STRATEGIC MANAGEMENT

WELLCOME TO

Strategy and Strategic Management

School of Economics and Management

Tongji University

同济大学经济与管理学院 俞秀宝 1

Reference Books

- Arthur A. Thompson, Jr. A. Strickland Ⅲ (1998), Strategic

Management: Concepts and Cases (12th edition),

Mechanical Industry and McGraw-Hill

- David A. Aaker (1998), Strategic Market Management

(fifth edition), John Wiley & Sons, Inc.

- Gerry Johnson and Kevan Scholes (1998), Exploring

Corporate Strategy (third edition, in Chinese), Prentice Hall

- Fred R. David (1998), Strategic Management (Six edition, in Chinese), Economics Science Press

- Cliff Bowman (1997), STRATEGIC MANAGEMENT , Press of China People’s University and Prentice Hall

同济大学经济与管理学院 俞秀宝 2

Unit 1 Introduction

Objects are an organization’s performance targets – the results and outcomes it wants to achieve.

Strategic objects

Relate to outcomes that strengthen an organization’s overall business position and competitive vitality.

3 同济大学经济与管理学院 俞秀宝

Strategy

-Is a continuous, interactive process aimed at keeping an organization as a whole appropriately matched to its environment

(Peter, 1988)

-A company’s strategy consists of the competitive efforts and business approaches that managers employ to please customers, compete successfully and achieving organizational objects

(Thompson & Strickeland, 2003)

4 同济大学经济与管理学院 俞秀宝

Strategy is concerned with

-the long term direction of an organization

-The scope of an organization ’ s activities

-achieving advantage over competition

-matching activities to resources and capabilities

-the value of power holders

-major resources implications

-influence over operation decisions

(Johnson & Scholes, 2002)

And in China

………

同济大学经济与管理学院 俞秀宝 5

Levels of Strategies

Corporate HQ Corporate strategy

SBU A SBU B

Manufacturing

Marketing

Accounting

HR

… .

SBU C

Competitive strategy

Functional strategies

同济大学经济与管理学院 俞秀宝 6

Content of strategy at different levels

corporate Portfolio and resource allocation

SBU

How to compete

Function

Product, market

Plans …

同济大学经济与管理学院 俞秀宝 7

Formulating strategy

Resource and capabilities insights strategy

Market understanding

Major environment influences Competitive analysis

同济大学经济与管理学院 俞秀宝 8

Schools of Strategy Formation

- Planning School

- Designing School

- Political School

- Culture School

- Learning School

- Fate School

- …..

同济大学经济与管理学院 俞秀宝 9

Classical model of strategic planning

External appraisal

Industry attractiveness

Threats & opportunities

Key successful factors

Social responsibilities

……

Strategy formulation

Strategy options evaluations

同济大学经济与管理学院 俞秀宝

Internal analysis

Organizational

Strengths & weaknesses

Core (distinctive)

Competencies

Managerial values

Personal ambitions … .

Mintzberg, 1994)

10

Strategy perceived and realized

Unrealized strategy

同济大学经济与管理学院 俞秀宝 11

Who Performs

•CEO

•Vice presidents

•Major org. units

Production

Marketing

Human resource

Other key department

Diversified companies:

•CEO

•Business units

•Department heads

•Managers of major operating units

•employees

同济大学经济与管理学院 俞秀宝 12

Unit 2 Vision and Mission

•What is a strategic vision?

•Why have a vision or mission?

•Mission statement - how to define

同济大学经济与管理学院 俞秀宝 13

What is a Strategic Vision

Management’s views and conclusions about:

- organization’s future course

- the customer focus

- the market position it should try to occupy

- business activities

What kind of company we are trying to create?

同济大学经济与管理学院 俞秀宝 14

Why Have a Vision or Mission

-A prerequisite of effective strategic leadership

- forming a strategic vision is not an exercise to create a catchy slogan thinking strategically about org future putting the company on a path that management is deeply committed to

- Chart a company future

同济大学经济与管理学院 俞秀宝 15

Mission Statement

The mission statement sets out the organization’s ground rules to its approach to doing business.

A good statement usually address the following:

•a statement of beliefs and values

•the products or services that the firm will sell

•the markets within which the firm will trade

•how those markets will be reached

•the technologies that the firm will use

•attitudes to growth and financing

同济大学经济与管理学院 俞秀宝 16

Pepsi Co ’ s Mission

“ Is to increase the value of our share holders’ investment. We do this through sales growth, cost control, and wise investment resources. We believe our commercial success depends upon offering quality and value to our consumers; providing products that are safe, wholesome, economically efficient and environmentaly sound; and providing a fair return to investors while adhering to the highest standards of integrity”.

同济大学经济与管理学院 俞秀宝 17

Vision of Amersham PK

“

To build our position as a leading provider of products and technologies to enable the molecular medicine revolution, in which disease will be better understood, diagnosed sooner and treated more effectively”.

同济大学经济与管理学院 俞秀宝 18

Tongji ’ s Vision

努力建设一所文理交融、医工结合,

科技教育与人文教育协调发展的研究型、

多功能的一流的现代化大学

19 同济大学经济与管理学院 俞秀宝

Financial Objects vs Strategic Objects

Financial objects

•Growth in revenues

•Growth in earnings

•Higher dividends

•Wider profit margins

•Higher returns

•Attractive EVA performance

•Strong bond and credit rating

•Bigger cash flows

•A rising stock price

•A more diversified revenue base

•Stable earning during recession

Strategic objects

•A big market share

•Quicker design-to-market times than rivals

•Higher product quality than rivals

•Lower costs relative to key competitors

•Broader pr more attractive product line than rivals

•A stronger reputation with customers than rivals

•Superior customer service

•Wide geographic coverage than rivals

•Recognition as a leader in technology and/or product innovation

同济大学经济与管理学院 俞秀宝 20

Establishing Objects

• Setting objects: convert the strategic vision and directional course into specific performance target.

• Objects: represent a managerial commitment to achieving specific performance targets within a specific time frame.

• Experience: “companies whose managers set objects for each key result typically outperform companies whose managers exhibit good intentions, try hard, and hope for the best”.

