ASSESSING INTERNATIONAL MARKETS

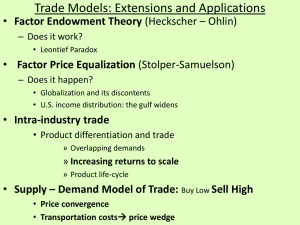

advertisement

INTERNATIONAL TRADE Case: Sri Lankan Trade • Since independence Sri Lanka has looked to international trade policy as a means of helping to solve such problems as: a) shortage of foreign exchange b) overdependence on one product and one market c) insufficient growth of output and employment • Import Substitution & Strategic Trade Policy • Development of exports of nontraditional Products • Identifying the most likely competitive Industries • Manufacturing has grown as a portion of total Exports I - INTRODUCTION • Trade theory focuses on three basic questions: a) What products to import and export? b) How much to trade?, and c) With whom to trade? • Some theories explain trade patterns that exist in the absence of governmental interference, and some theories explain what governmental actions should strive for in trade. II - TRADE THEORY AND GOVERNMENT POLICY A - Mercantilism: mid-16th century, principal assertion was that gold and silver were the mainstays of national wealth and essential to vigorous commerce. Main tenant: it was in a country’s best interest to maintain a trade surplus, a country would increase its national wealth and prestige Autarky Trade was viewed as a zero-sum-game David-Hume Neo-Mercantilism B – Absolute Advantage: a country has an absolute advantage in the production of a product when it is more efficient than any other country in producing it. Countries should specialize in the production of goods for which they have an absolute advantage and then trade these goods for goods produced by other countries. Basic Argument: you should never produce goods at home that you can buy at lower cost form other countries. trade Absolute advantage – exists potential for gains in Adam Smith’s 1776 “An Inquiry Into the Wealth of Nations.” Introduced the concept of specialization Trade is not a zero-sum game situation 1. Natural Advantage: a country may have a natural advantage in producing a product because of climatic conditions, access to a certain natural resources, or availability of an abundant labour force 2. Acquired Advantage: industrial policy C – Comparative Advantage: In his 1817 book “Principles of Political Economy”, David Ricardo says that it makes sense for a country to specialize in the production of those goods that it produces most efficiently and to buy the goods that it produces less efficiently from other countries, even if it could produce them more efficiently itself. In other words, nations should produce those goods for which they have the greatest relative advantage According to David Ricardo potential world production is greater with unrestricted free trade than it is with restricted trade. Consumers in all countries can consume more if there are no restrictions to trade. Differences in labour productivity between nations underlie the notion of comparative advantage C.1. Simple Extensions of the Ricardian Model: Diminishing Returns to Specialization: not all resources are of the same quality, draw upon marginal resources whose productivity is not as great as those initially employed Dynamic Effect and Economic Growth: Free trade might increase a country’s stock of resources, free trade might also increase the efficiency with which a country utilizes its resources Dynamic gains in both the stock of a country’s resources and the efficiency with which resources are utilized will cause a country’s Production Possibility Frontiers (PPF) to shift outwards C.2. Theory of Country Size: larger countries are more self-sufficient C.3. Transportation Costs: make it more likely that small countries will trade internationally C.4. Scale Economies: countries with large economies and high per capita income are more likely to produce goods that use technologies requiring long production runs. C.4. Scale Economies: countries with large economies and high per capita income are more likely to produce goods that use technologies requiring long production runs. D – Heckscher-Ohlin Theory Two swedish economists put forward a different explanation of comparative advantage: they argued that comparative advantage arises from differences in national factor endowments. Different nations have different factor endowments and different factor endowments explain differences in factor costs. The more abundant a factor, the lower its cost. This H-Ohlin theory predicts that countries will export those goods that make intensive use of those factors that are locally abundant, while importing goods that make intensive use of factors that are locally scarce The Leontief Paradox: U.S. produces and exports technology intensive educated labor. products that require highly D – Product Life Cycle: Raymond Vernon proposed the PLC in the early 1960s. Raymond argued that the size and the wealthy market gave American companies a strong motivation to develop innovative consumer goods. As the market in the US and other more developed countries matures, the products becomes more standardized, and price becomes the main competitive factor. Further along, the U.S. switches from being an exporter of the product to an importer of the product as production becomes concentrated in lower cost foreign locations. Ex: cellular phones PLC weakness E – The New Trade Theory: First Mover Advantages: the theory suggests that a country may predominate in the export of a good simply because it was lucky enough to have one or more firms among the first to produce that good. This theory generates an argument for government intervention, industrial policy, and strategic trade policy F – National Competitive Diamond Model Advantage: Porter’s Why a nation achieves international success in a particular industry? Porter’s thesis is that four broad attributes of a nation shape the environment in which local firms compete, and these attributes promote or impede the creation of competitive advantage. a) Factor Endowments: skilled labour, infrastructure, technology, etc. Advanced factors are the most significant for competitive advantage. b) Demand Conditions: home demand provides the impetus for upgrading competitive advantage. A nation’s firm gain competitive advantage if their domestic consumers are sophisticated and demanding. c) Related and Supporting Industries: Presence of suppliers or related industries that are internationally supportive. Successful industries within a country ten to be grouped into clusters of related industries. d) Firm Strategy, Structure, and Rivalry: Different nations are characterized by different management ideologies; there is a strong association between vigorous domestic rivalry and the creation and persistence of competitive advantage in an industry. e) Government: Business should urge government to increase its investment in education, infrastructure, and basic research and to adopt policies that promote strong competition within domestic markets. G - Country Similarity Theory: observations of actual trade patterns reveal that most of world’s trade occurs among countries that have similar characteristics. Thus, overall trade patterns seem to be at variance with the traditional theories that emphasize country-by-country differences. H - Pairs of Trading Relationships: How do you explain specific pairs of trade relationships? ¤ transport costs (natural traders) ¤ Cultural Similarity ¤ Historic Ties ¤ Political Relationships and Economic Agreements I - Independence, Interdependence, and Dependence J – Trade Strategies Among Emerging Countries - Outward-Led-Growth Strategies - Import Substitution Industrialization K – Why Companies Trade Internationally?