The ABCs of Association-Sponsored Insurance Programs

advertisement

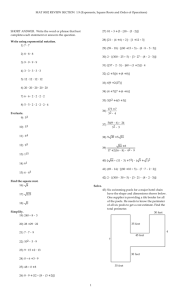

ABCs of Association-Sponsored Insurance Programs Presented to the 2006 NCCAE Insurance Conference by Dubravka Romano, Associate Executive Director Texas Association of School Boards April 12, 2006 A short history lesson… First evidence of “risk sharing” found in 3rd millennium B.C. among Chinese traders who spread wares among many vessels to minimize loss if one vessel capsized. In 1750 BC, Babylonians developed a system of charging an additional sum (“premium”) to fund a loan to finance shipments. In exchange for the premium, if shipment was lost, lender agreed to cancel the loan. In 600 BC, inhabitants of Rhodes invented concept of “general average.” Merchants whose goods were being shipped together would pay a proportionately divided premium which would be used to pay any merchant whose goods were lost during the journey. A short history lesson (cont.) In 600 AD, the Greeks and Romans introduced health and life insurance by creating guilds called “benevolent societies” to take care of families and funeral expenses upon the death of their members. Insurance contracts are found in 14th century Genoa. In 1680s, Mr. Edward Lloyd opened a coffee house popular with ship merchants. There, interested individuals could negotiate insurance for their ships. First insurance company in the U.S. was formed in Charleston, SC in 1732. Benjamin Franklin popularized and standardized the practice of property insurance, specifically for fire risks. Associations and Insurance— What do they have in common? Both concepts include individuals coming together for mutual benefit. Associations—to provide training and information to members and represent members before governing bodies. Insurance—to reduce individual risks and pay for losses if they occur. Collect small sums from many, to pay large claims of few. Why on earth would an Association get into the insurance business? Associations get into the insurance business for two primary reasons: To respond to a need from their members; To obtain additional revenue that allows them to provide other services. A few statistics… 1 in 4 associations endorses a property and casualty insurance program. Association executives consider insurance programs to be “valuable tools in recruiting members and increasing income to the Association.” Associations whose members are corporate entities, rather than individuals, are twice as likely to offer an insurance program. A few statistics (cont.) More than 50% of programs are offered through existing commercial carriers. Other options include: captives, self-insurance pools, retention groups and group purchase arrangements. 81% of Associations receive compensation from their insurance programs. Prevalent types of compensation are reimbursement of expenses, management fees and royalties. * From ASAE survey conducted by the Wyatt Company (1991) Types of coverages offered Workers’ Compensation Property Liability Employee Benefits Owner Controlled Insurance Program Personal lines Others The range of options… Endorsed insured programs Group-purchase programs Exclusive marketing arrangement with broker or agency Risk-sharing pools Mutual or captive insurance companies Endorsed Programs Association endorses a fully-insured product from an insurance company. Insurance company usually agrees to some preferred underwriting criteria for Association members. Association receives revenue from insurance company (usually % of premiums written) Pros: Relatively easy to administer; very little or no involvement by Association; provides coverage that might not otherwise be available to individual entities, or at costs below what they would find on the open market. Cons: Little control over quality of service or product; “black eye” to Association if something goes wrong. Group-Purchase Programs Association members join together to purchase a master insurance contract. Association may be involved in gathering underwriting information and providing other services. Association gets revenue as % of premiums and/or a share of underwriting profit. Pros: Association assumes no risk; gets revenue. Provides coverage that might not otherwise be available to individual entitles, or at costs well below what they would experience on the open market. Cons: Little or no control over quality of service or product. “Black eye” problem if something goes wrong. Marketing Arrangement with Broker or Agency Association selects one broker to market coverages to members. Association gets commission split or % of premiums earned. Pros: Very little involvement or cost to Association. Cons: Politics of local agents and brokers. No control over quality or service delivery. State laws may limit whether this option is viable. Risk-Sharing Pools Associations help create or sponsor governmental risksharing pools. Most pools are separate legal entities from Association Association may or may not provide any services. Revenue to Associations vary widely. Pros: Pools are usually not-for-profit and tax-exempt. Committed to meeting member needs. Interests more aligned with Association’s interests. Provides coverage that might not otherwise be available to individual entities, or at costs below what they would find on the open market. Cons: Many pools subject to sunshine laws. Relationship between Association and pool can become strained. Mutual or Captive Insurance Companies In some states, where pooling is not permitted by law, associations have created mutual or captive insurance companies. Revenue to Associations varies by company and state. Pros: Meets regulatory requirements. Can be as member-focused as pools. Cons: Heavy regulatory burdens. Less flexibility than pooling. More about pooling… First pools created in early 70s. Today, over 500 governmental pools in existence. Pooling is the most prevalent form of providing insurance coverages by local government associations (i.e. cities, counties, school districts.) AGRIP publishes Advisory Standards for Pool Governance and Management that provide guidance on sound practices. A typical pool… Separate legal entity with its own Board May or may not have sponsoring Association If there is a sponsoring Association, pool often pays royalty or endorsement fees. Coverages usually involve some level of selfinsurance Most pools purchase reinsurance May contract for services with outside vendors; have services provided by Association staff; or hire pool staff. Things to consider…. While an insurance program can bring additional revenue to the Association, it is not a panacea for long-term or fundamental financial difficulties in the Association. Sponsoring an insurance program exposes the Association to potential problems with membership (When your president’s claim gets denied, who do you think s/he is going to call?) Beware of slick brokers, promising a quick buck. Do your homework before you endorse a program! Getting it right… Only get into the insurance business if it responds to a real and continued need of your members. When choosing the best option for your Association, consider the following: How much expertise do you have on staff oversee the program? What are the legal limitations in your state for getting into this kind of business? (Beware of the unauthorized practice of insurance!) What are the tax implications for your Association? What option best fits your Association and your membership? What are the political/organizational realities you may need to address in formulating a program? What are the market conditions? And finally… It CAN be done right! Many Associations have successfully met their members’ needs and increased their revenues by offering an insurance program. Be smart, be thoughtful, be careful and you will be successful! Other Resources Association of Governmental Risk Pools (AGRIP) at www.agrip.org (excellent resources) American Society of Association Executives (ASAE) at asaenet.org Association-Sponsored Insurance Programs, 5th Edition Allbusiness.com (good articles)