chapter_71

advertisement

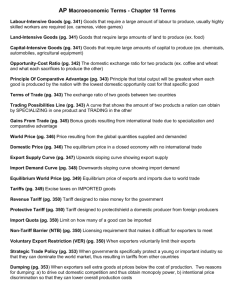

Chapter 7 – Global Markets in Actions How Global Markets Work Imports - the goods and services we buy from other countries Exports – the goods and services we sell to people in other countries What Drives International Trade? Comparative advantage drives international trade, fundamental force Comparative advantage – a situation in which a person can perform an activity or produce a good or service at a lower opportunity cost than anyone else. National comparative advantage – a situation in which a nation can perform an activity or produce a good or service at a lower opportunity cost than any other nation Why Canada Imports T-shirts Without imports, Canada supplies 4 million T-shirts for $8; with imports the world price for t-shirts is $5 so Canada demands 6 million t-shifts while it only supplies 2 million and it imports 4 million a year Price in Canada falls to world market price Quantity bought increases; quantity demanded at world price Why Canada exports Regional Jets Without exports, Canada supplies 40 jets for $100 million, with exports Canada supplies 20 jets and produces 70 jets at $150 where they exports 50 jets Price rises to world price Quantity demanded decreases; quantity demanded at world price We match the prices to the world market and compare to that product, we see how much we buy or export If the equilibrium price is lower than the world market , Canada exports If the equilibrium price is higher than the world market, Canada imports Winners, Losers, and the Net Gain From Trade The winners of trade are the ones whose surplus increases and the loser are the ones that their surplus decreases. Consumer’s gain on imports – lower price, increased purchases Consumers’ surplus changes to A + B + D o B – the loss of producer surplus o C – a net gain; lower price, increased purchases, gain from imports Producers’ gain from exports – higher price, increased production Producers’ surplus changes to B + C + D o B – the loss of consumers’ surplus o D – net gain; higher prices, increased production, gain from exports International Trade Restrictions Governments use these tools to influence international trade and protect domestic industries from foreign competition: Tariffs Import quotas Other import barriers Export subsidies Tariff – a tax on a good that is imposed by importing country when an imported good crosses its international boundary Provide revenue to the government Allows the government to satisfy the self-interest of the people who earn their incomes in the import-competing industries The Effects of a Tariff Without a tariff, Canada produces 2 million at $5, imports 4 million at $5, and Canadians buy 6 million tshifts When tariff is added The production of t-shirts in Canada increases o Increase of 1.5 million so producer 3.5 million at $7 The imports of t-shirts decreases o Instead of importing 4 million, import 1 million at $7 Canada collects tariff revenue o $2 per 1 million imported (purple rectangle) The price of t-shirt increases o Increases to world price + tariff, $7 Decrease in purchases o About 2.5 million of a decrease to 4.5 million purchases Tariff on imported goods creates winners, losers, and social loss Canadian consumer loss – the price of a t-shirt rises and quantity demanded decreases Canadian producers gain – producers sell their t-shirts for more world price + tariff. Higher price, quantity increases Society loses, deadweight loss arises – some loss transferred to producer and some to the government but because production cost increase and loss from imports it’s a society loss Consumers lose more than producers Before tariff, consumers’ surplus increases, B + C + D After tariff imposed o Producers gain a little more o C and E are deadweight loss o D is tariff revenue Import Quotas Import quota – a restriction that limits the maximum quantity of a good that may be imported in a given period. Price rises Quantity bought decreases Quantity produced in Canada increases The supply curve shifts to Supply + Quota Winners, Losers, and the Social Loss from an Import Quota Canadian consumers of the good lose Canadian producers of the good gain Society loses, deadweight loss Importers of good gain Producers gain – B; Dead weight loss C + E, imports’ profit D The difference between quota and tariffs is tariffs bring revenue for government while quota bring revenue to the importers Other Import Barriers Other barriers include health, safety, and regulation barriers and voluntary export restraint. Export Subsidies Subsidy – a payment by the government to a producer Export subsidy – a payment by the government to the producer of an exported good Illegal Brings gains to domestic producers Inefficient underproduction for the rest of the world Create deadweight loss The Case against Protection Infant-industry argument – it is necessary to protect a new industry to enable it to grow into a mature industry that can compete in world markets. Learning by doing benefits owners , workers , and spill over to other industries in the economy More efficient to use subsidy encourage maturity of industry and compete in the world market Dumping – a foreign firm sells its exports at a lower price than its cost of production In order to gain a global monopoly, to drive domestic firms out of business Illegal under the rules of WTO Temporary tariffs called antidumping duties Hard to track if dumping is occurring o Test compare with domestic price Hard to find a good produced by a global monopoly Dealing with it by regulation Reasons for Trade Saves jobs – creates and destroys old ones for new ones Allows us to compete with cheap foreign labour Penalizes lax environmental standards – make trade but eventually could match up with the higher income but poorer countries might want to do dirty work that allows other countries to have a higher environmental standards Prevents rich countries from exploiting developing countries – can increase their income trade and cause a stop to child labour and near-slave labour since incomes increase and demand for labour increase Offshoring hiring foreign labour and produce in other countries o Buy finished goods, components, or services from other firms in other countries Outsourcing buy finished goods, components, or services from other firms in Canada o Buy finished goods, components, or services from other firms in other countries Offshoring outsourcing buy finished goods, components, or services from other firms in other countries Why is Offshoring a Concern? - Fear of losing jobs but even though you import services from other countries, Canada also exports Winners and Losers Losers are those that invested in the human capital to do a job that is now gone offshore Why is International Trade Restricted? Tariff revenue – keep track might be hard Rent seeking – lobbying for special treatment by the government to create economic profit or to divert consumer surplus or producer surplus away from others

![Quiz About [Your Topic]](http://s3.studylib.net/store/data/009237721_1-467865351cf76015d6a722694bb95331-300x300.png)