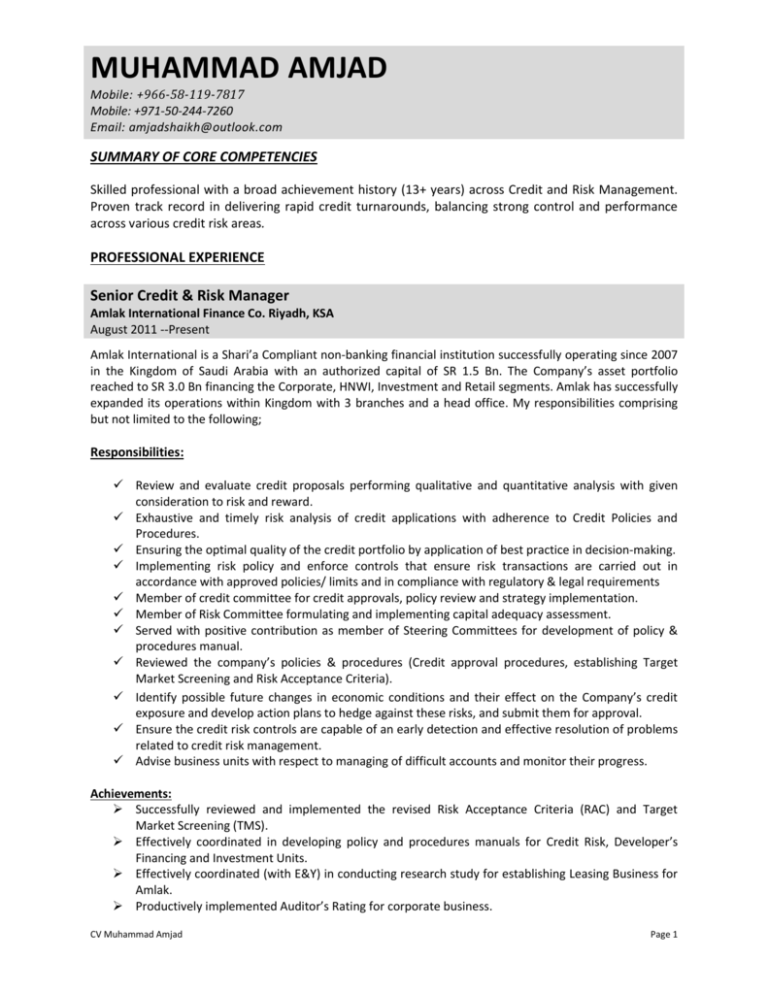

Senior Credit & Risk Manager

advertisement

MUHAMMAD AMJAD Mobile: +966-58-119-7817 Mobile: +971-50-244-7260 Email: amjadshaikh@outlook.com SUMMARY OF CORE COMPETENCIES Skilled professional with a broad achievement history (13+ years) across Credit and Risk Management. Proven track record in delivering rapid credit turnarounds, balancing strong control and performance across various credit risk areas. PROFESSIONAL EXPERIENCE Senior Credit & Risk Manager Amlak International Finance Co. Riyadh, KSA August 2011 --Present Amlak International is a Shari’a Compliant non-banking financial institution successfully operating since 2007 in the Kingdom of Saudi Arabia with an authorized capital of SR 1.5 Bn. The Company’s asset portfolio reached to SR 3.0 Bn financing the Corporate, HNWI, Investment and Retail segments. Amlak has successfully expanded its operations within Kingdom with 3 branches and a head office. My responsibilities comprising but not limited to the following; Responsibilities: Review and evaluate credit proposals performing qualitative and quantitative analysis with given consideration to risk and reward. Exhaustive and timely risk analysis of credit applications with adherence to Credit Policies and Procedures. Ensuring the optimal quality of the credit portfolio by application of best practice in decision-making. Implementing risk policy and enforce controls that ensure risk transactions are carried out in accordance with approved policies/ limits and in compliance with regulatory & legal requirements Member of credit committee for credit approvals, policy review and strategy implementation. Member of Risk Committee formulating and implementing capital adequacy assessment. Served with positive contribution as member of Steering Committees for development of policy & procedures manual. Reviewed the company’s policies & procedures (Credit approval procedures, establishing Target Market Screening and Risk Acceptance Criteria). Identify possible future changes in economic conditions and their effect on the Company’s credit exposure and develop action plans to hedge against these risks, and submit them for approval. Ensure the credit risk controls are capable of an early detection and effective resolution of problems related to credit risk management. Advise business units with respect to managing of difficult accounts and monitor their progress. Achievements: Successfully reviewed and implemented the revised Risk Acceptance Criteria (RAC) and Target Market Screening (TMS). Effectively coordinated in developing policy and procedures manuals for Credit Risk, Developer’s Financing and Investment Units. Effectively coordinated (with E&Y) in conducting research study for establishing Leasing Business for Amlak. Productively implemented Auditor’s Rating for corporate business. CV Muhammad Amjad Page 1 Senior Credit Officer Abu Dhabi Islamic Bank, Dubai, UAE July 2010 – August 2011 Responsibilities: Handling day to day appraisal of corporate (Mid-size & SME) customer’s credit requests with complete understanding of corporate and treasury products. Ensuring that credit packages are properly analyzed and in line with set strategy, policies and guidelines. Conclude the recommendation/rejection of credit proposal in consultation with Head of Credit. Ensure adherence to credit application process flow and the quality of credit presentations, also suggest mitigating measures where possible. Validate proposed facilities, pricing and obligor risk rating. Structure the proposed facilities (working capital, treasury products, long term financing) in accordance with customer’s requirements and Bank’s appetite. Analyzing and addressing the gaps of the credit proposals to the concerned business units. Communicate missing information/supporting documents to the units. Recommend upgrading or downgrading of relationships based on account or financial conduct. Respond to Audit / Review queries in consultation with Head of Credit. Monitor exception / reports excesses, past dues, utilization with respect to the