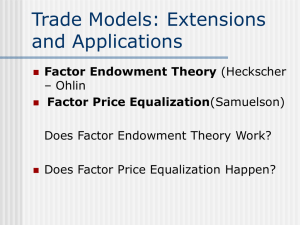

Trade Models: Extensions and Applications

advertisement

Trade Models: Extensions and Applications • Factor Endowment Theory (Heckscher – Ohlin) – Does it work? • Leontief Paradox • Factor Price Equalization (Stolper-Samuelson) – Does it happen? • Globalization and its discontents • U.S. income distribution: the gulf widens • Intra-industry trade • Product differentiation and trade » Overlapping demands » Increasing returns to scale » Product life-cycle • Supply – Demand Model of Trade: Buy Low Sell High • Price convergence • Transportation costs price wedge Factor Endowment Theory (Heckscher – Ohlin) • Focus on Supply: – Technology and input factors: labor, capital, land (natural resources) • Assume: everyone uses the same technologies to make things. – Also assume competitive factor markets: within each country, the factor’s “wage” is the same in all industries. • Then: a nation has comparative advantage in things that use a lot of its relatively abundant and cheap factor. Also assume everyone has roughly the same tastes. • Then: a nation exports things that use a lot of its relatively abundant and cheap factor. Factor endowments of countries & regions, as a percentage of the world total Capital Skilled Labor Unskilled Labor All Resources 20.8% 19.4% 2.6% 5.6% European Union 20.7 13.3 5.3 6.9 Japan 10.5 8.2 1.6 2.9 Canada 2.0 1.7 0.4 0.6 Mexico 2.3 1.2 1.4 1.4 China 8.3 21.7 30.4 28.4 India 3.0 7.1 15.3 13.7 Hong Kong, South Korea, Taiwan, Singapore 2.8 3.7 0.9 1.4 Eastern Europe, including Russia 6.2 3.8 8.4 7.6 OPEC 6.2 4.4 7.1 6.7 Rest of the world 17.2 15.5 26.6 24.8 Total 100.0 100.0 100.0 100.0 United States Source: Wm. R. Cline,Trade and Income Distribution, IIE, 1997, pp. 183 -185 Heckscher-Ohlin, skills, and comparative advantage Education:Land Area Leonief Paradox? •For US (~1950) (Capital/labor)Export Industries < (Capital/labor)Import Competing Industries Explanation: Considering human capital, US is “labor” abundant Education, skill intensity, and U.S. import shares, 1998 Factor Price Equalization • A nation exports things that use a lot of its relatively abundant and cheap factor. – In the exporting country, demand for this abundant factor increases. • The wage of the abundant factor increases. – In the importing country, where this factor is scarce and expensive, demand for this factor decreases. • The wage of the scarce and expensive factor decreases. • The factor’s wage is equalized in the exporting and importing countries. »Trade substitutes for factor flows. • There are winners and losers from trade • Specific factor issues: Factor specific to an import-competing industry loses big from trade Indexes of hourly compensation, manufacturing workers, 2006 (U.S.=100) Not all “labor” is equal Does Factor Price Equalization Theory Work? • In US, skilled workers are relatively abundant. • Skilled worker wages are relatively low in US TRADE Rich get richer in US. Poor get poorer. – Widened gap between skilled and unskilled wages in US explained in part, but small part, by globalization. • Increased importance of education/human capital in high-tech economy • But globalization disciplines all workers • Outsourcing of high-skilled jobs: Indian engineers/computer scientists Human capital/productivity gaps Wage differences persist • Productivity is both individual and social – Rule of law/The human capital of your co-worker • Labor not only factor subject to competitive pressures • Globalization disciplines all factors Much trade is in imports and exports of roughly the same kinds of goods Index of Intraindustry Trade: (Exports/Imports) US Industries, 1993 & 2007 Inorganic chemicals .99 Power-generating machinery .97/.99 Electrical machinery .96/.72 Organic chemicals .91 Medical and pharmaceutical .86 Office machinery .81 Telecommunications equipment .69 Road vehicles .65 Iron and steel .43 Clothing and apparel .27 Footware .00/.00 Ex/Im .43 3.8 .79 .72 .44 1.5 1.4 .34 Trade Models: Extensions and Applications Intraindustry Specialization & TradeIncreasing Returns – Dynamic Comparative Advantage • Industrial Policy: Promote champions? • Theory of Overlapping Demand • Product Life Cycle Model • Supply – Demand Model of Trade • Environmental Protection and Costs • Transportation Costs Theory of Overlapping Demands • Most US trade in manufactures is with other rich nations. • Linder: countries with similar incomes have similar tastes and patters of demand. • Firms first establish themselves in home market. • Firms find foreign markets where demands overlap. Product Life Cycle Theory…Think Gaming • Good is introduced in home market •Technological breakthrough/Specialized inputs/High Risk Small scale/Local Mkt •Success/growth/cost reduction •Domestic industry exports the good •Production becomes routine •Foreign production begins •Domestic industry loses competitive advantage •Import competition begins •Observe both exports and imports of same stuff Intraindustry Trade: Import and Export the “Same” Thing Homogeneous products Transport savings near borders Seasonal reasons Differentiated products Focus on particular product in industry Exploit economies of scale Serve domestic “majority” and overlapping foreign demand Explaining trade patterns: Summary • Comparative advantage owing to factor endowments Net exports by industry (“Interindustry” trade) • Product differentiation and economies of scale Intraindustry trade – Similar endowments – Similar tastes – Product Life Cycle: Technology evolves from breakthrough to routine • What you export/What you import History and accident Supply – Demand Model of Trade In the absence of trade, the same good will sell for different prices in different places. An opportunity presents itself: BUY LOW – SELL HIGH Free trade under increasing costs No transportation costs Transportation costs Free trade under increasing costs Transportation costs of $2000 per auto Supply – Demand Model of Trade If there are increasing costs Cost and price in the exporting country increases Cost and price in the importing country decreases Cost and price in the two countries converge. Trade effects of government regulation e.g., Environmental Standards Supply and Demand of Calculators Sweden Norway Price Quantity Supplied Quantity Demanded $0 5 10 15 20 25 30 35 40 45 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 1,200 1,000 800 600 400 200 0 0 0 0 Price Quantity Supplied Quantity Demanded $0 5 10 15 20 25 30 35 40 45 0 0 0 0 200 400 600 800 1,000 1,200 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0