Group Work Solutions

advertisement

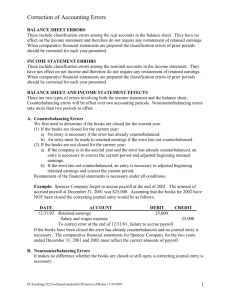

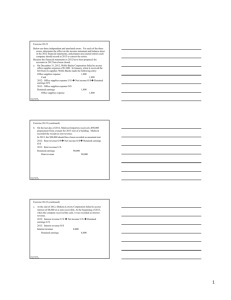

Chapter 22 – Group Work 1) XYZ Co. has depreciated its equipment for 3 years using Double-Declining Balance Method. In 2014, they chose to change depreciation methods to Straight-Line. No changes were made in estimates of useful life or salvage value. Prepare a journal entry to record depreciation for 2014 under the new method. Purchased January 1, 2011 Equipment Cost $360,000 Salvage Value $60,000 Useful Life 8 years Double-Declining Balance Method 2011 360,000 * .25 = $90,000 2012 (360,000 – 90,000) * .25 = $67,500 2013 (360,000 – 90,000 – 67,500) * .25 = 50,625 360,000 (208,125) 151,875 Cost Accumulated Depreciation Book Value in 2014 – New Cost Basis 8 (3) 5 Estimated Useful Life at Date of Purchase Years of Use as of 2014 Years of Life Remaining (151,875 – 60,000) 5 = $18,375 Depreciation Expense for 2014 using Straight-Line 2014 Depreciation Expense Accumulated Depreciation DR 18,375 CR 18,375 2) Assume XYZ Co. changed from Completed Contract to Percentage of Completion for long-term construction contracts at the end of 2014. The Tax Rate is 40%. Assume XYZ Co. continues to use Completed Contract for Tax Purposes. Accounting records for the current year 2014 have not yet been closed to Retained Earnings. The following information is reported as the difference in Pretax Income between the two accounting methods: 2013 2014 To % of Completion $480,000 $312,000 Pretax Income From Completed Contract $340,000 $200,000 Difference $140,000 $112,000 a) Prepare a journal entry to adjust for the effects of a Change in Accounting Principle on the prior year. 2013 Income Statement Accounts & Retained Earnings Income, Retained Earnings Understated - $140,000 Tax Expense Understated/ Retained Earnings Overstated - $56,000 Balance Sheet Accounts Deferred Tax Liability – Understated $56,000 Construction in Progress – Understated $140,000 DR Construction In Progress Deferred Tax Liability Retained Earnings CR 140,000 56,000 84,000 b) Assume XYZ Co. had a January 1, 2014 balance in Retained Earnings of $820,000, Net Income of $267,200, and Dividends of $100,000. Prepare a Statement of Retained Earnings for 2014. Statement of Retained Earnings 2014 Retained Earnings Balance January 1, 2014 Prior Period Adjustment Adjusted Retained Earnings Balance January 1, 2014 Net Income Dividends Retained Earnings Balance December 31, 2014 820,000 84,000 904,000 267,200 (100,000) 1,071,200 3) XYZ Co. started reporting under IFRS and is required to change their inventory system from a LIFO to a FIFO cost flow assumption [assume inflation has taken place in prior years]. The cumulative effect of all prior years’ Pretax Income under the new FIFO method is an increase of $360,000. The Tax Rate is 35%. What would be the required entry to adjust affected accounts in prior periods for this Change in Accounting Principle? Prior Years Income Statement Accounts & Retained Earnings Income, Retained Earnings Understated - $360,000 Tax Expense Understated/ Retained Earnings Overstated - $126,000 Balance Sheet Accounts Deferred Tax Liability – Understated $126,000 Inventory – Understated $360,000 DR Inventory Deferred Tax Liability Retained Earnings CR 360,000 126,000 234,000 4) You have been assigned to examine financial statements of XYZ Co. for the year ended December 31, 2014. You discover the following errors. Assume the books for fiscal year 2014 have not yet been closed. Disregard Tax effects. Prepare an adjusting journal entry to correct errors for the prior years and the current year. a. The physical count of Inventory on December 31, 2013 improperly counted $50,000 of inventory twice – overstating the final count by $50,000. XYZ Co. uses a Periodic Inventory system. 