the company’s shares are subject to ownership restrictions pursuant to law, licensing conditions, or the articles of association, and if appropriate the proportion of the shares to which such restrictions apply (cf. Listing Rules, section 3.4, third paragraph, item 7) Please provide information on any agreement related to the admission to stock exchange listing that prevents the sale of shares by an existing shareholder for a specific period (“lock-up”). In the case of any such agreement, information must be given on the shareholder’s total holding, the number of shares subject to the agreement, the period for which sales are restricted and any other terms and conditions of significance (cf. Listing Rules section 3.4, third paragraph, item 27/29, Oslo Axess/Oslo Børs). Please provide information on shareholder agreements or provisions in the articles of association that may restrict regular trading in the shares (cf. Listing Rules section 3.4, third paragraph, item 27). Voting rights for shares Please comment on whether the company, pursuant to its articles of association, law or regulations made pursuant to law, has been given a discretionary right to bar the exercise of voting rights. Minimum market value at time of admission to stock exchange listing Please state the estimated market value of the company’s shares (per share) at the time of listing. (Cf. Listing Rules, section 3.4, third paragraph, item 9). Registration of share capital with a Central Securities Depository Please state whether the shares (or depository receipts) will be registered with VPS (the Norwegian Central Securities Depository) or with an alternative Central Securities Depository. Registration of shares may take place using a Central Securities Depository other than VPS if it can be demonstrated that investors and member firms will be able to carry out settlement. If this will be the case, please comment on this and state the identity of the institution operating the share register account (i.e. the Central Securities Depository) here (cf. Listing Rules, section 9.1, second paragraph, item 1, second sentence). Optional for the introductory report (required for the listing application) Please state the identity of the institution operating the share register account for the company (cf. Listing Rules, section 3.4, third paragraph, item 3). Please state the securities identification number (ISIN) for the shares to be listed as used by the Central Securities Depository (cf. Listing Rules, section 3.4, third paragraph, item 3). 19 Specific listing rules for primary listing of foreign companies (if relevant) Optional for the introductory report (required for the listing application) If the shares are registered with a Central Securities Depository other than as mentioned in section 2.4.7, cf. section 9.1, second paragraph, item 1, second sentence of the Listing Rules, the securities registration number of the company's shares in such Central Securities Depository shall be stated in the application for admission to listing, cf. section 3.4, third paragraph, item 3 of the Listing Rules (see also section 1.7.1 below). If the shares are to be registered via a depository arrangement, please state this. Furthermore, please provide comments whether it will be “depository receipts” rather than shares that may be traded on Oslo Børs or Oslo Axess. Specific requirements for secondary listing (if relevant) Please state the number of shareholders (minimum 200 for listing on Oslo Børs, or minimum 100 for listing on Oslo Axess) holding shares with a value of at least NOK 10,000 who have their shares registered with the Central Securities Depository, alternatively whether and how this will be achieved later in the listing process. (Cf. section 1.7.2). Conclusion – Shares, owner structure and free float --------------------------- Reserved for Oslo Børs --------------------------- 20 1.4 Other requirements for listing 1.4.1 Transactions with close associates, patents, legal proceedings, corporate governance, mineral companies Listing Rules, section 2.8 Oslo Børs reserves the right to impose additional requirements on a company applying for stock exchange listing if it considers this necessary for the protection of potential investors. Transactions with close associates Optional for the introductory report (required for the listing application) Please provide a description of any transactions that the company has entered into or is in the process of entering into with close associates as mentioned in Section 3.3 of Continuing Obligations. If not relevant, state this. Patents Please provide information on significant patents, particularly patents that are business-critical. If not relevant, state this. (Cf. Listing Rules section 3.4, third paragraph, item 20/21 for Oslo Axess/Oslo Børs). Legal proceedings Please provide information on whether the company is involved in or has received notice that it may be involved in any legal proceedings of such import that they may be of significance for the company. If not relevant, state this. (Cf. Listing Rules section 3.4, third paragraph, item 29/31 for Oslo Axess/Oslo Børs). Corporate governance Please provide confirmation that the company complies with the Norwegian Code of Practice for Corporate Governance. If the company does not comply with the Norwegian Code of Practice in any respect, the company must provide an explanation of the reason for the deviation and what alternative solution it has selected. (Cf. Listing Rules section 3.4, third paragraph, item 30/32 for Oslo Axess/Oslo Børs). The Norwegian Code of Practice can be downloaded from the Norwegian Corporate Governance Board’s website: http://www.nues.no/en/ Corporate governance for primary listing of foreign companies, and for companies applying for secondary listing (if relevant) Please provide confirmation that the company complies with the principles for corporate governance, or provide an explanation of any deviation and what alternative solution it has selected. This can be given by reference to the equivalent code of practice that applies in the country where the company is registered. (Please also refer to section 1.7.1 below). (Cf. section 3.4, third paragraph, item 30/32 for Oslo Axess/Oslo Børs in the Listing Rules). 