同济大学经济与管理学院 俞秀宝 21

Unit 2 Activity

为你选定的一家企业撰写一个企业

愿景或使命。

同济大学经济与管理学院 俞秀宝 22

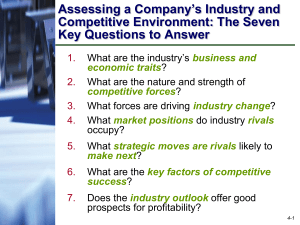

Unit 3 Industry and competitive analysis

Managers are not prepared to decided on a long term direction or a strategy until they have a keen understanding of the company ’ s strategic situation – the exact nature of The industry and competitive conditions it faces and how These conditions match up with its resources and capabilities.

Thompson & Strickland (2003)

同济大学经济与管理学院 俞秀宝 23

Sources of profit

Microeconomic context

Industry

Based view

Industry

Industry conditions attractiveness

Firm resource capabilities

Resource

Based view

Company performance

同济大学经济与管理学院 俞秀宝 24

A company ’ s Macro-environment

suppliers rivals company

New entrants substitutes

Buyers

同济大学经济与管理学院 俞秀宝 25

PESTD Analysis

Political

- political parties and alignment at local, national & regional trading-block level

- legislation, regulation, taxation, employment law

- Relations between government and the organization

- Government ownership of the industry and attitude to monopolies and to competition

Economic resent and future

- Total GDP and GDP per head

- Inflation, Interest rates, Unemployment

- Disposable income and consumer expenditure

- Currency fluctuations & exchange rate

- Investment (from state, private and foreign firms)

- Key material unit cost (energy, transport, telecommunication, … )

同济大学经济与管理学院 俞秀宝

(Lynch, 2003)

26

PESTD Analysis

Social and culture

- shift in value and culture, changes in lifestyle

- Attitudes to work and leisure, “ green environment ” issues

- Education and health

- Distribution of incomes

Technology

-rate of adoption of new technologies

-Expenditure on R&D by rivals

-New patents and products

Demogrphics

- age, income, education, geographic lacation

( Lynch 2003)

同济大学经济与管理学院 俞秀宝 27

Environment Analysis- key issues

Political

-what changes in regulation are possible? What will be their impact be?

-What tax or other incentives are being developed that might affect strategy?

- what are the political risks operating in a government jurisdiction?

Economic

-what are the economic prospects and inflation outlets for the countries in which the firm operates? How will they affect strategy?

Social and culture

- what are the current or emerging trends in lifestyles, fashions, and other components of culture? Why? What are their implications?

Technology

-To what extent are existing technologies maturing?

-What technological development or trends are affecting or will affect the industry?

Demographics

-what demographic trends will affect the market size or sub-market of the industry?

- what trends represent opportunities and threats?

同济大学经济与管理学院 俞秀宝 28

Customer Analysis

•

Segmentation – Strategic Business Units, definition

• How should segments be defined – 5-10 variables and firm history

•

Questions need to be asked for segmentation

•

Customer motivations – what lies behind their purchase decision

• Unmet needs – represents the opportunities for firms

同济大学经济与管理学院 俞秀宝 29

Competitor Analysis

•

Identify your competitors

Customer choices – from your customers point of view

Product approaches – who is offering similar products

Strategic Group approach

•

Understanding competitors

Size, growth, profitability

Current and past strategies

Cost structure

Image, positioning, culture

•

Competitors strengths and weaknesses

同济大学经济与管理学院 俞秀宝 30

What are the industry

’

s dominant economic traits?

•Market size

•Scope of competitive rivalry

•Market growth and where the industry is in the growth cycle

•Number of rivals and their relative sizes

•The number of buyers and their relative sizes

•The prevalence of backward and forward integration

•The pace of technology change

•Cost structure

•Whether rivals’ product or services are highly or weakly differentiated or identical

•Whether industry profitability is above/below par………..

同济大学经济与管理学院 俞秀宝 31

Learning curve

Cost

Per unit

$ 1

70 cents

Cost reduction 35 cents

1 2 4

Accumulated production

8 million units

同济大学经济与管理学院 俞秀宝 32

Industry structure

Perfect competition

- many equal suppliers of similar products

Monopolistic competition

- many sellers with each slightly differently

Oligopoly

- a few large suppliers

Monopoly

- one dominant seller

同济大学经济与管理学院 俞秀宝 33

Industry structure and advantages

Monopoly

Perfect competition

Oligopoly

Monopolistic competition

Considerable

Cost advantages very few

同济大学经济与管理学院 俞秀宝 34

Stages of industry evolution

Introduction

Growth

Maturity Decline

同济大学经济与管理学院 俞秀宝 35

Industry evolution and competition

Demand

Technology

Introduction growth maturity high income enlarged repeating improve consumers stable new prod decline clever decline

Products

Manufacture

Trade

Competition low quality high cost some export high quality standard low quality mass production more table over capacity enlarge large export small import few companies entry many export dec import inc no exp large inp price compt out many out

同济大学经济与管理学院 俞秀宝 36

Industry evolution

production

Innovating country

Other industrialized countries

New product maturing product

Developing countries standardized product

同济大学经济与管理学院 俞秀宝 37

Strategic groups

price/quality/image

奥迪

别克

本田雅阁

帕萨特 - Firm in an industry following the same or a similar strategy along key dimensions

- Variables

•price/quality/image

•geographic coverage

•market shares

桑塔纳

奥托

悦达

富康

夏利

捷达

Car industry in 2000 low market shares

同济大学经济与管理学院 俞秀宝 38

Common Types of Key Successful Factors

- The essential requirements for competing in an industry

•Technology-Related KSFs

• Manufacturing-Related KSFs

• Distribution-Related KSFs

• Marketing-Related KSFs

• Skill-Related KSFs

• Organizational Capacity

• Other Types

同济大学经济与管理学院 俞秀宝 39

Industry analysis – key issues

- Where is the industry now in terms of its evolution?

- what are the most important issue?

- where it will be ? And how it might take to go there?

- what are the implications to the firm?

同济大学经济与管理学院 俞秀宝 40

Competitive analysis

-competitive force: pressures to company’s profitability

- Five force model

Discover the main sources of competitive pressure and how strong each competitive force is? a key analytical tool to analyze whether an industry is attractive or not

41 同济大学经济与管理学院 俞秀宝

What is competitive like and how strong are each of the competitive forces?