2013 Cost of Goods Sold – Understated $50,000 Income and Retained Earnings – Overstated $50,000 2014 Cost of Goods Sold – Overstated $50,000 DR Retained Earnings Cost of Goods Sold CR 50,000 50,000 b. In 2014, XYZ Co. sold equipment for $6,000. The equipment was fully depreciated at the time of sale and had no salvage value. The original cost of the equipment was $30,000. To record the collection of proceeds from the sale, the company debited cash and incorrectly credited Accumulated Depreciation. Equipment Current Balance 30,000 30,000 Target Balance 0 Adjustment Accumulated Depreciation 36,000 36,000 Adjustment 0 Current Balance Target Balance Gain on Sale 6,000 Adjustment 6,000 Target Balance DR Accumulated Depreciation Equipment Gain on Sale CR 36,000 30,000 6,000 c. At the beginning of 2011, XYZ Co. purchased equipment for $380,000. Management estimated the equipment would have a useful life of 10 years and a salvage value of $80,000. The bookkeeper used Straight-Line depreciation but failed to deduct the salvage value in computing the depreciation base for the years 2011, 2012, 2013, and the current year 2014. Straight-Line Error 380,000 10 = 38,000 Depreciation Expense each year 38,000 * 3 = 114,000 Accumulated Depreciation Straight-Line Correct Calculation 380,000-80,000 10 = 30,000 Depreciation Expense each year 30,000 * 3 = 90,000 Accumulated Depreciation 114,000 (90,000) 24,000 Accumulated Depreciation current balance Accumulated Depreciation correct balance Overstatement of Accumulated Depreciation and Prior Year Depreciation Expense 2011-2013 Depreciation Expense – Overstated $24,000 Income and Retained Earnings – Understated $24,000 Accumulated Depreciation – Overstated $24,000 2014 Depreciation Expense - Overstated $8,000 Accumulated Depreciation – Overstated $8,000 DR Accumulated Depreciation Retained Earnings Depreciation Expense CR 32,000 24,000 8,000 d. At the end of 2013, XYZ failed to accrue Salaries of $40,000. 2013 Salaries Expense – Understated $40,000 Income and Retained Earnings – Overstated $40,000 2014 Salaries Expense – Overstated $40,000 DR Retained Earnings Salaries Expense CR 40,000 40,000 e. XYZ Co. purchased a Patent from another company in early 2011 for $180,000. XYZ Co. had not amortized the Patent since that date. On the date the Patent was purchased, the expected useful life and legal life were 15 years. Patent Amortization 180,000 = 12,000 * 3 = 36,000 Correct Accumulated Amortization for the prior 3 years 15 2011-2013 Amortization Expense – Understated $36,000 Income and Retained Earnings – Overstated $36,000 Accumulated Amortization – Understated $36,000 2014 Amortization Expense - Understated $12,000 Accumulated Amortization – Understated $12,000 DR Retained Earnings 36,000 Amortization Expense 12,000 Accumulated Amortization* CR 48,000 *That may also be a credit to Patent if the company chooses not to use a contra asset account for the Patent to accrue amortization. f. A $12,000 Insurance premium paid on July 1, 2013 for a policy that expires on June 30, 2016 (3 year policy) was charged to Insurance Expense on the date of purchase. Adjusting entry is made on December 31, 2014. 7/1/2013-----------------12/2013-----------------12/2014---------------12/2015-----------------6/30/2016 3 year Insurance Policy 6 Six-month Periods over life of Policy $12,000/6 periods = $2,000 Risk Coverage for each 6-month period 2013 Insurance Expense – Overstated $10,000 Income and Retained Earnings – Understated $10,000 2014 Insurance Expense – Understated $4,000 Prepaid Insurance – Understated $6,000 DR Insurance Expense Prepaid Insurance Retained Earnings CR 4,000 6,000 10,000