Finance 321 Advanced Corporate Finance

Does Debt Policy Matter?

• Student Presentations

• Capital Structure Considerations

• Modigliani and Miller – Propositions 1 and 2

• Financial Risk and Expected Returns

• Weighted Average Cost of Capital (WACC)

• After Tax WACC

Capital Structure

• Capital structure is mixture of debt and equity

• Firm value is total value of debt plus equity

• Types of equity

– Common

– Preferred

• Types of debt

– Term

– Seniority

– Covenants

• Hybrids

– Convertible bonds

Modigliani and Miller –

Proposition 1

• Capital structure does not matter if:

– Total cash flows do not change based on capital structure

– Markets are perfect

• No frictions (taxes or bankruptcy costs)

• Corporations have no borrowing advantage

• Investors have access to any desired investment

• This means that if the capital markets are providing adequate investment choices, then a firm’s value is independent of the debt ratio

Illustration of M&M Prop. 1

Two firms with exactly the same operating income

Investor owns 1% of each firm’s securities

Firm U is unlevered (all equity)

Dollar Investment

.

01V

U

Dollar Ret urn

.

01

Profits

Firm L is levered (has issued debt)

Debt

Equity

Total

Dollar Investment

.

01D

L

.

01E

L

.

01(D

L

.

01V

L

E

L

)

Dollar Ret urn

.01

Interest

.

01

( Profits Interest)

.

01

Profits

Therefore, the value of the two firms must be equal

Another Illustration

• Investor owns 1% of levered firm L

Dollar Investment

.

01E

L

.01(V

L

D

L

)

Dollar Ret urn

.

01

( Profits interest)

• Investor owns 1% of unlevered firm U and borrows an amount equal to 1% of the debt of the levered firm

Borrowing

Equity

Total

Dollar Investment

.

01D

L

.

.

01V

U

01(V

U

D

L

)

Dollar Return

.01

Interest

.

01

Profits

.

01

( Profits Interest)

• Therefore, the value of the two firms must be equal

Modigliani and Miller's Proposition I states that:

A) The market value of any firm is independent of its capital structure

B) The market value of a firm's debt is independent of its capital structure

C) The market value of a firm's common stock is independent of its capital structure

D) All of the above

E) None of the above

Law of Conservation of Value

• Two streams of cash flow

– Stream A has a present value of PV(A)

– Stream B has a present value of PV(B)

• Value additivity

– The present value of the combined cash flows A+B is PV(A) + PV(B)

• Conservation of value

– Splitting up a cash flow into different parts does not affect the total value of the parts

Example Macbeth Spot Removers

Table 17.1 – All Equity Financed

Data

Number of shares

Price per share

Market Value of Shares

1,000

$10

$ 10,000

Outcomes

Operating

Earnings

Return

Income per share on shares (%)

A

$500

$.50

5 %

B

1,000

1.00

10

C

1,500

1.50

15

D

2,000

2.00

20

Table 17.2 – Half Debt/Half Equity

Data

Number of shares

Price per share

Market Value of Shares

Market val ue of debt

500

$10

$ 5,000

$ 5,000

Outcomes

Operating

Interest

Equity

Income earnings

Earnings per share

Return on shares (%)

A

$500

$500

$0

$0

0%

B

1,000

500

500

1

10

C

1,500

500

1,000

2

20

D

2 , 000

500

1 , 500

3

30

Table 17.3 – All Equity Firm, Investor Leverage to Borrow Enough to Purchase Another Share

Outcomes

Earnings

LESS on two shares

: Interest @ 10%

Net earnings on investment

Return on $10 investment (%)

A

$1.00

$1.00

$ 0

0%

B

2.00

1.00

1.00

10

C

3.00

1.00

2.00

20

D

4.00

1.00

3.00

30

The law of conservation of value implies that:

A) The value of a firm's common stock is unchanged when debt is added to its capital structure

B) The value of any asset is preserved regardless of the nature of the claims against it

C) The value of a firm's debt is unchanged when common stock is added to its capital structure

D) All of the above

E) None of the above

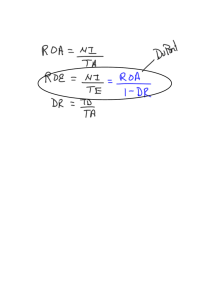

Financial Risk and Expected Returns

Expected return on assets

r

A

expected operating income market val ue of all securities r

A

r

D

D

D

E

r

E

D

E

E r

E

r

A

r

A

r

D

D

E

M&M Proposition 2

“The expected rate of return on the common stock of a levered firm increases in proportion to the debt-equity ratio (D/E), expresses in market values; the rate of increase depends on the spread between the expected return on a portfolio of all the firm’s securities and the expected return on the debt.”

Illustration of M&M Prop. 2

• Macbeth Spot Removers – All equity r

E

r

A

expected operating income market val ue of all securities

1500

.

15

10 , 000

• Half debt (at 10% interest) and half equity r

E

.

15

.

15

.

10

5000

5000

.

20 or 20%

Table 17.4 – Financial Leverage Increases Risk

All equity

50 % debt :

Earnings per share ($)

Return on shares

Earnings per share ($)

Return on shares

Operating

$1,500 to

1.50

15%

2

20%

Income

$500

0.50

5%

0

0

Change

$1.00

10%

$2.00

20%

Health and Wealth Company is financed entirely by common stock which is priced to offer a 15% expected return. If the company repurchases 25% of the common stock and substitutes an equal value of debt yielding 6%, what is the expected return on the common stock after refinancing? (Ignore taxes.)

A) 12%

B) 15%

C) 18%

D) 21%

E) None of the above

How Change in Capital Structure

Affects Beta

B

A

B

D

D

V

B

E

E

V

B

E

B

A

D

B

A

E

B

D

MM Proposition II states that:

A) The expected return on equity is positively related to leverage

B) The required return on equity is a linear function of the firm's debt to equity ratio

C) The risk to equity increases with leverage

D) All of the above

E) None of the above

The beta of an all equity firm is 1.1. If the firm changes its capital structure to 1/3rd debt and 2/3rds equity using

8% debt financing, what will be the beta of the levered firm? The beta of debt is 0.3. (Assume no taxes.)

A) 1.0

B) 1.1

C) 1.5

D) 1.65

E) None of the above

r

M&M Proposition II

r

E r

A r

D

Risk free debt Risky debt

D

E

Weighted Average Cost of Capital

WACC

r

A

D

D

V

r

E

E

V

Practical Problems with M&M

• Unsatisfied clientele

– Investors want, and will pay a premium for, securities that offer the particular financial instrument they want (risk, timing, etc.)

– Should be a temporary phenomenon

• Government regulation

– Restrictions on interest rates or available investments

• The impact of capital structure on cash flows

– Taxation issues

– Interest paid on corporate debt is a tax deduction

After-Tax WACC

WACC

r

D

( 1

Tc

)

D

V

r

E

E

V

where Tc

marginal corporate tax rate

Next Few Classes

• Thursday, April 5

– Case 2 – A-Rod

– Case is available in 340 Wohlers

– Be prepared to discuss the case in class

• Tuesday, April 10

– How much should a firm borrow? – Chapter 18

• Thursday, April 12

– Financing and valuation – Chapter 19