IAS INDUSTRY ACCOUNTING STANDARDS

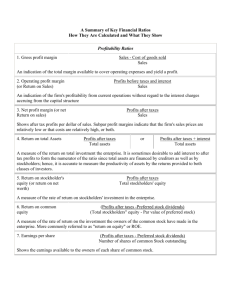

advertisement

Look For Violations Be Cautious • Recent accounting scandals highlighted importance of banker’s confidence in the accuracy and lack of distortion of accounting data • health of a bank’s loan portfolio • • The legal and moral culpability of top-level company managers (as well as auditors) is an issue Why do some companies distort accounting numbers as well as engage in other actions that damage the interests of company stakeholders, such as stockholders, banks, employees, and the community? MANAGEMENT DECISION Choosing accounting policies Changing accounting policies Deferring expenses Income smoothing Recognizing revenue too soon BANKER’S CONCERN Too liberal Unjustified Profits are overstated Profits are understated Profits are overstated Signs of Misleading Financial Statements Affecting All Industries MANAGEMENT DECISION Expense is under accrued Expense is under accrued Expense is over accrued BANKER’S CONCERN Profits are overstated and Expenses are understated Profits overstated and Liabilities understated Profits understated and Liabilities overstated MANAGEMENT DECISION Changing discretionary cost Low quality controls Change in auditors on a frequent basis BANKER’S CONCERN • Manipulation profits • Risk of financial statement manipulations • Risk of financial statement manipulations Cash A portion is restricted Currency uncertainty divisional levels Receivables Large overdue receivables Large increase with sales flat Overly dependent on one or two customers Related-party Receivables Slow Receivables turnover Right of return exists Uncollectibility of Receivables Warning Signs Large amount of overdue Receivables Large increase in Receivables with flat sales Exaggerated dependence on one or two customers Receivable Check List Watch and work the ACP Business dispute with customer Receivable Check List Watch "channel stuffing" making last minute sales to distributor just before quarters end. Change one bad asset for another Growth companies feel pressure to book sales no matter to whom Concentration vs. diversification Inadequate Salability of Inventory Warning Signs Change of corporate inventory valuation methods Increase in the number of LIFO pools Inclusion of inflation profits in inventory Large, unexplained increase in inventory Inclusion of improper costs in inventory High inventory of high tech products can be disastrous because improved products hit the market every 6 to 24 months Who wants a Verizon cell phone six years old? Watch Inventory turnover Watch Faddish Inventory Fixed Assets Warning Signs Old equipment and technology Cash flow signals High maintenance and repair expense Declining output level Inadequate depreciation charge Investments Watch Realization Switching between current and noncurrent categories Investments recorded in excess of costs Risky investments that must be written off Overstatement of Intangibles Warning Signs Slow amortization period Lengthening amortization period High ratio of intangibles to total assets and capital Large balance in goodwill even though profits are weak Liabilities Watch Understated Amortize warranties quickly Arbitrary adjustments Smoothing Equity Treasury Stock - large and frequent transactions Large and unreasonable dividends Unexpected and/or substantial reserves Worrisome negative cumulative translation adjustments • Accounting Policy Task Force (IATA) (APTF) of the International Air Transport Association (IATA) has issued a number of Airline Accounting Guidelines and liaises with standard setting bodies on issues for the industry. • • • Translation of Long Term Foreign Currency Borrowings Frequent Flyer Program Accounting Components of Fleet Acquisition Cost and Associated Depreciation Recognition of Revenue Accounting for Maintenance Costs Accounting for Leases of Aircraft Fleet Assets Segmental Reporting • • • • • The mining industry includes thousands of companies engaged in mining an array of products including precious metals, base metals, coal, uranium, and other industrial minerals ▫ Accounting for and Disclosure of Mineral Reserves How should the costs of acquiring mineral rights or properties be accounted for given these acquisitions may take the form of taking title to properties, obtaining mineral and mining rights, leases, patents, etc. How should