SUBSTITUTES

Win buyers

SUPPLIERS OF

KEY INPUTS

Ability to exercise bargaining power and leverage

COMPETING

SELLERS

Bargaining power and leverage

Threat of entry of new rivals

POTENTIAL

NEW ENTRANTS

BUYERS

同济大学经济与管理学院 俞秀宝 42

Rivalry intensity is likely to be high when

-the number of competitors increases and as competitors become more equal in size and capabilities

-the demand for the product is growing slowly

- industry conditions tempt competitors use price cuts etc to boost unit volume

- customers ’ costs to switch brands are low

- one or more competitors are dissatisfied with market position

- exit cost is high

同济大学经济与管理学院 俞秀宝 43

Buyers are like to have higher bargaining power when

- low switch cost

- number of buyers are small

- a customer is particularly important to a seller

- they are well informed at sellers ’ products, price, costs

- buyers pose a credible threat of integrating backward

- buyers have discretion in whether and when they purchase the products

同济大学经济与管理学院 俞秀宝 44

Supplier power tends to be higher if

- number of suppliers are small

- less substitutes available in the market

- supplier ’ s products are key to buyers

- significant switch cost for buyers

- supplier poses a credible threat of forward integration

( porter, 1980)

同济大学经济与管理学院 俞秀宝 45

Entry barriers of potential entrants

-Government regulations and policies

-economics of scale

- learning and experience curve effects

- technology

- Brand preference and customer loyalty

- capital requirement

- distribution channels

-……

同济大学经济与管理学院 俞秀宝 46

Competitive pressures from substitutes

- attractive price from substitutes

- better quality, performance, and other attributes

- low switching cost

同济大学经济与管理学院 俞秀宝 47

Strategic implications of five-force

As a rule, the stronger the collective impact of competitive forces, the low the combined profitability of participant firms.

同济大学经济与管理学院 俞秀宝 48

Unit 4 Case Study

阅读三星案例,并讨论该公司是否应该

投资主题公园项目?为什么?

同济大学经济与管理学院 俞秀宝 49

Unit 5 Evaluating Company Resources and competitive Capabilities

- How well is the company’s present strategy working?

- What are the company’s resource strengths and weaknesses and its external opportunities and threats?

- Are the company’s prices and costs competitive?

- How strong is the company’s competitive position relative to its rivals?

-What strategic issues does the company face?

SWOT analysis, shareholder value analysis, value chain analysis, strategic cost analysis and competitive strength assessment

同济大学经济与管理学院 俞秀宝 50

How well is the company ’ s present strategy working?

•The firm’s market share in the industry - rising, stable or declining

• profit margin

• trends in the firm’s net profits, return on investment

• company’s overall financial strength and credit rating is improving or on the decline

• trends in the company’s stock price and shareholder value

• firm’s sales - growing faster or slower than the market as a whole

• The firm’s image and reputation, product or service quality, customer satisfaction, employees capability and performance

• the company is regarded as a leader or not

同济大学经济与管理学院 俞秀宝 51

What are the company ’ s resource Strengths and

Weaknesses and its external Opportunities and Threats?

--

Provide a good overview of whether a firm’s business position is fundamentally healthy or unhealthy

-Concept: a strength is something a company is good at doing or a characteristic that gives it enhanced competitiveness.

-Concept: a weakness is that a company lacks or does poorly (in comparison to others) or a condition that puts it at a disadvantage.

同济大学经济与管理学院 俞秀宝 52

Identify company

’

s strengths and resource capabilities

•Strengths: skills and expertise, collection of assets, competitive capabilities and market achievements

•Forms of strengths: skill or expertise physical assets human assets organizational assets intangible assets competitive capabilities alliances or cooperative ventures

同济大学经济与管理学院 俞秀宝 53

Definitions

Resources

Stocks of available factors that are owned or controlled by a firm

Capabilities (competency)

A firm ’ s ability to utilize resource to achieve a desired end

( Amit etc, 1993)

同济大学经济与管理学院 俞秀宝 54

Core competency

• Core competencies : the ability to perform a competitively relevant activity very well (text book)

• Core competencies are the collective learning in the organization, especially hoe to coordinate diverse production skills and integrate multiple streams of technologies (Prahalad and Hamel,1990)

• is central to a company’s competitiveness and profitability

• skills, knowledge and capabilities

• lies in a company’s people, not in its assets on the balance sheet

• empowers a company to build competitive advantage

• A firm normally needs to have about 5 single competencies to keep a sustainable competitive advantages (Aaker, 2001)

同济大学经济与管理学院 俞秀宝 55

Core competency and firm competitive advantage

Delivery products and

Services highly valued by customers

High performance than rivals

Dynamic capabilities that are hard to copy by rivals

Core competency

Capabilities

Resource

同济大学经济与管理学院 俞秀宝 56

Samples of core competencies

Core competency of Dell

- direct sells + quality product + service

Core competency of EBA Papst

- High quality, reliable, innovative products and total thermal solutions

Core competency of Sharp Corporation

- Flat-panel display technology (Liquid crystal displays)

Core competency of Toyota and Honda

- low cost, high quality manufacturing, short design-to-market cycles

-

Core competency of your firm

同济大学经济与管理学院 俞秀宝 57

Competitive Value of a Company ’ s Resource

• Is the resource hard to copy?

• How long does the resource last?

• Is the resource really competitively superior?

• Can the resource be trumped by the different resources/capabilities of rivals?

