Sources of

Comparative Advantage

Chapter 3

Copyright © 2009 South-Western, a division of Cengage Learning. All rights reserved.

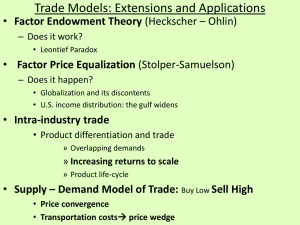

Factor Endowment Theory

economists Heckscher and Ohlin

o explanation of:

1) determinants of comparative advantage

2) impact of trade on earnings of factors

o nation will export goods which it produces with

resources that are relatively abundant

o nation will import goods which it produces with

resources that are relatively scarce

Factor Endowment - Example

o U.S.: capital/labor ratio = 0.5 (100/200)

o China: capital/labor ratio = 0.02 (20/1,000)

o Since the U.S. has relatively more abundant

capital, the U.S. will produce capital-intensive

goods with China producing goods that are

more labor-intensive.

Graphical Example

U.S. MRT = 0.33

China’s MRT = 4.0

implication is that U.S.

has a lower relative

price in aircraft

so U.S. has comparative

advantage in aircraft

& China has comparative

advantage in textiles

Graphical Example (cont.)

equilibrium at points B

and B where

slopes of PPCs are

equal

represents equal relative

price for each country

U.S. trades 6 aircraft to

China for 6 textiles

resulting in point C for

consumption

Implications of Factor Endowment

o U.S. - relatively abundant capital

China - relatively abundant labor

o expectation – U.S. produces capital intensive

goods and China produces labor intensive

o list of top exports confirm theory’s suggestions

Factor Price Equalization

o specialization causes U.S. to use more capital

and China to use more labor

o increases price of capital in U.S. and the price of

labor in China until factor costs are equal

Stolper-Samuelson Theory

o increased income for producers of goods

associated with relatively abundant resources

o decreased income for producers of goods

associated with relatively scarce resources

o magnification effect – change in price of the

resource is greater than the change in the price

of the good produced with that resource

o implication: overall, free trade provides gains

to a nation but specifically some parties gain

while others lose

Specific Factor Theory

o previous models assumed all resources were

completely mobile within a country

o in actuality specific factors may exist that

cannot move easily from one industry to another

o specific factor theory analyzes short run

income distribution effects in contrast to previous

theories focused on long term results assuming

resource mobility among industries

o conclusion: trade causes losses for resources

specific to import-competing industries and gains

for resources specific to export industries

Leontief Paradox

o Leontief tested validity of factor endowment

theory using 1947 data on capital to labor ratios

o results: ratio lower for U.S. export industries

than for import-competing industries

o contrary to factor endowment theory

o repeated using 1951 data – similar results

Trade & Income Inequality

S0

Wage Ratio

o wage ratio = wage of

skilled workers divided

by wage of unskilled

workers

o labor ratio = quantity

of skilled workers

divided by the quantity

of unskilled workers

o supply and demand

will determine wage

ratio and thus the level

of income inequality

2.0

D0

2.0

Labor Ratio

Technological Change

S0

2.5

Wage Ratio

o free trade, decreased

transportation costs,

and skill biased

technology increase the

demand for skilled

workers in relation to

unskilled workers

o result is an increase

in the wage ratio

o promotes a greater

degree of income

inequality

2.0

D1

D0

2.0

Labor Ratio

Immigration

S2

S0

2.5

Wage Ratio

o increase in unskilled

workers decreases the

supply of skilled

workers in relation to

unskilled workers

o result is an increase

in the wage ratio

o again promotes a

greater degree of

income inequality

2.0

D0

1.5

2.0

Labor Ratio

Education and Training

S0

Wage Ratio

o increased education

and training lead to an

increase in the supply

of skilled workers in

relation to unskilled

workers

o result is a decrease in

the wage ratio

o reduces income

inequality in this case

S1

2.0

1.5

D0

2.0

Labor Ratio

2.5

Increasing Returns to Scale

o increasing returns to scale also known as

economies of scale imply lower costs per unit at

higher levels of output

o increasing returns theory – despite limited

comparative advantage trade can be beneficial if

trade leads to lower cost per unit associated with

economies of scale

o home market effect – countries will specialize

in goods with large domestic demand since

proximity will reduce transportation costs

Theory of Overlapping Demands

economist Staffan Linder

o firms produce goods with large domestic demand

and these goods are potential exports

o export potential to countries with consumer

tastes similar to domestic market

o consumers conditioned by their income levels

high income – demand higher quality goods; luxuries

low income – demand lower quality goods; necessities

o limited trade in goods between wealthy and poor

nations because of limited overlap of demand

Intraindustry Trade

o industrialized nations have practiced

intraindustry specialization – focus on particular

products within a given industry

o 2006 data contradicts Ricardo and HeckscherOhlin

Intraindustry Trade (cont.)

Reasons for trade - homogeneous goods

o lower transportation costs near borders

o seasonal variations may impact both supply and

demand

Reasons for trade - differentiated goods

o demand of the ‘minority’ consumers not met by

domestic producers

o overlapping demand segments

o economies of scale associated with greater

output of a specific type of good

Product Life Cycle Theory

goods undergo a predictable trade cycle shifting

from export to import over the following stages:

1)

2)

3)

4)

5)

introduction of good in home market

domestic industry exports

foreign production begins

domestic industry loses comparative advantage

imports become more likely

implications:

• gains from trade are based on technological innovation

and spread of that innovation to other countries

• continual innovation needed to remain competitive

Dynamic Comparative Advantage

o Ricardo’s analysis was static assuming that

comparative advantage did not change.

o In actuality, comparative advantage can and

does change over time.

o Industrial policy refers to government

attempts to change or create comparative

advantage.

o Such policy is used to stimulate industries with

high productivity, economic significance, and a

possibility of long term growth.

Government Regulation

o Free trade leads to equal prices in the U.S. and

South Korea.

o South Korea exports 4 tons to the U.S.

Government Regulation (cont.)

o increase in U.S. environmental regulation

increases costs and decreases supply

o leads to higher prices and more exports from

South Korea to the U.S.

Transportation Costs

o free trade will

cause the U.S. to

produce more autos

and Canada to

produce fewer until

the prices are equal

o U.S. will export

autos to Canada and

the price will be

$6,000 in both

markets

Transportation Costs (cont.)

o transportation

costs will increase

the price to $7,000

in Canada

o Canada will import

fewer autos from the

U.S. as a result of

higher price

o U.S. price falls to

$5,000 as a result of

fewer exports and

lesser demand