generally accepted principles for determination of the impairment of such costs capitalized be determined? What financial information should be disclosed to investors that will provide relevant, comparable and transparent disclosures of mineral reserves? Accounting for costs associated with exploration and development activities Clarify that costs incurred in exploring for minerals may not be capitalized. Provide definitions of exploration activities (related costs are expensed) versus mine development activities (related costs are capitalized). • Accounting for development activities performed contemporaneous to production ▫ Specify that costs incurred at an operating mine, excluding costs included in inventory, should not be deferred. ▫ Provide guidance as to when a mine is under construction versus in production. ▫ Due to the nature of the business, specify which, if any mine development costs incurred prior or subsequent to commercial production commencing, should be capitalized. Accounting for operating activities Define when it would be appropriate for inventories of precious and base metals appropriately to be recorded at other than cost. Provide guidance about common revenue recognition matters unique to the industry. • Cost and Equity Method ▫ Cost method The original investment is recorded at cost in an investment account. Additions to the original investment also recorded at cost in the investment account. Dividends received out of accumulated earnings prior to acquisition are recorded as a return of investment. All other dividends are recorded as dividend income. The recording of dividends as dividend income is the major difference between the cost and the equity methods. Cost and Equity Method Equity method ▪ This method is exactly the same as the cost method except: ▪ Dividends received are credited to the investment account and are not considered income ▪ The investor periodically records its share of the investor's net income by a debit to the investment account and a credit to income from subsidiary INVESTMENT IN XEROX (10%) Debit Credit Investment in $700,000 Nerox Cash COST METHOD Record dividends when declared • No accounting distortions $700,000 Income of investment is ignored Adjust investment book value of value depreciates • No accounting distortions • No accounting distortions COST METHOD WHEN DIVIDENDS ARE DECLARED THE CASH ACCOUNT RECORDS A $36,000 INCREASE AND THE INCOME STATEMENT RECORDS $36,000 DIVIDEND INCOME: Debit Cash Dividend Income Credit $36,000 Record dividends Income of investment is ignored • No accounting distortions • No accounting distortions $36,000 Adjust investment book value of value depreciates • No accounting distortions INVESTMENT IN NEROX (25%) Debit Credit Investment in $1,000,000 Nerox Cash EQUITY METHOD Record pro rata share of profits • Likely accounting distortions $1,000,000 Record Dividends Adjust investment book value of value depreciates • No accounting distortions • No accounting distortions EQUITY METHOD ON DECEMBER 31, 2007, NEROX RECORDS A PROFIT OF $1,000,000. WE RECORD 25% OF THAT INCOME INTO OUR FINANCIAL STATEMENT: Debit Investment In Nerox Equity Earnings In Unconsolidated Subsidiary Record Pro Rata Share Of Nerox Income Credit Record divicends $250,000 $250,000 Adjust investment book value of value depreciates • Likely accounting distortions • No accounting distortions • No accounting distortions EQUITY METHOD ON DECEMBER 31, 2007, NEROX DECLARES A $100,000 DIVIDEND SENDING A CHECK OF $25,000 TO US, THE INVESTOR. Debit Cash Investment In Nerox Record dividends Credit Record dividends $25,000 • No accounting distortions • No accounting distortions $25,000 Adjust investment book value of value depreciates • No accounting distortions Restructuring Charges; How and Why? Gains and Losses on Sale of Businesses Tie into Gains/Losses on Sale of Equipment Deferred Tax Credits Amortization of Bond Premiums Amortization of Bond Discounts Risk of catastrophic losses Direct and indirect guarantees Financial instruments with off balance sheet risk Recourse obligations on Receivables or B/R's sold Securitization of assets Futures contracts Pensions Risk of catastrophic losses Direct and indirect guarantees Financial instruments with off balance sheet risk Recourse obligations on Receivables or B/R's sold Securitization of assets Futures contracts Pensions