• Can the resource/capability be transfer to provide products and service that customers put high value on

• Selecting the competencies and capabilities to concentrate on

• Size is not “all” about competitiveness

同济大学经济与管理学院 俞秀宝 58

Barriers to imitation

The true causes are not fully understood

Expensive Difficulty to copy current learning is based on past learning physically unique complexity complementarities

(Collins etc, 1995)

同济大学经济与管理学院 俞秀宝 59

Identifying a company ’ s market opportunities

(SWOT analysis)

•Market opportunities are the important factors of the formation of company strategies

•Market opportunities and company opportunities

•Turn market opportunities into company opportunities when

•offer big increase of profit

•company has most potential for competitive advantage

•the market opportunity matches well with company’s present resource capabilities

同济大学经济与管理学院 俞秀宝 60

Identify company threats

Threats

• the emergence of cheaper technology

• rivals’ introduction of new or better products

• the entry of lower-cost foreign competitors

• new regulations

同济大学经济与管理学院 俞秀宝 61

Real value of SWOT analysis

SWOT analysis draws conclusions about

•How the company’s strategy can be matched to both its resource capabilities and its market opportunities

•How urgent it is for the company to correct particular resource gap

Managerial and strategic implications:

•Basis for action

•Will the current company strength matter as much in the future?

•Do new types of competitive capabilities need to be put in place?

•……

同济大学经济与管理学院 俞秀宝 62

Are the company ’ s prices and costs competitive?

•Strategic cost analysis and value chains

Suppliers Operations

Distribution

Logistics

Sales

Marketing

Service

Profit margin R&D, Tech, System Development

Human Resource management

General Administration

同济大学经济与管理学院 俞秀宝 63

Benchmarking the costs of key activities

•Focus on cross-company comparisons

•how materials are purchased

•how suppliers are paid

•how inventories are managed

•how employees are trained

•how pay rolls are processed

•how quality control is performed

•how customer orders are filled

•how maintenance is performed

同济大学经济与管理学院 俞秀宝 64

The industry value chain

Supplier related

Activities

Cost, and

Margins of suppliers company distribution related customer related

Value chain

Internally

Performed

Activities

Cost, and

Margins

Activities

Cost, and

Margins of

Forward channels

Buyer/end

Use value chain

(Porter, 1985)

65 同济大学经济与管理学院 俞秀宝

Industry value chain of PCs

Intel, Motorola, RISCs chip

Dell, IBM, compacq, HP … .

computer

Windows, DOS, Unix …

Operating system

Word, SPSS

Application soft-ware

Sales and distribution

Retail, supermarket, dealers,

Direct sales …

66 同济大学经济与管理学院 俞秀宝

From value chain to competitive capability to competitive advantage

- out-sourcing

- industry cluster

- fully use firm specific resources and country resources

- gain control over main activities of the industry

… .

同济大学经济与管理学院 俞秀宝 67

What strategic issues does the company face?

1. Strategic Performance Indicators

Performance Indicator 19192020 20-

Market share

Sales growth

Net profit margin

Others

2. Internal resource strengths and competitive capabilities

Internal weaknesses and resource deficiencies

External opportunities

External threats to the company’s well being

同济大学经济与管理学院 俞秀宝 68

What strategic issues does the company face?

(cont)

3.

Competitive Strength Assessment

Ranting scale: 1= very weak; 10=Very strong

Key success factors/

Competitive Strength measure

Quality/product performance

Reputation/Image

Manufacturing capability

Technology skills/know how

Distribution capabilities

New prod. innovation cap.

Financial resources

Relative cost position

Customer service capability

Weight Firm Firm Firm Firm

A B C D

同济大学经济与管理学院 俞秀宝 69

What strategic issues does the company face?

(cont.)

4. Conclusions concerning Competitive position

(improving/slipping? Competitive advantages/disadvantages)

5. Major strategic issues the company must address

同济大学经济与管理学院 俞秀宝 70

Unit 6 Case study

阅读汇丽案例,讨论下列问题:

汇丽面临怎样的战略问题?

如果您是汇丽的老总,您将怎样使汇丽摆脱困境?

同济大学经济与管理学院 俞秀宝 71

Unit 7 Generic strategy and competitive advantage

同济大学经济与管理学院 俞秀宝 72

Strategic Thrusts

–

Routes to an SCA

Operational excellence

Customer intimacy

Product leadership….

Focus

Differentiation

Strategic

Thrusts

Preemption

Low cost

Synergy

Innovative

Entrepreneurial style

……

同济大学经济与管理学院 俞秀宝 73

The Role of Synergy

• Definition: the whole is more than the sum of its parts

(1+1) > (1) + (1)

• Aims of synergy:

1. Increase customer value and increase sales

2. Lower operating costs

3. Reduce investment

• GE: achieve synergy across many businesses

• IBM: create synergy by pushing core technologies across more product lines

74 同济大学经济与管理学院 俞秀宝

Means of Synergy

• Production capacity

• A brand name and its image

• Facilities used for manufacturing, offices or warehousing

• R & D efforts

• Staff and operating system

• Marketing and marketing research

• Customer and sometimes customer applications

• ….

• Synergy perceiving and realization – problems: culture mismatch, inadequate incentives, unpredictable market trends

同济大学经济与管理学院 俞秀宝 75

Preemptive move (first mover) strategies to use with those generic strategies

Supply systems

Product

Production system

Gain customer

– loyalty/commitment

Distribution/service

同济大学经济与管理学院 俞秀宝 76

First mover - pros and cons

For

Build image

Volume advantages

Gain market share

Lock in suppliers

Create technology standards

Against

Significant costs

Customer needs undeveloped

Technology leap-frogging

Unfavourable image

同济大学经济与管理学院 俞秀宝 77

Generic Strategies

How a company can achieve or defend a competitive advantage?

• Low-cost lead-ship strategy

• A broad differentiation strategy

• A focused or market niche strategy based on lower cost

• A focused or market niche strategy based on differentiation

同济大学经济与管理学院 俞秀宝 78

Low-Cost Lead-ship Strategy

• A powerful competitive approach where many buyers are price sensitive

• Low cost relative to rivals

• Rivals are difficult to copy or match

• To allow operating the business in a highly cost-effective manner and open up a sustainable cost advantage over rivals

同济大学经济与管理学院 俞秀宝 79

Low-Cost Lead-ship Strategy

必须发现和挖掘所有资源优势,出售标准和

朴实无华的产品,强调生产规模,追求成本

优势,成为行业中高水平经营者。

同济大学经济与管理学院 俞秀宝 80

Ways to achieve a cost advantage

-do a better job than rivals of performing internal value chain activities

- revamp the firm ’ s value chain to bypass some cost producing activities altogether

Controlling the cost drivers

-economies of scale

-Learning and experience curve effects

-Control cost of key inputs

-Link with other activities in the company or industry value chain

-The benefits of vertical integration vs outsourcing

-The percentage of capital utilization

-Strategic choices and operating decisions

-First-mover advantages vs disadvantages

(porter, 1985)

同济大学经济与管理学院 俞秀宝 81

When cost-lead-ship works best?

