Discount Notes - World Bank Treasury

advertisement

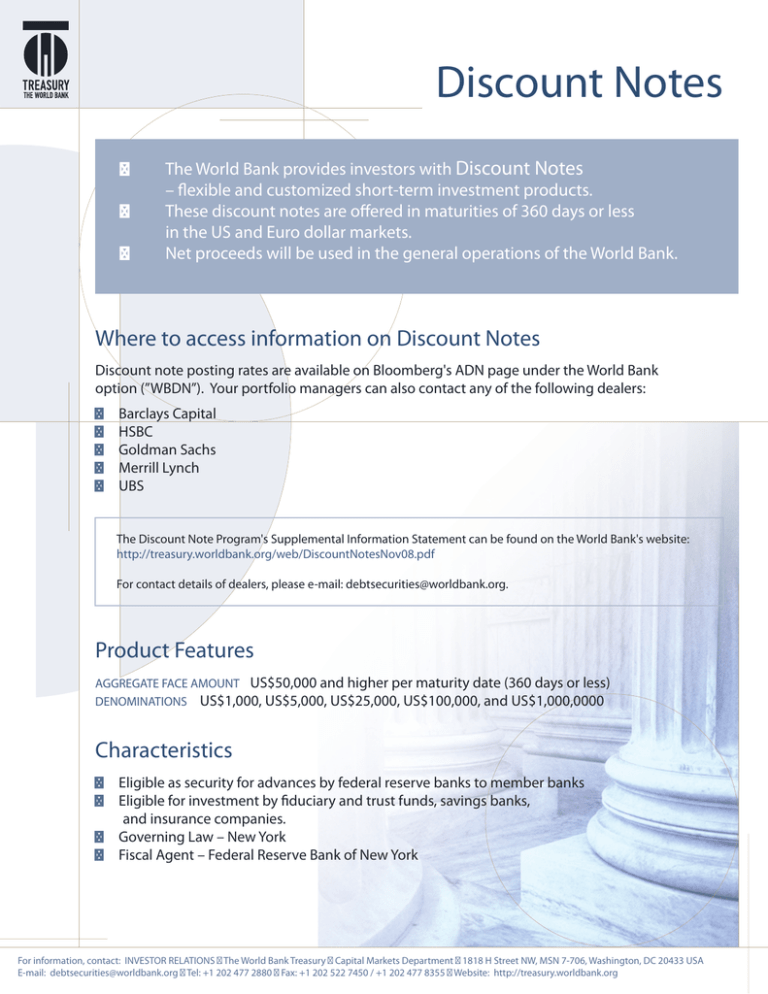

Discount Notes The World Bank provides investors with Discount Notes – flexible and customized short-term investment products. These discount notes are offered in maturities of 360 days or less in the US and Euro dollar markets. Net proceeds will be used in the general operations of the World Bank. Where to access information on Discount Notes Discount note posting rates are available on Bloomberg's ADN page under the World Bank option (”WBDN”). Your portfolio managers can also contact any of the following dealers: Barclays Capital HSBC Goldman Sachs Merrill Lynch UBS The Discount Note Program's Supplemental Information Statement can be found on the World Bank's website: http://treasury.worldbank.org/web/DiscountNotesNov08.pdf For contact details of dealers, please e-mail: debtsecurities@worldbank.org. Product Features AGGREGATE FACE AMOUNT US$50,000 and higher per maturity date (360 days or less) DENOMINATIONS US$1,000, US$5,000, US$25,000, US$100,000, and US$1,000,0000 Characteristics Eligible as security for advances by federal reserve banks to member banks Eligible for investment by fiduciary and trust funds, savings banks, and insurance companies. Governing Law – New York Fiscal Agent – Federal Reserve Bank of New York For information, contact: INVESTOR RELATIONS The World Bank Treasury Capital Markets Department 1818 H Street NW, MSN 7-706, Washington, DC 20433 USA E-mail: debtsecurities@worldbank.org Tel: +1 202 477 2880 Fax: +1 202 522 7450 / +1 202 477 8355 Website: http://treasury.worldbank.org