21 Mineral companies (if relevant) Companies that meet the definition of ”mineral companies” as set by ESMA for prospectuses must provide the information mentioned in section 132 of the ESMA recommendation and a report by an independent expert as required by section 1331 of the recommendation. A report on reserves prepared in accordance with the guidelines issued by Oslo Børs will be assumed to satisfy the requirements of section 132 and section 133, please see http://www.oslobors.no/ob_eng/Oslo-Boers/Regulations/Circulars/1-2013Revised-listing-and-disclosure-requirements-for-oil-and-natural-gas-companies . Oslo Børs may consent to the use of a report on reserves prepared in accordance with other guidelines, as well as – on the basis of an application – approve that companies already listed on another recognised market place and that have reported reserves/resources on a continuous basis in accordance with recognised reporting standards are exempted from the requirement of providing an expert report as part of the listing process. If not relevant, please state this. Conclusion - other requirements for listing --------------------------- Reserved for Oslo Børs --------------------------- 1 The ESMA update of the CESR recommendations is available here: http://www.esma.europa.eu/system/files/11_81.pdf 22 1.4.2 Share issue prior to admission to listing Listing Rules, section 2.5.1 If a public issue takes place prior to admission to listing, the subscription period must end before the first day of listing. Any new issues carried out in connection with or parallel to the admission to stock exchange listing must be registered with the Register of Business Enterprises and entered into the Central Securities Depository within the same period. Oslo Børs may in special circumstances grant an exemption from the provisions of the first paragraph, second sentence, if the new issue is not necessary to satisfy the requirements for admission to stock exchange listing. The first and second paragraphs shall apply similarly to a distribution sale. Please state whether or not the company intends to make a public issue (equity offering or secondary offering) prior to admission to listing. Please specify estimated amounts of proceeds, if such share issue is intended. (If such details cannot be provided at this point, state this). Please set out any plans for price stabilisation measures related to the admission to stock exchange listing. Optional for the introductory report (required for the listing application) Please provide a description of any planned price stabilization related to the admission to stock exchange listing. (Cf. Listing Rules section 3.4, third paragraph, item 28/30 for Oslo Axess/Oslo Børs). If not relevant, state this. 1.4.3 Due diligence Listing Rules, section 3.2 The company must carry out due diligence in connection with the process of admission to listing in order to identify whether there are any matters that are of significance for evaluating whether the shares are suitable for stock exchange listing. At a minimum, the company must carry out financial due diligence and legal due diligence. The company must also evaluate whether there is a need to carry out further investigations, including due diligence in respect of technical, commercial, environmental, taxation and financial matters, as well as any other matters of significance. Due diligence shall be carried out by parties that have appropriate expertise and that are sufficiently independent of the company that is applying for admission to listing. The results of the due diligence investigations shall be presented to Oslo Børs at a separate meeting attended by the advisers to the company responsible for producing the reports. The presentation to Oslo Børs must take place no later than three trading days before the application for stock exchange listing is submitted. Due diligence must for all practical purposes be completed by this time. Any matters that may be of significance for whether the company's shares are suitable for listing must be presented at the meeting, including matters that may be of significance for whether the company satisfies the particular requirements of the Listing Rules. Oslo Børs shall, upon request, be given access to the reports that have been prepared. Please provide a summarised account of which due diligence investigations the company intends to carry out (cf. section 3.1, third paragraph, fourth sentence in the Listing Rules). Please state the identity of the parties that will carry out the due diligence (cf. section 3.1, third paragraph, fourth sentence in the Listing Rules). 