• Price competition is vigorous

• Few ways to achieve product differentiation that have value to buyers

• Moat buyers use the product in the same way

• Low switching cost to buyers

• Buyers are large and have power to bargain

• Standardized products are available

同济大学经济与管理学院 俞秀宝 82

Differentiation Strategies

• To be unique in ways that are valuable to customers and that can be sustained

• A good competitive approach when buyers are too diverse to satisfied by a standardized product

• To study buyers needs – what they put high value on

• Hard or expensive for rivals to copy or duplicate

在被购买者认为极有价值的某些方向上做得高于

其他企业,独一无二,产品有额外加价,.....公司

通过差异化将自己与竞争对手区分开。

同济大学经济与管理学院 俞秀宝 83

Types of differentiation themes

• A unique taste

• Spare parts available (Caterpillar 48 hours delivery)

• More for money (Mcdonald’s)

• Engineering design and performance (Mercedes)

同济大学经济与管理学院 俞秀宝 84

Value chain and differentiating attributes

-purchasing and procurement activities – performance and quality

-R & D – improve product design

-R & D and technology – customer order manufacture at low cost

-Manufacturing activities – reduce product defects

-Out-band logistic and distribution activities – fast delivery

-Customer service

同济大学经济与管理学院 俞秀宝 85

When differentiation strategy works best

-there are many ways to differentiate the product or service that have value to many buyers

-buyers needs and users are diverse

-Few rival firms are following same differentiation approach

- technology change – rapid product innovation

同济大学经济与管理学院 俞秀宝 86

Pitfalls of a differentiation strategy

-differentiation attributes are not valuable to buyers

-over-differentiating leads to high cost (exceed buyers ’ needs)

-Trying to charge too high a price premium

-Not understanding or identifying what buyers consider as value

同济大学经济与管理学院 俞秀宝 87

Market Niche Strategies

•A focused or market niche strategy based on lower cost

•A focused or market niche strategy based on differentiation

•Concentrated attention on a narrow piece of the total market

When focusing is attractive?

•The target market niche is big enough to be profitable

•The niche has good growth potential

•The niche is not crucial to the success of major competitors

•The focuser can defend the challengers

•The focuser has the ability to serve the targeted niche effectively

同济大学经济与管理学院 俞秀宝 88

Unit 8 Case study (not)

阅读沃尔玛案例,分析

沃尔玛的一般竞争战略是什么?

-

沃尔玛是如何在日常管理中实施它的一般竞争战略的?

-

沃尔玛的创始人对该公司的一般竞争战略有何影响?

你认为,沃尔玛在中国是否会成功?

89 同济大学经济与管理学院 俞秀宝

Base?

Unit 9-1 Strategic Options

–

intensive strategies

Selection

Direction?

Approach?

Generic strategies

•Cost lead-ship

•Differentiation

•Focused

Directions

•Integration

•Intensive strategies

•Diversification

•Defending strategies

Approaches

•Joint venture

•Merge and acquisition

同济大学经济与管理学院 俞秀宝 90

* Strategic alliance - Motivations

-learn from one another in performing joint research, sharing technological know-how, and collaborating on complementary technologies and products

-manufactures typically pursue alliances with parts and components suppliers gain efficiencies of better supply chain

-JV- seeking advantages from partners

… .

同济大学经济与管理学院 俞秀宝 91

Strategic alliance - samples

GM has formed over 100 cooperative partnerships in a wide range of areas

-IBM has joined in over 400 strategic alliances

Oracle has over 15000 alliances

-Toyota has forged a network of long-term strategic partnerships with its suppliers of automotive parts and components

…… .

92 同济大学经济与管理学院 俞秀宝

The un-stability of S-A

-diverging objectives and priorities

-An inability to work well together

-The mergence of more attractive tech paths, market places

Strategic dangers of relying heavily on alliances and cooperative

Partnerships

# essential expertise and capabilities

同济大学经济与管理学院 俞秀宝 93

* Vertical Integration - definition

•Forward integration

•Gain control over sales (distributors and retailers)

•Backward integration

•Gain control over suppliers

Or extends a firm’s range of activities backward into sources of suppliers /or forward toward end users.

同济大学经济与管理学院 俞秀宝 94

Vertical integration

- Go for it in a big way and become heavily integrated to maximise benefits

- or outsource most non-core, non mission-critical activities so you have minimum expenditure, maximum flexibility

(and/or consider strategic alliances)

- do not be half hearted between these extremes

95 同济大学经济与管理学院 俞秀宝

Pros and cons of vertical integration

For

Cost savings

Improved quality

Protect resources

Increase profits

Improve access to customers'

Against

Requires different skills

Increases dependency on industry

Increases capital req’ts

Raises exit barriers

Creates balance problems

Reduces flexibility

同济大学经济与管理学院 俞秀宝 96

* Outsourcing

De-integration and outsourcing involves withdrawing from certain stages/

Activities in the value chain system and relying on outside vendors to

Supply the needed products, support services, or functional activities.

Facts: Companies have begun outsourcing activities formerly performed

In-house and concentrated their attentions more on a narrower portion

Of the value chain.

97 同济大学经济与管理学院 俞秀宝

When go outsourcing

-an activity be performed better or more cheaply by outside specialists

-the activity is not crucial to the firm ’ s ability to achieve SCA

-Reduces company ’ s risk exposure to changing technology

-improve org. flexibility, cut cycle time, decision making and coordination cost

-allows a company to concentrate on its core business and do what it does best

98 同济大学经济与管理学院 俞秀宝

Labor cost in China

Labor cost in textile industry (2002)

Nation

Japan

US

Taiwan

Hong Kong

South Cria

Poland

Turkey

Monaco

Thailand

China

Pakistan

Indonesia

1.9

1.1

0.6

0.4

0.2

5.7

3.6

3.5

2.5

cost/h (US$)

20.7

13

5.9

5

3

15

8

1

44

28

27

19 compared with US (%)

185

100

45

99 同济大学经济与管理学院 俞秀宝

Outsourcing in Chinese market

-Ford has plans to buy $1 billion in auto-components in China

-Wal-Mart establishing a souring division in Shenzhen

-Philips electronics ’ 23 factories in China surpassed $5 billion in goods produced.