allocated portfolio. Analyze requests for changes in documentation / standard terms / one off transactions. Achievements: Successfully achieved highest ranking for Credit Manual Assessment test. Effectively handled and coordinated for establishing automation of Early Warning Signals Manager Credit-Commercial Banking National Bank of Fujairah Dubai, UAE Feb 2006 – Dec 2009 Responsibilities: In-depth analysis of credit proposals (SME and mid-size corporate) based on financial and nonfinancial parameters to hedge against credit risks. To visit the clients to add value to the process and to better assess the business profile. To allocate credit grading independently based on assessment of parameters laid down in risk rating system. To coordinate with business unit managers for further information required for credit proposals and to make basis for the decisions. Conducting analysis of the securities and assets being offered as collateral for the purpose of identifying their suitability for lending against them. To provide appropriate guidelines to the business unit to ensure that the proposals are structured / tailored in line with the Bank’s prevailing credit policy. To provide recommendations and suggestions to higher management to improve the process flow, quality of lending procedures and system related issues. Within discretionary powers, approve/decline credits + transactions on merit and making recommendations to Credit Committee. Co-ordination of compliance processes, loans review on quarterly basis. Coordination of remedial and recovery team on frequently basis. Achievements: CV Muhammad Amjad Page 2 Effectively coordinated for establishing T24 core banking system with focus on risk management tools, set up of customer limits, profit accruals, overdue and excess limits monitoring. Relationship Manager MCB Bank Ltd Lahore, Pakistan Sep 1998 - Jan 2006 Responsibilities: Managing portfolio of the clients which included Fund based / Non Fund based financing to Corporate, SME and Agriculture sectors. To prospect potential customers for corporate banking/SME products. Scrutiny, processing and perfection of all credit proposals in line with Bank’s policy / Prudential Regulations and onwards presentation to the Central Credit Committee for formal approval. Comprehensive risk analysis of all proposals to mitigate the risk factors involved in financing. To coordinate with the Credit Administration Department and ensure perfection of security documentation of all finance accounts. Disbursements of limits, monitoring in the system in cooperation with credit admin department. The assignment also included close monitoring of operations of all loan accounts and initiation of corrective measures if any Early Warning Signals observed. Monitoring/reporting of irregularities and exceptions in credit limits of the portfolio. Coordination with Internal/External Auditors, credit administration & Control. EDUCATION / CERTIFICATION Masters in Economics 1996 - 1998 BZ University Pakistan Banking Diploma (DAIBP) 2000-2001 Institute of Bankers in Pakistan, Karachi. Pakistan Financial Risk Manager (FRM) Pursuing Level II Global Association of Risk Professionals TRAINING SKILLS Risk Modeling and VaR calculations by IIRME Dubai. Risk Management & Capital Implications in Banks by Fitch Training Dubai. Core Credit Skills Programme (5 Week) by 6 Sigma, Abu Dhabi UAE Credit Origination Skills by Emirates NBD Bank Dubai UAE. Multiple training sessions held by MCB Bank Ltd Pakistan covering customer handling, Relationship Building Skills, credit monitoring etc. I.T SKILLS & LANGUAGES Windows & Office tools, MS Office, Moody’s Financial Spread. T24 (Core Banking System) operated by National Bank of Fujairah. Mosaic & UNIX (Core and Credit systems) used at Abu Dhabi Islamic Bank. English – Fluent Urdu, Punjabi - Native Arabic - Working knowledge where I can read and write fairly with a trivial level of verbal communication. PERSONAL PROFILE Age Marital Status Nationality References CV Muhammad Amjad : : : : 36 Years Married (two kids) Pakistan Available upon request Page 3