23 Please describe any circumstances that are likely to create uncertainty over the independence of the advisers that will carry out the due diligence and any other matters that may be material to the question of whether satisfactory due diligence investigations are to be carried out. (Cf. section 3.2 in the Listing Rules and section 3.1, third paragraph, fourth sentence in the Listing Rules). Please note that additional guidance are given in: Oslo Børs Circular 5/2011, section 4.2: http://www.oslobors.no/ob_eng/Oslo-Boers/Regulations/Circulars/5-2011Changes-to-the-Oslo-Boers-Issuer-Rules-for-issuers-of-shares-and-equity-certificates Oslo Børs Circular 2/2013, section 3.3, 3.4, 3.5 and 3.6: http://www.oslobors.no/ob_eng/OsloBoers/Regulations/Circulars/2-2013-Changes-to-the-Oslo-Boers-Issuer-Rules-for-issuers-of-shares-andequity-certificates Specific requirements for secondary listing (if relevant) Please state whether the company plans a limited scope audit. A limited scope audit of the most recent interim report pursuant to section 2.2.4 in the Listing Rules will only be required by Oslo Børs in certain circumstances. (Please refer to section 1.7.2 below). If the company plans a limited scope audit, include a brief account here (with details and the rationale for the limited scope audit). 1.4.4 Other Please describe any other special circumstances that can have consequences for the potential listing of the company. In particular, details must be provided of any agreements of critical importance to the business. Conclusion – Other --------------------------- Reserved for Oslo Børs --------------------------- 24 1.5 Listing conditions to be fulfilled just prior to the first day of trading Oslo Børs may accept that some listing conditions are not fulfilled until after the Board of Oslo Børs has approved the listing and prior to the first day of trading. (Typically this would be an equity offering to provide sufficient liquidity to continue the business activities for at least 12 months from the planned listing date, and/or an equity offering to provide a sufficient number of shareholders and free float, and/or the finalization of the listing prospectus). Oslo Børs will consider whether such listing conditions can be satisfied just prior to the first day of trading, if so this would be reflected as a specific condition in the listing resolution passed by the Board of Oslo Børs. Please state which listing criteria will not be satisfied until after the Board of Oslo Børs has approved the application for listing, but prior to the first day of trading. (Alternatively, provide a reference to the relevant section in this report where this is addressed). 1.6 General listing criteria 1.6.1 Public interest, regular trading and suitability for listing Listing Rules, section 2.1.1 Shares issued by a public limited liability company or an equivalent foreign company may be admitted to stock exchange listing provided the shares are assumed to be of public interest and are likely to be subject to regular trading. When making this decision, Oslo Børs will also attach importance to the company’s financial condition and other factors of significance for whether the shares are suitable for stock exchange listing. Please comment briefly on whether the shares of the company would be of public interest, whether they would be expected to be subject to regular trading, and whether they are in general suitable for listing. 1.6.2 The company’s legal standing Listing Rules section 2.1.2 The company must be validly incorporated and operate its business activities in accordance with its articles of association and current legislation. Please state whether the company is validly incorporated, and whether it is a public limited liability company (or an equivalent foreign company). Alternatively, how this would be complied with. Conclusion general listing criteria --------------------------- Reserved for Oslo Børs --------------------------Overall conclusion --------------------------- Reserved for Oslo Børs --------------------------25 1.7 Specific requirements for the listing of foreign companies and secondary listing 1.7.1 Primary listing of foreign companies Listing Rules section 9.1, first paragraph and second paragraph, item 1 A foreign company may apply for a primary listing on Oslo Børs. The Listing Rules shall apply similarly, subject to the following changes and additions: The company must have as large a proportion of the share capital for which it is applying for listing on Oslo Børs registered with the Central Securities Depository mentioned above in section 1.3.3.3, that the requirements above regarding market value (section 1.3.1.1 above), 25 % spread (section 1.3.3.1 above) and spread of share ownership (section 1.3.3.2 above) are fulfilled also for this proportion of its share capital. Registration may take place using a Central Securities Depository other than that mentioned in section 1.3.3.3 (see above) if it can be demonstrated that investors and member firms will be able to carry out settlement. Listing Rules section 9.1, second paragraph, item 9 Oslo Børs reserves the right to require the company to provide such further documentation as it may consider necessary, including legal opinions issued by an external attorney. Please provide confirmation that the company complies with the principles for corporate governance, or an explanation of any deviation. This can be given by reference to the equivalent code of practice that applies in the country where the company is registered. The confirmation should be set out in section 1.4.1 above, under “Corporate governance for primary listing of foreign companies, and for companies applying for secondary listing”. (Cf. section 3.4, third paragraph, item 30/32 for Oslo Axess/Oslo Børs in the