-Reebok has most of the OEM plants in southern China (GD, FJ).

It does design, R&D, marketing, product quality control and sales …

100 同济大学经济与管理学院 俞秀宝

Pitfalls of outsourcing

Outbound activities that are key to company ’ s competitive advantages, and hollow out its own capabilities.

同济大学经济与管理学院 俞秀宝 101

* Merger and acquisition: definition

Merger:

Two companies merged together (David, 1998). Or a combination and

Pooling of equals, which the newly created company often taking on a new

Name (Thompson etc. 2004)

Acquisition:

One company purchases another (David, 1998). Or is when one company,

The acquirer, purchases and absorbs the operations of another, the acquired

(Thompson etc, 2004)

Difference: relates to the details of ownership, management control and

Financial arrangements.

同济大学经济与管理学院 俞秀宝 102

Samples of merger and acquisitions

Mergers

HP- Compacq merger (cost saving, reduce competition)

Tongji and Shanghai railway university merger (History reason)

Daimler-Benz and Chrysler merger (cost reduction and etc.)

Acquisitions

Intel (around 500 mergers)

Hair and its development (more than 20 mergers)

GE

Unilever

Procter & Gamble

同济大学经济与管理学院 俞秀宝 103

M-A Experience

-

Question: Why some companies acquire good performance companies and some AC bad or even bankrupt companies?

- Haier

- Fuxin

104 同济大学经济与管理学院 俞秀宝

* Other intensive strategies

•Market penetration

•Increase market share through greater efforts of marketing

•Market development *

•Bring products or services to a new market area

•Product development

•Increase sales through the development of new products or services

同济大学经济与管理学院 俞秀宝 105

Unit 9-2 Strategic options - Defending

Strategies

Retrenchment or re-organization (收缩或重组)

通过减少成本或资产对企业进行重组,以扭转销售

额和盈利的下降

•Divestiture ( 剥离)

将分公司或组织的一部分售出

•Liquidation (清算)

为实现其有形资产价值而将公司资产全部分块售出

同济大学经济与管理学院 俞秀宝 106

Case study – GM in China

同济大学经济与管理学院 俞秀宝 107

Unit 10 diversification strategies

同济大学经济与管理学院 俞秀宝 108

Related Diversification - definition

• Add new products and services which are related to the original business Or add activities which are supplement or complementary and support to the main business

(David, 1998)

• Or when there are competitively valuable relationships among the activities comprising their respective value chain

( Thompson etc, 2004)

• 增加新的但与原业务相关的产品与服务

• 增加与公司当前活动相竞争、相互补充、相互支持的活动

同济大学经济与管理学院 俞秀宝 109

Un-related diversification - definition

•Add new products and services that are not related to the company’s original business (David, 1998)

• 增加新的但与原业务不相关的产品与服务

•Or when the activities comprising their respective value chains are so dissimilar that no real potential exists to transfer skills or technology from one business to another or to combine similar activities and reduces costs or to otherwise produce competitively valuable benefits from operating under a common corporate umbrella (Thompson etc, 2004)

同济大学经济与管理学院 俞秀宝 110

Supply

Chain activities

Strategic fit of related diversification or business

Business A

Techno-

Logy Operation

Sales

And marketing

Distributio n

Customer

Service

•Efficient transfer of key skills, tech expertise, managerial know-how

•Lower cost

•Share a common brand name

•Build resource strengths and capabilities

Supply

Chain activities

Techno-

Logy Operation

Sales

And marketing

同济大学经济与管理学院 俞秀宝

Distributio n

Business B

Customer

Service

111

Sample of related diversifications

• Technology (AT & T into cable TV service, internet access, BHP mining)

• cost reduction (samples of most backward integration)

•Sales and marketing (Pepsi-cola into sports products)

•Distribution activities

•Managerial expertise

同济大学经济与管理学院 俞秀宝 112

Economics of scope and scale

• Economics of scope: arising whenever it is less costly to perform certain value chain activities for two or more businesses operated under centralized management than being performed independently.

• Economics of scale: are cost savings that accrue from increases in size and number

同济大学经济与管理学院 俞秀宝 113

Reasons to enter into Un-related diversification

-Decline of main business

-targeted industry has great growth potential

-Company has extra capital

-Company has extra human resources

-Top managers intentions

-……

同济大学经济与管理学院 俞秀宝 114

Pros & Cons of unrelated diversification

1. Business risk is scattered over a set of diverse industries (research)

2. Maximum employ company capital by investing what-ever good industries

3. More stable financial situation

4. Bargain-priced company and increase shareholder values

同济大学经济与管理学院 俞秀宝 115

Why Chinese firms are more diversified

now

United states

Early

Last century

China

Early 70s early 70s early 80s middle 80s middle 90s now

同济大学经济与管理学院 俞秀宝 116

Unit 10-2 Competing in global market

Reasons for companies enter into international market

• To access new customers or great potential of targeted market (New demand areas, such as Chinese market)

• To achieve lower cost

• to capitalize on company ’ s core competency

• to spread business risk across a wider market base

• profit & growth problems in home market

• Looking for R & D capabilities

• Looking for political legitimacy

同济大学经济与管理学院 俞秀宝 117

Multi-country or Global competition

Multi-country competition: (??)

Competition in one national market is independent of competition in another national market.

Global competition:

Competitive conditions across national markets ar linked strongly enough to form a true international market and when leading competitors compete head to head in many different countries.

同济大学经济与管理学院 俞秀宝 118

Strategic options for going international

• Export

• Licensing

• Franchising

• Multi-country

• Global strategy

同济大学经济与管理学院 俞秀宝 119

Entry model of MNCs

M&A JV

Cost

Speed

High ……..

Slow ……….

Investment High ……….

Learning High ……….

Risk High ……….

Leveraging High ……….

