Chapter 4

advertisement

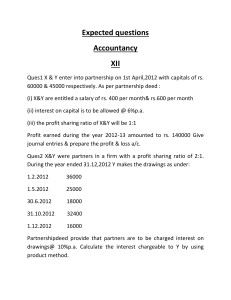

Chapter 4 M I N I C A S E Reeby Sports Ten years ago, in 1990, George Reeby founded a small mail-order company selling high-quality sports equipment. Reeby Sports has grown steadily and been consistently profitable (see Table 4.6). The company has no debt and the equity is valued in the company’s books at nearly $41 million (Table 4.7). It is still wholly owned by George Reeby. George is now proposing to take the company public by the sale of 90000 of his existing shares. The issue would not raise any additional cash for the company, but it would allow George to cash in on part of his investment. It would also make it easier to raise the substantial capital sums that the firm would later need to fiancé expansion. George’s business has been mainly in the East coast of the United States, but he plans to expand into the Midwest in 2002. This will require a substantial investment in new warehouse space and inventory. George is aware that it will take time to build up a new customer base, and in the meantime there is likely to be a temporary dip in profits. However, if the venture is successful, the company should be back to its current 12 percent return on book equity by 2007. George settled down to estimate what his shares are worth. First he estimates the profits and investment through 2007(Table 4.8 and 4.9). The company’s net working capital includes a growing proportion of cash and marketable securities which would help to meet the cost of the expansion into the Midwest. Nevertheless, it seemed likely that the company would needs to raise about $4.3 million in 2002 by the sale of new shares.(George distrusted banks and was not prepared to borrow to finance the expansion.) Until the new venture reached full profitability, dividend payments would have to be restricted to conserve cash, but from 2007 onward George expected the company to pay out about 40 percent of its net profits. As a first stab at valuing the company, George assumed that after 2007 it would earn 12 percent on book equity indefinitely and that the cost computed a more conservative valuation, which recognized that the mail-order sports business was likely to get increasingly competitive. He also looked at the market valuation of comparable business on the West coast, Molly Sports. Molly’s shares were currently priced at 50 percent above book value and were selling on a prospective price-earnings ratio of 12 and a dividend yield of 3 percent. George realized that a second issue of shares in 2002 would dilute his holdings. He set about calculating the price at which these shares could be issued and the number of shares that would need to be sold. That allowed him to work out the dividends per share and to check his earlier valuation by calculating the present value of the stream of per-share dividends. T A B L E 4. 6 Summary income data (figures in $millions) 1996 1997 1998 1999 2000 Gross profits 5.84 6.40 7.41 8.74 9.39 Depreciation 1.45 1.60 1.75 1.97 2.22 Pretax profits 4.38 4.80 5.66 6.77 7.17 Tax 1.53 1.68 1.98 2.37 2.51 After-tax profits 2.85 3.12 3.68 4.40 4.66 Note: Reeby Sports ha never paid a dividend and all the earnings have been retained in the business. T A B L E 4. 7 Summary balance sheet for year ending December 31st (figures in $millions) ASSETS 1999 LIABILITIES AND EQUITY 2000 1999 2000 Current Liabilities 2.90 3.20 Cash & securities 3.12 3.61 Other current assets 15.08 16.93 Net fixed assets 20.75 23.38 Equity 36.05 40.71 Total 38.95 43.91 Total 38.95 43.91 T A B L E 4. 8 Forecasted profits and dividends (figures in $millions) 2001 2002 2003 2004 2005 Gross investment 10.47 11.87 7.74 8.40 9.95 12.67 15.38 Depreciation 2.40 3.10 3.12 3.17 3.26 3.44 3.68 Pretax profits 8.08 8.77 4.62 5.23 6.69 9.23 11.69 Tax 2.83 3.07 1.83 2.34 3.23 4.09 After-tax profits 5.25 Dividends 2.00 Retained profits 3.25 5.70 1.62 3.00 2.00 2.50 3.79 .50 3.40 4.35 2.50 .90 T A B L E 2006 2007 6.00 7.60 2.50 2.50 3.00 1.85 3.50 4.60 4. 9 Forecasted investment expenditures (figures in $millions) 2001 2002 2003 2004 2005 2006 2007 Gross investment in 4.26 10.50 3.34 3.65 4.18 5.37 6.28 .60 .28 .41 .93 1.57 2.00 11.10 3.62 4.07 5.11 6.94 8.28 fixed assets Investments in net 1.39 working capital Total 5.65