Listing Rules). Please include a reference here. Please set out in the relevant sections above whether the following listing conditions are – or will be - fulfilled for the proportion of its share capital registered with the Central Securities Depository (or with an alternative Central Securities Depository): - market value (please include details in section 1.3.1.1) - 25 % spread (please include details section 1.3.3.1), and - spread of share ownership (please include details section 1.3.3.2) Optional for the introductory report (required for the listing application) If the company is registered outside the EEA, it must in the application give notice of which EEA member state is the company’s home member state pursuant to the Prospectus Directive. The company must produce a legal opinion from an external attorney addressed to Oslo Børs to confirm that the listing agreement is binding on the company and that there are no formal obstacles to the company performing its obligations pursuant to this agreement. Such a legal opinion must be made available no later than at the deadline for the submission of the application for listing. (Link to listing agreement (Statement – listing): http://www.oslobors.no/ob_eng/obnewsletter/download/9df0da7d70fb5790feac57e3e91af03e/file/f ile/Statement%20on%20listing%20of%20shares%20of%20a%20foreign%20company.pdf The company must produce a document equivalent to the company registration certificate issued for Norwegian companies by the Register of Business Enterprises. If the company is incorporated in a jurisdiction where such documents are not issued, it must produce a statement addressed to Oslo Børs from an external 26 attorney or a competent corporate body which confirms that the shares are validly and legally issued, fully paid-up and properly registered with the relevant register or equivalent body. A draft of such a statement must be made available no later than at the deadline for the submission of the application for listing. (Section 3.4, third paragraph, item 1 in the Listing Rules, shall not apply). Registration of shares may take place using a Central Securities Depository other than VPS (if it can be demonstrated that investors and member firms will be able to carry out settlement). Please state the identity of the institution operating the share register account (i.e. the Central Securities Depository) in section 1.3.3.3. Please provide a reference here. If the shares are registered with a Central Securities Depository other than as mentioned in section 2.4.7, cf. section 9.1, second paragraph, item 1, second sentence in the Listing Rules, the securities registration number of the company's shares in such Central Securities Depository shall be stated in the application for admission to listing, cf. section 3.4, third paragraph, item 3 in the Listing Rules. Please include the securities registration number in section 1.3.3.3. Please provide a reference here. 1.7.2 Specific requirements for secondary listing Listing Rules section 9.2, first paragraph and second paragraph, items 1 and 2 A Norwegian or foreign company that has a primary listing on a stock exchange or regulated marketplace recognised by Oslo Børs can apply for a secondary listing on Oslo Børs. The first sentence shall apply similarly to a Norwegian or foreign company that has a primary listing on a regulated market other than Oslo Axess. The Listing Rules shall apply similarly, with the following changes and additions: A limited scope audit of the most recent interim report pursuant to section 1.3.1.4 above will only be required if Oslo Børs so requests. A request for a limited scope audit will be particularly relevant if the company has undergone major changes since the last published annual report, for example by merger, demerger, or other material changes to its business activities. The requirement for spread of shares set out in sections 1.3.3.1 and 1.3.3.2 above shall apply to the company’s entire share capital, but such that a minimum of 200 shareholders (for listing on Oslo Børs) or 100 shareholders (for Oslo Axess) holding shares with a value of at least NOK 10,000 must have their shares registered with the Central Securities Depository as mentioned in section 1.3.3.3 above. Section 9.1, second paragraph, item 1, second sentence in the Listing Rules, shall apply similarly, unless the shares must be registered with a Central Securities Depository authorised pursuant to Section 3-1 of the Securities Register Act by virtue of Section 2-1 of the Securities Register Act. Section 2.4.6 in the Listing Rules shall not apply (the minimum market value at the time of admission to stock exchange listing). If the company plans a limited scope audit, please state this in section 1.4.3 above (Oslo Børs can require such limited scope audit in some circumstances, a request for a limited scope audit will be particularly relevant if the company has undergone major changes since the last published annual report, for example by merger, demerger, or other material changes to its business activities). If such a limited scope audit is set out in section 1.4.3, please provide a reference here. The requirements for spread of share ownership apply to the company’s entire share capital, and a description of this should be set out in sections 1.3.3.1 and 1.3.3.2 above. Please provide a reference here. The company should in section 1.3.3.3 above (under “Registration of share capital with a Central Securities Depository”) state the number of shareholders (minimum 200 for listing on Oslo Børs, or minimum 