Other…

SA SO

Low High

Fast Low

Low High

Low ……

Low High

Low High

同济大学经济与管理学院 俞秀宝 120

Competitive advantages by competing multi-nationally

• Deploy activities among various countries to gain lower costs

• R & D, parts manufacture, assembly, distribution, sales and marketing, customer service

• Transfer of valuable competencies and capabilities to foreign markets

• Draw on its ability to deepen or broaden its resource strength and capabilities and to coordinate its dispersed activities in ways that a domestic competitor can not.

(Porter)

同济大学经济与管理学院 俞秀宝 121

Cost reduction or differentiation

Local responsiveness

Differentiation

B (production ?)

C (marketing)

D (R & D)

A

Global integration

Cost reduction

同济大学经济与管理学院 俞秀宝 122

MNCs strategic Position in Chinese Market

Cost leader ship?

High Differentiation?

Industry difference ?

Other ?

Customer are price sensitive in emerging market

同济大学经济与管理学院 俞秀宝 123

Quality

Chinese local company reactions

How will the Chinese local firm react to MNC ’ s entry to

The Chinese market??

Price

同济大学经济与管理学院 俞秀宝 124

Case analysis: Ericsson in China (not)

Case: “ Ericsson in China ” , Questions:

1) Analyze in detail as what has contributed to the success of Ericsson in China before 2002?

2) What strategies do you suggest Ericsson should take in future to have further development in the Chinese market? (analysis can be focus onto a specific area)

同济大学经济与管理学院 俞秀宝 125

Unit 11 Strategy Evaluation

1. Evaluation standards

1) Suitability ( 适用性 )

• Can the strategy take advantage of the organizational strength and make use of the opportunities that offered by the environment?

• Can the strategy resolve or improve the weakness of the organization?

• Will the strategy be consistent with organizational objectives?

同济大学经济与管理学院 俞秀宝 126

Strategy Evaluation (cont.)

2) Feasibility ( 可行性 ) – will the organization have enough capacity to reach this strategy ?

•

Has enough capital?

•

Has managerial skills?

•

Has marketing know-how?

• Has technology capabilities?

• Has enough materials and services?

同济大学经济与管理学院 俞秀宝 127

Strategy Evaluation (cont.)

3) Acceptability ( 可接受性 )

• Top management

• Middle management

•

Employees

• External stakeholders (suppliers, customers competitors…)

•

And government, community, environment concerns and regulations…

同济大学经济与管理学院 俞秀宝 128

SWOT Analysis

Opportunity

OW strategies

(turn around strategies)

Weakness

WT strategies

(defending Stra.)

SO strategies

(Growth strategies)

ST strategies

(attack strategies)

Strength

Treats

同济大学经济与管理学院 俞秀宝 129

Portfolio Analysis

BCG Matrix

Market

Growth rate

High

Stars

Question marks low Cash cows

Lin dogs

High Low

Market share

同济大学经济与管理学院 俞秀宝 130

Four intensive growth strategies: Ansoff

’

s product/market expansion grid

Increasing risk

Existing products

New products

Existing markets

1. Market penetration

3. Product development

New markets

2. Market development

4. Diversification

同济大学经济与管理学院 俞秀宝 131

Life Circle Portfolio Matrix

–

生命周期组合矩阵

Product life circle

Beginning increase mature decrease

Leader

Strong

Welcome

快速增长

急剧上升

急剧上升

差别化

快速增长

急剧上升

差别化

集中

快速增长

保持成本领先

开发新产品

快速增长

保持成本领先

追赶 , 差别化

差别化

集中 , 追赶

与行业一起增长

保持地位

成本领先

注入新产品 \ 市场

成本领先 , 与行业

一起增长

新产品

集中 , 差别化

收获 , 寻找小分区

转产 , 差别化 , 集中

与行业一起增长

保持地位

集中

保持成本领先

寻找小分区

保持细分时常

收获

缩减

转产

Retain 与行业一起增长

集中

收获 , 追赶

寻找小分区

集中 , 转产

收获 , 转产 ,

寻找小分区

缩减

取消

缩减 weak

寻找小分区

追赶

转产

缩减

退出

消失

退出

同济大学经济与管理学院 俞秀宝 132

Research Evidence (SPI, 3000 org.)

1. The importance of market share

20

15

10

5

0

40

35

30

25

5 11 20 30 market share

40

Will the strategies that organizations employ bring benefits ?

同济大学经济与管理学院 俞秀宝 133

Research Evidence (SPI, 3000 org.)

2. Consolidate Strategies

Relative market share

Low 25% 60% high

Relative quality

Low

10 10 21

-10% 14 19 27

10%

22 27 35 high

Note: numbers are average PIMS

ROI (%) a) Industry leaders have strong competitive positions

同济大学经济与管理学院 俞秀宝 134

Research Evidence (SPI, 3000 org.)

Marketing / sales

Low 5% 10% high

18 15 9

Relative market share

Low

25% 20 20 21

Note: numbers are average PIMS

ROI (%)

60%

33 32 33 high b) Market share is important when marketing expenses are high

同济大学经济与管理学院 俞秀宝 135

Research Evidence (SPI, 3000 org.)

Marketing / sales

5%

Relative quality

-7

15 17

10%

15 Note: numbers are average PIMS

ROI (%)

21 22 22

+11

29 31 25

C) Intensive marketing can not replace product quality

同济大学经济与管理学院 俞秀宝 136

Research Evidence (SPI, 3000 org.)

35

30

25

20

15

10

5

0

20 35 45 58 75 investment/sales d) Negative impact of high investment on ROI

同济大学经济与管理学院 俞秀宝 137

Research Evidence (SPI, 3000 org.)

3. Results related to other strategies

R&D / sales

Low 0.5% 2.1% high

14 15 10

Relative market share

Low

26% 22 24 17

60%

30 35 31 high

•Intensive investment won’t hurt industry leaders

同济大学经济与管理学院 俞秀宝 138

Research Evidence (SPI, 3000 org.)

3. Results related to other strategies

ROI

(%)

60

50

40

30

Best 1/4

Average

Market leaders

20

10

0

Poor 1/4

-10

0 10 40

New products (recent 3 years) / sales (%)

同济大学经济与管理学院 俞秀宝 139

Research Evidence (SPI, 3000 org.)