100 for 27 listing on Oslo Axess) holding shares with a value of at least NOK 10,000 who have their shares registered with the Central Securities Depository. Please provide a reference here. If the company is a foreign company, the statement confirming compliance with the principles of corporate governance, or explanation of any deviation from such principles, can relate to the equivalent code of practice that applies in the state where the company is registered or to the exchange on which the company has its primary listing. (Cf. section 3.4, third paragraph, item 30/31 in the Listing Rules for Oslo Axess/Oslo Børs). Please set out the details in section 1.4.1 above, under “Corporate governance for primary listing of foreign companies, and for companies applying for secondary listing”. Please provide a reference here. Optional for the introductory report (required for the listing application) Registration of shares may take place using a Central Securities Depository other than VPS (if it can be demonstrated that investors and member firms will be able to carry out settlement). Please provide name and address for the company'(i.e. the Central Securities Depository) in section 1.3.3.3. Please provide a reference here. A company registered in a state outside the EEA must give notice in the application of which EEA member state is the company’s home member State pursuant to the Prospectus Directive. Please state which EEA member state is the company’s home member State. A company registered in a state outside the EEA must state in its application whether it is applying for exemption from the Norwegian takeover rules. Please state whether the company will be applying for exemption from the Norwegian takeover rules. 1.8 Listing of shares in respect of pre-issue allotment rights Listing Rules section 2.5.2 Please refer to section 2.5.2 in the Listing rules for the comprehensive requirements. Oslo Børs may in special circumstances agree to admit new shares to stock exchange listing after they have been allotted but before they are fully paid-up and registered with the Register of Business Enterprises and the Central Securities Depository (“If issued” or “When issued” listings). Further details are given in section 2.5.2 of the Listing Rules. Please provide information if the company intends to list before the shares are fully paid-up and registered with the Register of Business Enterprises and the Central Securities Depository. If not relevant, state this. 1.9 Timetable and contact persons Please identify the contact persons in relation to the listing process (company management and/or advisors). Optional for the introductory report (required for the listing application) Please set out a timetable for the relevant activities related to the listing (including any share issues, preparation of listing prospectus, first day of trading etc). 28 If only preliminary dates can be provided, state this. Please identify the company’s contact persons vis-à-vis Oslo Børs, cf. Section 2.5 of Continuing Obligations (cf. Listing Rules, section 3.4, third paragraph, item 4). 1.10 Attachments Please see sections C and D for relevant attachments, comment briefly that the relevant documents have been attached. 1.11 Concluding remarks - signature If necessary, please include any concluding remarks (with regards to the introductory report and/or the application for listing). When this document is filed as an application for listing, please sign below (in the scanned version).2 Signature: ____________________________________________________ 2 No such signature is needed for an introductory report. The application is to be signed by the board of directors or by a party duly authorized by the board of directors. 29 B. Checklist to be attached to the introductory report and (updated) to the application This checklist (see next page) must be completed and attached to the introductory report. Tick off either column with “Listing criteria – fulfilled” or “Not fulfilled”. If a listing criterion is not fulfilled, tick off either in the column for “an exemption is sought” for the specific listing criterion, or in the column “condition for listing”. (“Condition for listing”: This means that some listing criteria – for example number of shareholders or free float – would not be in place prior to the Oslo Børs approving the company for listing, but the intention is that this would be in place prior to the first day of trading. This is typically via an initial public offering). When the introductory report is updated and resubmitted as an application for listing, the checklist must also be updated, reflecting new information and the new status of the company’s compliance with the listing criteria (taking into account exemptions and listing conditions). The updated checklist is again submitted to Oslo Børs, as an attachment to the application. 30 Listing criteria – in brief 4 Compliance checklist - for fulfillment of listing criteria 3 Reference to relevant Listing criteria compliance sections of Listing Listing Listing criteria not fulfilled3 Rules5 criteria fulfilled Exemption is sought? Or a condition Comments on compliance with the specific listing criteria – if relevant for listing?6 Financial listing criteria Market cap. (NOK 8 mill Oslo Axess, NOK Sec. 2.2.1 300 mill Oslo Børs) Sufficient equity Sufficient liquidity for 12/18 months Financial accounts available Audit opinion Sec. 2.2.2 Sec. 2.2.3 Three years of existence (only for Sec. 2.3.2 Oslo Børs Sec. 2.2.4 Sec. 2.2.5 Listing criteria for existence, activity, management and board listing on Oslo Børs) Three years of activity (only for listing Sec. 2.3.3 Oslo Børs on Oslo Børs) Management: Competent Board composition Audit committee Management outsourced? Sec. 2.3.4 Oslo Børs, sec. 2.3.1 for Oslo Axess Sec. 2.3.5 for Oslo Børs, sec. 2.3.2 for Oslo Axess Sec. 2.3.6 Oslo Børs, sec. 2.3.3 for Oslo Axess Sec. 2.3.7 Oslo Børs, sec. 2.3.4 for Oslo Axess Listing criteria for the shares Free float: At least 25 % Number of relevant share-holders Oslo Børs (min 500) Number of relevant share-holders Oslo Axess (min 100) Other requirements for shares Sec. 2.4.1 Sec. 2.4.2 Reserve report for mineral company, if relevant Public interest, regular trading and suitable for listing Legal standing of company Due diligence to be carried out Sec. 2.2.6 Sec. 2.4.2 Sec.’s 2.4.3-2.4.7 Other listing requirements Sec. 2.1.1 Sec. 2.1.2 Sec 3.2 3 Some specific requirements apply for the listing of foreign companies and secondary listing of Norwegian companies, see section 8 above. 4 Areas marked grey are not available options, and should not be ticked off. Furthermore, some listing criteria are specific for listing on either Oslo Børs or Oslo Axess. This is indicated in the left column setting out the listing criteria. 5 For full set of listing rules (Børs and Axess), please see http://www.oslobors.no/Oslo-Boers/Regelverk/Regler-for-utstedere. References to the Listing Rules apply for both Oslo Børs and Oslo Axess, unless otherwise indicated. 6 “Condition for listing”: Any listing criteria – for example number of shareholders – that will not be in place prior to the Oslo Børs approving the company for listing, but that will be satisfied prior to the first day of trading. Please see section 1.5 to the template (above). 31 C. Documents to be attached to the introductory report The following documentation should be attached to the introductory report: Documentation: Please include attachment number: (Alternatively “not relevant”, or other comments) 1. 2. 3. The company’s most recent annual report and accounts together with the most recent interim report if it has been issued since the date of the last annual report. The full “curriculum vitae” of the company’s executive management and board members. A standard checklist in the form prescribed by Oslo Børs (please refer to section B – “Compliance checklist”). 32 D. E. Documents to be enclosed with the listing application The following documentation should be enclosed with the listing application7: Documentation: Please include attachment number: (Alternatively “not relevant”, or other comments) 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 7 A resolution to apply for admission to stock exchange listing must have been passed by the board of directors, and the application must be signed by the board of directors or by a party duly authorised by the board of directors. The company’s certificate of registration from the Register of Business Enterprises. The company’s articles of association. Copy of the minutes of the board meeting showing the resolution to apply for admission to stock exchange listing. The copy must be a certified copy. If the application is signed pursuant to a power of attorney, a copy of the signed power of attorney must be appended. Copies of the annual report and accounts and audit report for the last three financial years, and the latest interim report with the auditor’s statement in respect of the limited scope audit of this report. Confirmation from the Register of Company Accounts that it has received the company’s annual report and accounts and audit report for the last three years. A printout of the company’s shareholder register as at the date of application. Oslo Børs may decide that the printout shall only include the larger shareholders in the company. If the company’s board or executive management is aware of any shareholder that holds in total more than 1/10 of the share capital or shares that represent more than 1/10 of the voting rights, or belongs to the same group or is otherwise associated with the company, this must be stated in section 1.3.3.3 above. (cf. section 2.4.1, fourth section in the Listing Rules). Prospectuses published by the company in the last three years. Prospectus, cf. section 7 in the Listing Rules. If the prospectus provided is in draft form, it must be sufficiently complete for Oslo Børs to evaluate the relevant information. Only for companies pursuing a listing on Oslo Børs (not Axess): Financial information as required by section 2.3.2, third paragraph, and section 2.3.3, third paragraph in the Listing Rules (exemptions can be granted, please see sections 1.3.2.1 and 1.3.2.2 above). For foreign companies: In place of confirmation from the Register of Company Accounts, cf. section 3.4, third paragraph, item 11 in the listing rules, confirmation from any such equivalent register in the state where the company is incorporated shall be appended. (Cf. section 9.1, second paragraph, item 6, last sentence in the Listing rules). For foreign companies and secondary listed companies: The company must enter into a standard listing agreement for a primary listed company. (Cf. section 9.1, second paragraph, item 4 and section 9.2, second paragraph, item 7 in the Listing rules). Cf. Listing Rules, section 3.4, second paragraph, and third paragraph, items 1, 2, 8, 10, 11, 12, 15 and 17. 33 OSLO BØRS ASA Box 460 Sentrum NO-0105 Oslo, Norway Visiting address: Tollbugata 2, Oslo Questions may be directed to Listing: E-mail: listing@ oslobors.no Telephone: +47 22 34 17 00 www.oslobors.no