3. Results related to other strategies

60

ROI

(%)

50

40

30

20

10

0

-10

Best 1/4

Average

Poor 1/4

0 10 40

同济大学经济与管理学院 俞秀宝 140

Unit 11 Activity: Case study

阅读巨人集团案例,并讨论:

• 巨人集团在发展过程中有哪些重大失误?失误

的原因?

• 你认为,巨人集团当时是否有可以摆脱危机的

方法?为什么?

同济大学经济与管理学院 俞秀宝 141

Unit 12 Implementing Strategies

•Turn a strategy into actions and good results

•Make thing happen

•Demands a manager’s ability to direct organization change, motivate people, develop core competencies, build valuable capabilities, create a strategy-supportive corporate culture, and meet best performance target

• It is easier to develop a sound strategic plan than to make it happen

同济大学经济与管理学院 俞秀宝 142

A Frame-work for Implementing Strategy

No framework:

Reasons for not having proven paths

•Some managers are more effective than others

•Different org.

Culture, leadership, business practice

Different competitive circumstances, work environment, policies, mixes of personalities….

同济大学经济与管理学院 俞秀宝 143

The Principal Tasks of Implementing Strategy

Building an org. with the capabilities needed for successful strategy execution

Exercising the strategic leadership

Allocating resources to strategy-critical activities

Shaping the work environment and corporate culture

The Strategy implementer’s

Action agenda

•What to do now vs later

•What requires much time and personal attention

Establishing strategy supportive policies

Tying rewards and incentives to the achievement of key strategic targets

Installing information, communication and operating systems that enable company personal to better carry out their strategic roles

Instituting best practice

同济大学经济与管理学院 俞秀宝 144

Leading the Implementation Process

How managers lead the implementation task is the function of:

•Their experience and knowledge of the business

•Their network of personal relationship

•Problem solving skills

•The authority they’v been given

•The leadership style they are comfortable with

•Their view of the role they need to play to get things done

The most important leadership is a strong confident sense of “what to do” to get desired results

同济大学经济与管理学院 俞秀宝 145

Implementing Strategy: culture and leadership

•Culture: a company’s values, believes, traditions, operating styles and internal work environment

•The power of culture

•Strong cultures promote good strategy execution

•A powerful lever for successful strategy execution

•Strong vs weak culture

•Weak culture: many subcultures, few values, few behavioral norms, few traditions, little cohesion and glue across units

同济大学经济与管理学院 俞秀宝 146

Balanced scorecard**

PSC 是一张从四个角度出发,应用一系列绩效考核指标,描述组织经营行动

行为的表格 ( Olve, 2004)

-Supplemented traditional financial measures with criteria that measured performance from 3 additional perspective – those of customers, internal business processes, and learning and growth (Kaplan, 1996).

-It enabled companies to track financial results while simultaneously monitoring progress in building the capabilities and acquiring the intangible assets they would need for future growth (Kaplan, 1996).

-financial measures and target bear little relation to company ’ s long-term strategic objects ( Kaplan, 1996)

147 同济大学经济与管理学院 俞秀宝

Four perspectives** (or dimensions of BSC)

Financial

Profitability

Growth of revenue shareholder equity

Customer

Satisfaction

Growth of new customer

战略与

原景

Process

Operation efficiency

Learning and innovation

Learning ability

New skills attained

同济大学经济与管理学院 俞秀宝 148

BSC chart**

KSF KPI

Financial result.

…

Customer

…

Process

…

Learning

…

同济大学经济与管理学院 俞秀宝

Strategic plans

2004 2006 2007 Actions

149

Implications to strategic implementation**

BSC 的作用( Olve 等, 2004 )

• 沟通战略意图 – 公司上下的充分的沟通

• 讨论被战略目标驱动的行为 – 发展和培养公司长远的能力,而不是眼前能力

• 监控和奖励这些绩效行为 –

BSC 的作用(林俊杰, 2003 )

• 对一家公司业绩评估方法的重新思考(长远)

• 应用表明,它不仅是一种评估方法, 更是一种战略实施的方法

BSC 的作用 (Niwen, 2003) :

• 侧重因果关系链,并与之交织在一起

同济大学经济与管理学院 俞秀宝 150

Roles of BSC**

Kaplan and Norton (1996)

• Traditional management system – inability to link company ’ s long term strategy with its short term actions. BSC can.

• The four processes that, separately and combination, contribute to linking long-term strategies objects with short-term actions

• first process (translating the vision) helps managers to build a consensus org. vision and strategy

• second process (communicating and linking) can let managers to communicate their strategy up and down the org. and link it to departmental and individual objects

• the third process (planning) integrate business plans with financial plans

• fourth process (feedback and learning) gives companies the capacity of strategic learning

151 同济大学经济与管理学院 俞秀宝

Typical school of strategic management thought**

• the designing school (Christensen, Andrews and Guth, 1965)

• shift from Chandler ’ s internal structure to external strategy. The basic model is SWOT analysis – identify strategies which match org. internal distinctive capabilities with its environment

• criticism from Mintzberg – the environment has to be stable

• the planning school (Ansoff, 1965)

• analyze the components of strategy, deposed into corporate, business and functional strategies

• criticizes … ..

• from consulting industry

• experience curve

• BCG matrix

• PIMS

• positioning school (Porter, 1980)

• industry structure and position org. in it (five-force)

• late conditioned to competitive advantage

同济大学经济与管理学院 俞秀宝 152

Typical school of strategic management thought (cont.)**

• resource based view (Prahalad and Hamel, 1990)

• emphasis on solving the need for analytical content on strength and weakness side of SWOT framework

• the concept of core competency

• internal determinants of org. success

同济大学经济与管理学院 俞秀宝 153

Unit 12 Activity: implementation (not)

对汇丽案例,模拟战略实施行动方案。

1)

汇丽重组战略的实施,可能会遇到哪些问题和阻力?

2)

如何妥善处理这些问题才能减少阻力?

同济大学经济与管理学院 俞秀宝 154

WHAT I HAVE LEARNED?

I DON’T KNOW???

I AM FULL!

同济大学经济与管理学院 俞秀宝 155